TIDMKRS

RNS Number : 0668O

Keras Resources PLC

29 September 2023

29 September 2023

Keras Resources plc ('Keras' or the 'Company')

Interim Results

Keras Resources plc (AIM: KRS) announces its half year results

for the six months ending 30 June 2023.

Overview

-- Loss reduced to GBP255,000 and revenue increased to

GBP397,000 compared to the six-month period ended 30 June 2022 of

GBP467,000 and GBP212,000 respectively;

-- Sales of 2,196 tons compared to the six-month period ended 30 June of 2022 of 1,896 tons;

-- 2023 mining season has commenced with processing at the Spanish Fork plant ongoing; and

-- Significant interest from fertiliser blenders who have now

successfully completed testwork on the high-grade Diamond Creek

rock phosphate.

Graham Stacey, Keras Chief Executive Officer, commented, " It

was a tough start to the year with record snowfall and an

unpredictably long Utah winter, exacerbated by a late spring and

widespread heavy rains and flooding throughout the Central

California Valley where the majority of our customers are located.

That said we believe we are in a strong position to now gear-up on

the back of the marketing drive over the past year, which has

resulted in significant interest and positive testwork from third

party fertiliser blenders and producers. I think it is important to

note that creating markets for our product, which in essence is

convincing a farm to change its modus operandi, takes time but once

that change is made that market has longevity. As mentioned in the

Chairman's review we have had significant positive results in the

testwork undertaken by third party organic fertiliser companies

eager to use our rock phosphate in their blends and look forward to

updating our shareholders in the near future about potential

long-term offtakes or joint ventures. To that end, we will provide

guidance towards the end of the fourth quarter for production and

sales figures for 2024."

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 (as

amended) as it forms part of the domestic law of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 (as amended).

Upon the publication of this Announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Graham Stacey Keras Resources plc graham@kerasplc.com

Ewan Leggat / Charlie Bouverat SP Angel Corporate +44 (0) 20 3470

Nominated Adviser & Joint Finance LLP 0470

Broker

Joint Broker Shard Capital Partners +44 (0) 207 186

Damon Heath / Erik Woolgar LLP 9900

CHAIRMAN'S REVIEW

FOR THE SIX MONTHSED 30 JUNE 2023

I am pleased to provide an update on our progress since the last

report and to set out our outlook for the business going

forward.

2023 has been a transformative year for Keras with the

unbundling of our investment interest in the Nayéga manganese mine

in northern Togo and the focus on becoming the pre-eminent high

grade organic phosphate producer in North America.

The Diamond Creek phosphate mine

The Diamond Creek phosphate mine, which is believed to be one of

the highest grade organic rock phosphate deposits in the US,

comprises an opencast operation located on an 840 acre Federal

Lease located approximately 80km south-east of Salt Lake City,

Utah. Our focus going forward is to build the operation into the

premier high-grade organic phosphate producer in the US.

Our target market is the sustainable, organic agriculture sector

and we are strong advocates for the benefits of enhancing soil

health and reducing the impact that synthetic fertilisers have on

water resources. Our organic phosphate fertilizer products help

farmers realise better crop growth without sacrificing yields, and

reduces the soil degradation seen when farmers use chemically

manufactured fertilisers, while at the same time reducing the

carbon footprint associated with growing their crops.

Sales for the first six months of 2023 were 2,192 tons sold,

compared to the first six months of 2022 of 1,896 tons. Year to

date sales total 3,467 tons. The lower than expected first half

sales volume were a result of an extended Utah winter and flooding

throughout the Central California Valley which impacted several key

clients. High producer price inflation in the US also impacted on

buying patterns of organic fertilizer feedstocks as aggregators and

blenders preferred to preserve cash rather than build fertilizer

stocks as cost pressures impacted their own operations.

Mining has commenced, later than initially planned as a result

of both cash flow and inventory management which is a priority.

Given our existing saleable inventory, mining for the 2023 season,

between now and end-November will be between 2,500 and 4,000 tons

dependent on offtake commitments from customers. Although sales for

the first half of the year were below expectations, we are

confident that these will pick up in the fourth quarter as seen

during the same period in 2022. In addition to our own sales of dry

crushed and milled product we have now seen a significant interest

in organic fertiliser blenders who have now undertaken testwork on

our high-grade phosphate rock to be incorporated in their blends.

