KEY FIGURES OF DASSAULT AVIATION

GROUP

|

|

2023 |

2022 |

|

Order intake |

EUR 8,253 million60 Rafale of which 42 France and

18 Export23 Falcon |

EUR 20,954 million92 Rafaleof which 92 Export64 Falcon |

|

Adjusted net sales (*) |

EUR 4,801 million13 Rafale of which 11 France and

2 Export26 Falcon |

EUR 6,929 million14 Rafale of which 13 Export and 1 France32

Falcon |

|

Backlogas of December 31 |

EUR 38,508 million211 Rafaleof which 141 Export

and 70 France84 Falcon |

EUR 35,008 million164 Rafaleof which 125 Export and 39 France87

Falcon |

|

Adjusted operating income(*)Adjusted operating margin |

EUR 349 million7.3% of net sales |

EUR 572 million8.3% of net sales |

|

Self-funded Research and Development |

EUR 483 million10.1% of net sales |

EUR 572 million8.3% of net sales |

|

Adjusted net income (*) Adjusted net marginEarnings per share |

EUR 886 million18.5% of net salesEUR 10.95

per share |

EUR 830 million12.0% of net salesEUR 9.99 per share |

|

Available cashas of December 31 |

EUR 7,294 million |

EUR 9,529 million |

|

Dividends |

EUR 266 millionEUR 3.37 per share |

EUR 249 millionEUR 3.00 per share |

|

Employee profit-sharing and incentives including 20% employer’s

corresponding taxHeadcount as of December 31 |

EUR 170 million13,533 |

EUR 210 million12,768 |

NB: Dassault Aviation recognizes Rafale Export

contracts in their entirety (including the Thales and Safran

parts).

Main IFRS aggregates (see

reconciliation table below)

|

(*) Consolidated net sales |

EUR 4,805 million |

EUR 6,950 million |

|

(*) Consolidated operating income |

EUR 349 million |

EUR 591 million |

|

(*) Consolidated net income |

EUR 693 million |

EUR 716 million |

Saint-Cloud, March

6th 2024 - The Board of

Directors held yesterday and chaired by Mr. Éric Trappier approved

the 2023 statement of accounts. The audit procedures have been

completed and the audit opinion is in the process of being

issued.

“The Group’s backlog continues to

increase, driven by the commercial success of the Rafale. It stands

at EUR 38.5 billion as of December 31, 2023 (295 aircraft -

141 Rafale Export, 70 Rafale France and 84 Falcon). Post-closing of

the 2023 financial statements, the backlog increased with the entry

into force in January 2024 of the third batch of 18 Rafale of the

Indonesian contract. A total of 495 Rafale have thus been ordered

since the beginning of the program.

Certification of the Falcon 6X by EASA

and FAA (type certificate) has been approved on August

22nd, 2023, the entry into

service of the aircraft including the application of post

certification upgrades happened on November

30th 2023. The first delivery

took place in February 2024.

13 Rafale and 26 Falcon were delivered,

versus a guidance of 15 and 35, due to supply chain issues and the

delayed entry into service of Falcon 6X.

Group’s Revenues for this year stood at

EUR 4.8 billion, leading to an adjusted EBIT of EUR 349

million and a record breaking adjusted net result of EUR 886

million, representing 18.5% of net sales.

In 2023, the international context deteriorated,

marked by the ongoing war in Ukraine and the conflict in the Middle

East. France adopted an ambitious Military Procurement Law (Loi de

Programmation Militaire - LPM), which allocates a budget of

EUR 413 billion for the 2024-2030 period (representing an

increase of 40% compared to the previous LPM). For Dassault

Aviation, the LPM provides for the ongoing deliveries of the Rafale

program fourth batch, the coming into force of the 42 aircraft of

the fifth batch (20 of which are to be delivered from 2027 to

2030), the completion by 2027 of the Rafale Standard F4, the

negotiation and beginning of Rafale Standard F5 which should come

along with the development of a combat drone.

