Revenue and Net Income of € 81.4 Million

and € 9.5 Million, RespectivelySolid Performance

in Challenging Market

BE Semiconductor Industries N.V. (the “Company" or "Besi")

(Euronext Amsterdam: BESI; OTC markets: BESIY, Nasdaq International

Designation), a leading manufacturer of assembly equipment for the

semiconductor industry, today announced its results for the first

quarter ended March 31, 2019.

Key Highlights

- Revenue of € 81.4 million is down

12.0% vs. Q4-18. Better than guidance (-15%). Down 47.4% vs. Q1-18

due to adverse impact of industry downturn on Besi’s principal end

user application markets

- Orders of € 83.4 million, up 0.4%

vs. Q4-18 as customer demand stabilizes. Down 59.5% vs. Q1-18

- Gross margin of 55.9% remains at

attractive levels despite significantly lower revenue vs. Q4-18 and

Q1-18 reflecting alignment of production overhead with current

demand. At midpoint of guidance

- Net income of € 9.5 million, down €

13.2 million vs. Q4-18 primarily due to 12% revenue decrease and,

as anticipated, higher share based compensation expense. Down €

27.6 million (-74.4%) vs. Q1-18

- Net cash and deposits increase by €

30.3 million (+15.2%) vs. December 31, 2018 to reach € 229.7

million as solid quarterly cash generation continues

Outlook

- Q2-19 revenue expected to increase by approximately 5% vs.

Q1-19 reflecting more stable market conditions. Gross margin

anticipated to remain in 55%-57% range

|

(€ millions, except EPS) |

Q1-2019 |

Q4-2018 |

Δ |

Q1-2018 |

Δ |

|

Revenue |

81.4 |

92.5 |

-12.0% |

154.9 |

-47.4% |

|

Orders |

83.4 |

83.1 |

+0.4% |

205.8 |

-59.5% |

| Operating

Income |

14.7 |

26.3 |

-44.1% |

48.6 |

-69.8% |

|

EBITDA |

19.7 |

30.5 |

-35.4% |

52.0 |

-62.1% |

| Net

Income |

9.5 |

22.7 |

-58.1% |

37.1 |

-74.4% |

| EPS

(basic) |

0.13 |

0.30 |

-56.7% |

0.50 |

-74.0% |

| EPS

(diluted) |

0.13 |

0.29 |

-55.2% |

0.46 |

-71.7% |

|

Net Cash |

229.7 |

199.4 |

+15.2% |

290.1 |

-20.8% |

Richard W. Blickman, President and Chief

Executive Officer of Besi, commented:“Besi reported solid

results for Q1-19 with revenue and operating profit exceeding

expectations. After three consecutive quarters of sequential

revenue decreases, customer demand appeared to stabilize. As such,

orders were up by 0.4% versus Q4-18 as we saw a modest uptick in

bookings by Asian subcontractors and in orders for certain

multi-chip die bonding applications.

Profit metrics and cash flow generation also

remained healthy in this difficult market environment. Besi’s gross

margin held up well at 55.9% versus 56.4% in Q4-18 and 56.5% in

Q1-18 in the face of revenue decreases of 12.0% and 47.4%,

respectively. The maintenance of gross margin levels above 55%

during this down cycle has been accomplished by tight controls of

production labor, materials, and supply chain activities in

alignment with order activity. In addition, we have made

significant progress in reducing SG&A overhead to aid

profitability, both in headcount and other operating expenses. As a

result, baseline operating expenses declined to € 25.3 million in

Q1-19, a 1.6% decrease versus Q4-18 and a 20.2% decrease as

compared to the last peak in Q1-18. Further, net cash increased by

€ 30.3 million, or 15.2%, versus Q4-18, even after share

repurchases of € 12.8 million during the quarter.

Besi’s strategic agenda for 2019 focuses

primarily on maintaining attractive levels of profitability and

cash flow generation during this downturn while we prepare for the

next customer investment round. Accordingly, we continue to push

structural overhead cost reduction while increasing development

spending and headcount for targeted customer road maps. Particular

areas of R&D focus include TCB, wafer level processing and 5G

enabled devices for next generation applications in our principal

end user markets.

