Results Exceed Expectations

BE Semiconductor Industries N.V. (the “Company" or "Besi")

(Euronext Amsterdam:BESI) (OTC markets:BESIY) (Nasdaq International

Designation), a leading manufacturer of assembly equipment for the

semiconductor industry, today announced its results for the fourth

quarter and year ended December 31, 2016.

Key Highlights Q4-16

- Revenue of € 93.1 million, down 1.3% vs. Q3-16 but up 19.7% vs.

Q4-15. Better than guidance due to higher epoxy and flip chip die

bonding shipments for mobile and automotive applications

- Orders of € 91.4 million, up 17.0% vs. Q3-16 and 18.2% vs.

Q4-15 as a result of broad based demand for Besi’s advanced

packaging portfolio and improved industry conditions

- Gross margin reaches 53.2%. Up vs. 50.5% in Q3-16 and 50.0% in

Q4-15 due primarily to material cost efficiencies and forex

benefits

- Net income of € 16.7 million is up € 0.1 million vs. Q3-16 and

€ 7.0 million vs. Q4-15

- Net margin reaches 18.0% in Q4-16 vs. 17.6% in Q3-16. Up

significantly vs Q4-15 (12.4%) due primarily to revenue growth,

operating leverage and cost control efforts

- Financial position enhanced. Net cash up € 31.6 million (23.2%)

vs. Q4-15 to reach € 168.1 million

- € 125 million 2.5% Senior Unsecured Convertible Notes placed to

help fund, amongst others, future growth

Key Highlights 2016/2015

- Revenue of € 375.4 million, up 7.5% primarily as a result of

increased demand by Asian customers for Besi’s high end and

mainstream assembly solutions and improved industry conditions

- Orders up 7.3% primarily due to higher demand for new advanced

packaging capacity, smart phone features and automotive

electronics

- Gross margin rose to 51.0% vs. 48.8% principally as a result of

increased material and labor cost efficiencies, market position and

forex benefits

- Net income of € 65.3 million, up € 16.3 million. Net margin

increased to 17.4% vs. 14.0% in 2015

- 2016 dividend of € 1.74 proposed for May AGM (includes € 0.35

special dividend). Up 45% vs. 2015

Outlook

- Q1-17 revenue expected to increase 15-20% vs. Q4-16. Industry

upturn continues. Orders to date in Q1-17 significantly exceed

Q4-16 levels

| |

|

|

|

|

|

|

|

|

|

(€ millions, except EPS) |

Q4-2016 |

Q3-2016 |

Δ |

Q4-2015 |

Δ |

2016 |

2015 |

Δ |

|

Revenue |

93.1 |

94.3 |

-1.3 |

% |

77.8 |

+19.7 |

% |

375.4 |

349.2 |

+7.5 |

% |

|

Orders |

91.4 |

78.1 |

+17.0 |

% |

77.3 |

+18.2 |

% |

373.8 |

348.3 |

+7.3 |

% |

|

EBITDA |

23.3 |

23.0 |

+1.3 |

% |

16.9 |

+37.9 |

% |

89.8 |

73.0 |

+23.0 |

% |

|

Net Income |

16.7 |

16.6 |

+0.6 |

% |

9.7 |

+72.2 |

% |

65.3 |

49.0 |

+33.3 |

% |

|

Adjusted Net Income* |

16.7 |

16.7 |

+0.0 |

% |

10.9 |

+53.2 |

% |

65.2 |

46.9 |

+39.0 |

% |

|

EPS (basic) |

0.45 |

0.44 |

+2.3 |

% |

0.26 |

+73.1 |

% |

1.74 |

1.29 |

+34.9 |

% |

|

EPS (diluted) |

0.43 |

0.43 |

+0.0 |

% |

0.25 |

+72.0 |

% |

1.70 |

1.27 |

+33.9 |

% |

|

Net Cash |

168.1 |

131.9 |

+27.4 |

% |

136.5 |

+23.2 |

% |

168.1 |

136.5 |

+23.2 |

% |

* Adjusted net income excludes certain tax

benefits/charges and restructuring charges/benefits, net.

Richard W. Blickman, President and Chief

Executive Officer of Besi, commented:2016 was a year of

unexpected industry growth, strong financial performance and

strategic positioning for the future. Besi generated revenue of €

375.4 million and net income of € 65.3 million, increases of 7.5%

and 33.3%, respectively, vs. 2015. Net income grew even more

rapidly than sales this year as gross margins reached 51.0% and

cost control initiatives kept expense growth in check. In addition,

our financial position continued to strengthen with net cash at

year end reaching € 168.1 million, an increase of 23.2% vs. year

end 2015.

