AMEX Gold Miners Index (GDM) Up 27.73% Through November

04 Décembre 2006 - 6:30PM

PR Newswire (US)

NEW YORK, Dec. 4 /PRNewswire-FirstCall/ -- The Amex Gold Miners

Index (GDM) rose 10.28 percent in November and gained 27.73 percent

for the eleven months ending November 30, 2006.* GDM is a modified

market capitalization- weighted index that is comprised of the

common stocks or ADRs of publicly traded companies involved

primarily in the mining of gold and silver. As of November 30,

2006, GDM included 42 securities. The combined market

capitalization of its constituents was approximately $152 billion

and its beta** to gold bullion was 2.02. GDM is rebalanced

quarterly. The last rebalancing took place on September 15, 2006.

At that time Kimber Resources was removed. The next rebalancing

will occur on December 15, 2006. The Market Vectors -- Gold Miners

ETF (AMEX:GDX) is an exchange-traded fund that seeks to replicate,

as closely as possible, before fees and expenses, the price and

yield performance of GDM. GDX generally holds all of the securities

that comprise GDM in proportion to their weighting in GDM. Since

its inception on May 16, 2006, the NAV of GDX has gained 5.37

percent while gold bullion lost 6.14 percent. In November, the NAV

of GDX gained 10.22 percent*** while gold bullion gained 6.82

percent. Since it started trading, GDX has had average daily

trading volume of approximately 590,000 shares. It had close to

$489 million in assets as of November 30, 2006. Options on GDX are

listed on the Amex, CBOE, and Archipelago. GDX options volume was

49,211 for the four weeks ending November 24, 2006, up more than

15.19 percent from the 42,723 contracts traded during the four

weeks ending October 27, 2006. * Past performance does not

guarantee future results. GDM's return does not represent the

performance of any fund. GDM charges no fees, including management

fees or brokerage expenses, and no such fees or expenses were

deducted from the performance shown. Investors cannot invest

directly in GDM. ** Beta: A quantitative measure of volatility

relative to a benchmark. A beta above 1.00 indicates greater

volatility than the benchmark, while a beta below 1 indicates less

volatility. *** Performance data quoted represents past

performance, which does not guarantee future results. Current

performance may be higher or lower than performance quoted.

Investment returns and principal value will fluctuate and shares,

when sold, may be worth more or less than their original value.

Please call 1.888.MKT.VCTR or visit http://www.vaneck.com/gdx for

the most recent month-end performance. This information will be

available no later than seven business days after the most recent

month end. About Exchange-Traded Funds ETFs are passively managed

baskets of securities that trade in a manner similar to stocks.

They have grown in popularity as investment tools because of their

relatively low expense ratios and the tax efficiency they offer

compared to most mutual funds. Investors can buy and sell ETFs

intra-day and they can hold them both long and short, offering the

opportunity to prosper from both bear and bull markets. About the

American Stock Exchange The American Stock Exchange LLC (Amex(R))

currently leads the industry in ETF listings with more than $300

billion in assets under management in 205 ETFs. The Amex is the

only primary exchange that offers trading across a full range of

equities, options and ETFs, including structured products and

HOLDRS(sm). In addition to its role as a national equities market,

the Amex is the pioneer of the ETF, responsible for bringing the

first domestic product to market in 1993. The Amex is also one of

the largest options exchanges in the U.S., facilitating the trading

of options on broad-based and sector indexes as well as domestic

and foreign stocks. For more information, please visit

http://www.amex.com/. About Van Eck Global Founded in 1955, Van Eck

Global was among the first U.S. money managers to help investors

achieve greater diversification through global investing. In 1968,

it introduced the nation's first gold mutual fund. Today the firm

continues its 50+ year tradition by offering global investment

choices in hard assets, emerging markets, precious metals including

gold, and other specialized asset classes. Van Eck Global's mutual

funds and ETF are sold nationwide through retail brokers, financial

planners and investment advisors. Designed for investors seeking

innovative choices for portfolio diversification, they are often

categorized in asset classes having returns with low correlations

to those of more traditional U.S. equity and fixed income

investments. Van Eck Global also offers separate accounts and

alternative investments. In addition, it offers the Worldwide

Insurance Trust Fund, a series of investment choices within the

variable annuity contracts and variable life policies of widely

known and highly regarded insurers. As of October 31, 2006, the

company managed over $4.0 billion. About the Amex Gold Miners Index

(GDM) GDM is a modified market capitalization-weighted index

comprised of common stocks or ADRs of publicly traded companies

involved primarily in the mining for gold and silver. As of

November 30, 2006, GDM included 42 securities. The Amex launched

GDM in 2004 and its performance history dates to September 1993.

GDM is calculated using a modified market capitalization weighting

methodology. Only companies with a market capitalization greater

than $100 million that have had an average daily trading volume of

at least 50,000 shares over the past six months are eligible for

inclusion in GDM. The weight of any single component stock may not

account for more than 20% of the total value of GDM and the

aggregate weight of those component stocks which individually

represent more than 4.5 percent of the total value of GDM may not

account for more than 50 percent of GDM's total value. GDM

composition and share weightings are reviewed quarterly. The value

of GDM is disseminated every 15 seconds between the hours of

approximately 9:30 am and 4:15 pm Eastern Time. For a more complete

description of GDM, please read the GDX prospectus. GDM, a

trademark of the Amex, is licensed for use by Van Eck Associates

Corporation in connection with GDX. GDX is not sponsored or

endorsed by the Amex and the Amex makes no warranty or

representation as to the accuracy and/or completeness of GDM or

results to be obtained by any person from use of GDM in connection

with trading of GDX. Investing involves risk, including possible

loss of principal. Market Vectors ETF shares can be bought and sold

only through a broker (who may charge a commission) and cannot be

redeemed with the issuing fund. The market price of Fund shares may

be more or less than their net asset value. An investor should

consider the investment objective, risks, charges and expenses of

the investment company carefully before investing. The prospectus

contains this and other information about the investment company.

Please read the prospectus carefully before investing. Investors

may call 1.888.MKT.VCTR or visit http://www.vaneck.com/gdx for a

free prospectus. Investors should consider the investment

objective, risks, and charges and expenses of GDX carefully before

investing. The prospectus contains this and other information about

GDX. Please read the prospectus carefully before investing.

DATASOURCE: Van Eck Global CONTACT: Mike MacMillan, , or Andrew

Schiff, both of MacMillan Communications, +1-212-473-4442 Web site:

http://www.vaneck.com/gdx http://www.amex.com/

Copyright

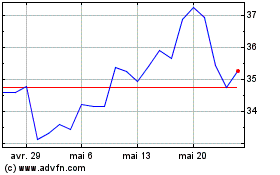

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024