For Q2-19, Besi estimates that revenue will grow

by approximately 5% vs. Q1-19 and for operating profit to modestly

exceed Q1-19 levels in an assembly equipment market that remains

challenging. Further, semiconductor inventories have not yet

reduced sufficiently to generate large additions to assembly

capacity. As such, we remain cautious as to the industry trajectory

in the near term. However, when the cycle turns, Besi is well

positioned to generate further revenue and share gains from its

advanced packaging portfolio and to achieve attractive levels of

financial performance from its highly scalable business model.”

First Quarter Results of

Operations

|

|

Q1-2019 |

Q4-2018 |

Δ |

Q1-2018 |

Δ |

|

Revenue |

81.4 |

92.5 |

|

-12.0% |

154.9 |

|

-47.4% |

|

Orders |

83.4 |

83.1 |

|

+0.4% |

205.8 |

|

-59.5% |

|

Book to Bill Ratio |

1.0x |

0.9x |

|

+0.1 |

1.3x |

|

-0.3 |

Besi’s Q1-19 revenue decreased by 12.0% vs.

Q4-18 and was better than guidance due to higher than anticipated

die bonding shipments. Revenue decreased by 47.4% vs. Q1-18 due

primarily to (i) lower die bonding shipments for high end mobile

capacity following significant customer investment in 2017 and 2018

and, to a lesser extent, (ii) lower shipments for computing and

automotive applications. In both comparative periods, the revenue

decrease was broad based and consistent with the industry downturn

that began at the end of Q2-2018.

Orders of € 83.4 million increased slightly

versus Q4-18 as customer demand stabilized. Per customer type,

subcontractor orders increased sequentially by € 7.6 million, or

41.4% vs. Q4-18 due to an uptick in bookings by Asian

subcontractors. In contrast, IDM orders decreased by € 7.3

million, or 11.2%. IDM and subcontractor orders represented 69% and

31%, respectively, of total Q1-19 orders vs. 54% and 46%,

respectively, in Q1-18.

|

|

Q1-2019 |

Q4-2018 |

Δ |

Q1-2018 |

Δ |

|

Gross Margin |

55.9% |

56.4% |

-0.5 |

56.5% |

-0.6 |

|

Operating Expenses |

30.7 |

25.9 |

+18.5% |

39.1 |

-21.5% |

|

Financial Expense, net |

3.9 |

4.2 |

-7.1% |

4.3 |

-9.3% |

|

EBITDA |

19.7 |

30.5 |

-35.4% |

52.0 |

-62.1% |

Besi’s gross margin in Q1-19 decreased by 0.5

points vs. Q4-18 and by 0.6 points vs. Q1-18 due primarily to

significantly lower revenue levels partly offset by lower labor,

materials and supply chain activities to help compensate for

decreased customer demand. Versus Q1-18, gross margin also

benefited from positive forex influences from a stronger USD vs.

the euro.

Q1-19 operating expenses increased by € 4.8

million (+18.5%) vs. Q4-18 due to (i) higher share based

compensation expense, as anticipated, associated with Besi’s 2018

performance and (ii) the absence in Q1-19 of favorable one-time,

year-end recordings in Q4-18. Excluding variable compensation,

restructuring, forex effect and one-time benefits/charges,

estimated baseline operating expenses decreased from € 25.7 million

in Q4-18 to € 25.3 million in Q1-19 due primarily to lower

headcount levels and other operating expenses. Total headcount at

March 31, 2019 decreased by 3.6% (-64 employees) vs. December 31,

2018 as Besi continued to align staffing levels with customer

demand. Operating expenses decreased by € 8.4 million (-21.5%)

vs. Q1-18 primarily due to a € 3.4 million decrease in share based

compensation expense, reduced personnel costs and lower variable

sales related costs such as warranty, freight and commissions. In

addition, total headcount at March 31, 2019 decreased by 20.7%

(-442 employees) vs. March 31, 2018.

