Marie Brizard Wine & Spirits_Description of the share buyback programme authorised by the Ordinary General Meeting of 27 June 2024

02 Juillet 2024 - 6:25PM

Marie Brizard Wine & Spirits_Description of the share buyback

programme authorised by the Ordinary General Meeting of 27 June

2024

Charenton-le-Pont,

2 July 2024

DESCRIPTION OF THE SHARE BUYBACK

PROGRAMME AUTHORISED BY THE ORDINARY GENERAL MEETING OF 27 JUNE

2024

In accordance with the provisions of Articles

241-2 et seq. of the AMF General Regulation, as well as EU

Regulation 596/2014 of 16 April 2014, this description outlines the

objectives and terms of the of the Marie Brizard Wine & Spirits

share buyback programme under the authorisation granted by the

eleventh resolution of the Combined General Meeting held on 27 June

2024.

Breakdown of equity securities held by

the Company by objective

On 27 June 2024, the Company held 100,781

treasury shares, out of 111,989,823 shares making up the Company’s

share capital, i.e. a total of 0.09%, allocated in part to the

implementation of the stock option plan and the allocation of bonus

shares (40,166 shares), and the remaining shares to the liquidity

agreement (60,615 shares).

Objectives of the share buyback

programme

The purpose of the buyback programme is to

enable the following to be performed:

- promote liquidity in transactions

and stability of prices of the Company’s shares under a liquidity

agreement entered into with an investment services provider, acting

in accordance with market practices approved by the French

Financial Markets Authority (AMF),

- retain shares that are bought back

and subsequently put them back on the market or use them as

consideration in potential external growth transactions, within the

limits set by applicable regulations,

- cover stock option plans or bonus

share plans and other forms of share allocation to employees and/or

corporate officers of the Company and its Group companies, in

particular under the profit-sharing scheme and Company Savings

Plan, under the conditions set out by law and market authorities,

and at the times the Board of Directors or the person acting on

behalf of the Board of Directors considers appropriate,

- enable (i) the delivery of Company

shares upon exercise of rights attached to securities giving

access, immediately or in the future, by way of redemption,

conversion, exchange, presentation of a warrant or in any other

way, to the allocation of Company shares and (ii) any hedging

transactions related to the issue of such securities, under the

conditions set by market authorities and at such times as the Board

of Directors or the person acting on behalf of the Board of

Directors may consider appropriate,

- cancel the shares in full or in

part by reducing the share capital.

The share buyback programme also lets the

Company trade in its own shares for any other purpose authorised

under applicable laws and regulations, now or in the future, or

recognised as a market practice by the AMF. In such case, the

Company would inform its shareholders thereof in a press

release.

Maximum proportion of share capital,

maximum number and characteristics of shares that the Company plans

to purchase, and maximum purchase price

Given that on 27 June 2024, the Company directly

or indirectly held a total of 100,781 treasury shares, i.e. 0.09%

of the share capital, the maximum number of shares that may be

bought back amounts to 11,098,201 shares, i.e. 9.91% of the share

capital. This cap may be increased to 10% of the share capital (at

any time) in the event that the Company sells or uses its treasury

shares.

The unit price may not exceed six euros (€6),

subject to adjustments relating to any transactions affecting the

Company’s shareholders’ equity. As such, based on the current share

capital, the theoretical maximum amount that the Company would pay

in the event of a buyback at the maximum unit price of six euros

(€6) would be sixty-seven million one hundred and ninety-three

thousand eight hundred and ninety-two euros (€67,193,892), for the

purchase of a maximum of eleven million one hundred and

ninety-eight thousand nine hundred and eighty-two (11,198,982)

shares.

The shares the Company wishes to buy back are

ordinary shares listed under Compartment C of the Euronext Paris

regulated market under ISIN code FR0000060873.

Duration of buyback

programme

The buyback programme will run for eighteen (18)

months from the date of the General Meeting authorising the

transaction, i.e. until 27 November 2025.

During the buyback programme period, the public

will be promptly informed of any significant change in any of the

information listed above, in accordance with the procedures set out

in Article 221-3 of the AMF General Regulation.

| Investor

and shareholder relations contact MBWS

GroupEmilie Drexlerrelations.actionnaires@mbws.comTel.:

+33 1 43 91 62 21 |

Press

contactImage Sept Claire Doligez -

Laurent Poinsotcdoligez@image7.fr – lpoinsot@image7.fr Tel.: +33 1

53 70 74 70 |

About Marie Brizard Wine & Spirits Marie

Brizard Wine & Spirits is a wine and spirits group based in

Europe and the United States. Marie Brizard Wine & Spirits

stands out for its expertise, a combination of brands with a long

tradition and a resolutely innovative spirit. Since the birth of

the Maison Marie Brizard in 1755, the Marie Brizard Wine &

Spirits Group has developed its brands in a spirit of modernity

while respecting their origins. Marie Brizard Wine & Spirits is

committed to offering its customers bold and trusted brands full of

flavour and experiences. The Group now has a rich portfolio of

leading brands in their market segments, including William Peel,

Sobieski, Marie Brizard and Cognac Gautier. Marie Brizard Wine

& Spirits is listed on Compartment B of Euronext Paris

(FR0000060873 - MBWS) and is part of the EnterNext© PEA-PME 150

index.

- PR MBWS description of the share buyback programme authorised

by the ordinary general meeting of 27 June 2024

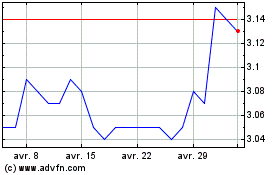

Marie Brizard Wine And S... (EU:MBWS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Marie Brizard Wine And S... (EU:MBWS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025