Maisons du Monde : Q2 2023 SALES AND HALF-YEAR RESULTS

PRESS

RELEASENantes, 27 July 2023

Q2 2023

SALES AND

HALF-YEAR RESULTS

Sequential sales improvement in

Q2

Continuing challenging

consumption dynamics in Home

& Decoration

3C recovery plan fully on track to

sustain EBIT and cash

generation

FY2023 guidance

unchanged

Group GMV: H1 at €610.9m (-5.1%

yoy), Q2

at €303.8m (-3.5%

yoy)

- Marketplace GMV: H1 at €85.1m

(+73.3% yoy), Q2 at €43.0m (+47.3% yoy)

- France GMV: H1 at €342.4m (-1.7%

yoy), Q2 at €169.0m (-0.9% yoy)

Group sales: H1 at

€543.4m (-10.0%

yoy), Q2

at €269.7m (-7.3%

yoy)3C recovery

plan fully on

track

- Sequential sales improvement thanks to targeted commercial

initiatives while safeguarding gross margin

- 50% annual cost savings plan already reflected in H1

- Capex reduced by €14m yoy and inventories adjusted by €23m (vs.

Dec. 2022)

Acceleration of the store network

optimization in H2 and

launch of the affiliation project

- Up to 5 stores converted to the new affiliate model (FY23)

- Up to 15 net integrated stores closures (vs 10 initially

planned)

François-Melchior de Polignac, CEO,

commented: “Maisons du Monde achieved sequential sales

improvement in Q2, reflecting the resilience of our operations in

an environment that remains challenging. Our 3C plan is on track

and our teams have accelerated efforts to enhance customer

experience both online and offline. We have implemented efficient

and targeted commercial initiatives and remained focused on price

accessibility to support purchasing power.

On the cost and cash fronts, with 50% of our €25

million cost savings plan already reflected in H1 numbers, we are

fully in line with our annual trajectory.

In H2, we will further accelerate our 3C

roadmap, implementing various initiatives to gradually improve

sales. We will also seize opportunities for cost optimization,

including managing our store network through a combination of

tactical closures and transfers to affiliates. These initiatives

will allow us to achieve our full-year guidance, which is

unchanged.”

|

2023 Half Year

Key Figures(in EUR million) |

H1 2023 |

H1 2022 |

%Change |

|

Sales |

543.4 |

603.9 |

-10.0% |

|

Like-for-like (LFL) |

520.8 |

587.9 |

-11.4% |

|

EBIT |

16.3 |

28.4 |

-42.6% |

|

As a % of Sales |

3.0% |

4.7% |

|

Profit /

(loss) |

1.0 |

8.4 |

-88.1% |

|

Base EPS (in EUR) |

0.02 |

0.19 |

|

Diluted EPS (in EUR) |

0.06 |

0.21 |

|

Free Cash

Flow |

2.7 |

(6.6) |

N.A |

|

Net debt |

100.1 |

91.8 |

+9.0% |

|

Leverage1 |

1.09x |

0.66x |

HALF-YEAR

2023 KEY

HIGHLIGHTS

Maisons du Monde continued to navigate a

challenging macroeconomic environment, marked by weak consumer

spending and limited discretionary expenses. In this context, the

Group maintained its efforts to support purchasing power through

innovative commercial initiatives and tactical promotional actions,

while safeguarding its distinctive market position. During the

quarter, the Group implemented its 3C plan, focusing on Customers,

Costs, and Cash, with the aim of enhancing customer experience,

strengthening its operating model and swiftly restoring conditions

for profitable organic growth.

MAIN ACHIEVEMENTS

Brand Platform

Development

Maisons du Monde unveiled its captivating

Fall-Winter 2023 collection, with inspiring universes and diverse

materials and colors. Showcased in Paris in May, this collection

has received very positive feedback from industry experts across

Europe, with an increase of nearly +40% in press coverage compared

to the Spring-Summer collection presented last February, further

anchoring its unique positioning.

3C

plan

execution

During the quarter, Maisons du Monde made major

progress on the delivery of its 3C plan focusing on three key

areas:

-

Customers: Concrete actions have

been taken to focus on customer experience to create conditions for

growth. Strong emphasis was placed on quality of execution and the

most recent initiatives include:

- Evolution of Maisons du Monde’s

after-sales service center into a proactive outbound selling

platform to strengthen customer relationships.

