0001842556

false

0001842556

2023-09-07

2023-09-07

0001842556

HNRA:CommonStockParValue0.0001PerShareMember

2023-09-07

2023-09-07

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfCommonStockAtExercisePriceOf11.50PerShareMember

2023-09-07

2023-09-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 7, 2023

HNR ACQUISITION CORP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston,

Texas 77098

(Address

of principal executive offices, including zip code)

(713)

834-1145

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

As

previously reported, on February 10, 2022, HNR Acquisition Corp (the “Company” or “HNRA”) entered

into an Underwriting Agreement (the “Underwriting Agreement”) with EF Hutton, a division of Benchmark Investments,

LLC (“EF Hutton”), in connection with the consummation of the Company’s initial public offering (the “IPO”).

Pursuant to the Underwriting Agreement, the principal sum of $2,587,500 was payable to EF Hutton upon consummation of the IPO (the “Deferred

Underwriting Commission”).

On

September 7, 2023, the Company and EF Hutton entered into a Satisfaction and Discharge of Indebtedness pursuant to Underwriting Agreement

dated February 10, 2022 (the “Satisfaction”). Pursuant to the Satisfaction, EF Hutton agreed, in lieu of collecting

the full amount of the Deferred Underwriting Commission in cash at the time of the closing of the Business Combination (as defined below),

to accept as full satisfaction of the Deferred Underwriting Commission, the specific allocated payments of (1) $500,000 in cash on the

date of the closing of the Business Combination (“Closing”) and (2) $1,300,000 in cash within 90 days of the Closing.

The

foregoing description of the Satisfaction is qualified in its entirety by reference to the full text of the Satisfaction, a copy of which

is included as Exhibit 1.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

As

previously announced, on August 28, 2023, the Company, HNRA Upstream, LLC, a newly formed Delaware limited liability company which is

managed by, and is a subsidiary of, the Company (“OpCo”), and HNRA Partner, Inc., a newly formed Delaware corporation

and wholly owned subsidiary of OpCo (“SPAC Subsidiary”, and together with the Company and OpCo, “Buyer”

and each a “Buyer”), entered into an Amended and Restated Membership Interest Purchase Agreement (the “A&R

MIPA”) with CIC Pogo LP, a Delaware limited partnership (“CIC”), DenCo Resources, LLC, a Texas limited liability

company (“DenCo”), Pogo Resources Management, LLC, a Texas limited liability company (“Pogo Management”),

4400 Holdings, LLC, a Texas limited liability company (“4400” and, together with CIC, DenCo and Pogo Management, collectively,

“Seller” and each a “Seller”) and, solely with respect to Section 6.20 of the A&R MIPA, HNRAC

Sponsors LLC, a Delaware limited liability company (“Sponsor”), which amended and restated in its entirety the previously

entered into membership interest purchase agreement between the parties thereto.

Attached

as Exhibit 99.1 is an updated investor presentation for use by the Company in meetings with certain of its stockholders, investors, as

well as other persons with respect to the proposed transactions contemplated by the A&R MIPA.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

8.01. Other Events

As

previously reported, on May 11, 2023, the stockholders of the Company approved an amendment to the Company’s amended and restated

certificate of incorporation to extend the date by which the Company must consummate its initial business combination from May 15, 2023,

by up to six (6) one-month extensions to November 15, 2023 (each of which we refer to as an “Extension”)

provided that the Sponsor (or its affiliates or permitted designees) deposits into the trust account in which the proceeds of the IPO

were placed (the “Trust Account”) the lesser of (x) $120,000 or (y) $0.04 per share for each public share

of common stock outstanding as of the applicable deadline for each such one-month extension until November 15, 2023, unless

the closing of the Company’s initial business combination shall have occurred in exchange for a non-interest bearing, unsecured

promissory note payable upon consummation of a business combination.

On

September 13, 2023, the Company issued a press release announcing that $120,000 had been deposited into the Trust Account on September

11, 2023, by the Sponsor’s designee to extend the date by which the Company has to consummate a business combination from its current

termination date of September 15, 2023 (after prior Extensions) to October 15, 2023. A copy of the press release is attached hereto as

Exhibit 99.2 and is incorporated herein by reference.

In

addition, on September 13, 2023, the Company issued a press release announcing that it had filed an updated preliminary proxy statement.

A copy of the press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

Additional

Information

In

connection with the proposed business combination (the “Business Combination”) between HNRA and Seller, HNRA intends

to file with the Securities and Exchange Commission (the “SEC”) a proxy statement to be filed by HNRA relating to

the Business Combination. HNRA will mail a definitive proxy statement and other relevant documents to its stockholders at such time as

it is filed (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document

that HNRA will send to its stockholders in connection with the Business Combination. Investors and security holders of HNRA are

advised to read, when available, the Proxy Statement in connection with HNRA’s solicitation of proxies for its special meeting

of stockholders to be held to approve the Business Combination (and related matters) because the Proxy Statement will contain important

information about the Business Combination and the parties to the Business Combination. The Proxy Statement will be mailed

to stockholders of HNRA as of a record date to be established for voting on the Business Combination. Stockholders will also be able

to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at www.sec.gov or by directing a

request to: HNR Acquisition Corp, Attention: David M. Smith, Chief Legal Officer and Secretary, 3730 Kirby Drive, Suite 1200, Houston,

TX 77098.

Participants

in the Solicitation

HNRA,

Seller and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of HNRA’s stockholders in connection with the Business Combination. Investors

and security holders may obtain more detailed information regarding the names and interests in the Business Combination of HNRA’s

directors and officers in HNRA’s filings with the SEC, including the Proxy Statement to be filed with the SEC by HNRA, and such

information and names of Seller’s directors and executive officers will also be in the Proxy Statement to be filed with the SEC

by HNRA.

Disclaimer

This

communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe

for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Business Combination or otherwise, nor

shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

The

following exhibits are being filed herewith:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| September

13, 2023 |

HNR

Acquisition Corp |

| |

|

|

| |

By: |

/s/

Donald H. Goree |

| |

Name: |

Donald

H. Goree |

| |

Title: |

Chief

Executive Officer |

Exhibit 1.1

SATISFACTION AND DISCHARGE

OF indebtedness pursuant to

underwriting agreement dated FEBRUARY 10, 2022

September

7, 2023

This Satisfaction and

Discharge of Indebtedness (the “Satisfaction and Discharge”) is made and entered into to be effective as of September 7, 2023,

by and between HNR Acquisition Corp., a Delaware corporation (the “Company”) and EF Hutton, division of Benchmark Investments,

LLC (“EF Hutton”). Capitalized terms used but not defined herein shall have the meanings assigned to them in the Underwriting

Agreement (as defined below).

