Crossject advances in its U.S. Strategy and reports Financial

Results for 2023

- Increase in visibility in its

regulatory and commercialization prospects in the U.S. since latest

interactions with the FDA

- Expectation to receive U.S.

Emergency Use Authorization (EUA) for ZEPIZURE® in Q1 2025

- Expectation to complete U.S. New

Drug Application (NDA) for ZEPIZURE® in H1 2025

- Reinforcement of supply chain [with

addition of a second fill-and-finish CDMO]

- Reporting of a reduced Net loss of

€8.5 million versus €11.2 million in 2022

Dijon, France April 2, 2024, 10:30am CET

-- Crossject (ISIN: FR0011716265; Euronext: ALCJ), a specialty

pharma company developing needle-free auto-injectors for emergency

situations, announces progress on multiple fronts in its

clinical development, registration and U.S. commercial strategy and

reports its financial results for the year ending December 31,

2023.

Patrick Alexandre, CEO of

Crossject, announces:

Crossject is approaching a number of important

value inflection points, which have the potential to transform our

company and deliver substantial shareholder value.

Our $92 million contract with the Biomedical

Advanced Research and Development Authority (BARDA) (up to $155

million if all options are exercised) is progressing. This

contract, with the Department of Health and Human Services;

Administration for Strategic Preparedness and Response; BARDA under

contract number 75A50122C00031, includes up to $32 million for the

advanced development of ZEPIZURE® through approval by the FDA for

the treatment of status epilepticus seizures in adults and children

over the age of 2. It also includes the procurement of $60 million

of ZEPIZURE® to the U.S. Government once it has received Emergency

Use Authorization (EUA) from the FDA. These proceeds will

contribute in a timely fashion to the deployment of ZEPIZURE® in

epilepsy markets.

During recent interactions with the FDA, we have

achieved better visibility on the next development steps for the

U.S. regulatory pathway. We estimate that a response from FDA

regarding the EUA will be received during Q1 2025.

In parallel, we expect to file in H1 2025 for an

NDA of ZEPIZURE®. We are firmly focused on the final development

stages for epileptic crises, including an upcoming 505(b)(2)

pivotal bioequivalence study, as part of the NDA that we anticipate

to file in H1 2025. We are also working on activities related to

its registration and pre-commercialization in the United States,

since Crossject intends to retain U.S. commercial rights to

ZEPIZURE®. We have been working in close collaboration with Syneos

Health, a leading contract research, market access and

commercialization services organization, which we engaged in

January. Together, we are working with the aim to ensure a smooth

and rapid launch of ZEPIZURE® upon receiving regulatory approval

from the Food and Drug Administration (FDA).

We intend to file our NDA application for the

Status Epilepticus indication under FDA’s 505(b)(2) regulatory

pathway.. This is a streamlined NDA process in which we can rely on

investigations previously conducted by third parties for an FDA

approved reference product, and where we will only need to

demonstrate bioequivalence with such a product. In our

upcoming pivotal study, we intend to replicate the comprehensive

positive bioequivalence results already demonstrated in our

precedent study released on 2 November 2022, which will be used for

the EUA. In this randomized crossover study, ZEPIZURE® demonstrated

bioequivalence to a predicate injectable marketed in

Europe. Based on these and other data, we are confident that

the ZENEO® platform will continue to demonstrate its ability to

mimic intramuscular injections from traditional injectables with a

high accuracy and low variability. These ZENEO features, now well

validated, will be essential to limit development and regulatory

risks. More importantly, we also expect them to drive market

acceptance versus traditional injectables, and versus other

delivery methods, including intranasals, which are known for their

intrinsic transmucosal pharmacokinetic variability, compounding

with the admnistration challenges customarily incurred during

crises.

Our market opportunity has been validated by the

relative success of such intranasal products, promoted as “needle

free”. We look forward to reaching the market with our first unique

solution in epilepsy, that is dependable and addresses the

limitations of currently marketed products.

Our two main additional programs, ZENEO®

Hydrocortisone and ZENEO® Adrenaline, are also progressing toward

planned market authorization filings in 2025 and 2026

respectively.

The supply chain organization, including our new

partner Eurofins Scientific as fill-and-finish CDMO (Contract

Development and Manufacturing Organization), was discussed with

BARDA and the FDA. Although it has led to further delay, we firmly

believe that, today, our level of automation will not only

strengthen our supply chain but also further secure the anticipated

volumes for all our programs.

This combination of positive developments has

served as a strong background for the continued strengthening of

our balance-sheet, recently achieved through our €12 million

financing with Heights Capital Management. As ZEPIZURE® progresses

toward market authorizations, and as we also support our two main

additional programs, we will continue to actively explore the best

way to finance our maturing global operations throughout the rest

of 2024.

Philippe Monnot, CEO and one of the founders of Gemmes Venture,

our reference shareholder, has confirmed his support :

« With the recent evolutions in Crossject’s supply chain

and the constructive interactions with the FDA we trust that the

Company can market its revolutionary products; we renew our trust

in the Company and its management. »

I am grateful to you, our shareholders, for your

unwavering attention and your continuing support of our efforts.

