Bitcoin May Slide To $65,000 As Critical Support Level Fails – Details

03 Novembre 2024 - 7:00PM

NEWSBTC

The price of Bitcoin has experienced some instability in the last

few hours declining by almost 3%. This negative price action drives

more attention to the largest digital asset, especially with the US

election fast approaching. While many analysts are now skeptical of

Bitcoin’s immediate movements, pro-trader Justin Bennett already

issued a cautionary insight into the asset’s future. Related

Reading: How To Trade Bitcoin During The US Election, Expert

Reveals Bitcoin Breaches Crucial $69,000 Support Zone In an X post

on November 1, Bennet shared an analysis of the BTC market,

proclaiming the dip below $70,000 as a concerning development.

Notably, the premier cryptocurrency had risen by over 23% in the

past three weeks to trade briefly above $73,000 before experiencing

a pullback to around $69,000 on Friday. Interestingly, Bennet

stated that $69,000 represented a critical support zone for

Bitcoin. He emphasized the importance of the token’s value staying

above this price level, describing it as the “last line of defense”

for the market bulls. In the last few hours, Bitcoin has fallen

below $69,000 reaching around $67,900. According to Bennet’s

prediction, Bitcoin could now slump as low as $65,000 where

its next major resistance lies. Importantly, such a decline will

indicate the digital asset has yet to break out of a consolidation

range stretching over the last eight months. In terms of future

price gains, Bennet has stated his expectations of Bitcoin to

eventually surpass its all-time high (ATH) at $73,750, albeit he

remains uncertain of how low the asset will trade before achieving

this feat. Since hitting its ATH in March, Bitcoin has only

produced a range-bound price movement between $55,000-$72,000 even

despite positive market indicators such as Fed rate cuts and

significantly high inflows in the Spot Bitcoin ETF

market. However, a traditionally bullish Q4, the potential of

sustained heightened ETF inflows, and the upcoming US election

signals an imminent possible price breakout for the crypto market

leader. Related Reading: Bitcoin On-Chain Indicator Signals Panic

Selling At Current Levels – Time To HODL? Bitcoin Sentiment Bullish

As US Election Approaches Despite recent price loss, data from

CoinMarketCap shows the general market sentiment on Bitcoin remains

highly bullish ahead of the US general election. Historically, the

maiden cryptocurrency has always experienced a decline in the days

leading to the election with price drops of 10.2% in 2016,

6.1% in 2020, and most recently 6.3% in 2024. While there is still

the possibility of further price losses before D-day on November 5,

investors are likely to be unfazed as Bitcoin’s price has always

gone parabolic after the elections. At the time of writing, the

crypto market leader continues to trade around $68,175 following a

2.52% loss in the past day. However, the daily trading volume is

down by 53.91% and is valued at $21.76 billion. Featured image from

Shutterstock, chart from Tradingview

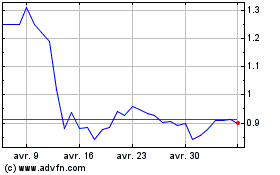

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025