RECITALS

WHEREAS, the Company

and EF Hutton are parties to an Underwriting Agreement dated February 10, 2022 (the “Underwriting Agreement”);

WHEREAS, the Sections

1.3 and 3.16 of Underwriting Agreement provide the principal sum of $2,587,500 (the “Deferred Underwriting Commission”) shall

be payable to EF Hutton upon the consummation of the Company’s initial business combination, and the Company agreed that it will

cause the Trustee to pay the Deferred Underwriting Commission directly from the Trust Account to EF Hutton.

WHEREAS, on December

27, 2022, the Company announced that it entered into a Membership Interest Purchase Agreement (“MIPA”) with CIC Pogo, LP,

Denco Resources, LLC, Pogo Resources Management, LLC, 4400 Holdings, LLC, Sellers, to acquire all ownership equity interests in Pogo Resources

LLC, and all of its subsidiaries, including, but not limited to, LH Operating, LLC, that will result at the closing of the business combination

in the Company (the “Business Combination”).

WHEREAS, the parties

to the MIPA together with HNRA Partner, Inc. and HNRA Upstream, LLC and HNRAC Sponsors, LLC subsequently entered into an Amended &

Restated Membership Interest Purchase Agreement dated August 28, 2023, which amended and restated the MIPA.

WHEREAS, the Business

Combination is anticipated to close in 2023, at which time, the Deferred Underwriting Commission to EF Hutton would be immediately due

and payable.

WHEREAS, the Company has requested of EF Hutton

that in lieu of the Company tendering the full amount of the Deferred Underwriting Commission ($2,587,500) in cash, EF Hutton accept $1,800,000

in full satisfaction of the Deferred Underwriting Commission.

WHEREAS, in lieu of collecting the full amount

of the Deferred Underwriting Commission in cash at the time of the closing of the Business Combination, EF Hutton hereby agrees to accept as

full satisfaction of the Deferred Underwriting Commission, the specific allocated payments of (1) $500,000 in cash on the

date of the closing of the Business Combination (“Closing”) and (2) $1,300,000 in cash within 90 days of the Closing.

For clarity, this Agreement is not intended to,

and shall not serve to affect, modify or amend the Underwriting Agreement except as set forth herein. In addition, this Agreement is not

intended to, and shall not serve to affect, modify or amend the Deferred Underwriting Commission unless or until the amounts specified

herein are timely paid in full, which amounts are only due if the Closing occurs.

ARTICLE I

CONDITIONS TO SATISFACTION

AND DISCHARGE

| 1.1 | EF Hutton shall only acknowledge and agree to the satisfaction and discharge of the Deferred Underwriting

Commission and will only acknowledge and agree that the Company’s obligations to pay in cash the Deferred Underwriting Commission

under the Underwriting Agreement have been satisfied and discharged, if the below conditions occur: |

| A. | At the time of Closing, the Company wires $500,000 to the bank account of EF Hutton; and |

| B. | Within ninety (90) days of the Closing, the Company wires $1,300,000 to the bank account of EF Hutton. |

| 1.2 | After the conditions above are satisfied, EF Hutton shall acknowledge the satisfaction and discharge of

the Deferred Underwriting Commission except with respect to Article II below. |

ARTICLE II

MISCELLANEOUS PROVISIONS

2.1 This Satisfaction

and Discharge shall be governed by and construed in accordance with the laws of the State of New York.

2.2 This Satisfaction

and Discharge may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all of which

shall together constitute but one and the same instrument.

IN WITNESS WHEREOF, EF Hutton and the Company

have caused their corporate names to be hereunto affixed, and this instrument to be signed by their respective authorized officers, all

as of the day and year first above written.

EF

HUTTON,

division

of Benchmark Investments, LLC

| By: |

/s/ Sam Fleischman |

|

| Name: |

Sam Fleischman |

|

| Title: |

Supervisory Principal |

|

HNR Acquisition Corp

| By: |

/s/

Mitchell B. Trotter |

|

| Name: |

Mitchell B. Trotter |

|

| Title: |

Chief Financial Officer |

|

3

Exhibit 99.1

HNR Acquisition Corp Corporate Slide Presentation September 2023

Disclaimer • This presentation relates to the potential financing of a portion of a contemplated purchase (the “Purchase”) between HNR Acquisition Corp (“ HNRA ”) and Pogo Resources LLC (“ Pogo”) through a private placement of HNRA’s common stock by potential accredited investors. This presentation shall not constitute a “solicitation” as defined in Rule 14a - 1 of the Securities Exchange Act of 1934, as amended. • This Presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. An y o ffering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Act”), and will be offered as a private placement to a l imi ted number of institutional “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Act or “qualified institutional buyers” as def ine d in Rule 144A under the Act. Accordingly, the Securities must continue to be held unless the Securities are registered under the Act or a subsequent dispo sit ion is exempt from the registration requirements of the Act. Investors should consult with their legal counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to b e i ssued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. HNRA is not making a n o ffer of the Securities in any state where the offer is not permitted. • The information in this presentation and in any preliminary proxy statement may not be complete and may be changed at any tim e. No offer to buy securities can be accepted and no part of the purchase price can be received until the proxy statement has become effective, and any such of fer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date. B efo re you invest, you should read the proxy statement and other documents the Company has filed with the SEC for more complete information about the Company and th e c ontemplated purchase. Copies of the proxy statement may be obtained for free by vising the SEC website at www.sec.gov. • This presentation does not purport to contain all of the information that may be required to evaluate a possible transaction. Th is presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No repres ent ation or warranty, express or implied, is or will be given by the Company or any of its affiliates, directors, officers, employees or advisers or any other pe rson as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made avai lab le to any party in the course of its evaluation of a possible transaction, and no responsibility or liability whatsoever is accepted for the accuracy or sufficien cy thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. Accordingly, none of the Company or any of its affiliates, directors , o fficers, employees or advisers or any other person shall be liable for any direct, indirect or consequential loss or damages suffered by any person as a result of rel ying on any statement in or omission from this presentation and any such liability is expressly disclaimed. 2