Financial expense, net decreased by € 0.3

million vs. Q4-18 and by € 0.4 million vs. Q1-18 due primarily to

lower hedging costs related to decreased sales volume.

|

|

Q1-2019 |

Q4-2018 |

Δ |

Q1-2018 |

Δ |

|

Net Income |

9.5 |

22.7 |

-58.1% |

37.1 |

-74.4% |

|

Net Margin |

11.6% |

24.5% |

-12.9 |

24.0% |

-12.4 |

|

Tax Rate |

12.5% |

-2.9% |

+15.4 |

16.3% |

-3.8 |

Besi’s Q1-19 net income

declined by € 13.2 million vs. Q4-18 due to (i) lower revenue

levels, (ii) higher share based compensation expense, (iii) the

absence in Q1-19 of favorable one-time, year-end recordings and

(iv) a net tax benefit realized in Q4-18. As compared to Q1-18, net

income decreased by € 27.6 million (-74.4%) due primarily to the

47.4% year over year revenue decrease.

Financial Condition

|

|

Q1-2019 |

Q4-2018 |

Δ |

Q1-2018 |

Δ |

| Net

Cash |

229.7 |

199.4 |

+15.2% |

290.1 |

-20.8% |

|

Cash flow from Ops. |

47.8 |

56.6 |

-15.5% |

54.9 |

-12.9% |

Besi’s net cash rose to € 229.7 million at the

end of Q1-19, an increase of € 30.3 million, or 15.2%, vs. the end

of Q4-18. The Company generated cash flow from operations of € 47.8

million in Q1-19 which was utilized primarily to fund (i)

€ 12.8 million of share repurchases, (ii) € 2.9 million

of capitalized development spending and (iii) € 0.6 million of

capital expenditures.

During the quarter, Besi repurchased 597,463 of

its ordinary shares at an average price of € 21.49 per share for a

total of € 12.8 million. Cumulatively, as of March 31, 2019, a

total of 1.8 million shares have been purchased under the current €

75 million share repurchase program (which started July 26, 2018)

at an average price of € 19.36 per share for a total of

€ 35.3 million.

OutlookBased on its March 31, 2019 order

backlog and feedback from customers, Besi forecasts for Q2-19

that:

- Revenue will increase by approximately 5% vs. the € 81.4

million reported in Q1-19.

- Gross margin will range between 55%-57% vs. the 55.9% realized

in Q1-19.

- Operating expenses will decrease by approximately 5% vs. the €

30.7 million reported in Q1-19.

Investor and media conference

callA conference call and webcast for investors and media

will be held today at 4:00 pm CET (10:00 am EST). The dial-in for

the conference call is (31) 20 531 5851. To access the audio

webcast and webinar slides, please visit www.besi.com.

Basis of PresentationThe

accompanying condensed Consolidated Financial Statements have been

prepared in accordance with International Financial Reporting

Standards (“IFRS”) as adopted by the European Union. Reference is

made to the Summary of Significant Accounting Policies to the Notes

to the Consolidated Financial Statements as included in our 2018

Annual Report which is available on www.besi.com

Besi has adopted IFRS 16 “Leases” as of January

1, 2019, using the modified retrospective approach and therefore

did not restate prior years presented upon adoption in 2019. The

most significant change in our accounting policy is the recognition

of right of use assets and lease liabilities for operating leases.

As of January 1, 2019 we recognized € 14.2 million of right of use

assets (€ 13.4 million as at March 31, 2019), and € 14.2

million of lease liabilities (€ 13.4 million as at March 31, 2019

of which € 10.0 million was recorded under lease liabilities and €

3.4 million under other current liabilities).

The adoption of IFRS 16 had a positive impact on

our cash flows from operating activities and EBITDA of

approximately € 0.9 million in Q1-19 with an offsetting negative

cash flow effect under financing activities.

About BesiBesi is a

leading supplier of semiconductor assembly equipment for the global

semiconductor and electronics industries offering high levels of

accuracy, productivity and reliability at a low cost of ownership.

