Decentralized Finance, commonly known as DeFi, is rapidly reshaping

the landscape of financial transactions and systems in our

increasingly digital world. This innovative approach to finance

merges traditional monetary processes with the cutting-edge

technology of blockchain, offering a more accessible, transparent,

and efficient financial system. In this guide, we delve into the

question “What Is DeFi”, we aim to demystify decentralized finance,

illustrating its importance and impact in today’s financial and

cryptocurrency landscapes. What Is DeFi? DeFi, short for

Decentralized Finance, represents a paradigm shift in the way we

think about financial services. At its core, DeFi is an umbrella

term for a variety of financial applications in cryptocurrency or

blockchain geared toward disrupting financial intermediaries.

Unlike traditional banking systems that rely on institutions like

banks and governments, DeFi operates on a decentralized network,

typically using blockchain technology. This means that DeFi

platforms are not controlled by any single entity and are instead

maintained by a distributed network of computers. DeFi encompasses

a broad spectrum of financial services, including lending,

borrowing, trading, investment, and insurance, all without the need

for a central authority. This approach aims to democratize finance

by making these services accessible to anyone with an internet

connection, reducing costs, and increasing transaction speed and

transparency. DeFi Explained: How It Challenges Traditional Finance

DeFi stands in stark contrast to traditional finance in several key

ways. The most notable difference is the elimination of

intermediaries. In traditional finance, banks, brokers, and other

financial institutions act as gatekeepers, controlling access to

financial services and often creating bottlenecks. DeFi, however,

uses blockchain technology and smart contracts to facilitate direct

peer-to-peer transactions, effectively removing these

intermediaries. This decentralization offers numerous advantages:

Lower Fees: Without intermediaries charging for their services,

DeFi platforms can significantly reduce transaction costs. This

cost efficiency is particularly beneficial in cross-border

transactions, where traditional banking fees can be substantial. No

Central Point Of Control: In traditional finance, centralized

systems create points of vulnerability, where failure or attack can

have widespread repercussions. DeFi’s decentralized nature

mitigates this risk, distributing operations across a blockchain

network, enhancing security and resilience. Accessibility And

Inclusivity: DeFi democratizes finance by providing access to

financial services to anyone with an internet connection,

regardless of location or status. This is particularly crucial for

unbanked or underbanked populations who have limited access to

traditional banking services. Transparency And Auditability:

Blockchain’s transparent ledger allows for greater visibility into

transactions and smart contract operations, fostering trust among

users. The Role Of Blockchain Blockchain is the backbone of DeFi.

It’s a distributed ledger technology that records transactions

across multiple computers in a way that ensures the data cannot be

altered retroactively. This technology enables the creation of

smart contracts – self-executing contracts with the terms of the

agreement directly written into lines of code. Smart contracts

automate and enforce the terms of an agreement, eliminating the

need for intermediaries and reducing the chances of fraud. In DeFi,

blockchain not only ensures the security and transparency of

transactions but also allows for the creation of decentralized

applications (dApps) that operate on this technology. These dApps

provide various financial services directly to users, bypassing

traditional financial institutions and reducing costs. The

innovation of blockchain in DeFi represents a significant step

towards a more open, inclusive, and efficient financial system,

promising to revolutionize the way we interact with money. DeFi In

The World Of Cryptocurrency DeFi within the cryptocurrency realm is

a transformative force, redefining the very essence of financial

transactions. This space, termed ‘DeFi crypto,’ is characterized by

the utilization of cryptographic assets to power a myriad of

financial services traditionally monopolized by banks and

centralized institutions. Understanding DeFi Crypto The

intersection of DeFi with cryptocurrencies, commonly referred to as

“DeFi crypto,” marks a significant milestone in the evolution of

digital finance. This synergy allows for the creation and

management of financial products and services in a decentralized

environment, free from traditional banking constraints and

centralized control. DeFi crypto platforms enable users to lend,

borrow, trade, and earn interest on their cryptocurrency holdings

in a trustless manner. These activities are conducted via smart

contracts, which autonomously execute the terms of a contract when

certain conditions are met, thereby eliminating the need for

intermediaries. The term “DeFi crypto” encompasses a wide range of

applications and protocols that operate on blockchain technology,

allowing for innovative financial solutions such as yield farming,

liquidity mining, and decentralized exchanges (DEXs). These DeFi

protocols offer users complete control over their financial assets,

with enhanced privacy and security, which is a significant shift

from the traditional finance model. DEXs are at the heart of DeFi

crypto activity. Uniswap, for example, stands out as a leading DEX,

providing liquidity through an automated market maker (AMM)