- Implementation of an innovative

digital platform in-store, known as AppShop, to provide a full

omnichannel experience with personalized services and

recommendations.This app won the award for Best In-Store Digital

Service in the 8th edition of the 100% Omnichannel awards organized

by LSA.

-

Costs:

Initiatives to streamline operations have already generated 50% of

the annual savings objective on SG&A before inflation, notably

including optimized structures at Head Office level and efficient

management of working hours at store level.

-

Cash: Maisons du Monde remained

strongly focused on maintaining a disciplined Capex policy, closely

monitoring inventories and actively negotiating payment terms with

suppliers.

FinancingAs anticipated in the

renewed credit facility negotiated in April 2022, Maisons du Monde

successfully extended the maturity of its RCF credit line

(Revolving Credit Facility) from April 2027 to April 2028 and

increased the credit line amount from €150 million to €194

million.

Q2 & H1

2023 SALES

PERFORMANCE

|

Summary of

sales |

Q2 23 |

Q2 22 |

%Change |

H1 2023 |

H1 2022 |

%Change |

|

(in EUR million) |

|

|

Group GMV |

303.8 |

314.5 |

-3.5% |

610.9 |

643.7 |

-5.1% |

|

Sales |

269.7 |

290.9 |

-7.3% |

543.4 |

603.9 |

-10.0% |

|

Like-for-like |

-8.6% |

-10.3% |

|

-11.4% |

-7.1% |

|

|

Sales by product

category |

|

|

|

|

|

|

|

Decoration |

133.6 |

148.9 |

-10.3% |

289.3 |

320.5 |

-9.7% |

|

% of sales |

49.5% |

51.2% |

|

53.2% |

53.1% |

|

|

Furniture |

136.1 |

142.1 |

-4.2% |

254.1 |

283.4 |

-10.3% |

|

% of sales |

50.5% |

48.8% |

|

46.8% |

46.9% |

|

|

Sales by

distribution channel |

|

|

|

|

|

|

Stores |

186,2 |

198.2 |

-6.1% |

382.2 |

407.1 |

-6.1% |

|

% of sales |

69.1% |

68.1% |

|

70.3% |

67.4% |

|

|

Online |

83.5 |

92.7 |

-10.0% |

161.2 |

196.8 |

-18.1% |

|

% of sales |

30.9% |

31.9% |

|

29.7% |

32.6% |

|

|

Sales by

geography |

|

|

|

|

|

|

|

France |

143.7 |

151.0 |

-4.8% |

291.6 |

312.6 |

-6.7% |

|

% of sales |

53.3% |

51.9% |

|

53.7% |

51.8% |

|

|

International |

126.0 |

139.9 |

-10.0% |

251.8 |

291.3 |

-13.6% |

|

% of sales |

46.7% |

48.1% |

|

46.3% |

48.2% |

|

H1 and Q2 2023

sales

overview

H1 2023 Group

GMV was €610.9 million, down -5.1% yoy, with

online GMV representing 36.4% at €222 million.

Q2 2023 Group GMV was €303.8 million, down -3.5%

yoy.

Marketplace GMV reached €85.1

million, up +73.5% compared to H1 2022, of which €7.7 million was

generated in-store and €77.3 million online. Q2 2023 amounted to

€43.0 million, up +47.6%.

H1

2023 sales were

€543.4 million, down -10.0% yoy, of which a significant sales

decline in Q1 2023 (-12.5%) due to the high comparable base. Sales

improved sequentially in Q2 (-7.3%). Q2

2023 sales amounted to €269.7

million and were affected by consumer behavior in a context of

constrained purchasing power.

In-store traffic was low-single digit negative

in Q2 2023 vs last year and nearly stable compared to Q1 2023.

Online traffic turned slightly positive in Q2 2023 vs last year and

sequentially improved compared to Q1 2023. At the same time, the

conversion rate variation vs last year remained negative both

in-store and online in a difficult consumption context.