The Company develops leading edge assembly processes and equipment

for leadframe, substrate and wafer level packaging applications in

a wide range of end-user markets including electronics, mobile

internet, cloud server, computing, automotive, industrial, LED and

solar energy. Customers are primarily leading semiconductor

manufacturers, assembly subcontractors and electronics and

industrial companies. Besi’s ordinary shares are listed on Euronext

Amsterdam (symbol: BESI). Its Level 1 ADRs are listed on the OTC

markets (symbol: BESIY Nasdaq International Designation) and its

headquarters are located in Duiven, the Netherlands. For more

information, please visit our website at www.besi.com.

|

Contacts: |

|

|

Richard W. Blickman, President & CEO |

CFF

Communications |

| Cor

te Hennepe, SVP Finance |

Frank Jansen |

|

Tel. (31) 26 319 4500 |

Tel. (31) 20 575 4024 |

|

investor.relations@besi.com |

besi@cffcommunications.nl |

Caution Concerning Forward Looking StatementsThis

press release contains statements about management's future

expectations, plans and prospects of our business that constitute

forward-looking statements, which are found in various places

throughout the press release, including, but not limited to,

statements relating to expectations of orders, net sales, product

shipments, expenses, timing of purchases of assembly equipment by

customers, gross margins, operating results and capital

expenditures. The use of words such as “anticipate”, “estimate”,

“expect”, “can”, “intend”, “believes”, “may”, “plan”, “predict”,

“project”, “forecast”, “will”, “would”, and similar expressions are

intended to identify forward looking statements, although not all

forward looking statements contain these identifying words. The

financial guidance set forth under the heading “Outlook” contains

such forward looking statements. While these forward looking

statements represent our judgments and expectations concerning the

development of our business, a number of risks, uncertainties and

other important factors could cause actual developments and results

to differ materially from those contained in forward looking

statements, including any inability to maintain continued demand

for our products; failure of anticipated orders to materialize or

postponement or cancellation of orders, generally without charges;

the volatility in the demand for semiconductors and our products

and services; failure to develop new and enhanced

products and introduce them at competitive price

levels; failure to adequately decrease costs and expenses as

revenues decline; loss of significant customers, including through

industry consolidation or the emergence of industry alliances;

lengthening of the sales cycle; acts of terrorism and

violence; disruption or failure of our information technology

systems; inability to forecast demand and inventory levels for

our products; the integrity of product pricing and protection of

our intellectual property in foreign jurisdictions; risks, such as

changes in trade regulations, currency fluctuations, political

instability and war, associated with substantial foreign customers,

suppliers and foreign manufacturing operations, particularly to the

extent occurring in the Asia Pacific region; potential instability

in foreign capital markets; the risk of failure to successfully

manage our diverse operations; any inability to attract and retain

skilled personnel; those additional risk factors set forth in

Besi's annual report for the year ended December 31,

2018 and other key factors that could adversely affect our

businesses and financial performance contained in our filings and

reports, including our statutory consolidated statements. We

expressly disclaim any obligation to update or alter our

forward-looking statements whether as a result of new information,

future events or otherwise.

