Coil : STRONG GROWTH IN 2021 RESULTS

|

PRESS RELEASEBrussels, 29 April 2022 (17.45) |

|

STRONG GROWTH IN

2021 RESULTS

- Sales:

€25.2 M,

up 10 %

- EBITDA:

€6.3

M,

(24.8%

of sales),

6-fold increase compared to 2020

- Net income:

€2.1

M, i.e.

8.1

% of sales

- Net financial debt: 13 %

of equity at 31

December

2021

- Medium-term carbon neutrality goals

COIL, world leader in aluminium anodising, has

released its annual results for the 2021 financial year.

- Significant events of the

financial year

After a 2020 financial year heavily impacted by

the global crisis linked to the COVID-19 pandemic, COIL recorded a

significant improvement in its performance in 2021.

The aftermath of the health crisis continued to

affect the Company's operations.

Tolling Sales were held back by lengthy delivery

times of anodising quality aluminium from European rolling mills

due to very high demand in other sectors. Export sales of Package

products1 to Asia suffered due to border closures and extended

delivery delays, due to a lack of capacity in the supply chain of

aluminium and very high delivery costs.

In this context, Tolling Sales recovered (+24%

compared to 2020), particularly in the second half of the year with

the continued recovery of demand in the construction and

architectural end markets. Package Sales decreased (-24%) due to a

high comparison base in 2020, which included large orders delivered

in China and could not be compensated by the solid recovery of

sales in Europe in 2021.

This shift in product mix towards Tolling Sales

resulted in a significant improvement in the Company's gross margin

given a much higher margins in Tolling Sales than in Package Sales,

which include metal.

From an industrial point of view, the Company

continued to optimise its variable costs by relying on a

rationalised production capacity. Growth and productivity

improvements thus had a positive impact on the Company's operations

and profitability.

Sales for the 2021 financial year were up 10% on

the previous year, amounting to €25.2M, above the Company's

expectations, but benefited from a favourable basis for comparison:

2020 sales were down by 23% on the previous year and had been

deeply affected by the consequences of the health crisis.

EBITDA increased by €5.3M to €6.3M, i.e. 24.8%

of sales compared to 4.4% in 2020 and 21.0% in 2019. This

favourable trend is explained by i) the increase in gross margin

due to the growth in sales and the shift in product mix towards

subcontracting, leading to a lower weighting of metal in sales, and

ii) the decrease in operating expenses with the reduction in

payroll and non-recurring items related to management remuneration

and bonuses.

After a €0.4M reduction in provisions and

depreciation, operating profit was €2.8M, compared with a loss of

€(2.9)M in 2020 and a profit of €2.1M in 2019.

Net income reached €2.1M, an increase of €5.4M

compared to 2020 and €1.1M compared to 2019. It included financial

expenses of €0.6M.

|

(€M) |

2019 |

2020 |

2021 |

2021 / 2019Variation |

|

Sales |

29.8 |

23.0 |

25.2 |

- 15 % |

|

Tolling Sales |

20.7 |

16.2 |

20.1 |

- 3 % |

|

Package Sales2 |

9.0 |

6.8 |

5.1 |

- 43% |

|

EBITDA |

6.3 |

1.0 |

6.3 |

+ 0 % |

|

% of sales |

21.0% |

4.4% |

24.8% |

+3.8 pts |

|

Operating result |

2.1 |

(2.9) |

2.8 |

+ 32 % |

|

% of sales |

7.1% |

(12.5)% |

11.1% |

+ 4.0 pts |

|

Pre-tax result |

1.1 |

(3.2) |

2.2 |

+ 102 % |

|

Net income |

1.0 |

(3.3) |

2.1 |

+ 107 % |

|

% of sales |

3.3% |

(14.1)% |

8.1% |

+4.9 pts |

Given the increased results, shareholders'

equity at 31 December 2021 was €29.2M, up €2.1M on 31 December

2020. Net financial debt at 31 December 2021 was €3.9M, down €4.7M

on the previous year, and represented 13% of equity, compared to

32% at 31 December 2020 and 28% at 31 December 2019.

- 2022 first-quarter sales

and outlook

Q1 2022 followed the trend observed in 2021.

Sales were €6.6M, up 11.8% compared to the first quarter of 2021.

Package Sales (€1.2M) were down 28.4%, while Tolling Sales

maintained their recovery (€5.4M ; +28.1%).

The company is confident in its prospects,

barring any major new impact from the health crisis and the

geopolitical context. However, the inflationary situation could

weigh on the Company's margins despite the increase in sales prices

at the beginning of the year.

In a context of a transition to new energy

sources and a reduction of fossil fuel consumption, the Company has

been exploring for more than a year ways to accelerate the

long-term purchase of new renewable energy sources at attractive

costs, especially in Germany. Working with a specialised industrial

partner, an action plan, to be implemented in 2022 and 2023, will

enable the Company to make significant savings in the long term and

to improve its energy efficiency, with carbon neutrality goals for

the Bernburg industrial site in Germany.

Despite a complex economic environment, the

Company continues to invest in the profitable development of its

business. With a flexible and efficient industrial organisation, a

growing geographical footprint and a solid financial position, the

Company remains confident in its development prospects by

capitalising on its portfolio of premium, sustainable and

low-carbon products to strengthen its global leadership.

The financial statements were approved by the

Board of Directors on 28 April 2022. They are included in the 2021

consolidated annual accounts available on the Company's financial

website (http://investors.coil.be).

|

|

Annual general meeting |

|

|

First half 2022 sales |

|

|

First half 2022 results and half-year financial report |

About COIL

COIL is the world's leading anodiser in the

building and industrial sectors and trades under the ALOXIDE brand

name.

Anodising is an electrochemical process which

develops a natural, protective oxide layer on the surface of

aluminium and can be coloured in a range of UV-proof finishes. It

gives the metal excellent resistance to corrosion and/or reinforces

its functional qualities. Anodising preserves all the natural and

ecological properties of aluminium; it retains its high rigidity

and excellent strength-to-weight ratio, its non-magnetic

properties, its exceptional resistance to corrosion. The metal

remains totally and repeatedly recyclable through simple

re-melting. Anodised aluminium is used in a wide variety of

industries and applications: architecture, design, manufacturing

and the automotive sector. COIL deploys an

industrial model that creates value by leveraging its unique

know-how, its operational excellence, the quality of its

investments and the expertise of its people. COIL has around 120

employees in Belgium and Germany and generated a turnover of €25.2

M in 2021.

Listed on Euronext Growth Paris | Isin:

BE0160342011 | Reuters: ALCOI.PA | Bloomberg: ALCOI: FP

For more information, please visit

www.aloxide.com

Contact

|

COILTim Hutton | Chief Executive Officer

tim.hutton@coil.be | Tel. : +32 (0)11 88 01 88 |

CALYPTUSCyril Combe cyril.combe@calyptus.net |

Tel. : +33 (0)1 53 65 68 68 |

1 The Package business include pre-anodised metal supplied

directly to the end customer.2 Anodising and metal included

- COILpressrelease29april2022_EN

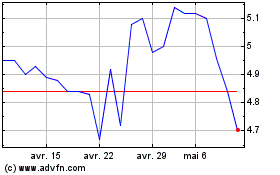

COIL (EU:ALCOI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

COIL (EU:ALCOI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025