false

0000004281

0000004281

2023-11-22

2023-11-22

0000004281

us-gaap:CommonStockMember

2023-11-22

2023-11-22

0000004281

us-gaap:CumulativePreferredStockMember

2023-11-22

2023-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Common Stock

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest

event reported): November 27, 2023 (November 22, 2023)

HOWMET AEROSPACE INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

1-3610 |

25-0317820 |

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| 201 Isabella Street, Suite 200 |

|

| Pittsburgh, Pennsylvania |

15212-5872 |

| (Address of Principal

Executive Offices) |

(Zip Code) |

Office of Investor

Relations (412) 553-1950

Office of the

Secretary (412) 553-1940

(Registrant’s

telephone number, including area code)

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

HWM |

New York Stock Exchange |

| $3.75 Cumulative Preferred Stock, par value $100 per share |

HWM PR |

NYSE American |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation or an Off-Balance Sheet Arrangement of a Registrant. |

On November 22, 2023, Howmet Aerospace Inc. (“Howmet

Aerospace” or the “Company”) entered into (i) a Term Loan Agreement (the “USD Term Loan Agreement”)

by and among the Company, a syndicate of lenders named therein, and Truist Bank, as administrative agent for the lenders and syndication

agent, and (ii) a Term Loan Agreement (the “JPY Term Loan Agreement” and, together with the USD Term Loan Agreement,

the “Term Loan Agreements” and each, individually, a “Term Loan Agreement”) by and among the Company,

a syndicate of lenders named therein, and Sumitomo Mitsui Banking Corporation, as administrative agent for the lenders.

The USD Term Loan Agreement provides a $200 million

senior unsecured delayed draw term loan facility (the “USD Credit Facility”) that matures on November 22, 2026, unless

earlier terminated in accordance with the provisions of the USD Term Loan Agreement. The JPY Term Loan Agreement provides a ¥33 billion

senior unsecured delayed draw term loan facility (the “JPY Credit Facility” and, together with the USD Credit Facility,

the “Credit Facilities”) that matures on November 22, 2026, unless earlier terminated in accordance with the provisions

of the JPY Term Loan Agreement.

Each of the Credit Facilities is unsecured and

amounts payable thereunder will rank pari passu with all other unsecured, unsubordinated indebtedness of the Company. Borrowings under

the USD Credit Facility will be denominated in U.S. dollars, and borrowings under the JPY Credit Facility will be denominated in Japanese

yen. Loans under each of the Credit Facilities may be prepaid without premium or penalty.

Under the USD Credit Facility, loans will bear

interest at a base rate or a rate equal to Term SOFR plus adjustment, plus, in each case, an applicable margin based on the credit ratings

of the Company’s outstanding senior unsecured long-term debt. Based on the Company’s current long-term debt ratings, the applicable

margin on base rate loans would be 0.750% per annum and the applicable margin on Term SOFR loans would be 1.750% per annum. Loans under

the USD Credit Facility amortize 2.5% in the second year and 5.0% in the third year.

Under the JPY Credit Facility, loans will bear

interest at a rate equal to the Cumulative Compounded RFR Rate utilizing the Tokyo Overnight Average Rate plus an applicable margin based

on the credit ratings of the Company’s outstanding senior unsecured long-term debt. Based on the Company’s current long-term

debt ratings, the applicable margin on loans under the JPY Credit Facility would be 1.750% per annum.

The obligations of the Company to pay amounts

outstanding under the respective Credit Facilities may be accelerated upon the occurrence of an “Event of Default” as defined

therein. Such Events of Default include, among others, (a) non-payment of obligations; (b) breach of any representation or warranty in

any material respect; (c) non-performance of covenants and obligations; (d) with respect to other indebtedness in a principal amount in

excess of $100 million, a default thereunder that causes such indebtedness to become due prior to its stated maturity or a default in

the payment at maturity of any principal of such indebtedness; (e) the bankruptcy or insolvency of the Company; and (f) a change in control

of the Company.

The Term Loan Agreements contain respective covenants,

including, among others, (a) limitations on the Company’s ability to incur liens securing indebtedness for borrowed money; (b) limitations

on the Company’s ability to consummate a consolidation, merger, or sale of all or substantially all of its assets; (c) limitations

on the Company’s ability to change the nature of its business; and (d) a limitation requiring the ratio of Consolidated Net Debt

to Consolidated EBITDA as of the end of each fiscal quarter for the period of the four fiscal quarters most recently ended, to be less

than or equal to 3.75 to 1.00.

Capitalized terms used in this Item 2.03 and not otherwise defined

herein shall have the same meaning as given in the respective Term Loan Agreement. The foregoing summary of the material terms of the

respective Term Loan Agreements does not purport to be complete and is subject to, and qualified in its entirety by, the full text of

the respective Term Loan Agreements, copies of which will be filed with Howmet Aerospace’s Annual Report on Form 10-K for the year

ending December 31, 2023.

