Brunel reports strong organic growth supported by all regions, additional boost from Taylor Hopkinson acquisition

29 Avril 2022 - 7:30AM

Brunel reports strong organic growth supported by all regions,

additional boost from Taylor Hopkinson acquisition

Amsterdam, 29 April 2022 – Brunel International

N.V. (Brunel; BRNL), a global provider of flexible workforce

solutions and expertise, today announced its first quarter (Q1)

2022 results.

Key points Q1 2022

- Revenue of EUR 275 million, up 29%, 18% growth

like-for-like

- EBIT up 46% to EUR 15.6 million

- Strategy continues to gain traction with strong need for

specialists and engineering solutions across global industries; all

regions growing and profitable

- Updated ESG strategy to accelerate commitments: Net zero

emission in 2022

- Acceleration in renewable recruitment solutions through Taylor

Hopkinson acquisition. Integration on track; market leadership

position strengthened

- Operational leverage further enhanced with a conversion to EBIT

of 39% of the increase in gross profit

- Strong cash position maintained at EUR 103 million

- Brunel is in the process of selling the activities in Russia to

local management.

Jilko Andringa, CEO of Brunel International

N.V.: “We started the year 2022 strongly

with revenue growth accelerating in all regions and strong growth

outside of Europe, particularly in Asia. As the quarter advanced,

we saw the trend accelerating even faster with revenue exceeding

EUR 100 million in March. Our gross margin increased in almost all

regions, as our clients recognize the value of the connected Brunel

specialists in many pioneering projects. Supported by strict

operating cost management, this resulted in an EBIT of 5.7% for the

quarter, which is testament to our ability of disciplined

execution.

We are in the process of selling our Russian activities to local

management. I would like to thank our Russian colleagues for their

commitment to Brunel and the business they build over the last 20

years.

As we acquired Taylor Hopkinson in the last quarter of 2021 to

expand our capabilities in the renewable market, we are steadily

progressing with the post-merger integration activities and are

confident that we will complete this in the coming months. This

will allow us to maintain our leading position in the renewables

vertical as we are driving the energy transition of our clients. To

show our strong commitment to these trends, we have updated our own

ESG strategy and accelerate our ambitions to become carbon

neutral.

We can build upon our strong team of Brunellers. We ask all

Brunellers to be ‘curious’ to grow our knowledge leadership and to

be ‘eager’ to show the right attitude to further expand our

business. We are confident we can stay ahead of our five year plan

and take advantage of the post-COVID momentum as most regions have

abandoned their restrictions and are already delivering upon the

increased demand for engineers.”

ESG strategy

Following our strategy update in March 2021, we

have seen our new growth strategy gaining further traction. We are

well positioned to take advantage of the increased demand for

specialists and engineering solutions for a more sustainable world.

The acquisition of Taylor Hopkinson has established our leadership

position in the renewables vertical and we are instrumental in our

clients’ energy transition. To underline our commitments for a more

sustainable world, we have updated our ESG strategy and will

accelerate the efforts to become carbon neutral. At last year’s

capital markets day, we had committed to reduce our footprint and

to fully compensate the remaining emission by 2030. The reduction

plan is well underway. We have decided to already offset all

remaining emission as of 2022.

|

Brunel International (unaudited) |

|

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

|

| Revenue |

274.6 |

213.0 |

29% |

a |

|

| Gross Profit |

61.8 |

49.3 |

25% |

|

|

| Gross margin |

22.5% |

23.1% |

|

|

|

| Operating costs |

45.1 |

38.6 |

17% |

b |

|

| Operating result |

16.7 |

10.7 |

56% |

|

|

| Earn out related share based

payments* |

1.1 |

- |

|

|

|

| EBIT |

15.6 |

10.7 |

46% |

c |

|

| EBIT % |

5.7% |

5.0% |

|

|

|

| |

|

|

|

|

|

| Average directs |

11,233 |

9,290 |

21% |

|

|

| Average indirects |

1,436 |

1,310 |

10% |

|

|

| Ratio direct / Indirect |

7.8 |

7.1 |

|

|

|

| |

|

|

|

|

|

| a 18 %

like-for-like |

|

| b 8 %

like-for-like |

|

| c 43 %

like-for-like |

|

| Like-for-like is

measured excluding the impact of currencies and acquisitions |

|

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

|

Q1 2022 results by regionP&L amounts in EUR

million

Summary:

|

Revenue |

Q1 2022 |

Q1 2021 |

Δ% |

| |

|

|

|

| DACH region |

58.4 |

55.7 |

5% |

| The Netherlands |

48.9 |

47.2 |

4% |

| Australasia |

34.0 |

25.2 |

35% |

| Middle East & India |

30.8 |

25.2 |

22% |

| Americas |

32.5 |

20.3 |

60% |

| Rest of world |

70.0 |

39.4 |

78% |

| |

|

|

|

| Total |

274.6 |

213.0 |

29% |

|

EBIT |

Q1 2022 |

Q1 2021 |

Δ% |

| |

|

|

|

| DACH region |

6.9 |

6.0 |

15% |

| The Netherlands |

5.2 |

4.0 |

30% |

| Australasia |

0.2 |

0.0 |

|

| Middle East & India |

3.0 |

2.4 |

25% |

| Americas |

0.4 |

-0.1 |

500% |

| Rest of world |

2.8 |

1.3 |

115% |

| Unallocated |

-2.9 |

-2.9 |

0% |

| |

|

|

|

| Total |

15.6 |

10.7 |

46% |

In Q1 2022 the Group’s revenue increased by 29%

or EUR 61.6 million y-o-y, driven by all regions, with the largest

growth in Rest of World and Americas. Excluding acquisitions,

revenue increased by 22%. Gross margin in DACH and The

Netherlands increased over the quarter. As a result of the change

in the mix between Europe and the other regions, total gross margin

decreased by 0.6 percentage points. EBIT increased by 46% or EUR

4.9 million y-o-y. Excluding acquisitions, EBIT increased by 47% or

EUR 5.1 million.

BREAKDOWN BY REGION

|

DACH region (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

| Revenue |

58.4 |

55.7 |

5% |

|

| Gross Profit |

21.1 |

19.6 |

8% |

|

| Gross margin |

36.1% |

35.2% |

|

|

| Operating costs |

14.2 |

13.6 |

4% |

|

| EBIT |

6.9 |

6.0 |

15% |

|

| EBIT % |

11.8% |

10.8% |

|

|

| |

|

|

|

|

| Average directs |

1,985 |

1,901 |

4% |

|

| Average indirects |

388 |

377 |

3% |

|

| Ratio direct / Indirect |

5.1 |

5.0 |

|

|

The DACH region includes Germany, Switzerland,

Austria and Czech Republic.

Revenue per working day in DACH increased by 3%.

The higher revenue and the 0.9 percentage point higher gross margin

are mainly driven by one additional working day as well as higher

rates, partially offset by a lower productivity due to higher

illness related absence. The gross margin adjusted for working days

is 35.2% in Q1 2022 (Q1 2021: 35.2%). EBIT% increased 1.0

percentage point.

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

60 |

66 |

62 |

252 |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

The Netherlands (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

| Revenue |

48.9 |

47.2 |

4% |

|

| Gross Profit |

14.9 |

13.5 |

10% |

|

| Gross margin |

30.5% |

28.6% |

|

|

| Operating costs |

9.7 |

9.5 |

2% |

|

| EBIT |

5.2 |

4.0 |

30% |

|

| EBIT % |

10.6% |

8.5% |

|

|

| |

|

|

|

|

| Average directs |

1,677 |

1,733 |

-3% |

|

| Average indirects |

276 |

301 |

-8% |

|

| Ratio direct / Indirect |

6.1 |

5.8 |

|

|

Revenue per working day in The Netherlands

increased by 2.1%. The increase is mainly the result of higher

rates, partially offset by the lower headcount and a lower

productivity. The business line Legal continues to be the major

driver of the growth. The gross margin adjusted for working days is

29.7% in Q1 2022 (Q1 2021: 28.6%).

Working days The Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

61 |

66 |

64 |

255 |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

Australasia (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

| Revenue |

34.0 |

25.2 |

35% |

a |

| Gross Profit |

3.1 |

2.4 |

29% |

|

| Gross margin |

9.1% |

9.5% |

|

|

| Operating costs |

2.9 |

2.4 |

21% |

b |

| EBIT |

0.2 |

- |

|

|

| EBIT % |

0.6% |

0.0% |

|

|

| |

|

|

|

|

| Average directs |

1,256 |

906 |

39% |

|

| Average indirects |

101 |

83 |

22% |

|

| Ratio direct / Indirect |

12.4 |

10.9 |

|

|

| |

|

|

|

|

| a 31 %

like-for-like |

|

| b 22 %

like-for-like |

|

| Like-for-like is

measured excluding the impact of currencies and acquisitions |

|

Australasia includes Australia and Papua New

Guinea. Revenue increased significantly in both markets following

the lifting of travel restrictions in the second half of 2021.

