THIS PRESS RELEASE IS NOT BEING MADE IN AND COPIES OF IT MAY NOT

BE DISTRIBUTED OR SENT, DIRECTLY OR INDIRECTLY, INTO THE UNITED

STATES, CANADA, SOUTH AFRICA, JAPAN OR AUSTRALIA

Regulatory News:

The Global Offering of approximately 25 million euros

aimed at institutional investors via a Private Placement through an

accelerated book-building process, as well as retail investors via

PrimaryBid platform only in France.

Funds raised will enable MedinCell to continue portfolio

development and strengthen R&D activities.

U.S. FDA granted approval on April 28, 2023 for UZEDY™, the

first innovative treatment formulated with MedinCell's BEPO®

technology platform and now commercialized by Teva. Two other

products based on the same technology platform, are already in

phase 3 and several others are in development.

MedinCell, a commercial-stage pharmaceutical technology company

developing a portfolio of long-acting injectable products in

various therapeutic areas (the “Company”), announces today the

launch of a Global Offering (as defined below) of approximately €25

million, through an offering to institutional investors via a

Private Placement and to retail investors via the PrimaryBid

platform.

“The FDA approval for UZEDYTM encourages us to accelerate the

development of our clinical pipeline and raise funds from the

capital markets. It is very important for us to allow individual

shareholders to participate in this operation, with the same

conditions than institutional investors” said Christophe Douat, CEO

of MedinCell before adding: “Teva, which now markets UZEDYTM in the

US, is an ideal partner to make it a reference treatment in

schizophrenia and to harvest its full commercial potential. Beyond

this first product, we have a solid portfolio of investigational

treatments in several therapeutic areas, all of which are based on

the same technology underpinning UZEDYTM. Two major products are

already in Phase 3 with results expected in the next 18 months, and

three others should enter the clinical phase in the next 12

months.”

The net proceeds from the Global Offering (as defined below),

combined with the Company’s existing funds, are intended to

contribute to finance:

- preclinical and clinical activities for Company’s programs, in

particular:

- the clinical Phase 1 of mdc-GRT

- preclinical and clinical activities of several investigational

products such as mdc-TMK and mdc-DPL,

- formulation activities of new products

- investments to expand and improve the laboratory in Jacou,

- research, development and industrialization of new

technologies,

Terms of the Global Offering

The Global Offering will be carried out in two distinct but

concomitant components:

a capital increase without shareholders'

preferential subscription rights [in favor of qualified investors

or a restricted circle of investors under the provisions of Article

L. 411-2 1° of the French Monetary and Financial Code, meeting the

following characteristics set out in the 20th resolution of the

Company's combined ordinary and extraordinary general shareholders'

meeting of 8 September 2022 (the “General Meeting”) (the

"Private Placement"), and

- a capital increase without shareholders'

preferential subscription rights in favor of retail investors via

the PrimaryBid platform only in France, pursuant to Article L.

225-136 of the French Commercial Code and in accordance with the

18th resolution of the General Meeting (the “PrimaryBid

Offering”, and, together with the Private Placement, the

“Global Offering”).

The Private Placement will be available in accordance with the

20th resolution of the General Meeting mentioned above, to (i)

qualified investors within the meaning of Article 2(e) of

Regulation 2017/1129 of the European Parliament and of the Council

of 14 June 2017, as amended (the “Prospectus Regulation”) or

in other circumstances falling within the scope of Article 1(4) of

the Prospectus Regulation in the European Union (including France)

and outside the European Union with the exception of the United

States, Canada, Australia, South Africa and Japan and (ii) certain

institutional investors in the United States. The PrimaryBid

Offering will not be made available to retail investors outside

France.

The gross proceeds of the Global Offering will depend

exclusively on the orders received for each of the above-mentioned

components without the possibility of reallocating the sums

allocated from one to the other. It is specified that the

PrimaryBid Offering is incidental to the Private Placement and will

represent a maximum of 20 % of the total amount of the Global

Offering and will be limited to a maximum of €8 million.

Allocations will be proportional to demand, limited to the amount

allocated to this public offer, with allocations reduced should

demand exceed this limit. In any event, the PrimaryBid Offering

will not be carried out if the Private Placement does not occur.

The Private Placement is not conditional on the PrimaryBid

Offering.