Supply chain issues that arose during the Covid

crisis continue to have a severe impact on sub-contractors in the

aviation industry, which are not always able to deliver the

required quality or meet deadlines. Certain supplier weaknesses,

coupled with capacity shortages, mainly in aerostructure, resulted

for the Group in delays in production start-ups. While these risks

will continue to weigh on the Group’s business in 2024, Dassault

Aviation has implemented a centralized steering plan to introduce

corrective measures, provide the necessary support to certain

sub-contractors and develop “Make in India.”

The Paris Le Bourget Air Show was held in June

2023. This trade show allowed Dassault Aviation to once again

showcase the efforts it has undertaken to decarbonize its processes

and products, and those that it will continue to pursue in the

years to come. The Group is committed to its decarbonization: the

Falcon aircraft are certified to fly with Sustainable Aviation Fuel

(SAF) blends with kerosene up to 50%. Today’s available alternative

fuels (SAF) offer a carbon emission reduction’s rate in the range

of 80% to 90% compared to conventional kerosene. All Dassault

Aviation flights, including those in the United States, are using

30% SAF blends which are the only ones available on the market

today. 413 flights have been operated in 2023 by Dassault Aviation

with 30% SAF blends (vs. 179 in 2022). Aircraft models currently

under production will be compatible with 100% SAF blends by 2030

(Falcon 10X natively).

In the military sector, 2023 saw:

-

the order by France for 42 Rafale placed in December 2023 under the

country’s new Military Procurement Law which was adopted in July

2023,

-

the addition to the backlog of the second batch of 18 Rafale under

the Indonesian contract (followed on January 8, 2024 by the entry

into force of a third batch of 18 aircraft),

-

the delivery of 11 Rafale to France,

-

the delivery of 2 new Rafale to Greece, as well as 6 pre-owned

Rafale,

-

the continuation of development work on the Rafale F4 standard and

the FCAS, for which Dassault Aviation is leader for the NGF

demonstrator,

-

the continuation of work on the Eurodrone contract. Dassault

Aviation is responsible in particular for flight controls and

mission communications as a sub-contractor,

-

in the field of military support, the Group has met the

availability commitments of its operational maintenance contracts

(Ravel for the Rafale, Ocean for the ATL2 and Balzac for the Mirage

2000), and participated in “High Intensity” warfare exercises with

the French forces. At the end of December, a new verticalized

maintenance contract was notified: “Alphacare” for the Alpha Jet.

Moreover, support for fleets in service for Export customers

continued as close as possible to operations.

In the civil aviation segment, 23 Falcon were

ordered and 26 Falcon were delivered in 2023, compared with a

guidance of 35.

The year also saw:

-

the continuation of development efforts on the Falcon 6X and 10X:

- The

Falcon 6X was certified on August 22, 2023 and entered into service

on November 30, 2023. Prospection has been stepped up, notably

thanks to a demonstration aircraft. The flights operated allowed

the first customers to confirm the cabin’s very high level of

comfort. The ramp up of production also continued, in a challenging

supply chain context,

- the

first Falcon 10X (development aircraft) is currently being built.

The program schedule has been adjusted and the first deliveries are

scheduled for 2027.

-

the expansion of the network of service centers, notably with the

opening of the service center in Dubai (to replace the previous

center).

Social and environmental responsibility was

reflected in 2023 through:

-

the Company’s commitment to the environment and to the

decarbonization of its Falcon aircraft, in particular with:

-

significant results for the Parent Company’s energy saving plan

which was launched at the end of 2022: -10.4% of energy consumption

per hour worked,

- the

ramp-up of the “SAF plan” which set an ambitious target for the use

of SAF for its internal flights (413 flights operated with “30%

SAF” blends in 2023 compared with 179 in 2022),

- the

entry into service of the flight plan optimization tool

FalconWays.

-

a major recruitment drive and an attractive employment model in

which – true to the ideals of Serge and Marcel Dassault – value

sharing is a core part of its DNA with notably:

-

almost 2,000 new hires, including 200 apprentices, in a tight labor

market,

-

based on the 2023 profits, profit-sharing and incentives reached

EUR 170 million (for employees of the Group’s French

companies , including the corresponding employer’s tax) compared

with the minimum legal profit-sharing of

EUR 8 million.