Consolidated Statements of

Operations

| (euro

in thousands, except share and pershare data) |

Three Months EndedMarch

31,(unaudited) |

| |

2019 |

2018 |

| |

|

|

| Revenue |

81,399 |

154,937 |

| Cost of sales |

35,928 |

67,327 |

| |

|

|

| Gross profit |

45,471 |

87,610 |

| |

|

|

| Selling, general and

administrative expenses |

21,685 |

29,242 |

| Research and development

expenses |

9,044 |

9,812 |

| |

|

|

| Total operating

expenses |

30,729 |

39,054 |

| |

|

|

| Operating income |

14,742 |

48,556 |

| |

|

|

| Financial expense,

net |

3,917 |

4,272 |

| |

|

|

| Income before taxes |

10,825 |

44,284 |

| |

|

|

| Income tax expense |

1,358 |

7,205 |

| |

|

|

| Net income |

9,467 |

37,079 |

| |

|

|

| Net income per share –

basic |

0.13 |

0.50 |

| Net income per share –

diluted |

0.13 |

0.46 |

| |

|

|

| Number of shares used in

computing per share amounts1:- basic- diluted2 |

73,260,83583,627,935 |

74,476,81084,778,428 |

Consolidated Balance Sheets

| (euro in

thousands) |

March

31,2019(unaudited) |

December

31,2018(audited) |

|

ASSETS |

|

|

| |

|

|

| Cash and cash

equivalents |

327,503 |

295,539 |

| Deposits |

130,000 |

130,000 |

| Trade receivables |

82,591 |

106,347 |

| Inventories |

60,929 |

60,237 |

| Other current assets |

10,440 |

11,496 |

| |

|

|

| Total current

assets |

611,463 |

603,619 |

| |

|

|

| |

|

|

| Property, plant and

equipment |

28,074 |

28,551 |

| Right of use assets |

13,414 |

- |

| Goodwill |

45,279 |

45,099 |

| Other intangible

assets |

38,899 |

38,334 |

| Deferred tax assets |

5,579 |

4,769 |

| Deposits |

50,000 |

50,000 |

| Other non-current

assets |

2,302 |

2,317 |

| |

|

|

| Total non-current

assets |

183,547 |

169,070 |

| |

|

|

|

Total assets |

795,010 |

772,689 |

|

|

|

|

|

|

|

|

|

|

| Notes payable to

banks |

3,307 |

2,812 |

| Current portion of

long-term debt |

1,525 |

1,502 |

| Trade payables |

35,573 |

33,158 |

| Other current

liabilities |

68,769 |

63,454 |

| |

|

|

| Total current

liabilities |

109,174 |

100,926 |

| |

|

|

| Long-term debt |

272,978 |

271,824 |

| Lease liabilities |

10,035 |

- |

| Deferred tax

liabilities |

10,273 |

10,244 |

| Other non-current

liabilities |

17,730 |

17,507 |

| |

|

|

| Total non-current

liabilities |

311,016 |

299,575 |

| |

|

|

| Total

equity |

374,820 |

372,188 |

| |

|

|

|

Total liabilities and equity |

795,010 |

772,689 |

Consolidated Cash Flow

Statements

| (euro

in thousands) |

Three Months EndedMarch

31,(unaudited) |

| |

2019 |

|

2018 |

|

| |

|

|

| Cash flows from

operating activities: |

|

|

| Income before income

tax |

10,825 |

|

44,284 |

|

| |

|

|

| Depreciation and

amortization |

4,922 |

|

3,414 |

|

| Share-based payment

expense |

3,711 |

|

7,161 |

|

| Financial expense,

net |

3,917 |

|

4,272 |

|

| Other non-cash items |

- |

|

- |

|

| |

|

|

| Change in working

capital |

25,373 |

|

(2,022 |

) |

| Income tax paid |

(928 |

) |

(1,877 |

) |

| Interest paid |

(49 |

) |

(309 |

) |

| |

|

|

| Net cash provided by

operating activities |

47,771 |

|

54,923 |

|

| |

|

|

| Cash flows from

investing activities: |

|

|

| Capital expenditures |

(628 |

) |

(1,926 |

) |

| Capitalized development

expenditures |

(2,927 |

) |

(2,640 |

) |

| Investment in

deposits |

- |

|

(130,000 |

) |

| |

|

|

| Net cash used in investing

activities |

(3,555 |

) |

(134,566 |

) |

| |

|

|

| Cash flows from

financing activities: |

|

|

| Proceeds from (payments

of) bank lines of credit |

363 |

|

(463 |

) |

| Proceeds from (payments

of) debt and financial leases |

(11 |

) |

307 |

|

| Payments of lease

liabilities |

(890 |

) |

- |

|

| Purchase of treasury

shares |

(12,838 |

) |

(6,000 |

) |

| |

|

|

| Net cash used in financing

activities |

(13,376 |

) |

(6,156 |

) |

| |

|

|