The Global Offering is subject to market and other conditions

and the final aggregate amount of the Global Offering is subject to

change. The Private Placement will be carried out via an

accelerated book-building process, following which the number and

price of the new shares to be issued will be decided by the

Company’s Directoire (as defined below), in accordance with the

delegations of competence granted by the Ordinary and Extraordinary

General Meeting and upon prior authorization of the Conseil de

Surveillance (as defined below) on the date of this press release,

it being specified that the maximum number of new shares that may

be issued in the Global Offering in accordance with such

delegations and authorizations is 4,545,449 new shares,

representing a maximum of 18% of the capital.

The subscription price of the new shares in the Private

Placement shall be at least equal to the volume-weighted average of

the closing prices of the Company's share of the last 3 trading

sessions preceding the beginning of the Private Placement, reduced

by a maximum discount of 10% in accordance with the 20th

resolution. The subscription price of the new shares in the

PrimaryBid Offering will be equal to the price of the new shares

offered in the Private Placement, as determined by the accelerated

book-building initiated with institutional investors.

The accelerated book-building process for the Private Placement

will begin immediately following the publication of this press

release and is expected to close before the markets open on 12 May

2023, subject to any early or extended closing. The PrimaryBid

Offering will begin immediately and close at 22:00h CEST, subject

to any early closing. The Company will announce the pricing and the

definitive number of new shares to be issued in the Global Offering

via a press release as soon as possible after the book-building

ends.

Settlement-Delivery of the new ordinary shares to be issued in

the Global Offering and the PrimaryBid Offering and their admission

for trading on the regulated market of Euronext Paris are expected

on 16 May 2023. The new ordinary shares will be of the same

category and fungible with the existing shares, will be entitled to

all the rights associated with the existing shares, and will be

admitted to trading on the regulated market of Euronext Paris under

the same ISIN FR0004065605.

Lock-up commitments

In connection with the Global Offering, the Company and the

members of the management board ("Directoire") and of the

supervisory boards ("Conseil de Surveillance") have signed a

lock-up commitment that comes into effect on the date of the

signing of the placement agreement concluded between the Company

and the banks today and for a period of 90 days following the

settlement/delivery of the Global Offering, subject to certain

customary exceptions.

Financial Intermediaries

Jefferies, Bryan Garnier Securities SAS and Bryan, Garnier &

Co are acting as Joint Global Coordinators and Joint Bookrunners in

connection with the Private Placement.

Within the framework of the PrimaryBid Offering, investors may

only subscribe via the PrimaryBid partners mentioned on the

PrimaryBid website (www.PrimaryBid.fr). The PrimaryBid Offering is

not covered by placement agreement. For further details, please go

to the PrimaryBid website at www.PrimaryBid.fr.

Risk factors

The attention of the public is drawn to the risk factors

associated with the Company and its activity presented in Section 2

of the universal registration document registered with the French

Financial Market Authority (Autorité des Marchés Financiers) (the

"AMF") under number D.22-0668 on 28 July 2022, which is

available free of charge on the Company’s website

(https://invest.medincell.com). The occurrence of all or part of

these risks could have a negative impact on the Company’s activity,

financial situation, results, development or outlook. The risk

factors presented in that document are the same today.

Additionally, investors are invited to consider the following

risks specific to this Global Offering: (i) the market price of the

Company’s shares may fluctuate and fall below the subscription

price of the shares issued as part of the Global Offering, (ii) the

volatility and liquidity of the Company’s shares may fluctuate

significantly, (iii) sales of the Company’s shares may take place

on the market and have a negative impact on the market price of its

share and (iv) the Company’s shareholders could suffer potentially

significant dilution resulting from any future capital increases

required to provide the Company with additional financing.

No Prospectus

The Global Offering is not subject to a prospectus requiring an

approval from the AMF.