2024 Objectives:

-

Deliver Rafale and Falcon,

-

Meet our schedule and cost commitments for Falcon and military

developments,

-

Availability and support for our aircraft: maintain satisfaction

levels among our military customers and regain our position as

leader in business aviation support rankings,

-

Get a contract for the F5 standard preliminary studies,

-

FCAS / NGF: continue developing the demonstrator,

-

Make in India: ramp up the activities transferred to India,

-

Continue Rafale Export business development and increase Falcon

sales efforts,

-

CSR: integrate new hires, continue our recruitment efforts and our

action to reduce our environmental impact.

2024 Guidance

We forecast an increase in Group’s revenue for

2024 compared to 2023, EUR 6 Billion range (of which deliveries of

35 Falcon and 20 Rafale).

The Board of Directors would like to

congratulate all the Group’s employees for the past year’s success

and express its confidence in achieving the objectives for the

coming year”

- ORDER

INTAKE

2023 order intake was

EUR 8,253 million versus EUR 20,954 million in

2022. Export order intake represented

64%.

Changes were as follows, in millions of

euros:

|

|

2023 |

2022 |

2021 |

|

|

|

|

|

|

Defense |

6,524 |

17,510 |

9,165 |

|

Defense Export |

3,583 |

15,657 |

6,173 |

|

Defense France |

2,941 |

1,853 |

2,992 |

|

|

|

|

|

|

Falcon |

1,729 |

3,444 |

2,915 |

|

|

|

|

|

|

Total order intake |

8,253 |

20,954 |

12,080 |

|

% Export |

64% |

90% |

74% |

The order intake is composed entirely of firm

orders.

Defense programs

In 2023, Defense order intake

totaled EUR 6,524 million, compared with EUR

17,510 million in 2022.

The Defense Export share

amounted EUR 3,583 million in 2023, versus

EUR 15,657 million in 2022. In 2022, 92 Rafale were

ordered (80 by the United Arab Emirates, 6 by Greece and 6 by

Indonesia) compared to 18 Rafale ordered by Indonesia in 2023.

The Defense France share

amounted to EUR 2,941 million in 2023, compared

with EUR 1,853 million in 2022. This increase is mainly due to the

order for Batch 5 of 42 Rafale (in 2022, the order relating to

Phase 1B of the FCAS demonstrator was recorded).

Falcon programs

In 2023, 23 Falcon orders were

recorded, compared with 64 in 2022. Order intake totaled

EUR 1,729 million versus EUR 3,444

million in 2022. This decrease is mainly due to the decline in the

number of Falcon ordered (23 vs. 64 in 2022).

2. ADJUSTED NET SALES

Net sales for 2023 were EUR 4,801

million versus EUR 6,929 million in 2022.

Export represented 68%.

Changes were as follows, in millions of

euros:

|

|

2023 |

2022 |

2021 |

|

|

|

|

|

|

Defense |

2,980 |

4,825 |

5,281 |

|

Defense Export |

1,512 |

3,616 |

4,549 |

|

Defense France |

1,468 |

1,209 |

732 |

|

|

|

|

|

|

Falcon |

1,821 |

2,104 |

1,952 |

|

|

|

|

|

|

Total adjusted net sales |

4,801 |

6,929 |

7,233 |

|

% Export |

68% |

82% |

89% |

Defense programs

In 2023, 13 Rafale (11 France and 2

Export) were delivered, compared with the guidance of 15.

14 Rafale (13 Export and 1 France) were delivered in 2022.

Defense net sales in 2023 were

EUR 2,980 million versus EUR 4,825

million in 2022.

The Defense Export share was

EUR 1,512 million versus EUR 3,616

million in 2022. This decrease is largely due to the delivery of 2

Export Rafale, whereas 13 Export Rafale were delivered in 2022.

