false

0001698113

0001698113

2023-12-26

2023-12-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 26, 2023

PARTS

iD, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

|

001-38296 |

|

81-3674868 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1 Corporate

Drive

Suite C

Cranbury, New Jersey 08512

(Address of Principal Executive Offices, including

Zip Code)

(609)

642-4700

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Class A Common Stock |

|

ID |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As

previously disclosed, on December 26, 2023, PARTS iD, Inc. (the “Company”) and its subsidiary, PARTS iD, LLC, a Delaware limited

liability company (collectively, the “Debtors”) filed voluntary petitions (the “Bankruptcy Petitions”) under Chapter

11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Chapter 11 Cases”).

On

December 26, 2023, 2023, the Company received written notice (the “Delisting Notice”) from the staff of NYSE Regulation, Inc.

(“NYSE Regulation”) notifying the Company that, in light of the Bankruptcy Petitions, the NYSE Regulation has determined that

the Company’s Class A common stock (the “Securities”) is no longer suitable for listing and will commence delisting

proceedings pursuant to Section 1003(c)(iii) of the NYSE American Company Guide.

The

Company may appeal the determination pursuant to Part 12 of the NYSE American Company Guide within seven calendar days of the Delisting

Notice. However, the Company does not intend to appeal this determination, and, therefore, it is expected that the Securities will be

delisted.

Trading

of the Securities are expected to be suspended and a Form 25-NSE will be filed with the Securities and Exchange Commission (the “SEC”),

which will remove the Securities from listing and registration on the NYSE American LLC (the “NYSE American”). As a result,

the Securities are expected to begin trading on the over-the-counter market following such suspension of trading on the NYSE American.

Item 8.01 Other Events.

On December

29, 2023, in accordance with the NYSE American’s procedures, the Company issued a press release discussing the matters disclosed

in Item 3.01 above. A copy of the press release is included herewith as Exhibit 99.1, which is incorporated by reference into this Item

8.01.

Cautionary Information Regarding Trading in

the Company’s Securities

The Company’s securityholders

are cautioned that trading in the Company’s Securities during the pendency of the Chapter 11 Cases is highly speculative and poses

substantial risks. Trading prices for the Company’s Securities may bear little or no relationship to the actual recovery, if any,

by holders thereof in the Company’s Chapter 11 Cases. The Company expects that holders of shares of the Company’s Securities

could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Cases. Accordingly, the

Company urges extreme caution with respect to existing and future investments in its Securities.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed

as part of this report:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

PARTS ID, INC. |

| |

|

|

| Date: January 2, 2024 |

By: |

/s/ Lev Peker |

| |

|

Name: |

Lev Peker |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

2

Exhibit 99.1

PARTS iD Announces

Delisting from NYSE American

CRANBURY, N.J., January 2, 2024 -- PARTS iD, Inc. (OTCPK: IDICQ) (“PARTS iD” or “the Company”) today announced that it received notification from the New York Stock Exchange

(“NYSE”) that the NYSE has initiated proceedings to delist the Class A common stock of PARTS iD, Inc. from the NYSE American.

The NYSE also indefinitely suspended trading of the Company’s Class A common stock effective December 26, 2023. PARTS iD does not

intend to appeal the NYSE’s determination.

The NYSE determined that the Company is no longer suitable for listing

and will commence delisting proceedings pursuant to Section 1003(c)(iii) of the NYSE American Company Guide in light of the disclosure

on December 26, 2023 that the Company filed a voluntary petition for relief under Chapter 11 of title 11 of the United States Code in

the United States Bankruptcy Court for the District of Delaware.

About PARTS iD, Inc.

PARTS iD is a technology-driven, digital commerce company focused on

creating custom infrastructure and unique user experiences within niche markets. Founded in 2008 with a vision of creating a one-stop

eCommerce destination for the automotive parts and accessories market, we believe that PARTS iD has since become a market leader and proven

brand-builder, fueled by its commitment to delivering a revolutionary shopping experience; comprehensive, accurate and varied product

offerings; and continued digital commerce innovation.

Cautionary Note Regarding Forward-Looking Statements

All statements made in this press release relating to future financial

or business performance, conditions, plans, prospects, trends, or strategies and other such matters, including without limitation, expected

future performance, consumer adoption, anticipated success of our business model or the potential for long term profitable growth, are

forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In addition, when or if used

in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “plan,” “predict,” “potential,”

“confident,” “look forward,” “optimistic” and similar expressions and their variants, as they relate

to us may identify forward-looking statements. We operate in a changing environment where new risks emerge from time to time and it is

not possible for us to predict all risks that may affect us, particularly those associated with the COVID-19 pandemic and the conflict

in Ukraine, which have had wide-ranging and continually evolving effects. We caution that these forward-looking statements are subject

to numerous assumptions, risks, and uncertainties, which change over time, often quickly and in unanticipated ways.

Important factors that may cause actual results to differ materially

from the results discussed in the forward-looking statements include risks and uncertainties, including without limitation: the ongoing

conflict between Ukraine and Russia has affected and may continue to affect our business; competition and our ability to counter competition,

including changes to the algorithms of Google and other search engines and related impacts on our revenue and advertisement expenses;

the impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto; disruptions

in the supply chain and associated impacts on demand, product availability, order cancellations and cost of goods sold including inflation;

difficulties in managing our international business operations, particularly in the Ukraine, including with respect to enforcing the terms

of our agreements with our contractors and managing increasing costs of operations; changes in our strategy, future operations, financial

position, estimated revenues and losses, product pricing, projected costs, prospects and plans; the outcome of actual or potential litigation,

complaints, product liability claims, or regulatory proceedings, and the potential adverse publicity related thereto; the implementation,

market acceptance and success of our business model, expansion plans, opportunities and initiatives, including the market acceptance of

our planned products and services; developments and projections relating to our competitors and industry; our expectations regarding our

ability to obtain and maintain intellectual property protection and not infringe on the rights of others; our ability to maintain and

enforce intellectual property rights and ability to maintain technology leadership; our future capital requirements; our ability to raise

capital and utilize sources of cash; our ability to obtain funding for our operations; changes in applicable laws or regulations; the

effects of current and future U.S. and foreign trade policy and tariff actions; disruptions in the marketplace for online purchases of

aftermarket auto parts; costs related to operating as a public company; the Company’s intention to continue operations during the

Chapter 11 Cases; the Company’s ability to conduct its business in an uninterrupted manner during the Chapter 11 Cases; the potential

outcome and timing of the delisting of the Company’s Class A common stock; the Company’s ability to obtain timely approval

of the Bankruptcy Court with respect to motions filed in the Chapter 11 Cases; and the possibility that we may be adversely affected by

other economic, business, and/or competitive factors.

Further information on the factors and risks that could cause actual

results to differ from any forward-looking statements are contained in our filings with the SEC, which are available at https://www.sec.gov

(or at https://www.partsidinc.com). The forward-looking statements represent our estimates as of the date hereof only, and we specifically

disclaim any duty or obligation to update forward-looking statements.

Investors:

Brendon Frey

ICR

ir@partsidinc.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

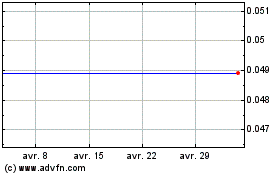

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025