Disclaimer • The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgate d by the SEC. Accordingly, such information and date may not be included in, may be adjusted in, or may be presented differently in, any proxy statement, pro spe ctus or other report or document to be filed or furnished by HNRA or Pogo with the SEC. Certain financial measures in this Presentation are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”). These non GAAP financial measures are in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non - GAAP financial measures as c ompared to their nearest GAAP equivalents. For example, other companies may calculate non - GAAP financial measures differently or may use other measures to eva luate their performance, all of which could reduce the usefulness of the non - GAAP financial measures herein as tools for comparison. • Certain statements contained in this presentation relate to the historical experience of our founders, management team and th eir affiliates and investments. An investment in the Company is not an investment in any of our founders’ or our management team’s past investments, companies o r f unds affiliated with them. • The historical results of these persons, investments, companies, funds or affiliates is not necessarily indicative of future per formance of the Company. • This Presentation may contain estimated or projected financial information with respect to Pogo Resources LLC, including, wit hou t limitation, Pogo Resources LLC’s projected revenue, gross operating profit, income before taxes, and EBITDA for calendar years 2024 and 2025. Such estimated o r p rojected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily bein g indicative of future results. The assumptions and estimates underlying such estimated or projected financial information are inherently uncertain and are subje ct to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from t hos e contained in the prospective financial information. See “Forward - Looking Statements” below. Actual results may differ materially from the results contemplate d by the estimated or projected financial information contained in this presentation, and the inclusion of such information in this presentation should not b e r egarded as a representation by any person that the results reflected in such estimates and projections will be achieved. Neither the independent registered publ ic accounting firm of HNRA nor the independent registered public accounting firm of Pogo Resources LLC audited, reviewed, compiled, or performed any procedures wit h respect to the estimates or projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or pr ovided any other form of assurance with respect thereto for the purpose of this presentation. • Forward - Looking Statements • Statements in this presentation which are not statements of historical fact are “forward - looking statements”. Our forward - lookin g statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regardin g t he future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any u nde rlying assumptions, are forward - looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “pl an,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward - looking statements, but the absence of these words doe s not mean that a statement is not forward - looking. Forward - looking statements in this presentation may include, for example, statements about: 3

Disclaimer • Our ability to complete our purchase; • Our success in retaining or recruiting, or changes required in, our officers or directors following our purchase; • Our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our bu sin ess or in approving the Purchase; • Our ability to obtain additional financing to complete our the Purchase ; • Our pool of prospective target businesses; • The ability of our officers and directors to generate a number of potential acquisition opportunities; • Our public securities’ potential liquidity and trading; • The use of proceeds from this offering not held in the trust account or available to us from interest income earned on the tr ust account balance; or • Our financial performance following this offering. • In preparing this presentation, the Company has substantially and materially relied on the Evaluations of Certain Oil and Gas Pr operties ("reserve reports") rendered by William M. Cobb & Associates, Inc. ("Cobb"), an unrelated third party that had previously been engaged and compen sat ed by Pogo concerning the oil and gas assets owned by Pogo including, without limitation, the proved reserves and future income as of the date of the Cobb res erve reports, the most recent reflecting values as of December 31, 2022. • These forward - looking statements are based on the information available to, and the expectations and assumptions deemed reasonab le by, the Company at the time this presentation was made. Although the Company believes that the assumptions underlying such statements are reasonable , i t cannot give assurance that they will be attained. These forward - looking statements involve a number of risks, uncertainties (some of which are beyond our c ontrol) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking stat ements. Factors that could cause actual results to differ materially from expectations include the risks detailed under the caption “Risk Factors” in the Comp any ’s registration statement. The statements in this presentation are summaries that are qualified by the Company’s registration statement, which you should re fer to and read in its entirety. We undertake no obligation to update or revise any forward - looking statements, whether as a result of new information, future event s or otherwise, except as may be required under applicable securities law. You are cautioned not to place undue reliance upon any forward - looking statements, whi ch speak only as of the date made. HNRA undertakes no commitment to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. 4

Executive Summary

HNR Acquisition Corp (HNRA) Who is HNRA? – HNRA is focused on the acquisition of undervalued oil and gas producing properties with significant development potential at a low cost to realize this potential What are key dates? • Incorporated in Delaware on December 9, 2020 • The registration statement for the IPO was effective on February 10, 2022 to become a blank check company (otherwise known as a special purposes acquisition company) • On February 15, 2022, the Company consummated the IPO • On May 11, 2023, the Company held a special meeting of the shareholders. The meeting resulted in: • A restated certificate of incorporation to extend the period of time to complete its initial business combination up to November 15, 2023 • There were 4.1 million shares redeemed resulting in approximately 7.5 million shares outstanding including the approximately 4.5 million public shares and approximately 3.0 million founders’ and private placement shares. 6

Target Acquisition Who is the Target? • To acquire our target acquisition profile, an agreement has been entered into to purchase Pogo Resources, LLC for an aggregate consideration valued at $90 million which includes a net cash equivalent of $63 million. Except for infield drilling through reduced spacing, their properties have virtually all the wells drilled and producing which are needed resulting in lower cost and risk, with the ability to achieve sustainable high earnings growth x Consideration was also given to properties that required new drilling and massive hydraulic fracturing treatments. We concluded to pass on properties that were capital intensive requiring the investment of $6 million plus per well along with the inherent higher risk • Pogo has a 100% ownership interest in LH Operating LLC (“LH”), the owner and operating entity of the properties • William M. Cobb and Associates, Inc. (“Cobb”), an independent external engineering firm, conducted a study as of December 2022 where they estimated the proved reserves and future income at a PV - 10% valuation of $434 million using the SEC Commodity Price Forecast, which is the arithmetic 12 - month average of the “first - day - of - the - month” WTI Spot pricing for oil prices and Henry Hub prices for natural gas. New Mexico Texas Eddy Co. Lea Co. LH Operating 7

Target Acquisition What are the Primary Assets of LH? • Proven reserves of $434 million and 550 wells producing oil and gas • Located on the Northwest Shelf of the Permian Basin among prolific legacy oil fields in Eddy County, New Mexico • The assets are on 20 federal and 3 state leases • The leases and wells are on ~13,700 contiguous acres What is the Ownership Interest? Generally: • 100% working interest (WI) • 74% average net revenue interest (NRI) What have been the results of operations? • LH started developing the property in 2020 with good results • Revenue growth is: $9 million in 2020; $18 million in 2021; and $35 million in 2023 • LH has been profitable for the past two years as disclosed in the proxy filing 8