The results of this testwork have been positive and we look forward

to updating shareholders once commercial terms have been agreed. As

a company we believe that longer term offtakes with fertiliser

blenders will form a significant proportion of our sales going

forward.

Togo

In May 2023 the Company announced an agreement with the Republic

of Togo (the "State") on a way forward for the Nayéga Manganese

project ("Nayéga") in Northern Togo. Keras and the State agreed

that Nayéga is a Togolese strategic asset and the exploitation

permit will be awarded to Société Togolaise de Manganèse, a

Togolese incorporated company 100% owned by the State ("STM") and

Keras will no longer pursue the Nayéga exploitation permit.

The State paid Keras a cash consideration of US$1.7m (one

million seven hundred thousand United States dollars) on 17 July

2023 and thereafter:

-- Keras will be paid an advisory fee of 1.5% (one and a half

percent) of gross revenue generated from the Nayéga mine for the

provision of advisory services for 3 (three) years; and

-- Keras will be paid 6.0% (six percent) of gross revenue

generated from the Nayéga mine for the provision of brokerage

services for the lesser of 3.5 (three and a half) years or 900,000

(nine hundred thousand) tonnes of beneficiated manganese ore

produced and sold from Nayéga.

Since the agreement was signed in May, the Company and State

have had positive discussions regarding the development of Nayéga.

This process continues and the Company believes that the continued

constructive dialogue between the Company and the State will stand

the project in good stead, and we look forward to updating

shareholders on the way forward.

Financial review

The results for the 6 months ended 30 June 2023 show a loss of

GBP255,000 compared to the six-month period ended 30 June 2022 of

GBP467,000. The reduced loss was due to increased revenue of

GBP397,00 (2022: GBP212,000) and a profit on sale of intellectual

property of GBP184,000.

On 13 April 2023 Chris Grosso from Kershner Grosso & Co.

('Kershner Grosso'), a Saratoga Springs, New York State based

Investment Advisor acquired First Uranium Resources Ltd's (CSE:

URNM) (KMMIF:OTC) ('First Uranium') entire holding of 8,000,000

ordinary shares of 1 pence each in the Company ("Ordinary Shares")

representing 10% of the Company's issued share capital. Subsequent

to his initial investment he has increased his holding to 15.64%.

The Keras Board is very pleased to have Kershner Grosso on board as

a cornerstone shareholder. Kershner Grosso's investment philosophy

is very much aligned with Keras's growth strategy in the US and the

relationship is expected to provide access to new markets and

opportunities throughout North America.

On 4 July 2023 the Company announced receipt of the US$1.7m cash

consideration from the Republic of Togo and made cash payments of

US$800,000, being part of the consideration for the acquisition of

Falcon Isle Resources LLC Falcon Isle Holdings LLC ("Falcon Isle"),

and US$240,000, being part of a severance payment to the former CEO

of Falcon Isle which totalled US$340,000.

Outlook

Although it has been a tough first half of the year, the Company

remains very positive about both the future of Diamond Creek and

the fertiliser market macro-economic conditions that underpin its

future. W e are mining an essential resource that can create value,

be part of the greener economy and contribute to a more sustainable

future. As a mining company we remain ever conscious of our

obligations and commitments in line with best environmental, social

and governance ("ESG") practice and will continue to take the

initiative within this area.

I would like to thank our shareholders for their ongoing support

and I look forward updating all stakeholders as we continue to

build Keras and Diamond Creek into the premier organic phosphate

producer in the US.