The Defense France share was

EUR 1,468 million versus EUR 1,209 million in

2022. Defense France 2023 net sales notably included the delivery

of 11 Rafale versus 1 Rafale in 2022.

Falcon programs

26 Falcon were delivered in

2023, compared with the guidance of 35, versus 32

deliveries in 2022.

Falcon net sales for 2023 were

EUR 1,821 million versus EUR 2,104

million in 2022. The decrease is primarily due to the number of

Falcon aircraft delivered (26 vs. 32).

****

The book-to-bill ratio of the Group (order

intake/net sales) is 1.72 for 2023.

3. BACKLOG

The consolidated backlog as of December 31, 2023

(determined in accordance with IFRS 15) was EUR 38,508

million, versus EUR 35,008 million as of December 31,

2022. Change in the backlog is as follows, in millions of

euros:

|

As of December 31 |

2023 |

2022 |

2021 |

|

|

|

|

|

|

Defense |

33,862 |

30,318 |

17,633 |

|

Defense Export |

23,986 |

21,915 |

9,874 |

|

Defense France |

9,876 |

8,403 |

7,759 |

|

|

|

|

|

|

Falcon |

4,646 |

4,690 |

3,129 |

|

|

|

|

|

|

Total backlog |

38,508 |

35,008 |

20,762 |

|

% Export |

71% |

72% |

58% |

The backlog as of December 31, 2023 consists of

the following:

-

Defense Export: EUR 23,986

million versus EUR 21,915 million as of December 31, 2022.

This figure notably includes 141 new Rafale in 2023, compared with

125 new Rafale and 6 pre-owned Rafale in the Defense Export backlog

as of December 31, 2022,

-

Defense France: EUR 9,876 million

versus EUR 8,403 million as of December 31, 2022. This figure

mainly comprises 70 Rafale (vs. 39 at the end of December 2022),

the support contracts for the Rafale (Ravel), Mirage 2000 (Balzac),

ATL2 (Ocean) and the Alpha Jet (Alphacare), the Rafale F4 standard

and the order for phase 1B of the FCAS demonstrator.

-

Falcon (including the Albatros and Archange

mission aircraft): EUR 4,646 million versus EUR

4,690 million as of December 31, 2022. It includes notably 84

Falcon, compared with 87 as of December 31, 2022.

Additional information on the backlog can be

found in Note 24 to the consolidated financial statements.

4. ADJUSTED RESULTS

Adjusted operating income

Adjusted operating income for

2023 was EUR 349 million, compared with EUR 572

million in 2022.

Research and development costs totaled EUR

483 million in 2023 and accounted for 10.1% of net sales,

compared with EUR 572 million and 8.3% of net sales in 2022. These

amounts reflect the self-funded R&D effort focused on the

Falcon 6X and Falcon 10X programs.

The adjusted operating margin

stood at 7.3% compared to 8.3% in 2022,

representing a 1.0 point decrease, notably due to the 1.8 point

increase in the weight of research and development expenditure.

The foreign exchange hedging rate was USD

1.20/EUR in 2023, vs. USD 1.19/EUR in 2022.

Adjusted financial income

2023 adjusted financial income

was EUR 210 million compared to EUR 11 million in

2022. This strong increase was due to financial income generated by

the Group’s cash position in a context of favorable interest

rates.

Adjusted net income

Adjusted net income for 2023

was EUR 886 million vs. EUR 830 million in

2022, increasing by 6.7 %. Thales’ contribution to the Group’s net

income was EUR 453 million, versus EUR 386 million in 2022.

As a result, adjusted net

margin was 18.5% in 2023, versus 12.0% in

2022. This increase is mainly due to the higher net financial

income and contribution from Thales.

Adjusted net income per share in 2023 was

EUR 10.95 vs. EUR 9.99 in

2022.

5. CONSOLIDATED KEY FIGURES UNDER IFRS

Consolidated operating income

(IFRS)

Consolidated operating income

for 2023 was EUR 349 million vs.

EUR 591 million in 2022.

