Binance Hacker Put Millions Of New BNB In Circulation, What Does This Mean For Price?

07 Octobre 2022 - 7:00PM

NEWSBTC

In the early hours of Friday, news broke that a hacker had been

able to successfully exploit the BNB Chain. However, unlike

decentralized finance (DeFi) hacks that have become prominent in

the crypto market, the hacker did not steal user funds. They had

actually brought new BNB coins into circulation, in what would be

one of the largest hacks recorded in crypto so far. Hack Puts New

BNB In Circulation The hack had happened directly on the Binance

bridge, where the attacker had been able to somehow convince the

bridge to send them millions of new tokens. The attack happened in

two waves, each transaction carrying 1 million new BNB. This

resulted in over $500 million worth of coins being sent into

circulation. Related Reading: Wash Trading Dominates Bitcoin

Volume, What Does This Mean For Price? The BSC Chain had been

quickly paused by the team before more damage could be done and

some of the coins gotten by the attacker were reportedly frozen,

leaving the hacker with about $100 million in their stolen loot.

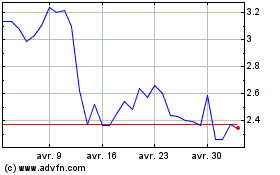

Binance Coin dips following hack | Source: BNBUSD on

TradingView.com However, the damage had already been done and the

BNB price had tanked following the news. Now, as the network

continues to handle the aftermath of what could have been a

devastating hack, speculations have now turned towards what the

hack could mean for the value of BNB, at least in the short term.

Will This Affect Price? The price of any asset is affected by the

available supply and if a large amount of supply is put into

circulation at once, it can obviously have an impact on the price

of that asset. However, in the case of BNB, the exploit had been

stopped at the right moment, it seems, and the amount the attacker

had made off with had not been enough to have any significant

impact on the price of BNB. Related Reading: Brace For Impact: This

Expert Trader Says Cardano (ADA) Will See A 50% Decline The major

concern regarding price now springs up from the trust level in the

network. As has been the case in the past, hacks have usually seen

a drastic decline in investor trust, leading them to pull out their

funds but that has not been the case with BNB. In Binance’s case,

it had brought up questions about how truly “decentralized” the

blockchain is if it can be paused due to a hack. Besides a slight

dip in the price of the digital asset since the hack was made

public, BNB looks to be holding up well. It still maintains its

value above $280 at the time of this writing. Additionally, BNB is

backed by the largest crypto exchange in the world that holds

quarterly burns and the 21st burn is expected to happen sometime

this month. So the impact on the price will likely not be

significant in any way. Featured image from Freepik, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

Waves (COIN:WAVESUSD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Waves (COIN:WAVESUSD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025

Real-Time news about Waves (Cryptomonnaies): 0 recent articles

Plus d'articles sur Waves