Transaction Highlights • Purchase Price and Consideration to the Seller • Net Aggregate : The purchase price is a net aggregate amount of $63 million in cash, which is net of a credit for four months of operating results, and 2 million shares of a new class of Class B Common Stock of the Company which have no economic rights (voting only) and 2 million units in the Company’s newly - formed subsidiary, HNRA Upstream, LLC (“ OpCo ”). The combined Class B Common Stock and OpCo’s units are ultimately exchangeable for 2 million shares of the Company’s Class A Common Stock. • Promissory Note Consideration : $15,000,000 may be payable to the Seller through a promissory note as a delayed cash payment. • Preferred Units Consideration : Up to another $20 million through issuance of preferred units in OpCo , which convert into shares of the Company’s Class B common stock in 2 years, at a conversion rate based on the Company’s stock price at the time. • Cash Consideration : A minimum of $33 million in cash is due to Seller at closing. • Sources of Cash • Debt Financing : The Company has a signed commitment letter with First International Bank & Trust (FIBT) for a senior secured term loan in the amount of $28 million • Equity : Anticipated $6 million from the trust fund and a private placement of $5 million. 9

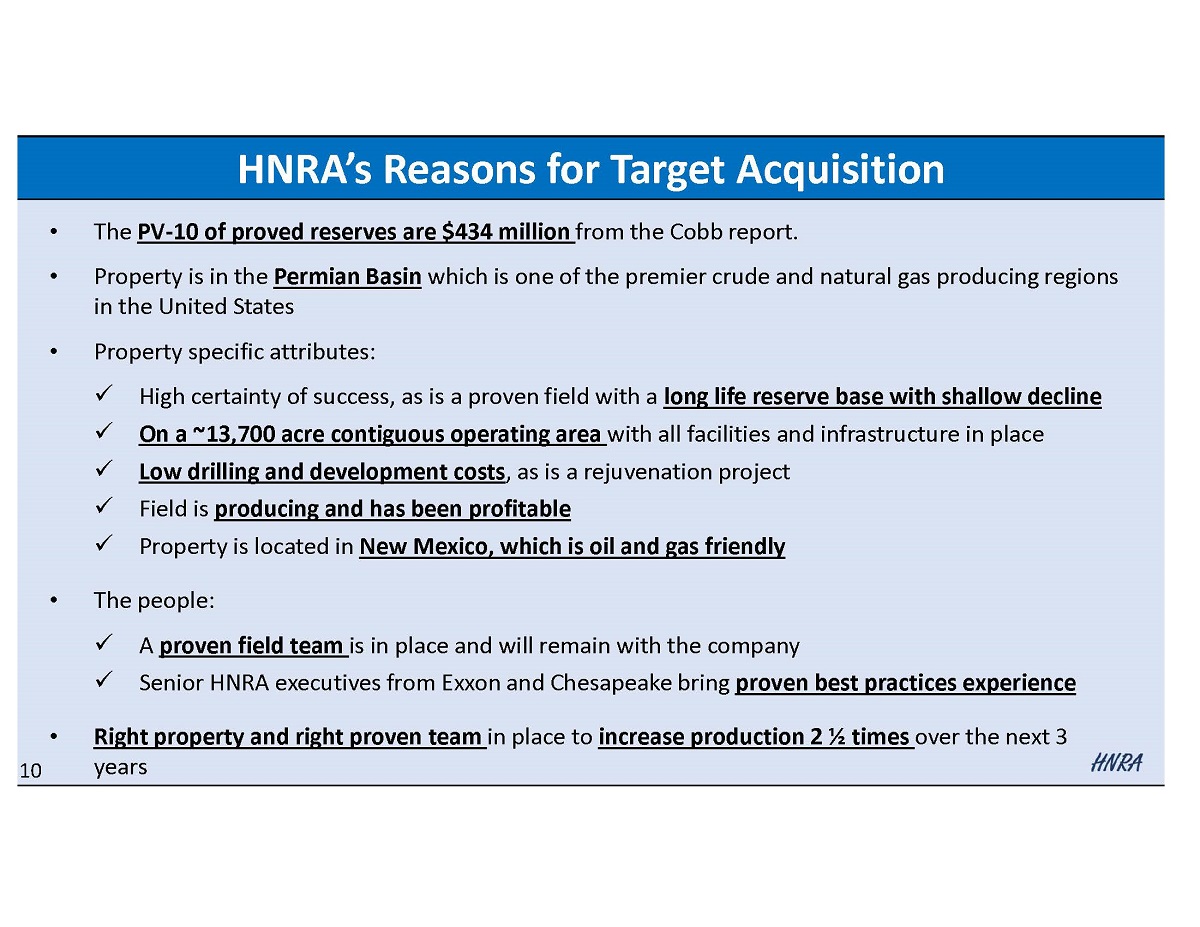

HNRA’s Reasons for Target Acquisition • The PV - 10 of proved reserves are $434 million from the Cobb report. • Property is in the Permian Basin which is one of the premier crude and natural gas producing regions in the United States • Property specific attributes: x High certainty of success, as is a proven field with a long life reserve base with shallow decline x On a ~13,700 acre contiguous operating area with all facilities and infrastructure in place x Low drilling and development costs , as is a rejuvenation project x Field is producing and has been profitable x Property is located in New Mexico, which is oil and gas friendly • The people: x A proven field team is in place and will remain with the company x Senior HNRA executives from Exxon and Chesapeake bring proven best practices experience • Right property and right proven team in place to increase production 2 ½ times over the next 3 years 10

Highlights of the Target

Asset Profile Highlights of the Assets • 95 active waterflood patterns (PDP) with additional 158 patterns planned (PDNP + PUD) • 550 wells (342 producing wells, 207 water injectors, 1 WSW); 98% of wells are active • Current production is primarily from Seven Rivers (7R) • Production is approximately 85% crude oil and 15% natural gas • 7R is part of an existing pool which allows for perforation adds without prior regulatory approval • Depth ranges from 1,500 to 4,000 feet LH Operating Leasehold LH Producer LH Injector 12

Seven Rivers Full Waterflood Development (Gross BOPD) Projections Seven Rivers Future Development • The projections are based on the Cobb report • 253 pattern total development x 95 PDP patterns x Plus 115 PDNP and 43 PUD patterns x Patterns are a combination of producing wells and water injectors to facilitate oil and gas recovery • Reserves based on the Cobb report mapped 7R OOIP and waterflood oil response model calibrated to the 95 pattern PDP response to date • Full waterflood development expected to raise gross plateau oil rates as follows: x ~3,700 BOPD PDP + PDNP + PUD x ~2,500 BOPD PDP + PDNP x ~1,000 BOPD PDP 10 100 1,000 10,000 Total Proved PDP+PDNP PDP Gross BOPD Commercial Gross EURs PUD: Workover re - entry rigs scheduled to start early 2024 PDNP: Workover rig scheduled to re - start early 2023 Historical Projected 13

