false

0001842556

0001842556

2024-02-20

2024-02-20

0001842556

HNRA:ClassCommonStockParValue0.0001PerShareMember

2024-02-20

2024-02-20

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-02-20

2024-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 20, 2024

HNR ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(Address of principal executive offices, including

zip code)

(713) 834-1145

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading symbol |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosure.

As previously announced,

HNR Acquisition Corp, a Delaware corporation (“HNRA” or the “Company”), entered into that certain Amended and

Restated Membership Interest Purchase Agreement, dated as of August 28, 2023 (as amended, the “MIPA”), by and among HNRA,

HNRA Upstream, LLC, a newly formed Delaware limited liability company which is managed by, and is a subsidiary of, HNRA (“OpCo”),

and HNRA Partner, Inc., a newly formed Delaware corporation and wholly owned subsidiary of OpCo (“SPAC Subsidiary”, and together

with the Company and OpCo, “Buyer” and each a “Buyer”), CIC Pogo LP, a Delaware limited partnership (“CIC”),

DenCo Resources, LLC, a Texas limited liability company (“DenCo”), Pogo Resources Management, LLC, a Texas limited liability

company (“Pogo Management”), 4400 Holdings, LLC, a Texas limited liability company (“4400” and, together with

CIC, DenCo and Pogo Management, collectively, “Seller” and each a “Seller”), and, solely with respect to Section

6.20 of the MIPA, HNRAC Sponsors LLC, a Delaware limited liability company. HNRA’s stockholders approved the transactions

contemplated by the MIPA at a special meeting of stockholders that was originally convened October 30, 2023, adjourned, and then reconvened

on November 13, 2023. On November 15, 2023, the Company closed the transactions contemplated by the MIPA (the “Closing”).

Attached as Exhibit 99.1

is an updated investor presentation for use by the Company in meetings with certain of its stockholders, investors, as well as other persons

with respect to the changes to the Company following the Closing of the MIPA.

In addition, on February 20, 2024, the Company

issued a press release announcing the posting of the updated investor presentation. A copy of the press release is filed as Exhibit 99.2

to this Report and is incorporated herein by reference.

The information in this

Item 7.01 and in Exhibit 99.1 and Exhibit 99.2 attached hereto is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| February 20, 2024 |

HNR Acquisition Corp |

| |

|

|

| |

By: |

/s/ Mitchell B. Trotter |

| |

Name: |

Mitchell B. Trotter |

| |

Title: |

Chief Financial Officer |

3

Exhibit 99.1

HNR Acquisition Corp Corporate Slide Presentation February 2024

Index • Disclaimers • About the Company • Operations and the Property • The Team 2

Disclaimers

Disclaimer • This presentation of HNR Acquisition Corp (“HNRA” or the “Company”) shall not constitute a “solicitation” as defined in Rule 14 a - 1 of the Securities Exchange Act of 1934 , as amended . • The information in this presentation may not be complete and may be changed at any time . Before you invest in the Company’s securities, you should read the documents the Company has filed or may file with the SEC for more complete information about the Company . Copies of any such filing may be obtained for free by visiting the SEC website at www . sec . gov . Filings by HNRA with the SEC may also be viewed through links on the HNRA website at HNRA - NYSE . com . • This presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice . No representation or warranty, express or implied, is or will be given by the Company or any of its affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto . Accordingly, none of the Company or any of its affiliates, directors, officers, employees or advisers or any other person shall be liable for any direct, indirect or consequential loss or damages suffered by any person as a result of relying on any statement in or omission from this presentation and any such liability is expressly disclaimed . • The financial information and data contained in this presentation is unaudited and does not conform to Regulation S - X promulgated by the SEC . Accordingly, such information and date may not be included in, may be adjusted in, or may be presented differently in, any proxy statement, prospectus or other report or document to be filed or furnished by HNRA with the SEC . Certain financial measures in this presentation are not calculated pursuant to U . S . generally accepted accounting principles (“GAAP”) . These non - GAAP financial measures are in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with GAAP . There are a number of limitations related to the use of these non - GAAP financial measures as compared to their nearest GAAP equivalents . For example, other companies may calculate non - GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of the non - GAAP financial measures herein as tools for comparison . • Certain statements contained in this presentation relate to the historical experience of our management team . An investment in the Company is not an investment in any of our management team’s past investments, companies or funds affiliated with them . The historical results of these persons, investments, companies, funds or affiliates is not necessarily indicative of future performance of the Company . • This Presentation may contain estimated or projected financial information, including, without limitation, HNRA’s projected revenue, gross operating profit, income before taxes and EBITDA for calendar years 2024 and 2025 . Such estimated or projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such estimated or projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . See “Forward - Looking Statements” below . Actual results may differ materially from the results contemplated by the estimated or projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such estimates and projections will be achieved . The independent registered public accounting firm of HNRA did not audit, review, compile, or perform any procedures with respect to the estimates or projections for the purpose of their inclusion in this presentation, and accordingly, did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation . 4

