Bitcoin Bargains: Expert Reveals Ideal Buy Zones For Maximum Gain

28 Mai 2024 - 3:00AM

NEWSBTC

As Bitcoin navigates through a period of consolidation, the asset’s

price movements are being monitored for optimal entry points.

Michaël van de Poppe, a renowned crypto analyst, has recently

shared valuable insights into Bitcoin’s current market status and

potential for future movement. According to van de Poppe, Bitcoin

aims to stabilize within a particular price level, hinting at a

possibly extended consolidation phase that could offer a clearer

picture for strategic market entries. Related Reading: Bollinger

Bands Inventor Foresees Bitcoin Pullback: Key Levels To Watch

Strategic Buying Opportunities For Bitcoin Van de Poppe suggests

specific price marks that could represent advantageous buying

opportunities for Bitcoin. He points out that if Bitcoin’s price

were to drop below $66,000, it could reach lower range levels,

presenting a prime buying opportunity. #Bitcoin aims to consolidate

in these levels. Where to buy? Losing $66K and I think we’ll test

range low and be buying there again. That’s the level where you’d

want to get your purchases ready. pic.twitter.com/RoYYzJJnt8 —

Michaël van de Poppe (@CryptoMichNL) May 27, 2024 Furthermore, in

another post published on May 24, the analyst revealed that Bitcoin

could slide towards $61,000, which could mark another significant

entry point for investors. Monitoring these price levels could be

key to capitalizing on potential market lows. In addition to

pinpointing optimal buying zones, Van de Poppe advocates adopting a

Dollar-Cost Averaging (DCA) strategy during this period. #Bitcoin

is consolidating, and it’s within the range. Probably that

consolidation will be taking place for a longer period and I

suspect we might see $61-63K even. Rotation from Bitcoin to

Ethereum causing a longer sideways period. It’s fine. Simply DCA.

pic.twitter.com/7hb77dNEKx — Michaël van de Poppe (@CryptoMichNL)

May 24, 2024 This method involves making regular purchases of

Bitcoin at fixed intervals, regardless of the fluctuating prices,

thereby averaging the investment cost over time. This strategy is

particularly beneficial in mitigating the risks associated with BTC

prices’ high volatility. It allows traders to build positions

without the pressure of timing the market perfectly. Comparative

Analysis And Future Outlook While van de Poppe focuses on immediate

strategies for navigating the current Bitcoin climate, other

analysts, like PlanB, look at broader market indicators to

forecast future movements. PlanB, known for its Bitcoin

Stock-to-Flow model, observes that the Market Value to Realized

Value (MVRV) score and Bitcoin’s Relative Strength Index (RSI) show

signs of a potential surge. Bitcoin is gaining momentum

pic.twitter.com/tbQu7o0hDB — PlanB (@100trillionUSD) May 26, 2024

Historical data suggests that rising MVRV scores, alongside

increasing RSI, often precede market tops and heightened buying

activity. Moreover, PlanB’s recent analysis indicates that the

periods with low MVRV scores, which typically correspond with

bearish market phases, might be cycling out, hinting at upcoming

bullish momentum. Related Reading: Bitcoin Bulls Gain Breathing

Room As Long-Term Holder Activity Eases – Glassnode This could mean

that, despite the recent high of $71,000, Bitcoin might not only

revisit these levels but could potentially exceed them, challenging

its all-time high of $73,000 set in March. Featured image created

with DALL·E, Chart from TradingView

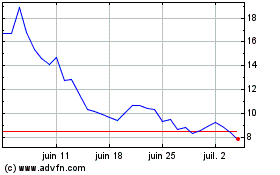

Prime (COIN:PRIMEUSD)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Prime (COIN:PRIMEUSD)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024