Two Precious Metal ETFs Set to Soar - ETF News And Commentary

19 Mai 2014 - 6:00PM

Zacks

Thanks to commodity strength and another bout of volatility in the

stock market, precious metals have been seeing smooth trading this

year. In fact, most of the precious metals are crushing the broad

market and the broad commodities in the year-to-date time

frame.

This is especially true as the two increasingly popular choices -

palladium and platinum – are outperforming this year driven by

continued supply disruptions in South Africa, fears of export

limitations from Russia and rising global demand. Palladium jumped

to a three-year high, climbing 15% this year while platinum gained

7%.

South Africa Worries Heating Up

South Africa is the world's largest platinum and second-largest

palladium producer, accounting for 80% and 33% of global supply

respectively (read: Will Election Hopes Boost The Fragile Five

Emerging ETFs?).

Tensions in South Africa are raising risks with the labor strike,

now in its fourth month, recently taking a violent turn. Four

platinum miners were killed on Wednesday as striking workers are

preventing other mineworkers to return to work, thwarting the

company's efforts to end the strike.

The longest and costlier strike ever by about 80,000 workers has

halted nearly 40% of global platinum production at the top three

producers – Anglo American Platinum, Impala Platinum and Lonmin.

Further, the strike has also resulted in a supply crunch for

palladium.

Risk in Russia is Growing

Escalating tensions between Russia and the West following the

annexation by the former of Ukraine's Crimea peninsula is also

threating the global supply. This is because tough sanctions

against Russia by the western powers might curtail export of the

metals from the country, resulting in lower global supplies (read:

Palladium ETF Surging on Tensions in Ukraine).

Demand is on the Rise

The automotive industry, mainly catalytic converters for vehicles,

is a big driver of demand in both platinum and palladium markets. A

rebound in the auto industry, new vehicle emission standards in

Europe and continued growth in Chinese auto sales would continue to

boost demand for the white metals.

Further, increasing industrial applications, higher retail

investments, and growing consumption of platinum and palladium for

jewelry will likely give a nice boost to their demand.

Given growing demand and dwindling supply, platinum and palladium

prices are poised to go up further, especially if the current

trends persist. As such, investors should definitely tap the

bullish fundamentals with the following two ETFs (see: all the

Precious Metals here):

ETF Securities Physical Palladium Shares

(PALL)

The fund seeks to match the spot price of palladium, net of fees

and expenses. With AUM of $507.5 million, the ETF owns palladium

bullion in plate or ingots kept in Zurich or London under the

custody of JPMorgan Chase Bank.

The product has expense ratio of 0.60% and sees moderate volume of

more than 75,000 shares a day. PALL is leading the precious metal

space, gaining nearly 16% in the year-to-date time frame.

ETFS Physical Platinum Shares (PPLT)

This fund tracks the performance of the price of bullion platinum,

before Trust expenses. With about $764 million in AUM, this is the

largest and the only physically backed platinum product and kept in

Zurich or London in plate and ingot form under the custody of JP

Morgan Chase Bank.

The product sees light volume of around 40,000 shares a day and

charges 60 bps in fees per year from investors. The ETF has added

about 8% in the year-to-date period (read: 3 Dirt Cheap Top Ranked

ETFs to Buy Now).

Bottom Line

Investors should note that these two products would continue their

outperformance given that the prolonged strikes in South Africa and

ongoing tensions in Russia are unlikely to be resolved any time

soon. These products have a Zacks ETF Rank of 2 or ‘Buy’

rating.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

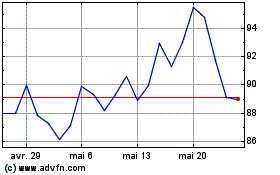

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025