Disclaimer • Forward - Looking Statements • Statements in this presentation which are not statements of historical fact are “forward - looking statements” . Our forward - looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future . In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements . The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking . All statements other than statements of historical fact included in this presentation are forward - looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks and uncertainties, and may include projections of our future financial performance based on our growth strategies, business plans and anticipated trends in our business . These forward - looking statements, are only predictions based on our current expectations and projections about future events . There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance, targets, goals or achievements expressed or implied in the forward - looking statements . These factors include, but are not limited to, those discussed in our Annual Report on Form 10 - K under Item 1 A “Risk Factors,” and also discussed from time to time in our quarterly reports on Form 10 - Q, current reports on Form 8 - K, proxy statements, and other SEC filings including the following : ( 1 ) the financial and business performance of the Company, ( 2 ) the Company’s abilities to execute its business strategies, ( 3 ) the level of production on our properties, ( 4 ) overall and regional supply and demand factors, delays, or interruptions of production, ( 5 ) competition in the oil and natural gas industry, ( 6 ) risks associated with the drilling and operation of crude oil and natural gas wells, including uncertainties with respect to identified drilling locations and estimates of reserves, and ( 7 ) the effect of existing and future laws and regulatory actions, including federal and state legislative and regulatory initiatives relating to hydraulic fracturing and environmental matters, including climate change . These forward - looking statements are based on the information available to, and the expectations and assumptions deemed reasonable by, the Company at the time this presentation was prepared . Although the Company believes that the assumptions underlying such statements are reasonable, it cannot give assurance that they will be attained . We undertake no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities law . You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made . HNRA undertakes no commitment to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law . • In preparing this presentation, the Company has substantially and materially relied on the Evaluations of Certain Oil and Gas Properties ("reserve reports") rendered by William M . Cobb & Associates, Inc . ("Cobb"), an unrelated third party that had previously been engaged and compensated by HNRA concerning the oil and gas assets owned by HNRA including, without limitation, the proved reserves and future income as of the date of the Cobb reserve reports, the most recent reflecting values as of December 31 , 2022 . 5

About the Company

Why Invest in HNRA? • Acquired property has proven oil field in Permian Basin, New Mexico • Upside where proven reserves can triple production in 3 to 4 years • Has produced revenues and cash flow since 2020 • Minimal downside drilling with 550 wells in shallow zones of 1,500 to 4,000 feet • Management experienced in waterflood technology and operations • Petroleum engineers and geologists • Decades of experienced • Focused on maintenance and capital program to: • Enhance production • Minimize lift costs and capital expenditures • Sound financial management • Downside protection from price erosion through hedging program • Focus on proper debt to equity balance 7

About HNR Acquisition Corp (HNRA) • HNRA is an independent public energy company with an acquisition and value creation strategy focused on building a company in the energy industry in North America • Our first acquisition and initial focus is to maximize total shareholder value from a diversified portfolio of long - life oil and natural gas properties in the United States • Key dates: • Incorporated in Delaware on December 9, 2020 • The IPO was effective on February 10, 2022 • Closed the first acquisition on November 15, 2023 8

