Current Report Filing (8-k)

11 Octobre 2022 - 2:01PM

Edgar (US Regulatory)

0001682220

false

0001682220

2022-10-06

2022-10-06

0001682220

us-gaap:CommonStockMember

2022-10-06

2022-10-06

0001682220

sach:Notes7.125PercentDue2024Member

2022-10-06

2022-10-06

0001682220

sach:Notes6.875PercentDue2024Member

2022-10-06

2022-10-06

0001682220

sach:Notes7.75percentDue2025Member

2022-10-06

2022-10-06

0001682220

sach:Notes6.00percentDue2026Member

2022-10-06

2022-10-06

0001682220

sach:Notes6.00percentDue2027Member

2022-10-06

2022-10-06

0001682220

sach:Notes7.125PercentDue2027Member

2022-10-06

2022-10-06

0001682220

sach:Notes8.00percentDue2027Member

2022-10-06

2022-10-06

0001682220

us-gaap:SeriesAPreferredStockMember

2022-10-06

2022-10-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 6, 2022

SACHEM

CAPITAL CORP.

(Exact name of Registrant as specified in its

charter)

| New

York |

|

001-37997 |

|

81-3467779 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 698

Main Street, Branford,

Connecticut |

|

06405 |

| (Address

of Principal Executive Office) |

|

(Zip

Code) |

Registrant's

telephone number, including area code (203)

433-4736

| (Former

Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Ticker

symbol(s) |

Name

of each exchange on which registered |

| Common

Shares, par value $.001 per share |

SACH |

NYSE

American LLC |

| 7.125%

Notes due 2024 |

SCCB |

NYSE

American LLC |

| 6.875%

Notes due 2024 |

SACC |

NYSE

American LLC |

| 7.75%

notes due 2025 |

SCCC |

NYSE

American LLC |

| 6.00%

notes due 2026 |

SCCD |

NYSE

American LLC |

| 6.00%

notes due 2027 |

SCCE |

NYSE

American LLC |

| 7.125%

notes due 2027 |

SCCF |

NYSE

American LLC |

| 8.00%

notes due 2027 |

SCCG |

NYSE

American LLC |

| 7.75%

Series A Cumulative Redeemable Preferred Stock, Liquidation Preference $25.00 per share |

SACHPRA |

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company

x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Stock Purchase Plan

Effective on October 7, 2022, the Board of

Directors of Sachem Capital Corp. (the “Company”) adopted a stock repurchase plan (the “Repurchase

Program”), pursuant to which the Company may repurchase up to an aggregate of $7,500,000 of its common shares (“Common

Shares”). Under the Repurchase Program, share repurchases will be made from time to time on the open market at prevailing

market prices or in negotiated transactions off the market in accordance with applicable federal securities laws, including Rule

10b-18 and 10b5-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Repurchase Program is

expected to continue through September 30, 2023, unless extended or shortened by the Company’s Board of Directors. Ladenburg

Thalmann & Co. Inc. will act as the Company’s exclusive purchasing agent under the Repurchase Program.

The Company cannot predict when or if it will repurchase

any of its common shares under the Repurchase Program as repurchases will depend on a number of factors, including constraints specified

in any Rule 10b5-1 Plan, price, general business and market conditions, and alternative investment opportunities. Information regarding

share repurchases under the Repurchase Program will be available in the Company’s periodic reports on Forms 10-Q and 10-K filed

with the U.S. Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

Attached as Exhibit 99.1 to this Current Report

on Form 8-K is a copy of the press release announcing the authorization of the Repurchase Program.

Urbane Acquisition

On October 6, 2022, the Company acquired substantially

all the business assets of Urbane New Haven, LLC (“Urbane”), a real estate firm specializing in all phases of real estate

development and construction, including architecture, design, contracting and marketing. The purchase price for the assets was 300,000

Common Shares. In connection with the acquisition, Eric O’Brien, one of the owners of Urbane, has been hired by the Company as its

new Senior Vice President, Asset Management. Mr. O’Brien’s primary responsibilities include construction management oversight

and real estate development.

The Company believes that the acquisition of Urbane

is both strategic and highly synergistic, as the Urbane team will be overseeing the Company’s construction finance business, which

has grown significantly over the past few years. Having Urbane’s construction expertise internally will allow Sachem to take on

larger and more profitable construction loans, as well as further vertically integrate its lending platform. The Company further believes

that the inclusion of Urbane into its construction loan origination process will be an important addition to its capabilities as it continues

to grow as it will provide the Company with greater flexibility compared to traditional lenders and help further differentiate the Company,

allowing it to take on additional projects at favorable terms with attractive margins, while continuing to expand its market share.

Attached as Exhibit 99.2 to this Current Report

on Form 8-K is a copy of the press release announcing the acquisition of Urbane.

* * *

This

report contains forward-looking statements, as that term is defined under the Exchange Act, including statements regarding repurchases

by the Company of its common shares under the Repurchase Program. All statements other than statements of historical facts contained

in this Current Report on Form 8-K are forward-looking statements. By their nature, forward-looking statements are subject to risks, uncertainties,

and contingencies, including changes in price and volume and the volatility of the Company’s common shares, adverse developments

affecting either or both the prices and trading the Company’s securities listed on the NYSE American LLC, and unexpected or otherwise

unplanned or alternative requirements with respect to the capital investments of the Company. The Company does not undertake to update

any forward-looking statements, including those contained in this report.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

* * * * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: October 10, 2022 |

By: |

/s/John L. Villano |

| |

|

John L. Villano, CPA |

| |

|

Chief Executive Officer |

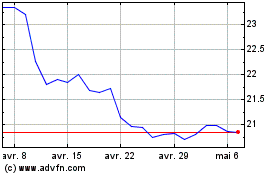

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025