Behind Ethereum’s Surge: Here’s How This Whale Is Taking Advantage Of The ETH Rally

14 Février 2024 - 2:30AM

NEWSBTC

In recent weeks, Ethereum has witnessed a noticeable uptick in its

market price, reaching a one-month high and showcasing a growing

demand for the asset. Amid this development, the on-chain analytics

platform Lookonchain revealed an Ethereum whale’s noteworthy

strategy, marking a bold stance on Ethereum’s future trajectory.

Strategic Accumulation Amid Rising Prices According to

Loookonchain, an unknown whale has been actively increasing their

Ethereum holdings, utilizing the Spark platform’s revolving loan

feature. Spark platform is a decentralized finance (DeFi) product

that enables users to borrow stablecoins like USDC or DAI against

their cryptocurrency holdings. Related Reading: Crypto Drama

Unfolds: Ethereum Co-Founder’s 22,000 ETH Transfer Sparks Price

Speculation This investor has managed to withdraw 39,900 ETH worth

roughly $99.5 million from major exchanges such as Binance, Bybit,

OKEx, and Bitfinex, leveraging the flexibility of revolving loans

to boost their position in Ethereum. Further insights from

Lookonchain reveal that these withdrawals by the whale represent a

continuous strategy rather than an isolated event. Since the start

of the month, the whale has consistently been pulling out ETH,

averaging a withdrawal price of $2,492, and has secured about 56.8

million DAI in loans from the Spark platform so far. A whale is

accumulating $ETH and going long $ETH by revolving loans on #Spark!

The whale has withdrawn 39.9K $ETH($99.5M) from #Binance, #Bybit,

#OKEx and #Bitfinex since Feb 1 at an average price of $2,492, and

borrowed 56.8M $DAI from #Spark.https://t.co/9EQSrwHnJD

pic.twitter.com/6CydURt2pc — Lookonchain (@lookonchain) February

13, 2024 While bold, this strategy highlights the optimism

surrounding Ethereum’s potential growth, especially in anticipation

of the upcoming altcoin bull run and the expanding interest in

Ethereum-based investment products like the spot exchange-traded

funds (ETFs). Spotlight On Ethereum Spot ETFs While the United

States Securities and Exchange Commission (SEC) is yet to disclose

any latest update on the already filed applications of the spot

Ethereum ETFs, asset manager Franklin Templeton has recently jumped

on the spot ETH ETF queue. A recent post by James Seyffart, an

experienced analyst at Bloomberg Intelligence, highlights that

Franklin Templeton has joined the ranks as the eighth firm in the

cryptocurrency sector to apply for product authorization. This

follows submissions by other prominent asset managers for Ethereum

ETFs, namely Hashdex, BlackRock, Fidelity, Ark and 21Shares,

Grayscale, VanEck, Invesco, and Galaxy. Here’s the most recent

table of other filers that I have pic.twitter.com/xCRRMwK76r —

James Seyffart (@JSeyff) February 12, 2024 These developments come

when Ethereum has sustained a positive momentum, closely tracking

Bitcoin’s performance. The asset has witnessed more than 10% surge

in the past week, maintaining this upward trend with an additional

nearly 1% increase in the past 24 hours. Related Reading: Ethereum

Price Rallies 5%, Why ETH Bulls Could Aim For $3K This Month This

price performance has elevated Ethereum to a current trading value

of $2,614 as of this writing. Featured image from Unsplash, Chart

from Tradingview

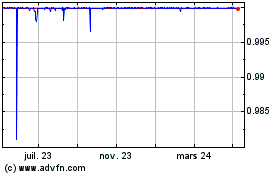

Dai Stablecoin (COIN:DAIUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

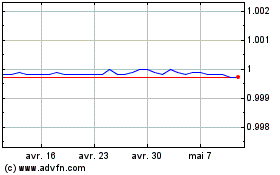

Dai Stablecoin (COIN:DAIUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024