Acquisition Closing Structure • Purchase price • Reductions to net due • Class B common stock • P&L credit for 4 months • Net required to close • Non - cash tenders • Note payable • Preferred stock units • Deferred cash payable • Cash due at close 90 mil (21 mil) ( 6 mil) 63 mil (15 mil) (15 mil) ( 2 mil) 31 mil • Cash transactions at closing • RBL loan from FIBT • Fees and other cash pmts • Total non - redemptions • Cash from private loans • Cash to seller at close 28 mil ( 4 mil) 5 mil 2 mil 31 mil 9

Capitalization Structure – Issued and Outstanding • HNRA common stock • Founders and sponsor shares • Class B shares issued to seller • Voting shares that convert within 3 years • IPO non - redemption shares • Shares issued in lieu of cash 7.0 mil 3.0 mil 2.0 mil 1.2 mil 0.8 mil • Warrants in common stock equivalents • Exercise price of $11.50 per common share • Warrants convert to 3/4 a common share 10.9 mil • IPO related: 8.6 mil warrants • Sponsor warrants: 0.5 mil warrants • Private loans: 5.4 mil warrants 6.5 mil 0.4 mil 4.0 mil 10

Long - Term Debt Financing Structure • HNRA has a $28 million Reserve Base Loan (“RBL”) with First International Bank & Trust (“FIBT”) with a 5 - year amortization • FIBT has been serving the community and industry for 113 years • That are headquartered in Watford City, North Dakota with offices in North Dakota, South Dakota, Minnesota and Arizona • FIBT specializes in assisting businesses and professional owners with complex oil and gas related issues and transactions • Their Mineral and Land Services Division team of industry experts includes petroleum engineers, land managers, and oil and gas attorneys • Other debt instruments • The Seller note of $15 million • Private Loans of $3 million 11

Operations and the Property

Operations and the Property • Industry and Acquisition Strategy Overview • Waterflood Operations • Grayburg - Jackson Oil Field Property • Land and Ownership Overview • The Oil Field • Development History • Seven Rivers (7R) – Development History • Seven Rivers (7R) Waterflood Development • Future Development • Cobb Report Projections • Stratigraphy & Seven Rivers Type Log 13

Industry and Acquisition Strategy Overview • HNRA is an independent energy company with an acquisition and value creation strategy focused on building a company in the energy industry in North America that complements the experience of our management team and can benefit from our operational expertise and executive oversight • Our first acquisition and initial focus is to maximize total shareholder value from a diversified portfolio of long - life oil and natural gas properties built through acquisition and through selective development, production enhancement, and other exploitation efforts on its oil and natural gas properties • Our first acquisition and operational entity is a waterflood property located on the Northwest Shelf of the Permian Basin in New Mexico 14

Waterflood Operations • Waterflooding process is a secondary recovery method to produce incremental oil and gas after production via the primary recovery method from natural pressure starts to diminish • The waterflood process uses the injection of water into an oil - bearing reservoir for pressure maintenance to stimulate oil flow through the rock to the producing well for oil and gas recovery • A waterflood property has long - lasting, low decline oil production. This creates a long - term steady revenue stream, which is a strong base to generate sustainable cash flow and earnings • A waterflood field typically has wells and thus the geological and mechanical risks are significantly mitigated • This steady revenue stream and low - risk oil recovery waterflooding method increases the economic value as the property is developed 15

Grayburg - Jackson Oil Field Property • Our first acquisition was the Grayburg - Jackson oil field which is a waterflood property, and is operated by the HNRA subsidiary LH Operating, LLC (“LHO”) • The Grayburg - Jackson oil field is located on the Northwest Shelf of the Permian Basin in Eddy County, New Mexico • According to the United States Geological Survey, the Northwest Shelf contains the largest recoverable reserves among all the unconventional basins in the United States New Mexico Texas Eddy Co. Lea Co. LH Operating 16

• ~13,700 gross acres • 23 Leases (20 BLM and 3 State leases) • 100% WI with 74% average NRI • 100% Operated • 100% HBP • Title opinion coverage on 97% of PDP PV10 value BLM and NM State Leases Title Opinion Coverage BLM Leases NM State Leases LH Leases with Title Opinion LH Leasehold <75% NRI 75% - 79% NRI 85% - 87.5% NRI 80% - 84% NRI Net Revenue Interest by Lease 17 LH Operating Leases Land and Ownership Overview