Our strong profit and cash flow generation in

recent years has enabled Besi to enhance shareholder returns. In

2016, we utilized € 67.8 million in cash for dividends and share

repurchases, an increase of 11.3% vs. 2015. Cumulatively, since

2011, we have utilized € 186.0 million of cash for such purposes.

Given our favorable 2016 performance and prospects, we have

proposed a dividend of € 1.74 per share, a 45% increase vs. 2015,

of which € 0.35 represents a special dividend for the year. The

proposed dividend represents a pay-out ratio relative to net income

of 100% for 2016 vs. 93% for 2015.

Revenue growth built progressively during 2016

stimulated by expanded investment by Chinese and Taiwanese

subcontractors for new, state of the art advanced packaging

capacity, accelerating demand for flash memory devices and the

continued proliferation of intelligent automotive electronics. In

addition, growth was aided by a new technology cycle which

encouraged capital spending for next generation <20 nano

applications. In the smart phone arena, there was expanded customer

investment in more advanced features and functionality such as

fingerprint sensors and advanced dual camera and flashlight

modules.

The second half of 2016 witnessed much stronger

than anticipated order, revenue and profit levels with particular

strength in Q4-16. During a traditionally weak period, revenue and

net income reached € 93.1 million and € 16.7 million, respectively,

while gross and net margins rose to 53.2% and 18.0%, respectively.

Besi’s results significantly exceeded guidance due primarily to

much stronger than anticipated shipments of epoxy and flip chip die

bonding systems for mobile and automotive applications and shorter

delivery times to customers. Order patterns to date in 2017 confirm

a continued industry upswing well into the first half year with

bookings to date in Q1-17 significantly exceeding levels realized

in all of Q4-16. As such, we guide for a sequential Q1-17 revenue

increase of 15-20% and are scaling our Asian supply chains and

production capabilities to meet anticipated demand.

Longer term, there still remains much unrealized

potential to increase Besi’s market position and profitability in

the years ahead. In this regard, we completed in Q4-16 a

comprehensive review of our business, strategic positioning and

cost structure with an independent consulting firm. Revenue and

cost initiatives were agreed for implementation over the next five

years. To help us capitalize on future growth opportunities, Besi

also successfully placed in December 2016 € 125 million of 2.5%

Convertible Notes due 2023 which provides funding on highly

attractive terms for our next growth

phase.

Fourth Quarter Results of

Operations

|

|

Q4-2016 |

Q3-2016 |

Δ |

Q4-2015 |

Δ |

|

Revenue |

93.1 |

94.3 |

-1.3 |

% |

77.8 |

+19.7 |

% |

|

Orders |

91.4 |

78.1 |

+17.0 |

% |

77.3 |

+18.2 |

% |

|

Backlog |

76.3 |

78.0 |

-2.2 |

% |

77.8 |

-1.9 |

% |

|

Book to Bill Ratio |

1.0x |

0.8x |

+0.2 |

|

1.0x |

- |

|

Besi’s Q4-16 revenue decreased by 1.3% vs. Q3-16

but significantly exceeded guidance (-10-15%) due to much stronger

than anticipated shipments of epoxy, multi module and flip chip die

bonding systems and shorter cycle times. In Q4-16, there was

particularly strong demand by both IDMs and Asian subcontractors

for mobile and automotive applications. Revenue increased by 19.7%

vs. Q4-15 due primarily to higher demand by Chinese and Taiwanese

subcontractors for new advanced packaging capacity and improved

industry conditions.

Orders increased by 17.0% vs. Q3-16 and by 18.2%

vs. Q4-15 primarily due to broad based strength in demand by both

IDMs and Asian subcontractors for Besi’s high end and mainstream

advanced packaging solutions and improved industry conditions. Per

customer type, subcontractor orders increased sequentially in Q4-16

by € 5.8 million, or 16.9%, while IDM orders increased by € 7.5

million, or 17.2%.