protocol rather than a traditional order book. It allows users to

swap ERC-20 tokens directly from their wallets, contributing to the

pool and earning fees proportionate to their share. Other DEXes

like SushiSwap have followed suit, iterating on Uniswap’s original

protocol with additional features and incentives. What Are The Most

Popular DeFi Blockchains? Ethereum, widely known as the leading

blockchain for DeFi applications due to its early adoption of smart

contract functionality, is not alone in the space. Several other

blockchains have become significant DeFi players, with their

popularity often measured by Total Value Locked (TVL). TVL in DeFi

refers to the aggregate value of assets locked within a

decentralized finance (DeFi) protocol. It signifies the amount of

crypto assets, such as tokens, staked or deposited by liquidity

providers in various DeFi platforms. TVL is a crucial metric for

assessing the overall health and popularity of a DeFi protocol. It

helps determine user demand and the protocol’s attractiveness to

investors. Top-10 Blockchains As of November 11, below is the list

of the most popular DeFi blockchains based on data from DefiLlama:

Ethereum: Despite high gas fees, Ethereum’s TVL of $25.559 billion

and daily active users amounting to 355.267 speak to its dominance

and pioneering role in DeFi. It remains the largest and most widely

used blockchain for DeFi, hosting numerous protocols like MakerDAO,

Aave, and Compound. Tron: Tron’s significant TVL of $8.331 billion,

coupled with its massive 1.59 million daily active users,

underscores its popularity, especially in Asian markets. Its DeFi

ecosystem is fueled by high throughput and effective community

engagement strategies. Binance Smart Chain (BSC): BSC has attracted

a considerable number of users, with 957.028 daily active users and

a TVL of $3.004 billion, due to its compatibility with Ethereum’s

assets and lower transaction costs. Solana: Known for its speed and

low fees, Solana has a TVL of $561.84 million and 179.363 daily

active users. It hosts Serum, a high-speed, non-custodial DEX, and

other innovative DeFi projects that exploit its fast block times.

Polygon: As a scaling solution for Ethereum, Polygon enhances

transaction speed and reduces costs, with a TVL of $832.66 million

and 346.808 daily active users. It serves as a sidechain that runs

alongside the main Ethereum chain, hosting popular DApps like

QuickSwap and Aavegotchi. Best Decentralized Finance Applications

DeFi is home to a multitude of applications, each striving to offer

unique and compelling financial services. Based on the latest data

from DappRadar, here’s an overview of the top DeFi applications,

distinguished by their Total Value Locked (TVL), which signifies

the amount of capital they have secured within their respective

protocols: Lido: At the zenith of the list with a TVL of $18.27

billion, Lido stands out as the most prominent liquid staking

solution. It allows Ethereum holders to stake their ETH while

retaining liquidity, facilitating participation in the network’s

security without sacrificing asset accessibility. MakerDAO: With a

TVL of $5.31 billion, MakerDAO is a trailblazer in the DeFi space.

It’s a decentralized credit platform on Ethereum that manages the

DAI stablecoin, pegged to the US dollar, and allows users to open

collateralized debt positions (CDPs) to generate DAI. Uniswap V3:

Commanding a TVL of $3.57 billion, Uniswap V3 is the latest

iteration of the popular DEX, offering improved capital efficiency

for liquidity providers through concentrated liquidity positions.