Russell Lamming

Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

6 months 6 months 12 months

to 30-Jun-23 to 30-Jun-22 to 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 397 212 994

Cost of

production (44) (104) (263)

-------------- -------------- -------------

Gross profit/loss 353 108 731

Profit on sale of intellectual 184 - -

property relating to Togo

Administrative expenses (686) (550) (1,524)

Loss from operating

activities (149) (442) (793)

Finance income - - -

Finance

costs (106) - (204)

Net finance costs (106) (25) (204)

Loss before taxation (255) (467) (997)

Taxation - - -

-------------- -------------- -------------

Loss for the period (255) (467) (997)

-------------- -------------- -------------

Other comprehensive income -

items that may be subsequently

reclassified to profit or loss

Exchange translation on foreign

operations 29 53 150

Total comprehensive loss for

the period (226) (414) (847)

============== ============== =============

Loss attributable

to:

Owners of the Company (255) (470) (1,076)

Non-controlling

interests - 3 79

-------------- -------------- -------------

Loss for the period (255) (467) (997)

============== ============== =============

Total comprehensive loss attributable

to:

Owners of the Company (226) (414) (907)

Non-controlling

interests - - 60

-------------- -------------- -------------

Total comprehensive loss

for the period (226) (414) (847)

============== ============== =============

Earnings per share

Basic and diluted loss

per share (pence) (0.28) (0.015) (1.148)

============== ============== =============

The notes are an integral part of this condensed consolidated

interim financial report.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 7 3,418 4,875 3,558

Property, plant and

equipment 8 372 591 381

Right of use asset 9 59 185 121

--------------

3,849 5,651 4,060

-------------- -------------- ------------

Current assets

Inventory 10 660 484 668

Trade and other receivables 11 1,612 115 191

Assets held for sale - - 1,558

Cash and cash equivalents 39 440 207

-------------- -------------- ------------

2,311 1,039 2,624

-------------- -------------- ------------

Total assets 6,160 6,690 6,684

============== ============== ============

Equity

Equity attributable

to owners of the Company

Share capital 12 797 798 797

Share premium 12 5,838 5,838 5,838

Other reserves 311 173 282

Retained deficit (3,245) (2,885) (2,990)

-------------- -------------- ------------

3,701 3,924 3,927

Non-controlling interests (146) (133) (146)

-------------- -------------- ------------

Total equity 3,555 3,791 3,781

-------------- -------------- ------------

Liabilities

Current liabilities

Trade and other payables 13 1,478 1,423 1,158

Liabilities held for

sale - - 471

Lease liabilities -

current 9 61 120 126

--------------

1,539 1,543 1,755

-------------- -------------- ------------

Non-current liabilities

Trade and other payables 13 1,066 1,293 1,148

Lease liabilities -

non-current 9 - 63 -

-------------- -------------- ------------

1,066 1,356 1,148

-------------- -------------- ------------

Total liabilities 2,605 2,899 2,903

-------------- -------------- ------------

Total equity and liabilities 6,160 6,690 6,684

============== ============== ============

The notes are an integral part of this condensed consolidated

interim financial report.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Share

option/ Retained Non-controlling

Share Share warrant Exchange earnings/ interests Total

capital premium reserve reserve (deficit) Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2023

(audited) 797 5,838 102 180 (2,990) 3,927 (146) 3,781

Loss for the

period - - - - (255) (255) - (255)

Other

comprehensive

income - - - 29 - 29 - 29

--------- --------- -------- ---------- ----------- --------- ----------------- ---------

Total

comprehensive

loss

for the period - - 29 (255) (226) - (226)

Issue of - - - - - - - -

ordinary shares

Issue costs - - - - - - - -

Non-controlling

interest - - - - - - - -

on acquisition

of subsidiary

Share based - - - - - - - -

payment

transactions

Transactions - - - - - - - -

with owners,

recognised

directly in

equity

Balance at 30

June 2023

(unaudited) 797 5,838 102 209 (3,245) 3,701 (146) 3,555

========= ========= ======== ========== =========== ========= ================= =========

The notes are an integral part of this condensed consolidated

interim financial report.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE TWELVE MONTHSED 31 DECEMBER 2022

Share

option/ Non-controlling

Share Share warrant Exchange Retained interests Total

capital premium reserve reserve Earnings/ Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 (deficit) GBP'000 GBP'000

GBP'000

Balance at 1

January

2022 (audited) 630 4,033 100 11 (1,721) 3,053 229 3,282

Loss for the

period - - - - (1,076) (1,076) 79 (997)

Other

comprehensive

income - - - 169 - 169 (19) 150

--------- --------- -------- ---------- ----------- ---------- ----------------- ---------