Q2 2023

sales

details

Sales by

channel

Q2

2023 online sales were €83.5 million, down -10.0%

yoy and represented 30.9% of Group sales, reflecting an activity

decrease on Maisons du Monde’s website while the marketplace

continued to grow. This included a positive base effect from the

ramp-up of the marketplace in Spain, launched in Q2 2022.In Q2

2023, online sales experienced a notable sequential improvement

compared to Q1 2023 (-25.4%).

Q2

2023 store sales amounted to €186.2 million, down

-6.1% yoy.

Continuing its active store network management,

Maisons du Monde operated 350 integrated stores at the end of Q2

2023, stable vs end of March, with 5 openings and 5 closures. The

Group successfully tested store conversion to the affiliation model

with 2 stores transferred to affiliate partners in France during

the quarter.

Sales by

category

In a context in which purchasing power remained

constrained and consumers prioritized non-discretionary expenses,

Q2 2023 decoration

sales amounted to €133.6 million, down -10.3% yoy

representing 49.5% of total sales.

Q2 2023 furniture

sales totaled €136.1 million, down -4.2% yoy, representing

50.5% of total sales.

The category recorded a sequential improvement

compared to Q1 2023 at -16.5%, benefiting from a price reduction on

140 references of the most attractive products, and appealing

promotional initiatives, notably on the Outdoor collection.

Sales by

geography

Q2

2023 sales in France were at

€143.7 million, down -4.8% yoy, outperforming Group average,

benefiting from the development of its marketplace. Store

sales accounted for 71.7%.

Q2

2023 international sales totaled

€126.0 million, down -10.0% yoy. Combined sales in Spain and Italy

(61% of total international sales) were down -5% yoy. Combined

sales in Belgium, Germany, and Switzerland (33% of total

international sales) decreased by -13.4% yoy.

As announced in May 2023, Maisons du Monde

stopped its online activities in the UK at the end of Q2.

H1 2023

sales

details

Sales

by channel

H1 online

sales were €161.2 million, down -18.1% yoy despite a

sequential improvement between Q1 2023 (-25.4%) and Q2 2023

(-10.0%). This decline is mainly linked to a decrease in traffic

compared to the same period last year and a deterioration of the

conversion rate.

H1 store sales amounted to

€382.2 million, down -6.1%.

Continuing its active store network management,

Maisons du Monde operated 350 integrated stores at the end of June

2023 and 2 stores transferred to affiliation, representing 5 store

openings, 11 closures compared to full-year 2022: 214 stores in

France (4 net closings o/w 2 affiliated stores) and 138 in rest of

Europe (2 net closures).

Sales by

category

H1 decoration sales amounted to

€ 289.3 million, down -9.7% yoy, and accounted for 53.2% of

total sales. H1 furniture sales totaled € 254.1

million, down -10.3% yoy.

Sales by geography

H1 sales

in France reached € 291.6 million, down -6.7% yoy

despite a sequential improvement compared to Q1 2023 (-8.5%),

heavily impacted by unrest in France mid-January, and Q2 2023

(-4.8%), showing resilience despite lower traffic and

conversion.

H1 international

sales totaled € 251.8 million, down -13.6% yoy. Combined

sales in Spain and Italy (60.2% of total international sales)

decreased by -7.9%. Combined sales in Belgium, Germany and

Switzerland (34% of total international sales) decreased by -18.6%

yoy.

FINANCIAL

PERFORMANCE

|

Gross margin,

EBITDA, EBIT(in EUR million) |

H1 2023 |

H1 2022 |

%Change |

|

Sales |

543.4 |

603.9 |

-10.0% |

|

Cost of goods sold |

(196.9) |

(217.2) |

-9.3% |

|

Gross margin |

346.5 |

386.7 |

-10.4% |

|

As a % of Sales |

63.8% |

64.0% |

|

|

Store operating and central costs |

(157.1) |

(170.7) |

-8.0% |

|

Advertising costs |

(27.8) |

(32.1) |

-13.4% |

|

Logistics costs |

(76.4) |

(84.5) |

-9.6% |

|

Operating Costs |

(261.3) |

(287.3) |

-9.0% |

|

EBITDA |

85.1 |

99.4 |

-14.3% |

|

As a % of Sales |

15.7% |

16.5% |

|

Depreciation, amortization, and allowance for provisions |

(68.8) |

(70.9) |

-2.9% |

|

EBIT |

16.3 |

28.4 |

-42.7% |

|

As a % of Sales |

3.0% |

4.7% |

|

Gross

margin rate was resilient in H1 2023, at 63.8%,

nearly stable compared to the same period last year.This is the

result of good management of the different components of gross

margin, notably:

- An agile and

selective pricing strategy designed to effectively mitigate the

impact of cost increases over time and a precise monitoring of

additional promotional investments to support traffic and sales, in

a context of strong competition on pricing.