The Oil Field • The oil field has several large reservoir structures that range from as shallow as 1,500 feet deep to 4,000 feet deep • The field has attainable proven reserves of approximately 20 million barrels of crude oil and 6 billion cubic feet of natural gas • Wells and reserves • 85% crude oil and 15% natural gas • 550 producing wells and 95 active patterns • Producing wells tap 40% of the reserves • Rest of reserves are proven Approx. Regional Thickness (ft) Formation Epoch Period 200 - 400 Dewey Lake Ochoan Permian 100 Rustler 1,000 Salado 200 Tansil Guadalupian 200 Yates 500 Seven Rivers 200 - 500 Queen 300 Grayburg 1,500 San Andres 100 Glorieta Leonardian 1,500 Paddock Yeso Blinebry Tubb Drinkard 1,000 Abo 0 - 1,500 Wolfcamp Wolfcampian 18

Development History • Development began in 1940’s for the Seven Rivers (“7R”), Queen, Grayburg, and San Andres intervals • In late 2019, LHO (a privately owned company) purchased the property and operated the Grayburg - Jackson field from early 2020 • The 2020 baseline production level was approximately 500 barrels of oil equivalent (“BOE”) per day • LHO’s production has increased from the baseline production of 500 BOE in 2020 to today’s range of 1,250 - 1,450 BOE per day by the implementation of Zone 7R waterflooding 19

10 100 1,000 10,000 10 100 1,000 10,000 1945 1950 1955 1960 1965 1970 2000 2005 2010 2015 2020 Seven Rivers (7R) – Development History Depositional Setting LH Operating Regional Setting GYBG - JACKSON 120 MMBO Cum MALJAMAR 140 MMBO Cum VACUUM 631 MMBO Cum LH Operating Gross Oil (BOPD) Gross Well Count Development began in 1940’s (Seven Rivers - Queen - Grayburg - San Andres production) 1960’s drilling program and waterflood LH Operating Gross Historical Production (All Horizons) 1980’s – 1990’s drilling program 34 MMBO Cum. Src: ENVERUS production data for current LH Operating wells 1975 1980 1985 1990 1995 Most Recent Drilling Activity 5 wells in 2014 LH 7R WF initiated late 2019 with initial production response in early 2020 LH Acquisition from Linn 2018 35 20

Seven Rivers (7R) Waterflood Development 7R Waterflood Development Pilot Response Starts Early 2020 Current 7R Waterflood Response • LH Operating’s 7R WF work began late 2019 in the H E West B 4 - pattern pilot with initial production response in February 2020 • 95 patterns have been brought online as of mid - 2022 (includes pilot) • 7R gross oil production from these 95 patterns has sustained ~1,000 BOPD • 95 pattern 7R OOIP = 30 MMBO Remaining 7R Waterflood Development • Additional 158 waterflood patterns planned (PDNP + PUD) • Full waterflood development requires approximately 214 workovers, 56 CTI’s, 55 re - entries of plugged wells, 24 new - drill producers, and 39 new - drill injectors • 158 pattern 7R OOIP = 50 MMBO 7R PDP Response (95 Patterns) – Gross Oil (BOPD) 10,000 1 10 100 1,000 02/2020 04/2020 06/2020 08/2020 10/2020 12/2020 02/2021 04/2021 06/2021 08/2021 10/2021 12/2021 02/2022 04/2022 06/2022 08/2022 4 - Pattern Pilot Response Starts 95 PDP Patterns Online ~1,000 BOPD Production shown does not include Legacy production 7R Pattern Count Gross 7R BOPD 36 20

Future Development • HNRA plans on doing the same successful workovers which will expand the existing waterflood patterns field - wide • Management expects to increase daily production to nearly 4,000 barrels of oil and oil equivalent in the next three to four years in accordance with a reserve report by William M. Cobb & Associates, Inc. (“Cobb”) a 3rd party engineering firm • Cobb conducted a study as of December 2022 where they estimated the proved reserves at a PV - 10% valuation of $434 million using the SEC Commodity Price Forecast for oil prices and Henry Hub prices for natural gas • Full development plan in the Cobb report triples oil reserves over the next three to four years 22

