ETF Trading Report: Vietnam, Palladium ETFs in Focus - ETF News And Commentary

23 Août 2012 - 7:13PM

Zacks

The glow from yesterday’s Fed minutes appears to have been

short-lived as equities again slumped in Thursday trading. Hopes

over more stimulus fell in today’s session, as James Bullard,

president of the St. Louis Fed, said that data has been somewhat

better in the U.S. since the last meeting, suggesting that wind

could be coming out of QE3’s sails.

Thanks to this, American equities finished the day broadly

lower, as the Nasdaq led with just a 0.7% loss while the S&P

500 fell by about 0.8% and the Dow slumped by 0.9% on the day.

Losses were pretty widespread throughout the market sectors,

although there was more pressure in the basic materials, consumer

staples, industrial goods, and banking segments. Seemingly the only

winners came in a few of the health care stocks and a handful of

large cap tech and telecom names (read Is ROOF A Better Real Estate

ETF?).

Still, despite the dashed hopes for more easing, the U.S. ten

year did slide another two basis points while investors saw yields

on the similar German note fall by nearly ten basis points, putting

the yields on these two benchmarks at, respectively, 1.67% and

1.38%. However, it should be noted that the dollar did slump

modestly on the day, although it held up well against the resource

currencies but was dragged down by its performance against the

euro.

Yet even with this gloom, investors did see some strength in a

few commodity markets in Thursday’s session, led by strong moves in

the livestock and metals markets as silver gained over 3% on the

session. On the losing side, agricultural products once again saw

weakness as the grains broadly slumped including 2.4% losses for

wheat and corn (also read Don’t Forget about These Impressive Muni

Bond ETFs).

In ETF trading, volume levels fell back slightly from

yesterday’s elevated levels, although it was still far better than

what investors had been seeing for most of August. The outsized

volume on the day was pretty much entirely carried by the commodity

ETF market, as most of the other major products either saw flat, or

lower than average trading days during Thursday.

Particularly, investors saw solid interest in the ETF

Securities Physical Palladium Shares (PALL) during today’s

trading. The fund usually does about 61,000 shares in a normal day

but saw more than 325,000 shares change hands in Thursday trading

(see Will the Palladium ETF Shine Bright This Year?).

The product probably saw such outsized volume thanks to its

incredible run over the past few days as the ETF has added nearly

12.2% in the past five days. This includes a nearly 3.6% move today

as worries continue to build over the South African mining

situation.

Major protests have begun to spread to other mines in the region

and there is some concern over more unrest in the volatile country.

The world’s top platinum miner said that, according to the

Washington Post, a group of workers have made their own demands

beyond unions, suggesting that the crisis could still have some

room to run, making platinum and palladium products to watch in the

coming days as well.

Another fund which saw a great deal of activity was the

Market Vectors Vietnam ETF (VNM). The product

usually does just over 100,000 shares in a normal day but saw more

than half a million shares move hands in Thursday’s session (read

Frontier Market ETF Investing 101).

The product lost nearly 6.3% on the session, bucking the

relatively solid trend that investors had been seeing in many of

the other Southeast Asia ETFs. There is some political risk in the

country after one of the nation’s top businessmen was arrested,

while worries are also growing that Vietnam could be headed for a

hard landing as well.

Thanks to this speculation, and the general risk off attitude in

the marketplace, investors have been staying away from the Vietnam

ETF and could continue to do so in favor of other markets in the

region over the next few weeks if these issues remain in play.

(see more in the Zacks ETF Center)

ETFS-PALLADIUM (PALL): ETF Research Reports

MKT VEC-VIETNAM (VNM): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

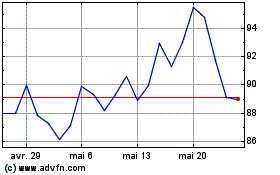

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024