Together, we have the opportunity to make a significant difference

for patients and create value for our company.

Financials for 2023

Key financial information as of December

31, 2023

In 2023, we continued the financing of the

development ZEPIZURE® and of the rest of our pipeline and

infrastructure through multiple sources:

- BARDA invoicing:

$6.7 million were invoiced as reimbursements of research and

development expenses incurred in 2023, versus $1.8 million in

2022;

- Invoicing to

distributor: € 145 thousand were collected as upfront payment upon

signing of the agreement with AFT Pharmaceuticals, Ltd;

- Research tax

credit: €2.4 million were collected in 2023 versus €2.0 million in

2022.

- Real estate

leaseback transaction : €4.7 million were raised through a

sale and leaseback transaction for two of its buildings with

leasing payments spread over the following 12 years;

- Borrowings: 8

million proceeds from loans contracted in 2022 were collected.

- Convertible

Bonds: All outstanding convertible bonds had been converted as of

31/12/2023.

In 2023, we

accelerated our research and development and overall activities. As

a result, we recorded a very substantial increase in operating

income to €12.8 million, an increase of 32% over 2022.

The table

below summarizes our income statement for the years ending 31

December 2023 and 2022:

|

€ thousands, as of 31 December |

2023 |

2022 |

|

Operating income |

12 826 |

9 718 |

|

Operating expenses |

-25 126 |

-23 005 |

|

Purchase of raw materials and supplies |

-1 595 |

-498 |

|

Other purchases and external expenses |

-8 869 |

-8 116 |

|

Personal expenses |

-7 713 |

-7 424 |

|

Taxes and duties |

-267 |

-176 |

|

Depreciation, amortisation and provision |

-6 185 |

-6 358 |

|

Other expenses |

-494 |

-433 |

|

Operating profit/loss |

-12 300 |

-13 288 |

|

Financial income/expense |

-497 |

-319 |

|

Exceptional income/expense |

1 463 |

228 |

|

Corporate tax |

2 867 |

2 222 |

|

Net profit/loss |

-8 467 |

-11 157 |

The

Operating expenses increased by 9% in 2023 over 2022, a very

moderate rise in relation to the increase of our operating income.

Such increase resulted from our advancing in the research and

development of ZEPIZURE and of our other programs as well as from

the initial steps in building our US team and operations.

Other

purchases and external expenses amounted to €8.9 million, compared

with €8.1 million in 2022, as we have been maintaining the progress

in our production work and third-party activities linked to the

regulatory development of ZEPIZURE® as well as activities on other

key programs in our pipeline.

As of 31

December 2023, Crossject had approximately 111 employees, an 11%

increase compared with 2022. Personnel expenses amounted to €7.7

million in 2023 compared to €7.4 million in 2022, the increase is

due to these new recruitments in 2023.

We reported

an Operating loss of €12.3 million, compared with a loss of €13.3

million in 2022 with the relative stability reflecting our

increased operating expenses and their partial offsetting by

operating income.

We recorded

net financial expenses of €0.5 million for 2023, compared to an

expense of €0.3 million for 2022.

After taking

into account an exceptional income of €1.5 million, provided

primarily from the transaction of the real estate leaseback and a

reversal of accounting provision, as well as the research tax

credit for an amount of €2.9 million, we are reporting a Net loss

for 2023 of €8.5 million versus a loss of €11.2 million in

2022.

Treasury

position

As of 31

December 2023, we had a cash balance of €2.3 million.

From the

beginning of 2024 we have made it a priority to explore all types

of financings to pursue our research and development and overall

activities. As of 28 February 2024, we raised a first financing of

up to €12 million from Heights Capital Management, in two tranches,

with the first tranche of €7 million extended at closing. That

tranche may be supplemented by a second tranche of a maximum amount

of approximately €5 million on our initiative and subject to

compliance with certain conditions.

Based on our

financial resources as of 31 March 2024 and taking into account

ongoing historical relationships with our lenders and creditors,

the Company is confident to be able to finance its business plan

until September 2024. In 2024, the Company also intends to obtain

material financings from its undisclosed European collaboration

partner, for an amount of €0.5 million, €0.7 million from grants as

well as from research tax credit payments related to the periods of

2023 and 2024.

As the

prospects for ZEPIZURE® improve and as we dedicate resources to the

research and development of our two main additional ZENEO product

candidates, ZENEO® Hydrocortisone and ZENEO® Adrenaline, we will

continue to actively explore the best ways to finance our maturing

global operations in equity, debt, public financings and other

kinds of financings throughout 2024.

Notable milestones in

2023

Non-dilutive financing

Crossject completed a combined non-dilutive

financial transaction of €14 million to accelerate the company's

development. The transaction includes various loans granted by its

long-standing banks (Caisse d'Epargne and BNP), Société Générale

and BPI, with amortization periods ranging from 5 to 10 years and

with nearly 85% of the total available.