Regulatory Production Pool: 7R - Q - GB - SA Period Epoch Approx. Regional Thickness (ft) 200-400 100 1,000 200 200 500 200-500 300 1,500 100 Paddock Blinebry Tubb Drinkard 1,000 Wolfcampian 0-1,500 Guadalupian Leonardian 1,500 Formation Grayburg San Andres Glorieta Yeso Abo Wolfcamp Permian Ochoan Dewey Lake Rustler Salado Tansil Yates Seven Rivers Queen Historical Production by Zone • Historical production has been from the Seven Rivers, Queen, Grayburg , and San Andres (7R - Q - GB - SA) in descending depth order • The producing reservoirs range in depth from 1,500’ to 4,000’ across the LH Operating leasehold Stratigraphy & Seven Rivers Type Log Source: Linn Energy Src: Modified from Pranter (1999) 7R Three Main Producing Intervals • R B1/B2/B3: Thin, discontinuous, low porosity in most areas • 7R B4/B5/B6: Main producing interval and waterflood target • 7R C: Thin, discontinuous, low porosity in most areas Stratigraphy of the NW Shelf of the Permian Basin Seven Rivers Type Log: State AZ 606 14

Key Takeaways on the Property • 100% operated, 100% HBP, 74% Average NRI, and 98% of wells are active • Low lifting costs of ~$15/ bbl demonstrated for more than 18 months • Strong 7R waterflood response with over 2 ½ years of performance • Full development plan in the Cobb report triples oil reserves and plateau oil rate • Oil price realizations becoming more favorable; now selling at a premium to West Texas Intermediate (WTI) • Low - risk near - term PDNP workover development opportunity to complete existing 7R waterflood PDP patterns 15

Key Aspects of the Execution Plan • The Target has had a successful waterflooding approach to increase production. We will continue to follow the development plan from the independent external engineering firm’s report • With HNRA’s planned expansion, production will increase by 2 - 1/2 times over next 3 years • Our Vice President of Operations will be laser focused in this effort • This Production Improvement Program of $90 million over the next three years will be funded by free cash flow and $45 million from the ELOC that is in place. • HNRA will pay down debt and build a strong balance sheet to prepare for future growth and expansion • We will responsibly grow the business by following a proven development plan , along with solid financial management 16

Land and Regulatory Overview

Land and Ownership Overview • ~13,700 gross acres • 23 Leases (20 BLM and 3 State leases) • 100% WI with 74% average NRI • 100% Operated • 100% HBP • Title opinion coverage on 97% of PDP PV10 value BLM Leases NM State Leases LH Leases with Title Opinion LH Leasehold <75% NRI 75% - 79% NRI 85% - 87.5% NRI 80% - 84% NRI BLM and NM State Leases Title Opinion Coverage Net Revenue Interest by Lease LH Operating Leases 18

Regulatory Overview Regulatory Environment • 7R - Q - GB - SA is considered a single, unitized pool (“pool”) for regulatory purposes and all current production and upside producti on are produced from this single pool • No regulatory approval required prior to performing well - work on an existing well within the pool (i.e. perf, frac, acidize, etc .) x Operator files a Subsequent Sundry Report notifying of new perforation after work completed x All PDP and PDNP reserves relate to existing wells within this pool x RCPs from GB - SA to 7R are viewed as “add perfs ” New Mexico State Inactive Well List • 98% of well inventory is currently active (537 of 550 wells) • 13 inactive wells on NMOCD inactive list x NMOCD’s “Inactive Well List” contains wells with 15 months since last production/injection x LH Operating considers the majority of the 13 remaining inactive wells to be candidates for recompletion • 9 wells have recently been addressed by LH (NMOCD website does not yet reflect updated status) x 8 wells brought back online between April and June 2022 x 1 well is approved for P&A 19

Field Operation - Employees

Field Personnel Experienced Field Personnel (12 company field employees) • 3 Field Supervisors (field, production, and development) with extensive industry experience x Production and Development Supervisors: >15 years industry experience x Field Supervisor: >10 years industry experience • 7 Gaugers / Pumpers and 2 Roustabouts x Includes Lead Gauger with >15 years industry experience x Includes a former BLM field inspector with 5 years experience at BLM and 10 years experience in remediation • All related labor costs for these 12 employees included in LOE (or LOS) • All field employees will be retained Field Operations Organizational Chart 21

Leadership and Management (after the Purchase)

Dean Rojas – Chief Executive Officer and Director • Mr. Rojas has 40 years’ experience in the oil and gas industry with most of that experience in energy operations onshore, offshore and internationally • He began his career in 1975 with Exxon Company and grew his career to the District Engineering Manager for Exxon’s Offshore District, with responsibility for more than 75 engineers, 200 offshore platforms and 2,000 wells. • After leaving Exxon, Mr. Rojas led several independent companies both in the United States and Latin America, including Enercap Corp (formerly, DCR Petroleum), which he founded in 1983, and served as Principal Owner until 1985. • Prior to DRC Petroleum, Mr. Rojas was an independent acquisitions and operations consultant involved in exploration and production (E&P) and services company activities. • From 1991 to 1994, Mr. Rojas served as Vice President of King Ranch Capital, where he managed King Ranch Capital’s acquisitions group. • For the past five years Mr. Rojas has served as a consultant with Enerlat , a private consulting company which he controls. • Mr. Rojas graduated with honors from the University of Florida with a Bachelor of Science in Mechanical Engineering. • We believe Mr. Rojas is qualified to serve as CEO and as a member of our board of directors based on our review of his experience, qualifications, attributes and skills, including his management experience and his considerable experience in the oil and gas industry. 23

Mitchell B. Trotter – Chief Financial Officer and Director • Mr. Trotter joined the Company in October 2022 • Mr. Trotter has 40+ years of experience beginning his career in 1981 as an auditor with Coopers & Lybrand for seven years. • He then served as CFO of two private investor backed private companies where the first was in real estate development and the latter in the engineering and construction industry. • For the past 35 years, Mr. Trotter served in various CFO and Controller positions with three publicly traded companies in the engineering and construction services industry which were: Earth Tech to 2002; Jacobs Engineering to 2017; and AECOM to 2022. • In those roles Mr. Trotter managed up to 400 plus staff across six continents supporting global operations with clients in multiple industries across private, semi - public and public sectors. • Mr. Trotter earned his BS Accounting from Virginia Tech in 1981 and his MBA from Virginia Commonwealth University in 1994. • He professional credentials are: Certified Public Accountant in Virginia; Certified Management Accountant; and Certified in Financial Management. 24