R&D costs totaled EUR 483 million in 2023

and accounted for 10.1% of consolidated net sales (EUR 4,805

million), compared to EUR 572 million and 8.2% of consolidated net

sales in 2022. These amounts reflect the self-funded R&D effort

focused on the Falcon 6X and Falcon 10X programs.

The consolidated operating

margin was 7.3% compared to 8.5% in

2022.

Consolidated financial income

(IFRS)

Consolidated net financial

income for 2023 was EUR 212 million vs.

EUR -12 million in 2022. This strong increase was due to

financial income generated by the Group’s cash position in a

context of favorable interest rates.

Consolidated net income

(IFRS)

Consolidated net income for

2023 was EUR 693 million, compared with EUR 716

million in 2022. Thales’ contribution to the Group’s net income was

EUR 259 million, versus EUR 275 million in 2022.

As a result, consolidated net

margin was 14.4% in 2023, as against

10.3% in 2022.

Consolidated net income per

share for 2023 was EUR 8.57 compared with

EUR 8.62 in 2022.

6. AVAILABLE CASH

The Group uses a specific indicator called

“Available cash”, which reflects the amount of total cash available

to the Group, net of financial debts. It includes the following

balance sheet items: cash and cash equivalents, current financial

assets and financial debt, excluding lease liabilities. The

calculation of this indicator is detailed in the consolidated

financial statements (see Note 9 of the December 31, 2023,

consolidated financial statements).

The Group’s available cash

stands at EUR 7,294 million, versus EUR 9,529

million as of December 31, 2022. The decrease in available cash in

2023 was mainly due to the increase in work-in-progress (execution

of military contracts, ramp-up of the Falcon 6X), share buybacks

and acquisition of the additional stake in Thales.

7. CONSOLIDATED BALANCE SHEET

Total equity stood at EUR 5,742 million as

of December 31, 2023 compared with EUR 6,006 million as of

December 31, 2022. This amount has been impacted by the share

buyback.

Borrowings and financial debt stood at EUR 262

million as of December 31, 2023, compared with EUR 234 million as

of December 31, 2022. Borrowings and financial debt include

locked-in employees’ profit-sharing funds, for EUR 78 million, and

lease liabilities, for EUR 184 million.

Inventories and work-in-progress rose to EUR

5,258 million as of December 31, 2023, compared with EUR 3,922

million as of December 31, 2022. This increase was due to the

execution of military contracts and the ramp-up of the Falcon

6X.

Advances and progress payments received on

orders, net of advances and progress payments paid decreased by

EUR 137 million as of December 31, 2023. The decrease

relating to the retrocession of Rafale Export downpayments received

at the end of 2022 to our co-contractors was almost entirely offset

by advances received, notably for the Rafale contracts in Indonesia

and Egypt.

Derivative financial instruments had a market

value of EUR 29 million as of December 31, 2023, compared with EUR

-88 million as of December 31, 2022, reflecting an improvement in

the hedging portfolio rate.

8. VALUE SHARING

The Board of Directors decided to propose to the

Annual General Meeting a dividend distribution, in 2024, of

EUR 3.37 per share, EUR 266 million in

aggregate, representing a payout of 30%. The Board of

Directors of March 5th, 2024, has decided to cancel 1,850,554

shares. The dividend per share is calculated based on the number of

shares as of December 31, 2023, netted of the number of those

shares canceled.

For 2023, the Group will pay EUR 170

million in employee profit-sharing and incentives,

including 20% employer’s corresponding tax, whereas the application

of the legal formula would have resulted in a EUR 8 million payment

(including the employer’s corresponding tax).

Dividends per share over the five last years are

provided in Note 32 to the Parent Company Financial Statements.

This Financial Press Release may contain

forward-looking statements which represent objectives and cannot be

construed as forecasts regarding the Company's results or any other

performance indicator. The actual results may differ significantly

from the forward-looking statements due to various risks and

uncertainties, as described in the Directors’report.

