US Spot Bitcoin ETFs Flip Nakamoto To Become Largest BTC Holder, Here’s How Much They’ve Bought

07 Décembre 2024 - 9:00PM

NEWSBTC

US Spot Bitcoin ETFs have significantly transformed both Bitcoin

and the broader crypto industry. These ETFs have seen their value

and holdings grow massively since their launch in January 2024,

breaking multiple ETF records in traditional finance. Related

Reading: Dogecoin Days At The Top Numbered? Cardano Set To Take

Over — Analyst As it stands, US Spot Bitcoin ETFs have now

surpassed BTC’s elusive creator, Satoshi Nakamoto, as the largest

holder of Bitcoin. A Historic Milestone For Bitcoin ETFs US

Spot Bitcoin ETFs have reached a remarkable milestone, becoming the

single largest holder of the top coin. Currently, the 12 US Spot

Bitcoin ETF providers collectively hold 1,104,534 BTC, which is

around 5.62% of the entire Bitcoin market cap. As such, they have

now exceeded Satoshi Nakamoto’s stash of 1,100,000 BTC, which has

remained untouched since his disappearance. Notably, these

1,100,000 BTC, mined during the early days of Bitcoin, have

remained stagnant for over a decade. The remarkable achievement by

US Spot Bitcoin ETFs is the result of consistent inflows, which

have played a significant role in driving its price above the

critical $100,000 psychological threshold. Recent data from

SosoValue highlights that US Spot BTC ETFs have recorded seven

consecutive trading days of inflows, with the most recent surge

being $376.59 million on December 6. Interestingly, this streak of

inflows extends far beyond the last seven trading days. Over the

past 40 trading days, US Spot Bitcoin ETFs have experienced inflows

on 32 occasions, reflecting a sustained trend of investor interest.

The total holdings of US Spot Bitcoin ETFs have significantly

strengthened due to these consistent inflows and are now valued at

$112.74 billion based on the current price of the digital currency.

Implications Of Growing ETF Dominance The growth of Spot Bitcoin

ETFs as the largest holders of BTC points to a maturing market and

reflects a shift in the crypto’s appeal to institutional investors.

Institutional participation has increased considerably, as the ETFs

offer a regulated means for investors to gain exposure to the

crypto without directly holding the cryptocurrency. This has

prompted many market participants to suggest that BTC might be

transitioning into an asset for institutional holders and not for

retail investors anymore. Nonetheless, the momentum behind Spot

ETFs is unlikely to stop anytime soon. The inflow is projected to

keep increasing with increasing adoption and approval in other

major markets, like the European market. However, it also raises

the question of market influence and centralization of crypto

holdings. Interestingly, on-chain data shows that many long-term

holders of Bitcoin holding in self-custody have also opted to

transfer their assets into these spot ETFs in order to take

advantage of their regulatory clarity. Related Reading: Market

Expert: Not Long On XRP? You’re ‘Disrespecting’ Yourself At the

time of writing, the BTC price is trading at $99,650 and is still

looking to register a decisive break above the $100,000 price

level. Featured image from Blue Trust, chart from TradingView

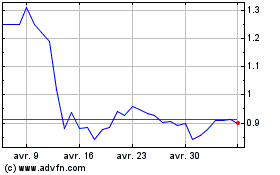

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024