Jesse J. Allen – Vice President of Operations • With over 42+ years experience operating and managing onshore and offshore oil and production in the US and internationally, Mr. Allen brings considerable knowledge to his role as VP of Operations. • His expertise includes artificial lift, completions, well stimulation, workovers and operationally challenging wells in high - temperature / high - pressure environments as well as extensive project management. • Most recently, Mr. Allen worked the STACK Play in Kingfisher and Logan Counties, Oklahoma, optimizing the completions in the Oswego, Osage and Woodford Shale formations along with optimizing sucker rod lift of these formations in horizontal wells. • Previously, Mr. Allen worked in various technical and managerial roles with Chesapeake Energy in various operating areas that included the Barnett Shale, the Mississippi Lime, and Eagle Ford Shale areas • Before Chesapeake Energy, Mr. Allen’s work experience included completion and production operations with Sun Production Company (which later became Oryx Energy, then Kerr McGee and finally Anadarko Petroleum). • Mr. Allen holds a Bachelor of Science in Petroleum Engineering from Texas Tech University, is a Professional Engineer, and is a member of the Society of Petroleum Engineers and the American Petroleum Institute. 25

David M. Smith, Esq. – Vice President, General Counsel and Secretary • Mr. Smith is a licensed attorney in Texas with over 40 years’ experience in the legal field of oil and gas exploration and production, manufacturing, purchase and sale agreements, exploration agreements, land and leaseholds, right of ways, pipelines, surface use, joint operating agreements, joint interest agreements, participation agreements and operations as well as transactional and litigation experience in oil and gas, real estate, bankruptcy and commercial industries. • Mr. Smith has represented a number of companies in significant oil and gas transactions, mergers and acquisitions, intellectual property research and development and sales in the oil and gas drilling business sector. • Mr. Smith began his career by serving in a land and legal capacity as Vice President of Land and, subsequently, as President of a public Canadian company until beginning his legal practice as a partner with several law firms and ultimately creating his own independent legal practice. • Mr. Smith holds a degree in Finance from Texas A&M University, a Doctor of Jurisprudence from South Texas College of Law and is licensed before the Texas Supreme Court 26

Donald H. Gorée – Public Markets Consultant • Mr. Gorée founded our company and has served as our Chairman and Chief Executive Officer since our inception and will serve as our publics market consultant • Mr. Gorée in 2018 founded Houston Natural Resources, Inc., a global natural resource corporation. • He has over 40 years’ experience in the oil and gas industry involving exploration and production, oil and gas pipeline construction and operations, natural gas gathering, processing and gas liquification. • In 2003, Mr. Gorée founded Global Xchange Solutions AG., a publicly reporting corporation, private equity, investment bank and market - making firm, based in Zurich, Switzerland, with offices in Frankfurt and London. He served as Chairman and Chief Executive Officer of Global Xchange Solutions until 2012. • Global Xchange Solutions sponsored listings of private companies to the London Stock Exchange, AIM, the Frankfurt Stock Exchange, the Berlin Stock Exchange and the Börse Stuttgart, and provided public company development and market development advice. • From 2003 to 2005, Mr. Gorée served as Chairman and Chief Executive officer of Azur Holdings, Inc., a Fort Lauderdale, Florida - based, OTC - listed luxury real estate developer of mid - rise waterfront condominiums. • From 2012 to 2019, He served as the Managing Director of Rhone Merchant House Ltd., a firm which provides merchant banking and investment banking services to a small and elite list of clients. • Mr. Gorée has an Executive Master of Business and Entrepreneurship degree from the Rice University Jones Graduate School of Business. 27

Donald W. Orr – Geological Consultant • Donald W. Orr has served as HNRA President and has been a member of our Board of Directors since January 2021 and will serve as our senior geological consultant • Mr. Orr is a geologist with over 42 years of experience in petroleum geology and production operations • Mr. Orr began his career as a junior geologist with Texas Oil and Gas Corporation in 1976 • In 1979, Mr. Orr helped form American Shoreline, Inc., an independent oil and gas company • Mr. Orr was a Senior Geologist at Seven Energy LLC, a wholly owned subsidiary of Weatherford International plc from 2005 to 2008, where he helped pioneer numerous innovations in UBD (underbalanced drilling), including drilling with unconventional materials and devising the methodology for unlocking the productive capacity of the Buda Lime through the use of UBD • In 2009, Mr. Orr founded XNP Resources, LLC, an independent oil and gas company engaged in the exploration, development, production, and acquisition of oil and natural gas resources. XNP Resources teamed up with Tahoe Energy Partners, LLC in 2012 to acquire oil and gas leases for drilling in the Rocky Mountain region • At Mr. Orr’s direction, XNP Resources began acquiring a strategic leasehold position in the Sand Wash Basin in Colorado. XNP Resources was able to secure a major leasehold position in the heart of what has become the highly competitive Niobrara Shale formation in western Colorado • Since 2014, Mr. Orr has been developing an unconventional resource play in Alaska that contains over 600 billion cubic feet of gas in stacked coal reservoirs • More recently, Mr. Orr assembled a team of oil and gas professionals to study certain oil provinces in Columbia. S.A. • Mr. Orr has a Bachelor of Science degree in Geology from Texas A&I University, with a minor in Mathematics. 28

Dante Caravaggio – Key Advisor and Consultant • Mr. Caravaggio has been a key member of the team in identifying the target, structuring the deal, structuring the capital raise and consulting with the management team and board of directors • He will continue in an advisory role after the IBC in developing the company and long - term strategies • Mr. Caravaggio is the Chairman of SWI Excavating, a large regional Colorado based Civil Construction Company • Formerly, he served as a Board Member of McCarl’s, a large Pennsylvania based Mechanical Construction firm • Mr. Caravaggio has held Executive (EVP and SVP) and Program Management Positions with Kellogg Brown and Root, Parsons Corp, Jacobs Engineering and Sun Oil in locations in North America, Asia, and the Middle East - all related to Energy, Mining, and Power. In these roles, Mr. Caravaggio gained global market knowledge in oil and gas, engineering and construction services, hydrocarbon, environmental, power, water, refining, chemicals, and midstream markets. He has a comprehensive understanding of market drivers, competitive best practices, and has hands - on international experience in North Americas, the Middle East, Europe, and Asia. • Mr. Caravaggio maintains key relationships with industry leaders. • He has the program management skills to lead large complex Energy EPC assignments. • Mr. Caravaggio has made several high value acquisitions, including leading a strategic Canadian acquisition that grew from $200M to over $1.5B in annual revenues. • He has a BS & MS in Petroleum Engineering , University of Southern California and a MBA, Pepperdine University • He is a Board Member of the University of Southern California’s Chemical and Petroleum Engineering Department; a lifetime member of the Society of Petroleum Engineers; and a Registered Professional Petroleum Engineer in the State of California. 29