- Productive

negotiations with suppliers to maximize the positive effects of

freight cost evolution and limit the impact of raw material

inflation.

- An efficient

hedging policy limiting the effect of USD variation in H1.

The marketplace also contributed positively,

notably thanks to the ramp-up in Spain since its launch in Q2 2022,

confirming the marketplace’s positive effect on Maisons du Monde’s

economics.

This performance is in line with Maisons du

Monde’s 2023 ambition to deliver gross margin of around 65% in

full-year 2023. The expected improvement of freight costs will

positively support a sequential improvement in gross margin in the

second half of the year.

Store operating and central

costs decreased by nearly €14 million yoy at €157.1

million.Despite continued inflationary pressure on operating costs,

all 3C plan cost initiatives are paying off and 50% of the annual

cost savings of €25 million have already been achieved.

Advertising expenses decreased

by -13.4% yoy to €27.8 million. Disciplined management ensured both

optimal capital allocation, notably prioritizing projects with the

highest return on investment to drive customer traffic, as well as

adjustments in some countries.

Logistics costs are below H1

2022 by -9.6% yoy, at €76.4 million, representing 14.1% of sales,

similar to H1 2022. This decrease is related to a decline in

volumes and the positive effects of efficiency measures implemented

in such areas as transportation.

EBITDA was down €14.3 million

to €85.1 million vs €99.4 million in H1 2022. Overall, the measures

taken as part of the 3C plan resulted in a -9% adjustment in

operating costs over the half-year. This helped contain the impact

of sales decrease on EBITDA margin to 80bps, at 15.7% in H1 2023

compared to 16.5% in H1 2022.

D&A expenses decreased by €2.1 million at

€68.8 million compared to €70.9 million in H1 2022, highlighting

Maisons du Monde’s financial discipline. This reflects an

adjustment of asset lifecycles linked to lower in-store Capex, and

additional costs related to the second warehouse and new IT

developments.

EBIT stood at €16.3 million,

representing a margin of 3.0%, with a ramp-up expected in the

second half of 2023.

Net income amounted to €1.0 million vs €8.4

million in H1 2022. EPS was €0.02, compared to €0.19 in H1

2022.

It included:

-

Other operating income and expenses, at €5.8 million, mainly

related to store closure costs.

-

Net financial result at €8.5 million vs €9.1 million in H1 2022,

due to lower interest on loans, including the revolving credit

facility, as well as gains on currency transactions.

-

Income tax, representing €0.9 million vs €4.2 million in H1 2022.

The effective tax rate was 25.8% as of 30 June 2023, same as last

year.

Free Cash Flow

|

(in EUR million) |

30 June 2023 |

|

30 June 2022 |

|

EBITDA |

|

85.1 |

99.4 |

|

Change in working capital |

4.0 |

(12.3) |

|

Change in other operating items |

(0.4) |

(4.2) |

|

Net cash

generated by/

(used in)

operating activities |

88.7 |

82.8 |

|

Capital expenditures (Capex) |

(18.0) |

(31.8) |

|

Change in debt on fixed assets |

(6.4) |

(0.2) |

|

Proceeds from sale of non-current assets |

0.5 |

0.2 |

|

Decrease in lease debt |

(55.7) |

(52.0) |

|

Decrease in lease debt/Lease interest paid |

(6.5) |

(5.6) |

|

Free cash

flow |

2.7 |

(6.6) |

In H1 2023, total Capex amounted to €18.0

million, down €14.0 million vs 30 June 2022, thanks to disciplined

allocation of capital resources, notably for in-store expenses.