CONTACTS:

Corporate Communication

Stéphane Fort - Tel. +33 (0)1 47 11 86 90 -

stephane.fort@dassault-aviation.com

Mathieu Durand - Tel. +33 (0)1 47 11 85 88 -

mathieu.durand@dassault-aviation.com

Investor Relations

Nicolas Blandin - Tel. +33 (0)1 47 11 40 27 -

nicolas.blandin@dassault-aviation.com

APPENDIX

-

DEFINITION OF ALTERNATIVE PERFORMANCE INDICATORS

To reflect the Group’s actual economic

performance, and for monitoring and comparability reasons, the

Group presents an income statement adjusted with the following

elements:

-

gains and losses resulting from the exercise of hedging

instruments, which do not qualify for hedge accounting under IFRS

standards. This income, presented as financial income in the

consolidated financial statements, is reclassified as net sales and

thus as operating income in the adjusted income statement,

-

the valuation of foreign exchange derivatives which do not qualify

for hedge accounting, by neutralizing the change in fair value of

these instruments (the Group considering that gains or losses on

hedging should only impact income as commercial flows occur), with

the exception of derivatives allocated to hedge balance sheet

positions whose change in fair value is presented as operating

income,

-

amortization of assets valued as part of the purchase price

allocation (business combinations), known as “PPA”,

-

adjustments made by Thales in its financial reporting.

The Group also presents the “available cash”

indicator, which reflects the amount of the Group’s total

liquidities, net of financial debt. It covers the following balance

sheet items:

-

cash and cash equivalents,

-

other current financial assets,

-

financial debt, excluding lease liabilities.

The calculation of this indicator is detailed in

the consolidated financial statements (see Note 9).

Only consolidated financial statements are

audited by statutory auditors.

Adjusted financial data are subject to the

verification procedures applicable to all information provided in

the annual report.

2. IMPACT OF THE ADJUSTMENTS

The impact in 2023 of adjustments to income

statement aggregates is presented below:

|

(in thousands of euros) |

2023 consolidated income statement |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

2023 adjusted income statement |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

4,804,891 |

-4,225 |

0 |

|

|

4,800,666 |

|

Operating income |

349,477 |

-4,225 |

0 |

3,908 |

|

349,160 |

|

Net financial income/expense |

211,645 |

4,225 |

- 5,793 |

|

|

210,077 |

|

Share in net income of equity associates |

266,540 |

|

|

3,228 |

190,694 |

460,462 |

|

Income tax |

-134,264 |

|

1,496 |

-636 |

|

-133,404 |

|

Net income |

693,398 |

0 |

- 4,297 |

6,500 |

190,694 |

886,295 |

|

Group share of net income |

693,398 |

0 |

- 4,297 |

6,500 |

190,694 |

886,295 |

|

Group share of net income per share (in euros) |

8.57 |

|

|

|

|

10.95 |

The impact in 2022 of adjustments to income

statement aggregates is presented below:

|

(in EUR thousands) |

2022 consolidated income statement |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

2022 adjusted income statement |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

6,949,916 |

-14,459 |

-6,618 |

|

|

6,928,839 |

|

Operating income |

591,403 |

-14,459 |

-7,771 |

3,142 |

|

572,315 |

|

Net financial income/expense |

-11,557 |

14,459 |

8,280 |

|

|

11,182 |

|

Share in net income of equity associates |

282,349 |

|

|

3,128 |

108,023 |

393,500 |

|

Income tax |

-145,970 |

|

-131 |

-652 |

|

-146,753 |

|

Net income |

716,225 |

0 |

378 |

5,618 |

108,023 |

830,244 |

|

Group share of net income |

716,225 |

0 |

378 |

5,618 |

108,023 |

830,244 |

|

Group share of net income per share (in euros) |

8.62 |

|

|

|

|

9.99 |

- Dassault Aviation - Financial Release - 2023 Results

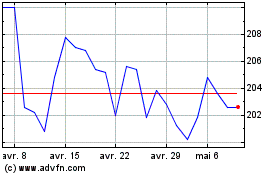

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025