|

|

Q4-2016 |

Q3-2016 |

Δ |

Q4-2015 |

Δ |

|

Gross Margin |

53.2 |

% |

50.5 |

% |

+2.7 |

|

50.0 |

% |

+3.2 |

|

|

Operating Expenses |

29.8 |

|

28.2 |

|

+5.7 |

% |

26.5 |

|

+12.5 |

% |

|

Financial Expense/ (Income),

net |

0.0 |

|

0.9 |

|

NM |

|

0.2 |

|

NM |

|

|

EBITDA |

23.3 |

|

23.0 |

|

+1.3 |

% |

16.9 |

|

+37.9 |

% |

Besi’s gross margin in Q4-16 increased by 2.7%

vs. Q3-16 primarily as a result of increased material and freight

efficiencies and forex benefits due principally to an increase in

the US dollar vs. the euro. As compared to Q4-15, the 3.2% increase

was primarily due to material and labor cost efficiencies and forex

benefits.

Q4-16 operating expenses increased by € 1.6

million (5.7%) vs. Q3-16 primarily as a result of higher

performance based compensation and one-time consulting costs.

Operating expenses increased by € 3.3 million (12.5%) vs.

Q4-15 due to similar factors as well as increased warranty expense

related to higher sales levels. Total headcount at December 31,

2016 increased by 3.0% vs. September 30, 2016 as ongoing decreases

in European headcount were more than offset by higher Asian fixed

and temporary production personnel associated primarily with the

Q4-16 order ramp.

|

|

Q4-2016 |

Q3-2016 |

Δ |

Q4-2015 |

Δ |

|

As Reported |

|

|

|

|

|

|

Net Income |

16.7 |

|

16.6 |

|

+0.6 |

% |

9.7 |

|

+72.2 |

% |

|

Net Margin |

18.0 |

% |

17.6 |

% |

+0.4 |

|

12.4 |

% |

+5.6 |

|

|

Tax Rate |

15.1 |

% |

11.1 |

% |

+4.0 |

|

20.6 |

% |

-5.5 |

|

|

|

|

|

|

|

|

|

As Adjusted* |

|

|

|

|

|

|

Net Income |

16.7 |

|

16.7 |

|

- |

|

10.9 |

|

+53.2 |

% |

|

Net Margin |

18.0 |

% |

17.7 |

% |

+0.3 |

|

14.0 |

% |

+4.0 |

|

|

Tax Rate |

15.1 |

% |

11.1 |

% |

+4.0 |

|

10.7 |

% |

+4.4 |

|

* Adjusted net income excludes € 0.1 million of

restructuring charges in Q3-16 and € 1.2 million in Q4-15 related

to deferred taxes.

Besi’s Q4-16 net income was up € 0.1 million vs.

Q3-16. As compared to Q4-15, net income increased by € 7.0 million

(72.2%) primarily as a result of (i) 19.7% revenue growth, (ii)

gross margin improvement of 3.2% and (iii) a lower effective tax

rate partially offset by increased operating expenses.

Full Year Results of Operations

2016/2015

|

|

As Reported |

As Adjusted* |

|

|

2016 |

|

2015 |

|

Δ2016/2015 |

2016 |

|

2015 |

|

Δ2016/2015 |

|

Revenue |

375.4 |

|

349.2 |

|

+7.5 |

% |

375.4 |

|

349.2 |

|

+7.5 |

% |

|

Orders |

373.8 |

|

348.3 |

|

+7.3 |

% |

373.8 |

|

348.3 |

|

+7.3 |

% |

|

Net Income |

65.3 |

|

49.0 |

|

+33.3 |

% |

65.2 |

|

46.9 |

|

+39.0 |

% |

|

Net Margin |

17.4 |

% |

14.0 |

% |

+3.4 |

|

17.4 |

% |

13.4 |

% |

+4.0 |

|

|

Tax Rate |

11.2 |

% |

14.3 |

% |

-3.1 |

|

12.5 |

% |

12.9 |

% |

-0.4 |

|

* Adjusted net income excludes certain tax

benefits/charges and restructuring charges/benefits, net.

Besi’s revenue increased by € 26.2 million

(7.5%) in 2016 primarily due to increased demand by Chinese and

Taiwanese subcontractors for its range of high end and mainstream

assembly solutions, more favourable industry conditions and the

benefits of a new technology cycle. In general, customers increased

advanced packaging capacity for mobile handsets, upgraded smart

phone features and continued investments in automotive

applications. In particular, Besi experienced strong growth for its

epoxy, multi module and eWLB die bonders and ultra-thin molding

equipment for such applications. Similarly, orders in 2016

increased by 7.3% vs. 2015. Orders by IDMs and subcontractors

represented approximately 51% and 49%, respectively, of Besi’s

total orders in 2016 versus 60% and 40%, respectively, in 2015.