About MedinCell

MedinCell is a commercial-stage pharmaceutical technology

company developing a portfolio of long-acting injectable products

in various therapeutic areas by combining its proprietary BEPO®

technology (licensed to Teva under the name SteadyTeq™) with active

ingredients already known and marketed. Through the controlled and

extended release of the active pharmaceutical ingredient, MedinCell

makes medical treatments more efficient, particularly thanks to

improved compliance (i.e. compliance with medical prescriptions)

and to a significant reduction in the quantity of medication

required as part of a one-off or chronic treatment. The BEPO®

technology makes it possible to control and guarantee the regular

delivery of a drug at the optimal therapeutic dose for several

days, weeks or months starting from the subcutaneous or local

injection of a simple deposit of a few millimeters, fully

bioresorbable. MedinCell collaborates with tier one pharmaceuticals

companies and foundations to improve Global Health through new

therapeutic options. Based in Montpellier, MedinCell currently

employs more than 140 people representing over 25 different

nationalities.

www.medincell.com

This document and the information contained herein do not

constitute either an offer to sell or purchase, or the solicitation

of an offer to sell or purchase, securities of the Company in any

jurisdiction.

No communication and no information in respect of the offering

by the Company of its shares may be distributed to the public in

any jurisdiction where registration or approval is required. No

steps have been taken or will be taken in any jurisdiction where

such steps would be required. The offering or subscription of

shares may be subject to specific legal or regulatory restrictions

in certain jurisdictions.

This announcement does not, and shall not, in any circumstances,

constitute a public offering nor an invitation to the public in

connection with any offer. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions.

Not for release, directly or indirectly, in or into the United

States, Canada, South Africa, Japan or Australia. This document

(and the information contained herein) does not contain or

constitute an offer of securities for sale, or solicitation of an

offer to purchase securities, in the United States, Canada, South

Africa, Japan or Australia or any other jurisdiction where such an

offer or solicitation would be unlawful. The securities referred to

herein have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (the “Securities Act”),

or under the securities laws of any state or other jurisdiction of

the United States, and may not be offered or sold in the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and in compliance with the securities laws of any state or any

other jurisdiction of the United States. No public offering of the

securities will be made in the United States.

This document (and the information contained within) is an

advertisement and not a prospectus within the meaning of the

Prospectus Regulation. With respect to each member state of the

European Economic Area (“Member State”), no action has been

undertaken or will be undertaken that constitutes an offer of the

securities referred to herein to the public in any Member State and

requiring a prospectus in any Member State. The securities referred

to herein may not and will not be offered in any Member State,

except in accordance with the exemptions set forth in the

Prospectus Regulation, including any relevant implementing measures

in each Member State. For the purposes of the above, the expression

an “offer to the public” in any Relevant Member State shall have

the meaning ascribed to it in Article 2(d) of the Prospectus

Regulation.

In France, the offer of the Company shares described above will

be made in the context of (i) a capital increases in favor of

qualified investors or a restricted circle of investors, pursuant

to Article L. 411-2 1° of the French monetary and financial code

(Code monétaire et financier) and applicable regulatory provisions

and (ii) a public offering primarily intended to retail investors

through the PrimaryBid platform. Pursuant to Article 211-3 of the

general regulations of the AMF and Articles 1(4) and (3) of the

Prospectus Regulation, the offer of the Company shares will not

require the publication of a prospectus approved by the AMF.

MIFID II Product Governance/Target Market: solely for the

purposes of the requirements of article 9.8 of the EU Delegated

Directive 2017/593 relating to the product approval process, the

target market assessment in respect of the shares of the Company

has led to the conclusion in relation to the type of clients

criteria only that: (i) the type of clients to whom the shares are

targeted is eligible counterparties and professional clients and

retail clients, each as defined in Directive 2014/65/EU, as amended

(“MiFID II”); and (ii) all channels for distribution of the shares

of the Company to eligible counterparties and professional clients

and retail clients are appropriate. Any person subsequently

offering, selling or recommending the shares of the Company (a

“distributor”) should take into consideration the type of clients

assessment; however, a distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the shares of the Company and determining appropriate

distribution channels.

This communication does not constitute an offer of securities to

the public in the United Kingdom and is being distributed only to

and is directed only at (a) persons outside the United Kingdom, (b)

persons who have professional experience in matters relating to

investments, i.e., investment professionals within the meaning of

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”),

and (c) high net worth entities, unincorporated associations and

other bodies to whom it may otherwise lawfully be communicated in

accordance with Article 49(2)(a) to (d) of the Order (all such

persons together being referred to as relevant persons). The

securities are available only to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such

securities will be available only to and will be engaged in only

with, relevant persons. Any person who is not a relevant person

should not act or rely on this communication or any of its

contents.

