Kazera Global PLC Delay of Results & Trading Update (4032R)

28 Février 2023 - 6:41PM

UK Regulatory

TIDMKZG

RNS Number : 4032R

Kazera Global PLC

28 February 2023

Kazera Global Plc ( " Kazera " or the "Company")

Delay of Results & Trading Update

Kazera Global plc , the AIM-quoted investment company, announces

that it will not be able to publish its Annual Report &

Accounts for the year ended 30 June 2022 (the " Results " ) by the

end of February 2023. Trading in the Company's shares will continue

to be suspended on AIM until the publication of the Results in

accordance with Rule 19 of the AIM Rules for Companies. The Company

has submitted final accounts to its auditors , which is currently

conducting its review process that it hopes to conclude before the

middle of March 2023.

Further to the RNSs dated 20 December 2022 and 9 January 2023

regarding the sale of Kazera's interest in 100% of the shares in

African Tantalum to Hebei Xinjian Construction ("Xinjian"), the

Company has now received an aggregate of US $2,225,034.51 from

Xinjian.

Operationally, the Company continues to make progress, with both

its Heavy Mineral Sands (HMS) and Diamond operations now in

production . The Company has also placed an order for the

manufacture of equipment to undertake the separation of HMS at its

Alexander Bay site. The equipment, on which the Company has made a

substantial downpayment and has sufficient funds to complete the

purchase, is expected to be delivered in approximately four months

and, once installed, will allow the Company to sell Ilmenite and

Garnet. Accordingly, the Company is in discussions with several

prospective purchasers for these products, whilst it continues to

stockpile large volumes of HMS , whilst also separating out

diamonds.

Finally, the Company can confirm that it has paid off all

outstanding debt to the former Directors and loan providers and now

sits in a healthy net cash position.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc

Dennis Edmonds (CEO)

finnCap (Nominated Adviser & Broker)

Christopher Raggett / Fergus Sullivan

(Corporate Finance) Tel: +44 (0)207 220 0500

St Brides Partners (Financial PR)

Paul Dulieu / Isabel de Salis / Will

Turner kazera@stbridespartners.co.uk

Tel: +44 (0) 20 7236 1177

**ENDS**

About Kazera Global

Kazera is a global investment company focused on developing

early-stage assets towards meaningful cashflow and production in

the resource sector. Its current assets include a diamond mine and

heavy mineral sands production in South Africa. The Company intends

to leverage its unique board expertise, investment capability and

operational proficiency, to facilitate exceptional cash generation

and shareholder growth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTPMRTMTJTBFJ

(END) Dow Jones Newswires

February 28, 2023 12:41 ET (17:41 GMT)

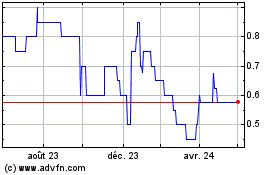

Kennedy Ventures (AQSE:KZG.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

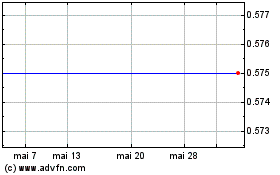

Kennedy Ventures (AQSE:KZG.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025