Net income increased by € 16.3 million (33.3%)

vs. 2015 primarily due to a (i) 7.5% revenue increase, (ii) 2.2%

gross margin improvement and (iii) 3.1% reduction in Besi’s

effective tax rate partially offset by € 3.8 million of increased

operating expenses primarily due to the absence of net

restructuring benefits recognized in

2015. Financial Condition

|

|

Q4-2016 |

Q3-2016 |

Δ |

Q4-2015 |

Δ |

|

Net Cash |

168.1 |

131.9 |

+27.4 |

% |

136.5 |

+23.2 |

% |

|

Cash flow from Ops. |

33.4 |

30.1 |

+11.0 |

% |

32.5 |

+2.8 |

% |

At year end 2016, Besi’s cash and deposits

increased by € 151.5 million vs. Q3-16 to reach € 304.8

million primarily due to the net proceeds received from the

issuance of € 125 million of Convertible Notes in December. In

addition, net cash increased by € 36.2 million to reach € 168.1

million. Besi generated cash flow from operations of € 33.4 million

in Q4-16 which was utilized primarily to fund (i) € 4.5

million of share repurchases, (ii) € 2.2 million of capital

expenditures and (iii) € 1.9 million of capitalized

development spending.

As compared to year end 2015, net cash increased

by € 31.6 million, or 23.2%. Besi generated cash flow from

operations during the year of € 98.7 million which was utilized

primarily to fund (i) cash dividends of € 45.4 million, (ii) share

repurchases of € 22.0 million, (iii) € 6.7 million of capitalized

development spending and (iv) € 4.5 million of capital

expenditures.

Convertible Bond OfferingOn

December 2, 2016, Besi issued € 125 million principal amount of

2.5% Senior Unsecured Convertible Notes due December 2023 (the

“Notes”). The Notes convert into approximately 2.9 million Besi

ordinary shares at a conversion price of € 43.51 (subject to

adjustment). The Company may redeem the Notes after December 2020,

provided that the price of its ordinary shares exceeds 130% of the

then effective conversion price for a specified period of time. The

net proceeds from the offering totalled € 122.7 million and were

added to Besi’s cash and deposits. These proceeds will be used,

amongst others, to finance Besi's growth.

Share Repurchase ProgramIn

September 2015, Besi initiated a program to repurchase up to 1.0

million of its ordinary shares, or approximately 3% of its shares

outstanding. The program was successfully completed in October 2016

under which the full 1.0 million shares were repurchased at an

average price of € 22.50 for a total of € 22.5 million.

In October 2016, Besi initiated a new share

repurchase program under which it may buy back up to 1.0 million

ordinary shares (2.7% of its outstanding shares at October 27,

2016) from time to time on the open market and depending on market

conditions. In 2016, Besi purchased 126,395 shares under this

program at a weighted average price of € 31.30 per share for € 4.0

million. Through February 22, 2017, Besi had purchased an

additional 101,512 shares at a weighted average price of € 33.62

for € 3.4 million. At such date, Besi held approximately 2.8

million shares in treasury at an average price of € 13.47 per

share.

DividendDue to its earnings,

cash flow generation and prospects, Besi’s Board of Management has

proposed a cash dividend of € 1.74 per share for the 2016 year for

approval at its AGM on May 1, 2017, of which € 0.35 represents

a special dividend. The proposed dividend represents an increase of

45% over 2015 and will be payable from May 8, 2017. The dividend

payments for the 2015 fiscal year and proposed for the 2016 fiscal

year represent a pay-out ratio relative to net income of 93% and

100% (approximately 80% ex special dividend), respectively.

Outlook Based on its December 31, 2016

backlog and feedback from customers, Besi forecasts for Q1-17

that:

- Revenue will increase by 15-20% vs. the € 93.1 million reported

in Q4-16.

- Gross margin will range between 52-54% vs. the 53.2% realized

in Q4-16.

- Operating expenses will increase by approximately 5-10% vs. the

€ 29.7 million reported in Q4-16 due primarily to higher share

based incentive compensation expense.

Investor and media conference

callA conference call and webcast for investors and media

will be held today at 4:00 pm CET (10:00 am EST). The dial-in for

the conference call is (31) 20 531 5871. To access the audio

webcast and webinar slides, please visit www.besi.com.