Aave V3: Aave V3 has garnered a TVL of $3.27 billion and is known

for its innovative approach in decentralized lending. It allows

users to lend and borrow a diverse range of cryptocurrencies with

varying interest rate options. Aave V2: Preceding its successor,

Aave V2 holds a TVL of $2.96 billion. It introduced features such

as collateral swapping and stable borrowing rates, which have been

instrumental in advancing the DeFi lending landscape. DeFi Staking

Explained DeFi staking is a process that involves locking up one’s

cryptocurrency holdings to support the operations of a blockchain

network and, in return, earning rewards. In DeFi, staking is not

merely a support mechanism for the network, but also a way for

users to earn passive income on their crypto holdings. This is

achieved through various DeFi protocols that offer staking

services. When users stake their cryptocurrencies within a DeFi

protocol, they typically transfer their assets into a smart

contract, which then uses those assets in various network functions

such as validating transactions if it’s a Proof of Stake (PoS)

blockchain, or providing liquidity. The users’ staked assets help

maintain the security and efficacy of the platform or network. In

return for staking their assets, users receive rewards, usually in

the form of additional tokens. The rate of return can vary widely,

depending on the platform and the demand for the asset being

staked. Some DeFi protocols also offer additional incentives such

as governance rights, where users can participate in

decision-making processes regarding the future development of the

protocol. Platforms like Synthetix and Curve Finance exemplify DeFi

staking. On Synthetix, users stake SNX tokens to mint synthetic

assets, while on Curve Finance, users stake stablecoins to earn

trading fees and CRV tokens. The complexity of staking varies

across platforms, with some offering simple ‘deposit and earn’

mechanisms, while others may require active participation in

governance or other network activities. What Is Liquidity Mining?

Liquidity mining is a key concept in DeFi that incentivizes users

to supply liquidity to decentralized exchanges and other financial

applications by rewarding them with governance tokens. This process

is fundamental to Automated Market Makers (AMMs), which are at the

core of many DeFi trading platforms. In liquidity mining, users

deposit two assets that form a trading pair into a liquidity pool.

For example, a user might supply both Ethereum and USDC to the

ETH/USDC pool. By providing liquidity, they enable other users to

trade between these two assets more efficiently. The liquidity

provider (LP) gets a share of the transaction fees generated from

trades that happen in that pool, proportional to their share of the

pool’s total liquidity. Beyond transaction fees, liquidity miners

also earn additional rewards, typically in the form of the

platform’s native tokens. These tokens can carry significant value

and often grant holders governance rights, allowing them to vote on

proposals that can affect the platform’s direction and tokenomics.

The phenomenon of liquidity mining really took off with the

emergence of Compound’s COMP token, which was distributed to users

who borrowed or supplied assets to the protocol, kicking off the

“yield farming” craze in the summer of 2020. While liquidity mining

can offer substantial returns, it’s not without risks. Users can

experience an impermanent loss when the price of your deposited

assets changes. Additionally, smart contract vulnerabilities pose a

risk, as exploitation of these vulnerabilities can lead to a loss

of funds. What Is Yield Farming? Yield farming, a cornerstone

activity within DeFi, is an investment strategy that involves

staking or lending crypto assets to generate high returns or

rewards in the form of additional cryptocurrency. This process,

akin to earning interest in a traditional bank, takes advantage of

the intricate incentive structures built into many DeFi protocols.

Investors engage in yield farming by adding their assets to a

liquidity pool, which is essentially a smart contract that contains

funds. In exchange for their contribution, participants obtain

liquidity tokens, which they can subsequently utilize to garner

additional rewards. The DeFi platform typically generates these

rewards from transaction fees, or sometimes they come from new

tokens released during a promotion. For instance, protocols like

Compound distribute their native COMP tokens to users who lend or

borrow on their platform. Similarly, users who provide liquidity to

Uniswap’s pools earn a portion of the trading fees in addition to

potential UNI token rewards. These incentives can be quite

lucrative, leading to the rapid growth and popularity of yield

farming within the DeFi ecosystem. Notably, yield farming involves

high complexity and significant risks, such as smart contract

vulnerabilities, impermanent loss (a change in the value of

deposited assets compared to their value at the time of deposit),

and the volatility of reward tokens. Yet, it remains a popular

method for crypto-savvy users to potentially grow their holdings by

leveraging the DeFi sector’s innovative protocols. DeFi Explained:

Risks And Rewards DeFi’s allure is largely due to its high-yield

opportunities and the democratization of financial services. Users

can engage directly with markets, offering liquidity, borrowing,

lending, and earning potential returns that far surpass traditional

banking products. For example, protocols like Yearn.finance have

popularized yield farming, where investors can earn rewards by

staking or lending cryptocurrency assets. Yet, DeFi is not without

substantial risks. One of the most significant risks comes from

smart contract vulnerabilities. High-profile incidents like the

hack of The DAO, where attackers drained $50 million worth of Ether

due to a smart contract exploit, and the recent Poly Network

attack, leading to the siphoning off of over $600 million (though

largely returned later), highlight the potential for catastrophic

losses. Market volatility can lead to the rapid devaluation of

assets, as seen in the May 2021 market crash, where DeFi markets

experienced significant stress. Furthermore, the absence of a

regulatory safety net means there’s no FDIC insurance equivalent,

leaving users fully exposed if their funds are lost or stolen. What

Is The Future Of DeFi Crypto The trajectory of DeFi crypto is

anticipated to be revolutionary, with potential integration into

mainstream finance and the creation of more complex financial

instruments. This integration could see the likes of Aave or

Compound potentially working alongside or within traditional

financial institutions, bringing liquidity and new lending

mechanisms to the market. However, the road ahead is fraught with

challenges that need addressing. Expected changes in regulatory

frameworks could legitimize DeFi platforms by ensuring their

compliance with global financial regulations. This could mitigate

one of the most pressing risks: the uncertainty and the “Wild West”

nature of the current DeFi landscape. The future also likely holds

more advanced security protocols to prevent exploits and hacks,

which have historically plagued platforms like dForce and Harvest

Finance, resulting in losses worth millions. Improved security,

alongside enhanced user experience, could help in reducing the

entry barrier for less tech-savvy users, broadening DeFi’s appeal.

Another anticipated development is the rise of “DeFi 2.0”, with

protocols that address the issues of its predecessor, such as

impermanent loss in liquidity pools or the sustainability of yield

farming rewards. With these advancements, coupled with a possible

increase in institutional involvement, DeFi crypto stands to

redefine not only how we understand finance but how we interact

with money in a digital age. FAQ: What Is Decentralized Finance

(DeFi)? What Is DeFi? DeFi, or Decentralized Finance, refers to a

movement that aims to create an open-source, permissionless, and

transparent financial service ecosystem that operates without

central authorities. Blockchain networks host DeFi systems, which

use smart contracts to offer services that include banking, loans,

asset trading, and complex financial instruments. What Is

Decentralized Finance? Decentralized Finance is a term synonymous

with DeFi. It represents the shift from traditional, centralized

financial systems to peer-to-peer finance enabled by decentralized

technologies built on the blockchain. What Is DeFi Crypto? DeFi

crypto refers to the use of cryptocurrency within DeFi systems. It

involves the application of crypto assets to engage in financial

activities such as earning interest, borrowing, lending, and

trading through decentralized platforms. What Is Compound DeFi?

Compound is a DeFi protocol that allows individuals to earn

interest on their cryptocurrencies by depositing them into one of

several pools supported by the platform. Moreover, it also enables

borrowing of a range of cryptocurrencies. What Is DeFi Staking?

DeFi staking involves locking up one’s cryptocurrency holdings

within a DeFi protocol to earn rewards or interest. What Does DeFi

Mean? “Decentralized Finance,” or DeFi, represents financial

services built on open and decentralized blockchain technologies,

independent of traditional financial institutions. What Does DeFi

Stand For? DeFi stands for Decentralized Finance, encapsulating the

idea of financial services being open to everyone, operating

autonomously on blockchain, and utilizing smart contracts to

facilitate transactions. What Does DeFi Mean In Crypto? In the

context of crypto, DeFi describes the ecosystem of financial

applications built on blockchain technology, especially those

employing smart contracts, commonly on networks like Ethereum. This

setup allows parties to conduct a variety of financial transactions

directly with each other, eliminating the need for centralized

intermediaries. Featured images from Shutterstock

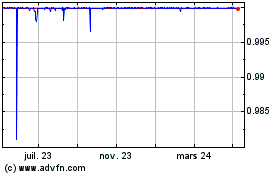

Dai Stablecoin (COIN:DAIUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Dai Stablecoin (COIN:DAIUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024