New licensing agreement on ZENEO®

Midazolam epilepsy rescue therapy

Crossject signed an Australia & New Zealand

commercial agreement with AFT Pharmaceuticals for ZENEO® Midazolam,

its innovative rescue therapy for epileptic seizures. AFT

Pharmaceuticals is a particularly well-suited partner because of

its strong regional presence and extensive experience with

successful commercial launches.

Commercialization agreement in northern

Europe

Under this agreement with an undisclosed

strategic partner, Crossject will receive milestone payments of up

to €1 million in total, upon marketing authorizations being granted

in the partner’s territories. Crossject will manufacture and sell

ZEPIZURE® to its strategic partner with a markup that is a share of

the gross profit (defined as net sales minus cost of goods).

Successful completion of European and

U.S. audits

Crossject's manufacturing sites in Dijon and

Gray (France) passed an annual ISO certification audit, expanded

their scope of certification by the French Health Agency, and

received positive feedback after an audit by BARDA on compliance of

manufacturing ZENEO® Midazolam for the U.S. market.

Appointment of Daniel Teper as Director

on the Supervisory Board

With a PhD in Pharmacy from Paris-Saclay

University and an MBA from INSEAD, Daniel Teper is a U.S.-based

pharmaceuticals industry leader and entrepreneur with a compelling

background spanning the fields of marketing, capital markets,

strategy and development.

hErOiSme early stage

project

The French Ministry of Armed Forces (Ministère

des Armées) selected the project offered by a research consortium

to develop a new molecule for rescue therapies for hemorrhagic

shock treatment with ZENEO® auto-injector. Many civilian and

military lives could be saved by promptly stabilizing the condition

of a person suffering from hemorrhagic shocks. Crossject and IDD,

its long-term regulatory partner, have officially joined this

3-year-long research program with a total budget of EUR

800,000.

Initiation of coverage by

ODDO-BHF

In November 2023, ODDO-BHF analysts rated

Crossject as “Outperform” with a price target of €7.10, citing the

significant advantages associated with the company’s needle-free

ZENEO® device.

Significant improvement in Gaïa ESG

rating

Crossject’s new score of 73/100 is significantly

up from 60 last year and 46 in 2021. Crossject's Gaïa rating,

compiled by EthiFinance ESG Ratings, increased across all four

themes: governance, social, environment and external stakeholders.

There were particularly notable improvements in the ratings for

environment and external stakeholders' performance.

Events beyond the reporting

period

Convertible bond financing of up to €12

million

The financing is in two tranches, from an entity

managed by Heights Capital Management, in issued bonds convertible

in new shares, with a conversion premium of 35%1, or repayable (in

cash and/or stocks, according to the company’s options) over 36

months at a rate of 7%. Heights Capital Management, Inc. is an

institutional investor specialized in financing growing companies.

The financing is a sign of confidence in our industrial and market

progress, particularly in North America.

Engagement of Syneos Health for U.S.

commercial launch of ZEPIZURE®

Crossject engaged Syneos Health, a leading fully

integrated biopharmaceutical solutions organization, to prepare for

the commercial launch of ZEPIZURE® for epileptic seizures in the

U.S. Under the agreement, Syneos Health will provide support in all

pre-launch and launch activities for ZEPIZURE®. Syneos Health

brings a strong U.S. presence and significant expertise in

commercializing new therapies for Crossject.

Gender equality score reaches 96/100 in

2024

This is the third successive year the score has

been above 90%. The Gender Equality Index is a tool to measure the

progress of gender equality in the EU and is assessed by a score

from 1 to 100, with 100 meaning full equality between women and

men.

About Crossject

Crossject SA (Euronext:

ALCJ; www.crossject.com) is an emerging specialty pharma

company. It is in advanced regulatory development for ZEPIZURE®, an

epileptic rescue therapy, for which it has a $60 million contract

with the U.S. Biomedical Advanced Research and Development

Authority (BARDA). ZEPIZURE® is based on the Company’s

award-winning needle-free autoinjector ZENEO®, designed to enable

patients and untrained caregivers to easily and instantly deliver

emergency medication via intramuscular injection on bare skin or

even through clothing. The Company’s other products in development

include rescue therapies for allergic shocks, adrenal

insufficiencies, opioid overdose and asthma attacks.

For further information, please contact:

|

Investors Natasha DrapeauCohesion Bureau+41 76 823

75 27natasha.drapeau@cohesionbureau.com |

MediaSophie BaumontCohesion Bureau+33 6 27 74 74

49sophie.baumont@cohesionbureau.com |

|

- Crossject_PR_FinResults_EN

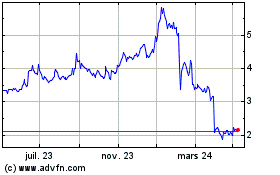

Crossject (EU:ALCJ)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

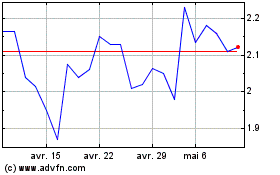

Crossject (EU:ALCJ)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025