Important Investor Relations Dates

2017

| - Publication

Annual Report 2016 |

March 16, 2017 |

| - Publication Q1

results |

April 25, 2017 |

| - Annual General

Meeting of Shareholders |

May 1, 2017 |

| - Publication

Q2/semi-annual results |

July 27, 2017 |

| - Publication

Q3/nine month results |

November 1, 2017 |

| - Publication

Q4/full year results |

February 1, 2018 |

About BesiBesi is a

leading supplier of semiconductor assembly equipment for the global

semiconductor and electronics industries offering high levels of

accuracy, productivity and reliability at a low cost of ownership.

The Company develops leading edge assembly processes and equipment

for leadframe, substrate and wafer level packaging applications in

a wide range of end-user markets including electronics, mobile

internet, computer, automotive, industrial, LED and solar energy.

Customers are primarily leading semiconductor manufacturers,

assembly subcontractors and electronics and industrial companies.

Besi’s ordinary shares are listed on Euronext Amsterdam (symbol:

BESI). Its Level 1 ADRs are listed on the OTC markets (symbol:

BESIY Nasdaq International Designation) and its headquarters are

located in Duiven, the Netherlands. For more information, please

visit our website at www.besi.com.

Statement of ComplianceThe

accounting policies applied in the condensed consolidated financial

statements included in this press release are the same as those

applied in the Annual Report 2016 which will be published on March

16, 2017. These consolidated financial statements to be included in

the Annual Report 2016 were authorized for issuance by the Board of

Management and Supervisory Board on February 22, 2017. In

accordance with Article 393, Title 9, Book 2 of the Netherlands

Civil Code, Deloitte Accountants B.V. has issued an unqualified

auditor’s opinion on the Annual Report 2016. The Annual Report 2016

will be published on March 16, 2017 and still has to be adopted by

the Annual General Meeting on May 1, 2017.

The condensed financial statements included in

this press release have been prepared in accordance with

International Financial Reporting Standards (IFRS), as adopted by

the European Union. However, these condensed financial statements

do not include all of the information required for a complete set

of IFRS financial statements. Selected explanatory notes are

included in this press release to explain events and transactions

that are significant to an understanding of the change in the

Group’s financial position and performance since the annual

consolidated financial statements for the year ended December 31,

2015.

Caution Concerning Forward Looking StatementsThis

press release contains statements about management's future

expectations, plans and prospects of our business that constitute

forward-looking statements, which are found in various places

throughout the press release, including, but not limited to,

statements relating to expectations of orders, net sales, product

shipments, backlog, expenses, timing of purchases of assembly

equipment by customers, gross margins, operating results and

capital expenditures. The use of words such as “anticipate”,

“estimate”, “expect”, “can”, “intend”, “believes”, “may”, “plan”,

“predict”, “project”, “forecast”, “will”, “would”, and similar

expressions are intended to identify forward looking statements,

although not all forward looking statements contain these

identifying words. The financial guidance set forth under the

heading “Outlook” contains such forward looking statements. While

these forward looking statements represent our judgments and

expectations concerning the development of our business, a number

of risks, uncertainties and other important factors could cause

actual developments and results to differ materially from those

contained in forward looking statements, including any inability to

maintain continued demand for our products; failure of anticipated

orders to materialize or postponement or cancellation of orders,

generally without charges; the volatility in the demand for

semiconductors and our products and services; failure

to develop new and enhanced products and introduce them at

competitive price levels;failure to adequately decrease costs and

expenses as revenues decline; loss of significant customers;

lengthening of the sales cycle; acts of terrorism and

violence; disruption or failure of our information technology

systems; inability to forecast demand and inventory levels for

our products; the integrity of product pricing and protection of

our intellectual property in foreign jurisdictions; risks, such as

changes in trade regulations, currency fluctuations, political

instability and war, associated with substantial foreign customers,

suppliers and foreign manufacturing operations; potential

instability in foreign capital markets; the risk of failure to

successfully manage our diverse operations; any inability to

attract and retain skilled personnel; those additional risk factors

set forth in Besi's annual report for the year ended December 31,

2015 and other key factors that could adversely affect our

businesses and financial performance contained in our filings and

reports, including our statutory consolidated statements. We

expressly disclaim any obligation to update or alter our

forward-looking statements whether as a result of new information,

future events or otherwise.