Joseph V. Salvucci, Sr – Board of Directors, Chairman (nominee) • Joseph V. Salvucci, Sr. has served as a member of our board of directors since December 2021 • Mr. Salvucci acquired PEAK Technical Staffing USA (“PEAK”), peaktechnical.com in 1986 and has grown the business to be a premier provider of USA - based contract engineers and technical specialists, on assignment worldwide through a comprehensive, customer focused, enterprise - wide Managed Staffing Solution. PEAK has expanded from Pittsburgh to do business in all 50 States, Canada, Europe, South America, India, and the Philippines • He served 10 years on the board of directors culminating as President of the National Technical Services Association, a trade association representing 300,000 contractors on assignment in the technical staffing industry, later merging with the American Staffing Association • He is an active member of the Young Presidents Organization Gold, formerly known as the World Presidents Organization (WPO) and has served as a member of the WPO International Board, as well as chairman of East Central US (ECUS) Region and Pittsburgh chapters • As a 1976 Civil Engineering graduate of the University of Pittsburgh, he was member of the Triangle (Engineering) Fraternity and its Alumni Association • He earned the Triangle Fraternity Distinguished Alumnus Citation and currently serves on the Board of Directors • Mr. Salvucci is also active in several professional and charitable organizations including being awarded the Manifesting the Kingdom Award by the Catholic Diocese of Pittsburgh and the “Big Mac Award” from the Ronald McDonald Charities • He earned his BS in Civil Engineering from the University of Pittsburgh in 1976 and attended Harvard Business School’s OPM 33 30

Joseph V. Salvucci, Jr – Board of Directors • Joseph V. Salvucci, Jr. has served as a member of our board of directors since December 2021, and is head of the compensation committee. • Mr. Salvucci began his career with PEAK Technical Staffing USA in November 2010 and is currently serving as the Chief Executive Officer PEAK has hundreds of employees including nine branches focused on engineering and IT recruitment and a Managed Staffing group which coordinates recruitment actives across any labor category across multiple staffing vendors • Before joining PEAK, Mr. Salvucci worked with Merrill Lynch in various banking and brokerage back - office functions from 2007 to 2009 • Mr. Salvucci Jr received his Executive MBA from the University of Pittsburgh, which included international education in Czech Republic and Brazil • A graduate of Susquehanna University in Pennsylvania, Mr. Salvucci earned his Bachelor of Science in Business Administration with emphasis in Finance and studied Business in London • Mr. Salvucci serves on the board of Temporary Services Insurance Limited, a Workers’ Compensation company serving staffing companies • Mr. Salvucci is a member of Young President's Organization (YPO), the world’s largest leadership community of chief executives with over 34,000 extraordinary global members. • Mr. Salvucci brings extensive experience, qualifications, attributes and skills, including his education and expertise in finance and his management and executive experience as CEO of PEAK 31

Byron Blount – Board of Directors (nominee) • Mr. Blount joins the HNRA Board of Directors and will be the head of the audit committee • Mr. Blount has extensive experience in finance, investments and acquisitions. • He was Managing Director for the Blackstone Real Estate Group from 2011 to 2021 where he: had Primary Asset Management responsibilities for several industries and portfolio companies; oversaw the onboarding of acquisitions and establishment of Blackstone - affiliated PortCos ; and had Primary Disposition responsibilities for several portfolios and companies across several industries. • Mr. Blount was the LXR/Blackstone Executive VP from 2005 to 2010. His responsibilities involved: underwriting and acquisition of domestic and international property and mortgage loan portfolios; asset management; renovation and reconstruction projects, debt and business model restructuring; and dispute resolution. • He was a Principal of Colony Capital from 1993 to 2004 and was responsible for sourcing and structuring new investments; consummating transactions valued in excess of $5 billion. His Primary Acquisitions responsibilities included domestic and international acquisitions of real property, distressed mortgage debt, and real estate - related assets and entities. • From 1987 to 1992, Mr. Blount was Vice President of WSGP which was formed to capitalize on the struggles of the US Savings and Loan industry and the FSLIC. He was responsible for structuring and managing/working out new investment opportunities, generally acquired from failed financial institutions. • He graduated from University of Southern California in 1982 with a B.S. in Business Administration • Mr. Blount earned his MBA from University of Southern California’s Marshall School of Business in 1987 and is a member Beta Gamma Sigma (International Business Honor Society) 32

Appendix Technical Backup and Information

Pilot Overview • LH Operating (“LH”) assets located on the Northwest Shelf of the Permian Basin among prolific legacy oil fields • ~13,700 contiguous acres in Eddy County, New Mexico; 100% HBP • 100% Operated; 100% WI and 74% average NRI Highlights • Significant current net operating cash flow • Current net prod. ~1,400 BOEPD (Sept ‘22) primarily from Seven Rivers (7R) (85% oil | 15% gas) • Low operating costs with robust operating margins The Waterflood & Legacy Production • 7R waterflood development (2020 to 2022) has increased total gross oil production by ~1,000 BOPD • 95 active waterflood patterns (PDP) with additional 158 patterns planned (PDNP + PUD) • RCP injectors to 7R producing patterns for >200 BOPD gross (7R is part of an existing pool which allows for perf adds without p rior approval) • Legacy gross oil production of ~275 BOPD with established shallow declines Technical Report • William M. Cobb & Associates, Inc. (“Cobb”) has prepared a Reserve Report for these properties • Cobb has mapped OOIP in 7R and built WF response model calibrated to ~2 ½ years of performance • Full waterflood development expected to build the plateau gross oil rate to ~3,700 BOPD (Total Proved) 7R waterflood developm ent (2020 to 2022) has increased total gross oil production by ~1,000 BOPD Permian Oil Opportunity with Significant Growth Potential 34

10 100 1,000 10,000 10 100 1,000 10,000 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 Seven Rivers (7R) – Development History LH Operating Gross Historical Production (All Horizons) Depositional Setting LH Operating Regional Setting GYBG - JACKSON 120 MMBO Cum MALJAMAR 140 MMBO Cum VACUUM 631 MMBO Cum LH Operating Gross Oil (BOPD) Gross Well Count Development began in 1940’s (Seven Rivers - Queen - Grayburg - San Andres production) 1960’s drilling program and waterflood 1980’s – 1990’s drilling program 34 MMBO Cum. Src: ENVERUS production data for current LH Operating wells Most Recent Drilling Activity 5 wells in 2014 LH 7R WF initiated late 2019 with initial production response in early 2020 LH Acquisition from Linn 2018 35