Seven Rivers Full Waterflood Development (Gross BOPD) Cobb Report Projections Seven Rivers Future Development • The projections are based on the Cobb report • 253 pattern total development x 95 PDP patterns x Plus 115 PDNP and 43 PUD patterns x Patterns are a combination of producing wells and water injectors to facilitate oil and gas recovery • Reserves based on the Cobb report mapped 7R OOIP and waterflood oil response model calibrated to the 95 pattern PDP response to date • Full waterflood development expected to raise gross plateau oil rates as follows: x ~3,700 BOPD PDP + PDNP + PUD x ~2,500 BOPD PDP + PDNP x ~1,000 BOPD PDP 10 100 1,000 10,000 Total Proved PDP+PDNP PDP Gross BOPD Commercial Gross EURs PUD: Workover re - entry rigs scheduled to start early 2024 PDNP: Workover rig scheduled to re - start early 2023 Historical 23 Projected

Regulatory Production Pool: 7R - Q - GB - SA Approx. Regional Thickness (ft) Formation Epoch Period 200 - 400 Dewey Lake Ochoan Permian 100 Rustler 1,000 Salado 200 Tansil Guadalupian 200 Yates 500 Seven Rivers 200 - 500 Queen 300 Grayburg 1,500 San Andres 100 Glorieta Leonardian 1,500 Paddock Yeso Blinebry Tubb Drinkard 1,000 Abo 0 - 1,500 Wolfcamp Wolfcampian Historical Production by Zone • Historical production has been from the Seven Rivers, Queen, Grayburg, and San Andres (7R - Q - GB - SA) in descending depth order • The producing reservoirs range in depth from 1,500’ to 4,000’ across the LH Operating leasehold Stratigraphy & Seven Rivers Type Log Source: Linn Energy Src: Modified from Pranter (1999) 7R Three Main Producing Intervals • R B1/B2/B3: Thin, discontinuous, low porosity in most areas • 7R B4/B5/B6: Main producing interval and waterflood target • 7R C: Thin, discontinuous, low porosity in most areas Stratigraphy of the NW Shelf of the Permian Basin Seven Rivers Type Log: State AZ 606 24

The Team

Organization Chart Dante Caravaggio CEO & Director David O'Brian Field Superintendent David Smith General Counsel Jesse Allen VP Operations Mitch Trotter CFO & Director Independent Directors • Joseph Salvucci, Sr. • Joseph Salvucci, Jr. • Byron Blount Consultants & Advisors • Don Orr – Geological • Don Gorée – Public Markets Service Providers Land, Legal and Risk Firms Michael Burton Environmental Ernesto Valdez Workover Foreman Emilio Aranda Field Lead Joey Dodge Field Lead Teisha O’Brian Admin & Logistics 26

Dante Caravaggio – Chief Executive Officer and Director Mr. Caravaggio has 40+ years of experience in the oil and gas industry. He has held Executive and program management positions with Kellogg Brown and Root, Parsons Corp, Jacobs Engineering and Sun Oil in locations in North America, Asia, and the Middle East all related to energy, mining, and power. In these roles, Mr. Caravaggio gained global market knowledge in oil and gas, engineering and construction services, hydrocarbon, environmental, power, water, refining, chemicals, and midstream markets. Mr. Caravaggio has a comprehensive understanding of market drivers, competitive best practices, and has hands - on international experience in North Americas, the Middle East, Europe, and Asia. He has built strong relationships with investors, clients and suppliers, and he has also been an integral player in several high value acquisitions over his career. Mr. Caravaggio has his BS and MS in Petroleum Engineering from University of Southern California and his MBA from Pepperdine University. 27

Mitchell B. Trotter – Chief Financial Officer and Director Mr. Trotter has 40+ years of experience in various controller and CFO roles after beginning his career in 1981 with Coopers & Lybrand. Most of his experience was in the engineering and construction industry with a majority of the time with public companies. In those roles Mr. Trotter managed up to 400 plus staff across six continents supporting global operations with clients in multiple industries across private, semi - public and public sectors. Many of his clients were in the oil and gas, and chemicals industries. Mr. Trotter earned his BS Accounting from Virginia Tech in 1981 and his MBA from Virginia Commonwealth University in 1994. 28