| Consolidated Statements of Operations |

| |

| (euro

in thousands, except share and per share data) |

Three Months EndedDecember

31,(unaudited) |

Year EndedDecember

31,(audited) |

|

|

2016 |

2015 |

2016 |

2015 |

| Revenue |

93,081 |

77,838 |

375,375 |

349,206 |

| Cost of sales |

43,564 |

38,929 |

183,894 |

178,766 |

| |

|

|

|

|

| Gross profit |

49,517 |

38,909 |

191,481 |

170,440 |

| |

|

|

|

|

| Selling, general and

administrative expenses |

21,050 |

17,496 |

80,454 |

74,088 |

| Research and

development expenses |

8,737 |

9,010 |

35,859 |

38,457 |

| |

|

|

|

|

| Total operating

expenses |

29,787 |

26,506 |

116,313 |

112,545 |

| |

|

|

|

|

| Operating income |

19,730 |

12,403 |

75,168 |

57,895 |

| |

|

|

|

|

| Financial expense

(income), net |

35 |

209 |

1,614 |

793 |

| |

|

|

|

|

| Income before

taxes |

19,695 |

12,194 |

73,554 |

57,102 |

| |

|

|

|

|

| Income tax expense |

2,964 |

2,510 |

8,259 |

8,147 |

| |

|

|

|

|

| |

|

|

|

|

| Net

income |

16,731 |

9,684 |

65,295 |

48,955 |

| |

|

|

|

|

| Net income per share –

basic |

0.45 |

0.26 |

1.74 |

1.29 |

| Net income per share –

diluted |

0.43 |

0.25 |

1.70 |

1.27 |

| |

|

|

|

|

| Number of shares used

in computing per share amounts: |

|

|

|

|

| - basic |

37,390,551 |

37,863,456 |

37,600,855 |

37,931,201 |

| - diluted1 |

39,020,180 |

38,493,443 |

38,508,080 |

38,503,706 |

|

|

|

|

|

|

| |

|

|

|

|

| 1 The

calculation of diluted income per share assumes the exercise of

equity settled share based payments. |

| |

| Consolidated Balance Sheets |

| |

|

(euro in thousands) |

December 31,2016(audited) |

September 30,2016(unaudited) |

June 30,2016(unaudited) |

March 31,2016(unaudited) |

December 31,2015(audited) |

|

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Cash and cash

equivalents |

224,790 |

153,264 |

132,075 |

169,756 |

157,818 |

| Deposits |

80,000 |

- |

- |

- |

- |

| Accounts

receivable |

89,845 |

94,189 |

106,209 |

79,624 |

80,640 |

| Inventories |

55,054 |

56,579 |

60,825 |

61,056 |

53,877 |

| Income tax

receivable |

395 |

371 |

279 |

686 |

446 |

| Other current

assets |

9,995 |

12,225 |

10,134 |

10,957 |

6,055 |

| |

|

|

|

|

|

| Total current

assets |

460,079 |

316,628 |

309,522 |

322,079 |

298,836 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Property, plant and

equipment |

26,993 |

24,419 |

25,016 |

26,355 |

26,718 |

| Goodwill |

45,867 |

45,261 |

45,362 |

43,461 |

45,542 |

| Other intangible

assets |

37,844 |

37,950 |

38,696 |

41,309 |

40,374 |

| Deferred tax

assets |

14,265 |

16,213 |

17,441 |

17,684 |

18,545 |

| Other non-current

assets |

2,521 |

2,500 |

2,721 |

2,696 |

2,711 |

| |

|

|

|

|

|

| Total

non-current assets |

127,490 |

126,343 |

129,236 |

131,505 |

133,890 |

| |

|

|

|

|

|

|

Total assets |

587,569 |

442,971 |

438,758 |

453,584 |

432,726 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Notes payable to

banks |

11,855 |

8,004 |

8,000 |

8,000 |

8,000 |

| Current portion of

long-term debt and financial leases |

2,240 |

2,240 |

- |

- |

- |

| Accounts payable |

38,949 |

36,279 |

46,819 |

37,677 |

27,529 |

| Accrued

liabilities |

44,494 |

40,489 |

35,724 |

36,330 |

31,850 |

| |

|

|

|

|

|

| Total current

liabilities |

97,538 |

87,012 |

90,543 |

82,007 |

67,379 |

| |

|

|

|

|

|

| Other long-term debt

and financial leases |

122,603 |

11,112 |

13,352 |

13,352 |

13,352 |

| Deferred tax