Item 8.01. Other Events

On November 27, 2023, Howmet Aerospace issued a notice of partial redemption

to redeem on December 28, 2023 (the “Redemption Date”) $500,000,000 aggregate principal amount of its outstanding 5.125%

Notes due 2024 (CUSIP No. 013817AW1) (the “2024 Notes”) in accordance with the terms of the 2024 Notes and the Indenture

dated as of September 30, 1993, as supplemented, between Howmet Aerospace and The Bank of New York Mellon Trust Company, N.A., as trustee

(the “Indenture”). As of November 27, 2023, the aggregate outstanding principal amount of the 2024 Notes is approximately

$705,273,000.

The redemption price (the “Redemption Price”) for

the 2024 Notes to be redeemed shall be equal to the greater of (i) 100% of the principal amount of the 2024 Notes to be redeemed, plus

accrued interest, if any, to the Redemption Date or (ii) the sum of the present values of the Remaining Scheduled Payments, discounted

on a semi-annual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate plus 40 basis points, plus accrued

interest to the Redemption Date that has not been paid. The Company expects the aggregate Redemption Price for the 2024 Notes to be redeemed

to be approximately $506 million, which the Company intends to pay with funds drawn under the Credit Facilities and cash on hand. The

Company intends to enter into interest rate swaps to exchange the floating interest rates of the Credit Facilities into fixed interest

rates, subject to market conditions and other considerations, before December 28, 2023.

Capitalized terms used in this Item 8.01 and not otherwise defined

herein shall have the same meaning as given in the Indenture or the 2024 Notes, as the case may be.

This Current Report on Form 8-K does not constitute a notice of redemption

of the 2024 Notes. The redemption of the 2024 Notes is made solely pursuant to the notice of redemption pursuant to the Indenture.

Forward-Looking Statements

This Current Report on Form 8-K contains statements that relate to

future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,”

“could,” “estimates,” “expects,” “forecasts,” “goal,” “guidance,”

“intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,”

“should,” “targets,” “will,” “would,” or other words of similar meaning. All statements

that reflect the Company’s expectations, assumptions or projections about the future, other than statements of historical fact,

are forward-looking statements, including, without limitation, expectations relating to the planned redemption of the 2024 Notes and the

Company’s intention to enter into swap agreements. These statements reflect beliefs and assumptions that are based on the Company’s

perception of historical trends, current conditions and expected future developments, as well as other factors the Company believes are

appropriate in the circumstances. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties,

and changes in circumstances that are difficult to predict, which could cause actual results to differ materially from those indicated

by these statements. Such risks and uncertainties include, but are not limited to: (a) deterioration in global economic and financial

market conditions generally; (b) unfavorable changes in the markets served by Howmet Aerospace; (c) the impact of potential cyber attacks

and information technology or data security breaches; (d) the loss of significant customers or adverse changes in customers’ business

or financial conditions; (e) manufacturing difficulties or other issues that impact product performance, quality or safety; (f) inability

of suppliers to meet obligations due to supply chain disruptions or otherwise; (g) failure to attract and retain a qualified workforce

and key personnel; (h) uncertainty of the residual impact of the COVID-19 pandemic on Howmet Aerospace’s business, results of operations,

and financial condition; (i) the inability to achieve revenue growth, cash generation, restructuring plans, cost reductions, improvement

in profitability, or strengthening of competitiveness and operations anticipated or targeted; (j) inability to meet increased demand,

production targets or commitments; (k) competition from new product offerings, disruptive technologies or other developments; (l) geopolitical,

economic, and regulatory risks relating to Howmet Aerospace’s global operations, including geopolitical and diplomatic tensions,

instabilities, conflicts, and wars, as well as compliance with U.S. and foreign trade and tax laws, sanctions, embargoes and other regulations;

(m) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation,

which can expose Howmet Aerospace to substantial costs and liabilities; (n) failure to comply with government contracting regulations;

(o) adverse changes in discount rates or investment returns on pension assets; and (p) the other risk factors summarized in Howmet Aerospace’s

Annual Report on Form 10-K for the year ended December 31, 2022 and other reports filed with the U.S. Securities and Exchange Commission.

The Company disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information,

future events, or otherwise, except as required by applicable law.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HOWMET AEROSPACE INC. |

| |

|

|

| |

|

|

| Dated: November 27, 2023 |

By: |

/s/ Paul Myron |

| |

Name: |

Paul Myron |

| |

Title: |

Vice President and Treasurer

|

v3.23.3

Cover

|

Nov. 22, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2023

|

| Entity File Number |

1-3610

|

| Entity Registrant Name |

HOWMET AEROSPACE INC.

|

| Entity Central Index Key |

0000004281

|

| Entity Tax Identification Number |

25-0317820

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

201 Isabella Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Pittsburgh

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

15212-5872

|

| City Area Code |

412

|

| Local Phone Number |

553-1940

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

HWM

|

| Security Exchange Name |

NYSE

|

| Cumulative Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

$3.75 Cumulative Preferred Stock, par value $100 per share

|

| Trading Symbol |

HWM PR

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CumulativePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

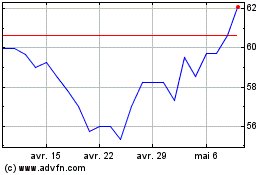

Howmet Aerospace (AMEX:HWM-)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

Howmet Aerospace (AMEX:HWM-)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025