- M&P’s working interest production in first-half 2021:

25,182 boepd

- Production of 15,189 bopd for M&P’s working interest on the

Ezanga permit in Gabon, relatively unchanged from H2 2020 (15,671

bopd) pending the resumption of development drilling

- Production of 3,561 bopd for M&P’s working interest in

Angola and 38.6 mmcfd in Tanzania

- Valued production of $204 million for the half year, up

sharply as a result of the significant increase in crude prices

- Average sale price of oil up to $63.0/bbl, a rise of 82% versus

H1 2020 ($34.6/bbl) and 38% versus H2 2020 ($45.5/bbl)

- Sales of $188 million after taking into account drilling

activities ($1 million) and the restatement for lifting imbalances

and inventory revaluation, which had a negative impact of $16

million (only two liftings during the period)

- Continuing debt reduction and resumption of development

activities

- Net debt down to $413 million versus $455 million as of 31

December 2020, thanks to debt repayments of $41 million during the

first half and a stable cash position ($167 million at 30 June 2021

versus $168 million on 31 December 2020)

- Development drilling on the Ezanga permit resumed in mid-July,

in parallel with a stimulation campaign on existing wells, in order

to restore the production potential of the fields

Regulatory News:

Maurel & Prom (Paris:MAU):

Key indicators for the first half of

2021

Q1

2021

Q2

2021

H1

2021

H1

2020

H2

2020

Change H1 2021 vs

H1 2020

H2 2020

M&P working interest

production

Gabon (oil)

bopd

15,120

15,256

15,189

18,134

15,671

-16%

-3%

Angola (oil)

bopd

3,333

3,786

3,561

4,108

3,759

-13%

-5%

Tanzania (gas)

mmcfd

40.7

36.5

38.6

28.0

34.9

+38%

+11%

Total

boepd

25,240

25,124

25,182

26,917

25,243

-6%

-0%

Average sale price

Oil

$/bbl

57.3

68.5

63.0

34.6

45.5

+82%

+38%

Gas

$/mmBtu

3.34

3.35

3.35

3.32

3.31

+1%

+1%

Sales

Gabon

$mm

71

80

151

119

122

+27%

+24%

Angola

$mm

12

16

28

20

20

+38%

+39%

Tanzania

$mm

13

12

25

17

26

+49%

-7%

Valued production

$mm

96

108

204

156

169

+31%

+21%

Drilling activities

$mm

0

0

1

6

0

Restatement for lifting imbalances and

inventory revaluation

$mm

-11

-6

-16

-20

19

Consolidated sales

$mm

85

102

188

142

188

+32%

+0%

M&P’s working interest production stood at 25,182 boepd in

H1 2021, relatively unchanged from H2 2020 (25,243 boepd), with

production declines in Gabon and Angola being offset by increased

gas production in Tanzania.

The average sale price of oil was $63.0/bbl for the period, up

82% versus H1 2020 ($34.6/bbl) and 38% versus H2 2020

($45.5/bbl).

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

stood at $204 million for H1 2021, a rise of 31% versus H1 2020 and

21% versus H2 2020. The restatement of lifting imbalances ($38

million produced but not lifted during the period, which saw just

two liftings for the Group), net of inventory revaluation, had a

negative impact of $16 million in the first half of the year. As a

result, the Group’s consolidated sales for first-half 2021 came in

at $188 million.

Production activities

M&P’s working interest oil production (80%) on the Ezanga

permit was 15,189 bopd (gross production: 18,986 bopd) in H1 2021,

stable compared with the production level of H2 2020 (15,671 bopd

for M&P working interest). The lack of drilling since March

2020 adversely affected the fields’ production potential, which

currently stands at around 21,000 bopd (gross).

After production cuts imposed under OPEC quotas came to an end,

M&P resumed development drilling in the middle of July, which

is expected to significantly increase the production potential. A

campaign of stimulation operations also began in mid-July to

optimise the production and injectivity of some existing wells.

M&P’s working interest gas production (48.06%) on the Mnazi

Bay permit stood at 38.6 mmcfd (gross production: 80.30 mmcfd) for

H1 2021, up 38% from H1 2020 and up 11% from H2 2020. The low

seasonal demand usually observed during the rainy season (which

more or less coincides with Q2) did not materialise this year, and

M&P’s working interest production came in at 36.5 mmcfd in Q2

2021, versus 25.4 mmcfd in Q2 2020.

A presentation adjustment explains the relative decline in

sequential sales versus H2 2020, despite higher production. It

should be noted that this adjustment does not affect operating

income.

M&P’s working interest production (20%) in Block 3/05 in H1

2021 was 3,561 bopd (gross production: 17,804 bopd). Output from

the asset rose sharply in Q2 2021 (up 14% from Q1 2021) following

the completion of maintenance work, which had caused operations to

be suspended or significantly reduced at the end of February and

throughout March.

Workover operations are planned for the second half of 2021,

which should in particular see production resume on Block

3/05A.

Financial position

M&P’s cash position at 30 June 2021 was $167 million,

relatively unchanged from 31 December 2020 ($168 million) due to

just two liftings during the period. M&P nevertheless repaid

$41 million in debt in H1 2021, reducing its total debt to $580

million. At end-June 2021 net debt stood at $413 million, versus

$455 million as of 31 December 2020.

As announced in the first quarter 2021 press release, the sum of

$43 million corresponding to the debt owed by Gabon Oil Company

(GOC) to M&P in respect of pre-2018 carrying costs remains

frozen in an escrow account. Discussions are now at an advanced

stage with GOC and the Gabonese authorities to find a positive and

constructive resolution to this situation, and also to other

matters currently ongoing with the Gabonese Republic.

French

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, visit www.maureletprom.fr.

This document may contain forward-looking

statements regarding the financial position, results, business and

industrial strategy of Maurel & Prom. By nature,

forward-looking statements contain risks and uncertainties to the

extent that they are based on events or circumstances that may or

may not happen in the future. These projections are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070/Bloomberg MAU.FP/Reuters

MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210721005853/en/

Maurel & Prom Press, shareholder and investor

relations +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

+33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

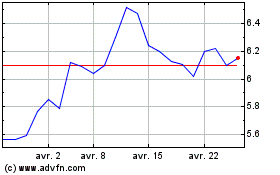

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Déc 2024 à Déc 2024

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024