via NewMediaWire -- Timber Pharmaceuticals, Inc. (“Timber” or the

“Company”) (NYSE American: TMBR) today announced that it has

entered into a definitive agreement to be acquired by LEO US

Holding, Inc. (“LEO Pharma”), a wholly-owned subsidiary of LEO

Pharma A/S, in a total transaction value of up to $36 million with

(i) an initial upfront consideration of $14 million and (ii) up to

an additional $22.0 million in contingent value rights (CVRs)

payable upon achievement of certain milestones described below. All

of the issued and outstanding shares of capital stock and other

equity interests of Timber will be converted into the right to

receive the initial upfront consideration, less the payments for

certain outstanding warrants that contain a Black Scholes cash

payout value. For example, based on a current estimate of the Black

Scholes value of such warrants of approximately $5.1 million,

subject to change based on the assumptions detailed below, Timber

expects the initial amount per share to be paid to Timber

stockholders to be approximately $2.62 based on approximately 3.4

million shares of Timber common stock and restricted stock issued

and outstanding as of August 20, 2023.

The current estimated value to stockholders is based on an

implied value assigned to certain outstanding warrants based on

Black Scholes option pricing model as of August 18, 2023. This

value will not be finalized until the closing of the merger and is

subject to increase or decrease based on certain variables,

including the actual trading price of Timber at the time of the

merger and the trading volatility of Timber common stock prior to

the merger.

The CVRs that Timber stockholders will receive provide for the

payment of up to an additional $22 million with respect to specific

milestones for TMB-001, of which up to $12 million is related to

FDA approval of TMB-001 by October 1, 2025 for the treatment of

congenital ichthyosis, and up to $10 million of which is related to

the first achievement of TMB-001 net sales exceeding $100 million

within four consecutive calendar quarters by December 31, 2028. As

part of the transaction, LEO Pharma has agreed to provide Timber

with a bridge loan of up to $3.0 million, subject to certain

conditions. The payments of the CVRs are subject to certain

deductions relating to the repayment of 50% of the bridge loan

provided by LEO Pharma to Timber in connection with the merger.

John Koconis, Chairman and Chief Executive Officer of Timber,

said, “We are very pleased to deliver a transaction that will

maximize long term value for Timber’s shareholders. LEO Pharma is a

leader in global dermatology with a mission that matches our own -

a relentless pursuit to help patients suffering from skin

diseases.

“LEO’s expertise and global footprint make it the best choice to

advance and achieve the full potential of Timber’s portfolio of

product candidates. We believe that LEO has the potential to

establish TMB-001 as the standard of care in the treatment of

congenital ichthyosis, a devastating, rare disease.

“Finally, I would like to sincerely thank our dedicated team at

Timber for their tireless efforts, and the clinical investigators,

medical professionals, patients and families whose personal

contributions have been instrumental in shaping our understanding

of TMB-001.”

The transaction has been unanimously approved by the Boards of

Directors of both companies and is expected to close in the fourth

quarter of 2023, subject to customary closing conditions, including

approval by the holders of a majority of the shares of Timber’s

common stock. Following completion of the transaction, Timber will

become a privately held company and shares of Timber’s common stock

will no longer be listed on any public market.

Timber will file a Current Report on Form 8-K with the

Securities and Exchange Commission (“SEC”) that will include a copy

of the merger agreement and the CVR agreement and will contain a

more detailed description of the merger and the consideration to be

received by Timber stockholders.

Advisors

Lowenstein Sandler LLP is serving as legal counsel to Timber.

Covington & Burling LLP is serving as legal counsel to LEO

Pharma.

About Timber Pharmaceuticals, Inc.

Timber Pharmaceuticals, Inc. is a clinical-stage

biopharmaceutical company focused on the development and

commercialization of treatments for rare and orphan dermatologic

diseases. The Company's investigational therapies have proven

mechanisms-of-action backed by decades of clinical experience and

well-established CMC (chemistry, manufacturing, and control) and

safety profiles. Timber is focused on developing non-systemic

treatments for rare dermatologic diseases including congenital

ichthyosis (CI) and sclerotic skin diseases. For more information,

visit www.timberpharma.com.

About LEO Pharma

LEO Pharma is a global company dedicated to advancing the

standard of care for the benefit of people with skin conditions,

their families and society. Founded in 1908 and majority owned by

the LEO Foundation, LEO Pharma has devoted decades of research and

development to advance the science of dermatology, and today, the

company offers a wide range of therapies for all disease

severities. LEO Pharma is headquartered in Denmark with a global

team of 4,700 people, serving millions of patients across the

world. In 2022, LEO Pharma generated net sales of DKK 10.6

billion.