| Net increase (decrease) in

cash and cash equivalents |

30,840 |

|

(85,799 |

) |

| Effect of changes in

exchange rates on cash and cash equivalents |

1,124 |

|

(1,024 |

) |

| Cash and cash equivalents

at beginning of the Period |

295,539 |

|

527,806 |

|

| |

|

|

|

Cash and cash equivalents at end of the period |

327,503 |

|

440,983 |

|

Supplemental Information

(unaudited) (euro in millions, unless stated

otherwise)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

REVENUE |

Q1-2018 |

Q2-2018 |

Q3-2018 |

Q4-2018 |

Q1-2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

120.5 |

|

78 |

% |

88.6 |

|

55 |

% |

71.2 |

|

61 |

% |

66.6 |

|

72 |

% |

54.5 |

|

67 |

% |

|

| |

EU / USA |

34.4 |

|

22 |

% |

72.5 |

|

45 |

% |

45.5 |

|

39 |

% |

25.9 |

|

28 |

% |

26.9 |

|

33 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

154.9 |

|

100 |

% |

161.1 |

|

100 |

% |

116.7 |

|

100 |

% |

92.5 |

|

100 |

% |

81.4 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

ORDERS |

Q1-2018 |

Q2-2018 |

Q3-2018 |

Q4-2018 |

Q1-2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

120.8 |

|

59 |

% |

47.5 |

|

55 |

% |

70.1 |

|

65 |

% |

61.5 |

|

74 |

% |

55.9 |

|

67 |

% |

|

| |

EU / USA |

85.0 |

|

41 |

% |

38.8 |

|

45 |

% |

37.8 |

|

35 |

% |

21.6 |

|

26 |

% |

27.5 |

|

33 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

205.8 |

|

100 |

% |

86.3 |

|

100 |

% |

107.9 |

|

100 |

% |

83.1 |

|

100 |

% |

83.4 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per customer type: |

|

|

|

|

|

|

|

|

|

|

|

| |

IDM |

111.1 |

|

54 |

% |

70.8 |

|

82 |

% |

82.0 |

|

76 |

% |

64.8 |

|

78 |

% |

57.5 |

|

69 |

% |

|

| |

Subcontractors |

94.7 |

|

46 |

% |

15.5 |

|

18 |

% |

25.9 |

|

24 |

% |

18.3 |

|

22 |

% |

25.9 |

|

31 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

205.8 |

|

100 |

% |

86.3 |

|

100 |

% |

107.9 |

|

100 |

% |

83.1 |

|

100 |

% |

83.4 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

HEADCOUNT |

Mar 31,

2018 |

Jun 30,

2018 |

Sep 30,

2018 |

Dec 31, 2018 |

Mar 31, 2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fixed staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

1,254 |

|

71 |

% |

1,259 |

|

72 |

% |

1,255 |

|

72 |

% |

1,230 |

|

73 |

% |

1,174 |

|

72 |

% |

|

| |

EU / USA |

500 |

|

29 |

% |

495 |

|

28 |

% |

483 |

|

28 |

% |

462 |

|

27 |

% |

452 |

|

28 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

1,754 |

|

100 |

% |

1,754 |

|

100 |

% |

1,738 |

|

100 |

% |

1,692 |

|

100 |

% |

1,626 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Temporary staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

290 |

|

76 |

% |

257 |

|

75 |

% |

108 |

|

61 |

% |

6 |

|

9 |

% |

11 |

|

16 |

% |

|

| |

EU / USA |

93 |

|

24 |

% |

86 |

|

25 |

% |

68 |

|

39 |

% |

61 |

|

91 |

% |

58 |

|

84 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

383 |

|

100 |

% |

343 |

|

100 |

% |

176 |

|

100 |

% |

67 |

|

100 |

% |

69 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total fixed and temporary staff (FTE) |

2,137 |

|

|

2,097 |

|

|

1,914 |

|

|

1,759 |

|

|

1,695 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER FINANCIAL DATA |

Q1-2018 |

Q2-2018 |

Q3-2018 |

Q4-2018 |

Q1-2019 |

|

| |

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

87.6 |

|

56.5 |

% |

91.1 |

|

56.5 |

% |

67.6 |

|

57.9 |

% |

52.1 |

|

56.4 |

% |

45.5 |

|

55.9 |

% |

|

| |

Restructuring charges / (gains) |

- |

|

- |

|

0.4 |

|

0.2 |

% |

(0.0 |

) |

-0.0 |

% |

- |

|

- |

|

- |

|

- |

|

|

| |

Gross profit as adjusted |

87.6 |

|

56.5 |

% |

91.5 |

|

56.8 |

% |

67.6 |

|

57.9 |

% |

52.1 |

|

56.4 |

% |

45.5 |

|

55.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Selling, general and admin expenses: |