Total

comprehensive

loss for the

period - - - 169 (1,076) (907) 60 (847)

Issue of ordinary

shares 167 1,845 - - - 2,012 - 2,012

Costs of share

issue - (40) - - - (40) - (40)

Acquisition of

non-controlling

interest - - - - (200) (200) (435) (635)

Share option

expense - - 9 - - 9 - 9

Share option

forfeit - - (7) - 7 - - -

Transactions with

owners,

recognised

directly

in equity 167 1,805 2 - (193) 1,781 (435) 1,346

Balance at 31

December

2022 (audited) 797 5,838 102 180 (2,990) 3,927 (146) 3,781

========= ========= ======== ========== =========== ========== ================= =========

The notes are an integral part of this condensed consolidated

interim financial report.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2022

Share

option/ Non-

Share Share warrant Exchange Retained controlling Total

capital premium reserve reserve earnings Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2022 (audited) 630 4,033 100 11 (1,721) 3,053 229 3,282

Loss for the period - - - - (470) (470) 3 (467)

Total other comprehensive

income - - - 56 - 56 (3) 53

--------- --------- -------- ---------- -------- -------- ----------- ----------

Total comprehensive

loss for the period - - - 56 (470) (414) - (414)

Issue of ordinary shares 168 1,845 - - - 2,013 - 2,013

Issue costs - (40) - - - (40) - (40)

Acquisition of NCI

without

a change in control

(note 14) - - - - (694) (694) (362) (1,056)

Share based payment

transactions - - 6 - - 6 6

Transactions with owners,

recognised directly

in equity 168 1,805 6 - (694) 1,285 (362) 923

Balance at 30 June

2022 798 5,838 106 67 (2,885) 3,924 (133) 3,791

(unaudited)

========= ========= ======== ========== ======== ======== =========== ==========

The notes are an integral part of this condensed consolidated

interim financial report.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

30-Jun-23 30-Jun-22 31 -Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Loss from operating activities (226) (467) (997)

Adjustments for:

Depreciation and amortisation 61 99 179

Profit on sale of intellectual (184) - -

property relating to Togo

Expenses settled in shares - - 109

Finance costs recognised 106 - 204

Foreign exchange differences - (356) -

Equity-settled share-based payment

transactions - 6 9

-------------- -------------- ------------

(243) (718) (496)

Changes in:

- inventories 8 (211) (395)

- trade and other receivables (8) (21) (97)

- trade and other payables 116 (747) 119

-------------- -------------- ------------

Cash used in operating activities (127) (1,697) (869)

Interest paid (9) - (52)

--------------

Net cash used in operating (1,697

activities (136) ) (921)

-------------- -------------- ------------

Cash flows from investing

activities

Interest received - - -

Acquisition of property, plant - - -

and equipment

Exploration and licence expenditure - (2) -

Consideration for purchase of

minority interest in subsidiary - - (286)

--------------

Net cash used in investing

activities - (2) (286)

-------------- -------------- ------------

Cash flows from financing

activities

Net proceeds from issue of

share capital - 1,973 1,641

Loans received - - 100

Repayment of loans - - (375)

Payment of lease obligations (61) - (93)

--------------

Net cash flows from financing

activities (61) 1,973 1,273

-------------- -------------- ------------

Net (decrease)/increase in

cash and cash equivalents (197) 274 66

Cash and cash equivalents at

beginning of period 207 166 166

Effect of foreign exchange

rate changes 29 - (25)

-------------- -------------- ------------

Cash and cash equivalents at

end of period 39 440 207

============== ============== ============

The notes are an integral part of this condensed consolidated

interim financial report.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2023

1. Reporting entity

Keras Resources plc (the "Company") is a company domiciled in

England and Wales. The unaudited condensed consolidated interim

financial statements of the Company as at and for the six months

ended 30 June 2023 comprise the Company and its subsidiaries

(together referred to as the "Group") and the Group's interests in

associates and jointly controlled entities. The Group currently

operates as an explorer and developer.

2. Basis of preparation

(a) Statement of compliance

This condensed consolidated interim financial report has been

prepared in accordance with IAS 34 Interim Financial Reporting.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial performance and position of the Group since

the last consolidated financial statements as at and for the period

ended 31 December 2022. This condensed consolidated interim

financial report does not include all the information required for

full annual financial statements prepared in accordance with

International Financial Reporting Standards.