Additional Information about the Proposed Merger

Transaction and Where to Find It

This communication relates to the proposed merger transaction

involving Timber and may be deemed to be solicitation material in

respect of the proposed merger transaction. In connection with the

proposed merger transaction, Timber will file relevant materials

with the SEC, including a proxy statement on Schedule 14A (the

“Proxy Statement”). This communication is not a substitute for the

Proxy Statement or for any other document that Timber may file with

the SEC or send to Timber’s stockholders in connection with the

proposed merger transaction. BEFORE MAKING ANY VOTING DECISION,

INVESTORS AND SECURITY HOLDERS OF TIMBER ARE URGED TO READ THE

PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT TIMBER, THE PROPOSED MERGER TRANSACTION

AND RELATED MATTERS. The proposed merger transaction will be

submitted to Timber’s stockholders for their consideration.

Investors and security holders will be able to obtain free copies

of the Proxy Statement (when available) and other documents filed

by Timber with the SEC through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed by Timber with

the SEC will also be available free of charge on Timber’s website

at www.timberpharma.com or by contacting Timber’s Investor

Relations contact at sprince@pcgadvisory.com.

Participants in the Solicitation

Timber and its directors and certain of its executive officers

and employees may be deemed to be participants in the solicitation

of proxies from Timber’s stockholders with respect to the proposed

merger transaction under the rules of the SEC. Information about

the directors and executive officers of Timber and their ownership

of shares of Timber’s common stock is set forth in its Annual

Report on Form 10-K for the year ended December 31, 2022, which was

filed with the SEC on March 31, 2023, its proxy statement for its

2023 annual meeting of stockholders, which was filed with the SEC

on May 1, 2023 and in subsequent documents filed with the SEC,

including the Proxy Statement. Additional information regarding the

persons who may be deemed participants in the proxy solicitations

and a description of their direct and indirect interests in the

merger transaction, by security holdings or otherwise, will also be

included in the Proxy Statement and other relevant materials to be

filed with the SEC when they become available. You may obtain free

copies of this document as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Timber generally identifies forward-looking statements by

terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or

“continue” or the negative of these terms or other similar words.

These statements are only predictions. Timber has based these

forward-looking statements largely on its then-current expectations

and projections about future events and financial trends as well as

the beliefs and assumptions of management. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond Timber’s

control. Timber’s actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including but not limited to: (i) risks associated with

Timber’s ability to obtain the stockholder approval required to

consummate the proposed merger transaction and the timing of the

closing of the proposed merger transaction, including the risks

that a condition to closing would not be satisfied within the

expected timeframe or at all or that the closing of the proposed

merger transaction will not occur; (ii) the final calculation of

the Black Scholes value of certain of Timber’s warrants, which

value will impact the amount of upfront cash consideration to be

received by Timber stockholders and is subject to significant

change based on certain variables, including the actual trading

price of Timber at the time of the merger and the volatility of

Timber common stock prior to the merger, and which Timber will only

be able to fully calculate until the closing date of the merger and

could be significantly higher in value than currently determined by

Timber, (iii) the outcome of any legal proceedings that may be

instituted against the parties and others related to the merger

agreement; (iv) the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the merger agreement, (v) unanticipated difficulties or

expenditures relating to the proposed merger transaction, the

response of business partners and competitors to the announcement

of the proposed merger transaction, and/or potential difficulties

in employee retention as a result of the announcement and pendency

of the proposed merger transaction; (vi) the CVR payments are tied

to our ability to obtain regulatory approvals or commercialize our

products, including the results of any ongoing or future clinical

trials which may not satisfy U.S. regulatory authorities; (vii) the

regulatory approval process is expensive, time consuming and

uncertain and (viii) those risks detailed in Timber’s most recent

Annual Report on Form 10-K and subsequent reports filed with the

SEC, as well as other documents that may be filed by Timber from

time to time with the SEC. Accordingly, you should not rely upon

forward-looking statements as predictions of future events. Timber

cannot assure you that the events and circumstances reflected in

the forward-looking statements will be achieved or occur, and

actual results could differ materially from those projected in the

forward-looking statements. The forward-looking statements made in

this communication relate only to events as of the date on which

the statements are made. Except as required by applicable law or

regulation, Timber undertakes no obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events.

For more information, contact:

Timber Pharmaceuticals, Inc.John KoconisChairman and Chief

Executive Officerjkoconis@timberpharma.com

Investor Relations:Stephanie PrincePCG Advisory(646)

863-6341sprince@pcgadvisory.com

Media Relations:Adam DaleyBerry & Company Public

Relations(212) 253-8881adaley@berrypr.com

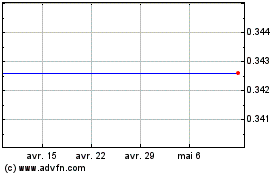

Timber Pharmaceuticals (AMEX:TMBR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Timber Pharmaceuticals (AMEX:TMBR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024