In terms of working capital requirement, the

Group benefited from negotiations with key suppliers on payment

terms and tight monitoring of inventories, decreasing from €245.7

million at end-December 2022 to €222.8 million at end-June

2023.

Free cash

flow turned positive at €2.7 million, compared to

a negative €6.6 million at end-June 2022.

Net financial

debt

|

Net debt &

leverage(in EUR million) |

|

Net debt calculation |

|

30 June 2023 |

|

31 Dec. 2022 |

|

Convertible bonds (“OCEANE”) |

198.1 |

195.6 |

|

Term loan |

(0.4) |

(0.5) |

|

Revolving Credit Facilities (RCFs) |

(0.7) |

(0.7) |

|

Share buyback |

- |

28.1 |

|

Other debt |

1.7 |

1.7 |

|

Gross debt |

198.6 |

224.2 |

|

Finance leases |

600.9 |

613.1 |

|

Cash & cash equivalents |

100.2 |

121.3 |

|

Net debt (IFRS

16) |

699.3 |

716.0 |

|

Less: Lease debt (IFRS 16) |

(600.9) |

(613.1) |

|

Plus: Lease debt (finance lease) |

1.7 |

2.2 |

|

Net debt |

100.1 |

105.1 |

|

LTM (Last twelve months) EBITDA2 |

91.6 |

109.5 |

|

Leverage |

1.09x |

0.96X |

Maisons du Monde benefits from a sound balance

sheet. The Group’s gross debt position as of 30 June 2023 was

€198.6 million compared to €224.2 million at the end of December

2022. Finance leases were down €12.2 million, mainly linked to

store closures. Considering its cash and cash equivalents position

of €100.2 million vs €121.3 million as of 31 December 2022, Maisons

du Monde’s net debt position on 30 June 2023 was €100.1 million

(leverage of 1.09x) compared to €105.1 million on 31 December 2022

(leverage of 0.96x).

H2 2023 3C PLAN PRIORITIES

For the second half of the year, Maisons du

Monde will continue the execution of its 3C plan by accelerating

certain initiatives to strengthen its operating model and gradually

resume conditions for profitable growth:

-

On the

Customer side, the Group will

continue efforts to support purchasing power. These include an

agile pricing policy combining tactical promotions and price

reductions on a selected product range, as already initiated in the

first half of the year. The Group is also finalizing the launch of

itsmarketplace in Germany by the end of the third quarter of 2023.

Maisons du Monde will also benefit from measures to continuously

improve product availability in-store and online to drive traffic

and sales conversion.

- On the

Cost and Cash side, Maisons du Monde will continue to

deploy its cost optimization plan to achieve its annual cost

savings objective of €25 million.

Maisons du Monde will accelerate the dynamic

management of its store network, with an objective of up to 15 net

store closures, up from the 10 net closures announced in May.

Lastly, after a successful transfer of 2 stores to an affiliate

partner at the end of the second quarter, Maisons du Monde will

continue the roll-out with up to 3 additional stores, resulting in

up to 5 affiliated stores.

2023 GUIDANCE

UNCHANGED

In line with the 2023 roadmap built on the 3C

plan, and taking into account the H2 2023 priorities, Maisons du

Monde keeps its objectives for 2023 unchanged:

-

Top line decrease in the low-to-mid-single digit range, with a

sequential improvement in H2 vs H1

-

EBIT in a range of €65 million to €75 million

-

Free Cash Flow in a range of €40 million to €50 million

-

Dividend payout ratio of 30% to 40%

-

ESG commitment: One-third of Maisons du Monde’s 2023 collections

included in the ‘Good is beautiful’ selection

SHARE BUYBACK PROGRAM FULLY

COMPLETED

As of June 30, 2023, Maisons du Monde has

completed its second share buyback program, which was launched on

July 29, 2022. The Group has repurchased 4,098,809 shares at an

average market price of €10.17. These shares are intended to be

canceled by the end of the year.

During the Board of Directors meeting on March

8, 2023, the first cancellation of 2,300,000 shares was carried

out. The capital reduction was executed on March 10, 2023.

The share capital of Maisons du Monde S.A.

amounts to 132,801,434.28 euros, divided into 40,988,097

shares.