Gross margin decreased slightly due to a change in the client

mix.

|

Middle East & India (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

| Revenue |

30.8 |

25.2 |

22% |

a |

| Gross Profit |

5.2 |

4.1 |

27% |

|

| Gross margin |

16.9% |

16.3% |

|

|

| Operating costs |

2.2 |

1.7 |

29% |

b |

| EBIT |

3.0 |

2.4 |

25% |

|

| EBIT % |

9.7% |

9.5% |

|

|

| |

|

|

|

|

| Average directs |

2,179 |

2,078 |

5% |

|

| Average indirects |

130 |

125 |

4% |

|

| Ratio direct / Indirect |

16.8 |

16.7 |

|

|

| |

|

|

|

|

| a 14 %

like-for-like |

|

| b 21 %

like-for-like |

|

| Like-for-like is

measured excluding the impact of currencies and acquisitions |

|

Middle East & India includes Qatar, Kuwait,

Dubai, Oman, Kurdistan, Iraq and India. All countries contributed

to the strong revenue increase, mainly driven by new projects with

both existing and new clients, another short term shutdown project

and a favourable currency effect. Gross margin increased due to

focus on higher value added activities and client diversification.

Operating costs increased as a result of investments in staff to

support future growth.

|

Americas (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

| Revenue |

32.5 |

20.3 |

60% |

| Gross Profit |

4.2 |

2.6 |

62% |

| Gross margin |

12.9% |

12.8% |

|

| Operating costs |

3.8 |

2.7 |

41% |

| EBIT |

0.4 |

-0.1 |

500% |

| EBIT % |

1.2% |

-0.5% |

|

| |

|

|

|

| Average directs |

861 |

761 |

13% |

| Average indirects |

115 |

100 |

15% |

| Ratio direct / Indirect |

7.5 |

7.6 |

|

| |

|

|

|

| a 47 %

like-for-like |

| b 26 %

like-for-like |

| Like-for-like is

measured excluding the impact of currencies and acquisitions |

We continue to see strong growth in our main

markets in the USA, Canada and Brazil. The growth is mainly driven

by new projects and higher rates. The increased volume helped the

region return to profitability in Q1 2022.

|

Rest of world (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2022 |

Q1 2021 |

Δ% |

|

| Revenue |

70.0 |

39.4 |

78% |

a |

| Gross Profit |

13.3 |

7.1 |

87% |

|

| Gross margin |

19.0% |

18.0% |

|

|

| Operating costs |

9.4 |

5.8 |

62% |

b |

| Operating result |

3.9 |

1.3 |

200% |

|

| Earn out related share based

payments* |

1.1 |

- |

|

|

| EBIT |

2.8 |

1.3 |

115% |

c |

| EBIT % |

4.0% |

3.3% |

|

|

| |

|

|

|

|

| Average directs |

3,276 |

1,911 |

71% |

|

| Average indirects |

366 |

264 |

39% |

|

| Ratio direct / Indirect |

9.0 |

7.2 |

|

|

| |

|

|

|

|

| a 35 %

like-for-like |

|

| b 8 %

like-for-like |

|

| c 127 %

like-for-like |

| Like-for-like is

measured excluding the impact of currencies and acquisitions |

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

The growth is mainly driven by the acquisition

of Taylor Hopkinson in Q4 2021 and a strong performance in Asia,

where we continue to see strong growth with construction projects

in China and Singapore.

OutlookWe expect the current

favourable trends to continue throughout Q2 2022: Revenue will be

higher y-o-y at a slightly lower overall gross margin compared to

the same quarter in 2021. Compared to Q1 2022, gross margin and

EBIT in Q2 2022 are expected to be lower than Q1 due to seasonality

and a lower number of working days, following the normal trend in

our business.

Brunel is in the process of selling the activities in Russia to

local management. In Q1 2022, Russia contributed EUR 9.7 million

revenue and EUR 0.8 million EBIT to Brunel’s results. The net

investment in Russia at 31 March 2022 is EUR 14 million.

Source: Brunel International NV

- Press release Q1 2022.pdf

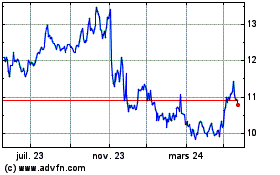

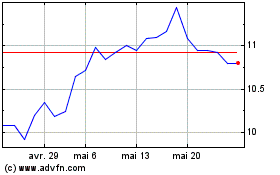

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024