liabilities |

6,716 |

6,125 |

6,158 |

6,180 |

6,201 |

| Other non-current

liabilities |

15,675 |

16,542 |

16,245 |

13,355 |

13,574 |

| |

|

|

|

|

|

| Total

non-current liabilities |

144,994 |

33,779 |

35,755 |

32,887 |

33,127 |

| |

|

|

|

|

|

| Total

equity |

345,037 |

322,180 |

312,460 |

338,690 |

332,220 |

| |

|

|

|

|

|

|

Total liabilities and equity |

587,569 |

442,971 |

438,758 |

453,584 |

432,726 |

| |

|

|

|

|

|

| Consolidated Cash Flow Statements |

| |

| (euro

in thousands) |

Three Months EndedDecember

31,(unaudited) |

Year EndedDecember

31,(unaudited) |

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

| |

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

| Operating income |

19,730 |

|

12,403 |

|

75,168 |

|

57,895 |

|

| |

|

|

|

|

| Depreciation and

amortization |

3,606 |

|

4,456 |

|

14,616 |

|

15,107 |

|

| Share based

compensation expense |

1,014 |

|

685 |

|

7,247 |

|

5,193 |

|

| Other non-cash

items |

- |

|

(396 |

) |

- |

|

(16 |

) |

| (Gain) loss on

curtailment |

- |

|

(106 |

) |

- |

|

(5,626 |

) |

| |

|

|

|

|

| Change in working

capital |

10,001 |

|

16,743 |

|

3,879 |

|

16,829 |

|

| Income tax received

(paid) |

(1,003 |

) |

(1,178 |

) |

(2,482 |

) |

(3,146 |

) |

| Interest received

(paid) |

96 |

|

(129 |

) |

303 |

|

271 |

|

| |

|

|

|

|

| Net cash provided by

operating activities |

33,444 |

|

32,478 |

|

98,731 |

|

86,507 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Capital

expenditures |

(2,188 |

) |

(614 |

) |

(4,488 |

) |

(4,168 |

) |

| Capitalized development

expenses |

(1,886 |

) |

(1,526 |

) |

(6,737 |

) |

(5,627 |

) |

| Proceeds from sale of

equipment |

- |

|

15 |

|

7 |

|

15 |

|

| |

|

|

|

|

| Net cash used in

investing activities |

(4,074 |

) |

(2,125 |

) |

(11,218 |

) |

(9,780 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Proceeds from (payments

of) bank lines of credit |

3,851 |

|

(12,589 |

) |

3,855 |

|

(5,679 |

) |

| Proceeds from (payments

of) debt and financial leases |

122,670 |

|

10,144 |

|

122,670 |

|

9,559 |

|

| Dividends paid to

shareholders |

- |

|

- |

|

(45,420 |

) |

(56,877 |

) |

| Proceeds from

reissuance (purchase) of treasury shares |

(4,520 |

) |

(3,499 |

) |

(21,979 |

) |

(3,100 |

) |

| Investment in

deposits |

(80,000 |

) |

- |

|

(80,000 |

) |

- |

|

| Other financing

activities |

(63 |

) |

- |

|

(63 |

) |

- |

|

| |

|

|

|

|

| Net cash provided by

(used in) financing activities |

41,938 |

|

(5,944 |

) |

(20,937 |

) |

(56,097 |

) |

| |

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

71,308 |

|

24,409 |

|

66,576 |

|

20,630 |

|

| Effect of changes in

exchange rates on cash and cash equivalents |

218 |

|

575 |

|

396 |

|

1,866 |

|

| Cash and cash

equivalents at beginning of the period |

153,264 |

|

132,834 |

|

157,818 |

|

135,322 |

|

| |

|

|

|

|

| Cash and

cash equivalents at end of the period |

224,790 |

|

157,818 |

|

224,790 |

|

157,818 |

|

| |

|

|

|

|

|

|

|

|

Contacts:

Richard W. Blickman, President & CEO

Cor te Hennepe, SVP Finance

Tel. (31) 26 319 4500

investor.relations@besi.com

Citigate First Financial

Frank Jansen

Tel. (31) 20 575 4024

Frank.Jansen@citigateff.nl

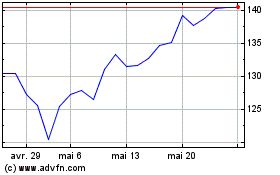

Be Semiconductor Industr... (EU:BESI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Be Semiconductor Industr... (EU:BESI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025