Conference call

for investors

and analysts

Date: 27 July 2023 at 09.00 am CET

Speakers:François-Melchior de Polignac, CEO and Régis

Massuyeau, CFO

Connection details:

- Webcast:

https://edge.media-server.com/mmc/p/e58uetez

- Conference call:

https://register.vevent.com/register/BI1f81ee797aa04cc2af0a86b8a2c04003

***

Financial calendar

26 October

2023 Q3

and 9M 2023 sales

Disclaimer:

Forward Looking

Statement

This press release contains certain statements

that constitute "forward-looking statements," including but not

limited to statements that are predictions of or indicate future

events, trends, plans or objectives, based on certain assumptions

or which do not directly relate to historical or current facts.

Such forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted or implied by such

forward- looking statements. Accordingly, no representation is made

that any of these statements or forecasts will come to pass or that

any forecast results will be achieved. Any forward-looking

statements included in this press release speak only as of the date

hereof and will not give rise to updates or revision. For a more

complete list and description of such risks and uncertainties,

refer to Maisons du Monde’s filings with the French Autorité des

marchés financiers.

***

About Maisons

du Monde

Maisons du Monde, a uniquely positioned and

beloved brand across Europe, stands as the European leader in

inspirational and affordable home & living. It offers a wide

and constantly renewed range of furniture and home accessories

across multiple styles. Creativity, inspiration and engagement are

the brand’s core pillars. Leveraging its distinctive

direct-to-consumer omnichannel model, the company generates over

50% of its sales digitally, through its online platform and

in-store digital sales and operates 357 stores across 9 European

countries. At the end of 2020, the Group launched a curated

marketplace to complement its offering and become the reference

one-stop shop in inspirational and affordable home and living. In

November 2021, Maisons du Monde unveiled its company purpose:

“Inspiring everyone to open up to the world, to create together

unique, warm and sustainable places to live.”