This condensed consolidated interim financial report was

approved by the Board of Directors on 27 September 2023, subject to

certain amendments that were delegated to and approved by a

Director on 29 September 2023.

(b) Judgements and estimates

Preparing the interim financial report requires Management to

make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates.

In preparing this condensed consolidated interim financial

report, significant judgements made by Management in applying the

Group's accounting policies and key sources of estimation

uncertainty were the same as those that applied to the audited

consolidated financial statements as at and for the period ended 31

December 2022.

3. Significant accounting policies

The accounting policies applied by the Group in this condensed

consolidated interim financial report are the same as those applied

by the Group in its audited consolidated financial statements as at

and for the period ended 31 December 2022.

4. Financial instruments

Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the audited consolidated

financial statements as at and for the period ended 31 December

2022.

5. Segment information

The Group considers that it operates in two distinct business

areas, manganese mining in West Africa and phosphate mining in

Utah, USA. These business areas form the basis of the Group's

operating segments. For each segment, the Group's CEO (the chief

operating decision maker) reviews internal management reports on at

least a quarterly basis.

Operations ceased in the manganese segment of the Group during

the period. This was a result of the sale of the intellectual

property relating to this geographic region. As a result, an amount

of GBP1,412,077 is recognised within other receivables reflecting

the amounts due on the sale and an amount of GBP184,653 recognised

as a gain on disposal within operating profit.

Other operations relate to the group's administrative functions

conducted at its head office and by its intermediate holding

company together with consolidation adjustments.

Information regarding the results of each reportable segment is

included below. Performance is measured based on segment profit

before tax, as included in the internal management reports that are

reviewed by the Group's CEO. Segment results are used to measure

performance as Management believes such information is the most

relevant in evaluating the performance of certain segments relative

to other entities that operate within the exploration industry.

Information about reportable segments

For the six months ended 30 June 2023 (unaudited)

Other

ManganeseGBP'000 Phosphate operationsGBP'000 Total

GBP'000 GBP'000

External revenue - 397 - 397

=================== ============ =================== ==========

Profit/(loss) before

tax - 141 (396) (255)

=================== ============ =================== ==========

Segment assets - 4,689 1,471 6,160

=================== ============ =================== ==========

For the six months ended 30 June 2022 (unaudited)

Other

ManganeseGBP'000 Phosphate operationsGBP'000 Total

GBP'000 GBP'000

External revenue - 212 - 212

=================== ============ =================== ==========

Profit/(loss) before

tax 22 9 (498) (467)

=================== ============ =================== ==========

Segment assets 1,228 4,744 718 6,690

=================== ============ =================== ==========

5. Segment information (continued)

For the twelve months ended 30 December 2022 (audited)

Other

Manganese Phosphate operations Total

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - 994 - 994

=================== ============ =================== ==========

Profit/(loss) before

tax (131) 68 (934) (997)

=================== ============ =================== ==========

Segment assets 1,558 5,027 99 6,684

=================== ============ =================== ==========

Information about geographical segments:

For the six months ended 30 June 2023 (unaudited)

West US Other Total

Africa operationsGBP'000

GBP'000 GBP'000 GBP'000

External revenue - 397 - 397

========= =================== =================== ==========

Profit/(loss)

before

tax - 141 (396) (255)

========= =================== =================== ==========

Segment assets - 4,689 1,471 6,160

========= =================== =================== ==========

For the six months ended 30 June 2022 (unaudited)

West US Other Total

Africa operationsGBP'000

GBP'000 GBP'000 GBP'000

External revenue - 212 - 212

========= =================== =================== ==========

Profit/(loss)

before

tax 22 9 (498) (467)

========= =================== =================== ==========

Segment assets 1,228 4,744 718 6,690

========= =================== =================== ==========

5 Segment information (continued)

Information about geographical segments(continued)

For the 12 months ended 31

December 2022 (audited)

West US Other Total

Africa operations

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - 994 - 994

========= =================== =================== ==========

Profit/(loss)

before

tax (131) 68 (934) (997)

========= =================== =================== ==========

Segment assets 1,558 5,027 99 6,684

========= =================== =================== ==========

6. Seasonality of operations

Mining at Falcon Isle takes place between May and November due

to winter snow cover at the mine site and on the approach road. The

fertiliser produced is used primarily during the planting and

growing seasons, but sales by Falcon Isle take place throughout the

year.

