KLÉPIERRE: S&P INCREASES KLÉPIERRE’S OUTLOOK TO POSITIVE AFTER THE ROMAEST ACQUISITION

27 Mai 2024 - 5:45PM

KLÉPIERRE: S&P INCREASES KLÉPIERRE’S OUTLOOK TO POSITIVE AFTER

THE ROMAEST ACQUISITION

PRESS RELEASE

S&P INCREASES KLÉPIERRE’S OUTLOOK TO POSITIVE

AFTER THE ROMAEST ACQUISITION

Paris — May 27, 2024

Klépierre, the European leader in shopping

malls, today announces the closing of the acquisition of RomaEst,

one of the largest malls in Rome. With a 10 million footfall, it is

the 6th most visited center in Italy. Strategically located in a

catchment area of 2.2 million consumers, this 97,000 sq.m. GLA

scheme is one of the leading retail and entertainment destinations

in Italy with 214 national and international banners like Inditex,

Primark, JD Sports, Sephora, New Yorker, Mango, H&M…This is

Klépierre’s second external growth transaction of the year and a

further stage of the Group’s strategy to strengthen the portfolio

while generating additional net cash flow.

Concurrently to this acquisition and assuming

Klépierre’s capacity to make further opportunistic acquisitions

with high cash returns, S&P has increased Klépierre’s outlook

from stable to positive. At the same time, S&P has revised

upwards its assessment of Klépierre’s liquidity profile, from

‘Adequate’ to ‘Strong’.

On May 24, 2024, Fitch confirmed its ‘A-’ rating

with a stable outlook on Klépierre’s senior unsecured debt.

|

AGENDA |

|

|

July 09, 2024 July 10,

2024July 11, 2024July 31,

2024October 23, 2024 |

Ex-dividend date for the final dividend paymentRecord date for the

final dividend paymentFinal dividend paymentFirst-half 2024

earnings (before market opening)Trading update for the first nine

months of 2024 (before market opening) |

| |

|

|

INVESTOR RELATIONS CONTACTS |

MEDIA CONTACTS |

|

|

Paul Logerot, Group Head of IR and Financial

Communications +33 (0)7 50 66 05 63 —

paul.logerot@klepierre.comHugo Martins, IR Manager +33 (0)7 72 11

63 24 — hugo.martins@klepierre.comTanguy

Phelippeau, IR Manager +33 (0)7 72 09 29 57

—tanguy.phelippeau@klepierre.com |

Hélène Salmon, Group Head of Communications +33 (0)6 43 41 97 18 –

helene.salmon@klepierre.com Wandrille Clermontel, Taddeo +33

(0)6 33 05 48 50 – teamklepierre@taddeo.fr |

|

ABOUT KLÉPIERRE

Klépierre is the European leader in shopping

malls, combining property development and asset management skills.

The Company’s portfolio is valued at €19.3 billion at December

31, 2023, and comprises large shopping centers in more than 10

countries in Continental Europe which together host hundreds of

millions of visitors per year. Klépierre holds a controlling stake

in Steen & Strøm (56.1%), Scandinavia’s number one shopping

center owner and manager. Klépierre is a French REIT (SIIC) listed

on Euronext Paris and is included in the CAC Next 20 and EPRA Euro

Zone Indexes. It is also included in ethical indexes, such as

Euronext CAC 40 ESG, Euronext CAC SBT 1.5, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change. For more information, please

visit the newsroom on our website: www.klepierre.com

This press release is available in the

“Publications section” of Klépierre’s Finance page:

www.klepierre.com/en/finance/publications

- PR_KLEPIERRE_RomaEst_Acquisition_Positive_S&P_Rating

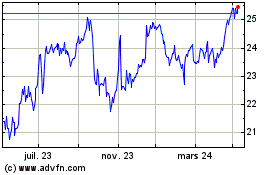

Klepierre (EU:LI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

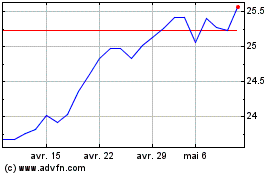

Klepierre (EU:LI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024