corporate.maisonsdumonde.com

Contacts

|

Investor Relations |

Press Relations |

|

Carole Alexandre Tel: (+33) 6 30 85 12 78 |

Pierre Barbe Tel: (+33) 6 23 23 08 51 |

|

calexandre@maisonsdumonde.com |

pbarbe@maisonsdumonde.com |

APPENDIX

|

Consolidated income statement |

|

H1 2023 |

|

H1 2022 |

|

(in EUR million) |

|

|

|

Sales |

|

543.4 |

|

603.9 |

|

Other revenue |

|

67.1 |

|

23.6 |

|

Total revenue |

|

560.4 |

|

627.5 |

|

Cost of sales |

|

(196.9) |

|

(217.2) |

|

Gross Margin |

|

346.5 |

|

386.7 |

|

As a % of Sales |

|

63.8% |

|

64.0% |

|

Personnel expenses |

|

(116.9) |

|

(120.3) |

|

External expenses |

|

(166.7) |

|

(196.2) |

|

Depreciation, amortization and allowance for provisions |

|

(68.8) |

|

(70.9) |

|

Fair value – derivative financial instruments |

|

(1.3) |

|

(3.1) |

|

Other income/(expenses) from operations |

|

3.8 |

|

3.0 |

|

Current operating profit |

|

16.2 |

|

22.8 |

|

Other operating income and expenses |

|

(5.8) |

|

(1.1) |

|

Operating profit / (loss) |

|

10.4 |

|

21.7 |

|

Cost of net debt |

|

(3.0) |

|

(3.0) |

|

Cost of lease debt |

|

(6.6) |

|

(5.7) |

|

Finance income |

|

2.1 |

|

2.0 |

|

Finance expenses |

|

(1.1) |

|

(2.4) |

|

Financial profit / (loss) |

|

(8.5) |

|

(9.1) |

|

Profit / (loss) before income tax |

|

1.9 |

|

12.6 |

|

Income tax |

|

(0.9) |

|

(4.2) |

|

Profit / (loss) from continuing operations |

|

1.0 |

|

8.4 |

|

Profit / (loss) |

|

1.0 |

|

8.4 |

|

Attributable to: |

|

|

|

|

|

|

|

0.9 |

|

8.5 |

- Non-controlling interests

|

|

0.02 |

|

(0.1) |

|

Basic EPS (in €) |

|

0.02 |

|

0.19 |

|

Consolidated Balance Sheet(in EUR million) |

30 June 2022 |

|

31 Dec. 2022 |

|

ASSETS |

|

|

|

|

Goodwill |

327.0 |

327.0 |

|

Other intangible assets |

244.2 |

238.9 |

|

Property, plant and equipment |

170.0 |

174.8 |

|

Right-of-use assets related to lease contracts |

604.6 |

617.3 |

|

Other non-current financial assets |

16.3 |

16.5 |

|

Deferred income tax assets |

9.3 |

9.8 |

|

Derivative financial instruments |

- |

- |

|

NON-CURRENT ASSETS |

1,371 |

1,384.3 |

|

Inventory |

222.8 |

245.7 |

|

Trade receivables and other current receivables |

79.4 |

82.4 |

|

Current income tax assets |

10.8 |

9.9 |

|

Derivative financial instruments |

- |

9.4 |

|

Cash and cash equivalents |

100.2 |

121.3 |

|

CURRENT ASSETS |

413.2 |

468.7 |

|

TOTAL ASSETS |

1,784.2 |

1,853.0 |

|

|

|

EQUITY AND

LIABILITIES |

|

|

TOTAL EQUITY |

|

587.6 |

|

604.1 |

|

Non-current borrowings |

0.5 |

0.3 |

|

Non-current convertible bonds |

- |

- |

|

Medium and long-term lease liability |

480.1 |

494.2 |

|

Deferred income tax liabilities |

42.6 |

46.3 |

|

Post-employment benefits |

8.9 |

9.2 |

|

Provisions |

16.6 |

12.9 |

|

Derivative financial instruments |

1.3 |

6.2 |

|

Other non-current liabilities |

4.2 |

4.2 |

|

NON-CURRENT LIABILITIES |

554.1 |

573.3 |

|

Current borrowings and convertible bonds |

198.2 |

223.9 |

|

Short-term lease liability |

120.8 |

119.0 |

|

Trade payables and other current payables |

306.0 |

322.7 |

|

Provisions |

2.8 |

6.4 |

|

Current income tax liabilities |

3.9 |

3.5 |

|

Derivative financial instruments |

10.7 |

0.1 |

|

CURRENT LIABILITIES |

642.4 |

675.6 |

|

TOTAL LIABILITIES |

1,197 |

1,248.9 |

|

TOTAL EQUITY AND

LIABILITIES |

1,784.2 |

1,853.0 |

|

Consolidated cash flow statement(in EUR million)