7. Intangible assets

30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cost

Balance at beginning of period 3,613 4,643 4,643

Additions - 3 -

Effect of movement in exchange

rates (145) 298 349

Transfers to assets held for

sale - - (1,379)

------------------- -------------- ------------

Balance at end of period 3,468 4,944 3,613

=================== ============== ============

Impairment losses

Balance at beginning of period 55 37 37

Impairment - 26 -

Amortisation - - 13

Disposals - - -

Effect of movement in exchange

rates (5) 6 5

------------------- -------------- ------------

Balance at end of period 50 69 55

=================== ============== ============

Carrying amounts

Balance at end of period 3,418 4,875 3,558

====== ====== ======

Balance at beginning of period 3,558 4,606 4,606

====== ====== ======

Intangible assets comprise the fair value of prospecting and

exploration rights.

8. Property, plant and equipment

Acquisitions and disposals

No assets were acquired or disposed of during the six months

ended 30 June 2023 or the comparative period.

9. Right of use asset

30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Balance at beginning of period 121 215 215

Additions - - -

Depreciation (59) (66) (118)

Effects of movements in exchange

rates (3) 36 24

-------------- -------------- ------------

59 185 121

============== ============== ============

Lease liability

GBP'000 GBP'000 GBP'000

Balance at beginning of period 126 219 219

Principal reduction (61) (64) (93)

Finance cost 2 5 9

Effects of movements in exchange

rates (6) 23 (9)

-------- -------- --------

61 183 126

======== ======== ========

Current portion 61 120 126

Non current portion - 63 -

--- ---- ----

61 183 126

=== ==== ====

10. Inventories

30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Phosphate 660 484 668

660 484 668

============== ============== ============

11. Trade and other receivables

30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Trade receivables 89 - 69

Other receivables 1,496 95 85

Prepayments 27 20 37

--------------

1,612 115 191

============== ============== ============

Trade receivables and other receivables are stated at their

nominal values less allowances for non-recoverability.

12. Share capital and reserves

Dividends

No dividends were declared or paid in the six months ended 30

June 2023 (six months ended 30 June 2022 : GBPnil, twelve months

ended 31 December 2022: GBPnil).

13. Trade and other payables

Current 30-Jun-23 30-Jun-22 31-Dec-22

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Trade payables 510 401 262

Accruals 92 208 59

Other payables 247 814 209

Deferred consideration and loans

to previous minority shareholders 629 - 628

1,478 1,423 1,158

============== ============== ============

Non-current 30-Jun-23 30-Jun-22 31-Dec-21

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Other payables - 1,293 83

Deferred consideration and loans

to previous minority shareholders 1,066 - 1,065

1,066 1,293 1,148

============== ============== ============

There is no material difference between the fair value of trade

and other payables and their book value.

14. Acquisition of non-controlling interest ("NCI") in Falcon Isle

In the comparative period, the Group agreed to acquire the

outstanding 49% equity interest in Falcon Isle, together with loans

totalling US$1,816,527 made by the vendor to Falcon Isle for total

consideration of $3.2 million payable in four annual tranches of

US$800,000 commencing on 1 July 2022. The first payment was made on

30 June 2022., The second payment, due by 1 July 2023, has been

treated as a current liability and is included in other payables.

The final two instalments have been treated as non-current

liabilities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVRALITFIV

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

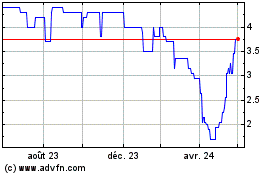

Keras Resources (AQSE:KRS.GB)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

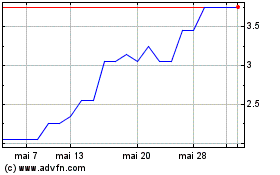

Keras Resources (AQSE:KRS.GB)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025