David M. Smith, Esq. – Vice President, General Counsel Mr. Smith is a licensed attorney in Texas with 40+ years of experience in the legal field of oil and gas exploration and production, manufacturing, purchase and sale agreements, exploration agreements, land and leaseholds, right of ways, pipelines, surface use, joint operating agreements, joint interest agreements, participation agreements and operations as well as transactional and litigation experience in oil and gas, real estate, bankruptcy and commercial industries. Before practicing law, Mr. Smith was Vice President of Land and then President of an exploration and production company based in Houston, Texas. Mr. Smith has represented a number of companies in significant oil and gas transactions, mergers and acquisitions, intellectual property research and development and sales in the oil and gas drilling business sector. Mr. Smith holds a degree in Finance from Texas A&M University, a Doctor of Jurisprudence from South Texas College of Law and is licensed before the Texas Supreme Court. 29

Jesse J. Allen – Vice President of Operations Mr. Allen has 40+ years of experience operating and managing onshore and offshore oil and production in the US and internationally. He brings considerable knowledge as his expertise includes artificial lift, completions, well stimulation, workovers and operationally challenging wells in high - temperature and high - pressure environments as well as extensive project management. Mr. Allen has worked for several key companies in the oil and gas industry starting with Sun Production Company (which later became Oryx Energy, then Kerr McGee and finally Anadarko Petroleum) and including various technical and managerial roles with Chesapeake Energy. Mr. Allen holds a Bachelor of Science in Petroleum Engineering from Texas Tech University, is a Professional Engineer, and is a member of the Society of Petroleum Engineers and the American Petroleum Institute. 30

Thank you for your interest in HNRA

Exhibit 99.2

HNR Acquisition Corp Posts

Updated Investor Deck to the Company Website

https://www.hnra-nyse.com/

HOUSTON, TX / February 20, 2024 / HNR Acquisition

Corp (NYSE American: HNRA) (the “Company” or “HNRA”) is an independent oil and gas company focused on the

acquisition, development, exploration and production of oil and gas properties in the Permian Basin. Today, the Company posted an updated

investor deck to the company website: https://www.hnra-nyse.com/.

About HNR Acquisition Corp

HNRA is an independent upstream energy company

focused on maximizing total returns to its shareholders through the development of onshore oil and natural gas properties in the United

States. HNRA’s long-term goal is to maximize total shareholder value from a diversified portfolio of long-life oil and natural gas

properties built through acquisition and through selective development, production enhancement, and other exploitation efforts on its

oil and natural gas properties. On November 15, 2023, HNRA acquired its operating entity, LH Operating, LLC, whose assets include interests

in the Grayburg-Jackson oil field in the prolific Permian Basin in Eddy County, New Mexico.

HNRA’s Class A Common Stock trades on the

NYSE American Stock Exchange (NYSE American: HNRA). For more information on HNRA, please visit the Company website: https://www.hnra-nyse.com/

Forward-Looking Statements

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause actual results to differ materially from what is expected. Words

such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks,”

“may,” “might,” “plan,” “possible,” “should” and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company’s

management’s current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company’s expectations are disclosed

in the Company’s documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

of this press release. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

v3.24.0.1

Cover

|

Feb. 20, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 20, 2024

|

| Entity File Number |

001-41278

|

| Entity Registrant Name |

HNR ACQUISITION CORP

|

| Entity Central Index Key |

0001842556

|

| Entity Tax Identification Number |

85-4359124

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3730 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

713

|

| Local Phone Number |

834-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

HNRA

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HNRAW

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

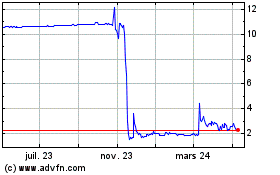

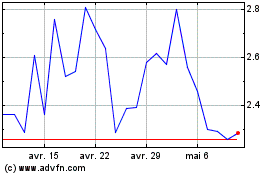

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025