|

|

|

|

|

|

|

|

30 June 2023 |

|

30 June 2022 |

|

Profit/(loss) before income tax |

|

1.9 |

|

12.6 |

|

Adjustments for: |

|

|

|

|

- Depreciation, amortization and

allowance for provisions

|

|

71.4 |

|

72.8 |

- Net gain/(loss) on disposals

|

|

2.8 |

|

2.1 |

- Fair value – derivative financial

instruments

|

|

(1.3) |

|

3.1 |

|

|

|

0.8 |

|

0.0 |

- Cost of net financial debt

|

|

3.0 |

|

3.0 |

|

|

|

6.6 |

|

5.7 |

|

Change in operating working capital requirement: |

|

4.0 |

|

(12.3) |

|

Income tax paid |

|

(0.4) |

|

(4.1) |

|

Net cash generated

by/(used in) operating

activities(a) |

|

89.0 |

|

82.8 |

|

Acquisition of non-current assets: |

|

|

|

|

- Property, plant and equipment

|

|

(9.4) |

|

(23.8) |

|

|

|

(8.7) |

|

(8.9) |

|

|

|

0.1 |

|

0.9 |

|

Change in debt on fixed assets |

|

(6.4) |

|

(0.2) |

|

Proceeds from sale of non-current assets |

|

0.4 |

|

0.2 |

|

Net cash generated

by/(used in) investing

activities(b) |

|

(24.0) |

|

(31.8) |

|

Of which investment flow related to

discontinued operations |

|

- |

|

- |

|

Proceeds from issuance of borrowings |

|

0.2 |

|

0.1 |

|

Repayment of borrowings |

|

(22.9) |

|

(29.7) |

|

Decrease of lease debt |

|

(55.7) |

|

(52.0) |

|

Acquisitions (net) of treasury shares |

|

(0.5) |

|

(0.7) |

|

Dividends paid |

|

- |

|

(23.4) |

|

Interest paid |

|

(0.4) |

|

(1.8) |

|

Interest on lease debt |

|

(6.5) |

|

(5.6) |

|

Net cash generated

by/(used in) financing

activities(c) |

|

(85.9) |

|

(113.0) |

|

Of which financing flow related to

discontinued operations |

|

- |

|

- |

|

Exchange gains/(losses) on cash and cash equivalents |

|

0.06 |

|

0.1 |

|

Net increase/(decrease) in cash & cash

equivalents(a)+(b)+(c) |

|

(21.0) |

|

(61.9) |

|

|

|

|

|

|

|

Cash & cash equivalents at period begin |

|

121.0 |

|

163.2 |

|

Cash & cash equivalents at period end |

|

100.1 |

|

101.3 |

In addition to the financial indicators set out

in International Financial Reporting Standards (IFRS), Maisons du

Monde's management uses several non-IFRS metrics to evaluate,

monitor and manage its business. The non- IFRS operational and

statistical information related to Group's operations included in

this press release is unaudited and has been taken from internal

reporting systems. Although none of these metrics are measures of

financial performance under IFRS, the Group believes that they

provide important insight into the operations and strength of its

business. These metrics may not be comparable to similar terms used

by competitors or other companies.

Sales: Represent the revenue

from 1) sales of decorative items and furniture through the Group’s

retail stores, websites and B2B activities, 2) marketplace

commissions, and 3) service revenue and commissions. They mainly

exclude:

- customer

contribution to delivery costs,

- revenue for

logistics services provided to third parties, and

- franchise

revenue.

The Group uses the metric of “Sales” rather than “Total revenue” to

calculate growth at constant perimeter, like-for-like growth, gross

margin, EBITDA margin and EBIT margin.

Like-for-like sales

(LFL) growth: Represents the

percentage change in sales from the Group’s retail stores, websites

and B2B activities, net of product returns between one financial

period (n) and the comparable preceding financial period (n-1),

excluding changes in sales attributable to stores that opened or

were closed during either of the comparable periods. Sales

attributable to stores that closed temporarily for refurbishment

during any of the periods are included. Gross

margin: Is defined as sales minus cost of sales. Gross

margin is also expressed as a percentage of Sales.

EBITDA: Is defined as current operating profit,

excluding:

- depreciation, amortization, and

allowance for provisions and,

- the change in

the fair value of derivative financial instruments. The EBITDA

margin is calculated as EBITDA divided by Sales.

LTM EBITDA: Last twelve months

EBITDA. EBIT: Is defined as EBITDA minus

depreciation, amortization, and allowance for provisions. The EBIT

margin is calculated as EBIT divided by Sales. Net

debt: Is defined as the Group’s finance leases,

convertible bond (“OCEANE”), unsecured term loan, unsecured

revolving credit facilities, the French state guaranteed term loan,

short- and long-term rental, deposits and bank borrowings, net of

cash and cash equivalents. Leverage

ratio: Is defined as net debt less finance leases

divided by LTM EBITDA. Free cash flow: Is

defined as net cash from operating activities less the sum of

capital expenditures (capital outlays for property, plant and

equipment), intangible and other non-current assets, change in debt

on fixed assets, proceeds from disposal of non-current assets and

reduction of and interest on rental debt.

1 Leverage: Net debt divided by LTM (Last twelve

months) EBITDA 2 EBITDA of €85.1 million is restated in accordance

with the senior credit facility agreement dated April 22, 2022

- 2023 07 27 Q2-H1 23 Results_EN_FOR RELEASE

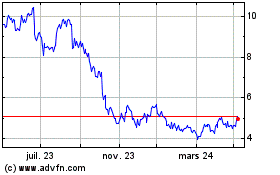

Maisons du Monde (EU:MDM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

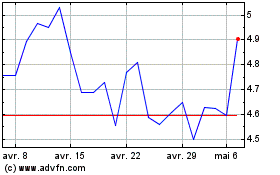

Maisons du Monde (EU:MDM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025