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

29.2 |

|

18.8 |

% |

22.7 |

|

14.1 |

% |

20.3 |

|

17.4 |

% |

18.0 |

|

19.5 |

% |

21.7 |

|

26.7 |

% |

|

| |

Amortization of intangibles |

(0.1 |

) |

-0.1 |

% |

(0.1 |

) |

-0.1 |

% |

(0.1 |

) |

-0.1 |

% |

(0.2 |

) |

-0.2 |

% |

(0.1 |

) |

-0.1 |

% |

|

| |

Impairment charges |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(0.4 |

) |

-0.4 |

% |

- |

|

0.0 |

% |

|

| |

Restructuring gains / (charges) |

0.0 |

|

0.0 |

% |

(0.1 |

) |

-0.1 |

% |

(0.4 |

) |

-0.3 |

% |

(0.2 |

) |

-0.2 |

% |

- |

|

0.0 |

% |

|

| |

SG&A expenses as adjusted |

29.1 |

|

18.8 |

% |

22.5 |

|

14.0 |

% |

19.8 |

|

17.0 |

% |

17.2 |

|

18.6 |

% |

21.6 |

|

26.5 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Research and development expenses: |

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

9.8 |

|

6.3 |

% |

9.0 |

|

5.6 |

% |

8.7 |

|

7.5 |

% |

7.9 |

|

8.5 |

% |

9.0 |

|

11.1 |

% |

|

| |

Capitalization of R&D charges |

2.6 |

|

1.7 |

% |

3.4 |

|

2.1 |

% |

2.7 |

|

2.3 |

% |

2.7 |

|

2.9 |

% |

2.9 |

|

3.6 |

% |

|

| |

Amortization of intangibles |

(2.1 |

) |

-1.4 |

% |

(2.1 |

) |

-1.3 |

% |

(2.4 |

) |

-2.1 |

% |

(2.4 |

) |

-2.6 |

% |

(2.5 |

) |

-3.1 |

% |

|

| |

R&D expenses as adjusted |

10.3 |

|

6.6 |

% |

10.3 |

|

6.4 |

% |

9.0 |

|

7.7 |

% |

8.2 |

|

8.9 |

% |

9.4 |

|

11.5 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Financial expense (income), net: |

|

|

|

|

|

|

|

|

|

|

|

| |

Interest expense (income), net |

2.5 |

|

|

2.4 |

|

|

2.4 |

|

|

2.3 |

|

|

2.4 |

|

|

|

| |

Foreign exchange effects |

1.8 |

|

|

2.7 |

|

|

1.8 |

|

|

1.9 |

|

|

1.5 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

4.3 |

|

|

5.1 |

|

|

4.2 |

|

|

4.2 |

|

|

3.9 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

48.6 |

|

31.4 |

% |

59.3 |

|

36.8 |

% |

38.6 |

|

33.1 |

% |

26.3 |

|

28.4 |

% |

14.7 |

|

18.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

52.0 |

|

33.6 |

% |

62.8 |

|

39.0 |

% |

42.4 |

|

36.3 |

% |

30.5 |

|

33.0 |

% |

19.7 |

|

24.2 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

37.1 |

|

23.9 |

% |

47.2 |

|

29.3 |

% |

29.3 |

|

25.1 |

% |

22.7 |

|

24.5 |

% |

9.5 |

|

11.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income per share |

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

0.50 |

|

|

0.63 |

|

|

0.39 |

|

|

0.30 |

|

|

0.13 |

|

|

|

| |

Diluted |

0.46 |

|

|

0.58 |

|

|

0.37 |

|

|

0.29 |

|

|

0.13 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

_____________________________

1 Share amounts in 2018 have

been adjusted for the 2-for-1 stock split effective May 4, 2018.2

The calculation of diluted income per share assumes

the exercise of equity settled share based payments and the

conversion of the Convertible Notes.

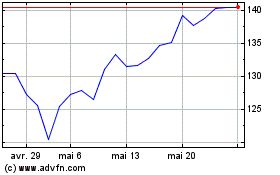

Be Semiconductor Industr... (EU:BESI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Be Semiconductor Industr... (EU:BESI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024