Seven Rivers (7R) Waterflood Development 7R PDP Response (95 Patterns) – Gross Oil (BOPD) 7R Waterflood Development Pilot Response Starts Early 2020 Current 7R Waterflood Response • LH Operating’s 7R WF work began late 2019 in the H E West B 4 - pattern pilot with initial production response in February 2020 • 95 patterns have been brought online as of June 1, 2022 (includes pilot) • 7R gross oil production from these 95 patterns has sustained ~1,000 BOPD • 95 pattern 7R OOIP = 30 MMBO Remaining 7R Waterflood Development • Additional 158 waterflood patterns planned (PDNP + PUD) • Full waterflood development requires approximately 214 workovers, 56 CTI’s, 55 re - entries of plugged wells, 24 new - drill producers, and 39 new - drill injectors • 158 pattern 7R OOIP = 50 MMBO 1 10 100 1,000 10,000 02/2020 04/2020 06/2020 08/2020 10/2020 12/2020 02/2021 04/2021 06/2021 08/2021 10/2021 12/2021 02/2022 04/2022 06/2022 08/2022 4 - Pattern Pilot Response Starts 95 PDP Patterns Online ~1,000 BOPD Production shown does not include Legacy production 7R Pattern Count Gross 7R BOPD 36

Exhibit 99.2

HNR Acquisition Corp Announces

Extension of Timing for Initial Business Combination

HOUSTON, TX / September 13, 2023 / HNR Acquisition

Corp (NYSE American: HNRA) (the “Company” or “HNRA”) announces that, in accordance with the Company’s

amended and restated certificate of incorporation, it has received notice from HNRAC Sponsors LLC (the “Sponsor”) of its intention

to extend the period of time by which the Company must complete its initial business combination for one month until October 15, 2023.

Extension of time for Initial Business Combination

In accordance with the Company’s amended and restated

certificate of incorporation, the Sponsor’s designee has timely deposited into trust, on September 11, 2023, an aggregate of $120,000

in order to extend the period of time by which the Company must complete its initial business combination from September 15, 2023 to October

15, 2023.

Intent to purchase all equity interests in

Pogo

Previously the Company announced its intent to

purchase all equity interests in Pogo Resources LLC and its subsidiaries, and to acquire the Grayburg- Jackson oil field in the prolific

Permian Basin in Eddy County, New Mexico. The Pogo fields comprise 13,700 contiguous leasehold acres, 343 producing wells and 207 injection

wells for a total of 550 wells on the properties. Current production is approximately 1,400 barrels of oil and oil equivalent per day.

Management expects to increase daily production to nearly 4,000 barrels of oil and oil equivalent in the next three years in accordance

with the reserve report by William Cobb & Associates, a 3rd party engineering firm retained by Pogo.

About HNR Acquisition Corp

HNRA is a blank check company (otherwise known

as a special purpose acquisition company or SPAC) formed for the purpose of effecting a merger, share exchange, asset acquisition, share

purchase, reorganization or similar business combination with one or more businesses or entities.

For more information on HNRA, the acquisition

and the transaction, please visit the Company website: https://www.hnra-nyse.com/

Forward-Looking Statements

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause actual results to differ materially from what is expected, including

the funding of the Trust Account to further extend the period for the Company to consummate an initial business combination, if needed.

Words such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks,”

“may,” “might,” “plan,” “possible,” “should” and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company’s

management’s current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company’s expectations are disclosed

in the Company’s documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

of this press release. In addition, please refer to the Risk Factors section of the Company’s Form 10-K as filed with the SEC on March

31, 2023 for additional information identifying important factors that could cause actual results to differ materially from those anticipated

in the forward-looking statements. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation

to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

Exhibit 99.3

HNR ACQUISITION CORP ANNOUNCES

Filing of Updated Preliminary Proxy Statement

HOUSTON, TX / September 13, 2023 / HNR Acquisition

Corp (NYSE American: HNRA) (the “Company” or “HNRA”) announces that it filed an updated preliminary proxy

statement with the Securities and Exchange Commission (“SEC”) on September 11, 2023.

Updated Proxy Filing

The updated preliminary proxy statement provides shareholders with an update on certain activities including: details on the Amended and

Restated Membership Interest Purchase Agreement as described in the Company’s 8-K filing dated August 30, 2023; details on the signed

commitment letter for a senior secured term loan as described in the Company’s 8-K filing dated August 30, 2023; questions and answers

about the purchase of all of the equity interests of a Texas oil company and its subsidiaries with New Mexico oil and gas holdings; and

details on the Company’s five proposals planned for shareholder approval.

The preliminary proxy statement can be found on

the Company’s website https://www.hnra-nyse.com/ in the investor relations section under SEC filings, or by searching the EDGAR

section of the SEC’s website at www.SEC.gov.

Shareholders will receive a notice from the Board

of Directors for a special meeting of shareholders in the near future.

About HNR Acquisition Corp

HNRA is a blank check company (otherwise known

as a special purpose acquisition company or SPAC) formed for the purpose of effecting a merger, share exchange, asset acquisition, share

purchase, reorganization or similar business combination with one or more businesses or entities.

For more information on HNRA, the acquisition

and the transaction, please visit the Company website: https://www.hnra-nyse.com/

Forward-Looking Statements

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause actual results to differ materially from what is expected, including

the funding of the Trust Account to further extend the period for the Company to consummate an initial business combination, if needed.

Words such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks,”

“may,” “might,” “plan,” “possible,” “should” and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company’s

management’s current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company’s expectations are disclosed

in the Company’s documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

of this press release. In addition, please refer to the Risk Factors section of the Company’s Form 10-K as filed with the SEC on March

31, 2023 and the Risk Factors section of the preliminary proxy statement filed on Schedule 14A on September 11, 2023 for additional information

identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements.

Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

v3.23.2

Cover

|

Sep. 07, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 07, 2023

|

| Entity File Number |

001-41278

|

| Entity Registrant Name |

HNR ACQUISITION CORP

|

| Entity Central Index Key |

0001842556

|

| Entity Tax Identification Number |

85-4359124

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3730 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

713

|

| Local Phone Number |

834-1145

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

HNRA

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HNRAW

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

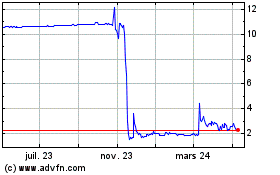

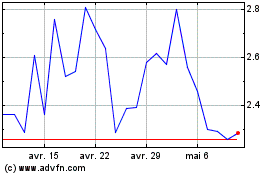

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025