Jefferies GmbH is authorised and regulated in Germany by the

Bundesanstalt für Finanzdienstleistungsaufsicht. Each of Bryan,

Garnier & Co, Bryan Garnier Securities SAS and Jefferies GmbH

(together, the "Banks") is acting exclusively for the

Company and for no one else in connection with the Private

Placement and will not regard any other person (whether or not a

recipient of this document) as a client in relation to the Private

Placement or any other matter referred to in this document and will

not be responsible to anyone other than the Company for providing

the protections afforded to its clients or for giving advice in

relation to the Private Placement or any other matter referred to

in this Document. None of the Banks is acting for the Company with

respect to the PrimaryBid Offering.

This document is being issued by and is the sole responsibility

of the Company. No representation or warranty, express or implied,

is or will be made as to, or in relation to, and no responsibility

or liability is or will be accepted by or on behalf of the Banks or

by their respective affiliates or any of their respective

directors, officers, partners, employees, advisers or agents

(collectively, "Representatives") as to, or in relation to, the

accuracy, adequacy, fairness or completeness of this document or

any other written or oral information made available to or publicly

available to any interested party or its advisers or any other

statement made or purported to be made by or on behalf of the Banks

or any of their respective affiliates or any of their respective

Representatives in connection with the Company, the securities

being offered or the Global Offering and any responsibility and

liability whether arising in tort, contract or otherwise therefor

is expressly disclaimed. No representation or warranty, express or

implied, is made by the Banks or any of their respective affiliates

or any of their respective Representatives as to the accuracy,

fairness, verification, completeness or sufficiency of the

information or opinions contained in this Announcement or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any liability therefor

is expressly disclaimed.

This press release contains forward-looking statements,

including statements regarding Company’s expectations for (i) the

timing, progress and outcome of its clinical trials; (ii) the

clinical benefits and competitive positioning of its product

candidates; (iii) its ability to obtain regulatory approvals,

commence commercial production and achieve market penetration and

sales; (iv) its future product portfolio; (v) its future partnering

arrangements; (vi) its future capital needs, capital expenditure

plans and ability to obtain funding; and (vii) prospective

financial matters regarding our business. Although the Company

believes that its expectations are based on reasonable assumptions,

any statements other than statements of historical facts that may

be contained in this press release relating to future events are

forward-looking statements and subject to change without notice,

factors beyond the Company's control and the Company's financial

capabilities.

These statements may include, but are not limited to, any

statement beginning with, followed by or including words or phrases

such as "objective", "believe", "anticipate", “expect”, "foresee",

"aim", "intend", "may", "anticipate", "estimate", "plan",

"project", "will", "may", "probably", “potential”, "should",

"could" and other words and phrases of the same meaning or used in

negative form. Forward-looking statements are subject to inherent

risks and uncertainties beyond the Company's control that may, if

any, cause actual results, performance, or achievements to differ

materially from those anticipated or expressed explicitly or

implicitly by such forward-looking statements. A list and

description of these risks, contingencies and uncertainties can be

found in the documents filed by the Company with the AMF pursuant

to its regulatory obligations, including the Company's universal

registration document, filed with the AMF on July 28, 2022, (the

"Universal Registration Document"), as well as in the

documents and reports to be published subsequently by the Company.

In particular, readers' attention is drawn to section 2 entitled

"Facteurs de Risques" on page 24 of the Universal Registration

Document.

Any forward-looking statements made by or on behalf of the

Company speak only as of the date they are made. Except as required

by law, the Company does not undertake any obligation to publicly

update these forward-looking statements or to update the reasons

why actual results could differ materially from those anticipated

by the forward-looking statements, including in the event that new

information becomes available. The Company's update of one or more

forward-looking statements does not imply that the Company will

make any further updates to such forward-looking statements or

other forward-looking statements. Readers are cautioned not to

place undue reliance on these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230511005760/en/

MedinCell David Heuzé Head of Communications

david.heuze@medincell.com +33 (0)6 83 25 21 86

NewCap Louis-Victor Delouvrier/Alban Dufumier Investor Relations

medincell@newcap.eu +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations medincell@newcap.eu +33

(0)1 44 71 94 94

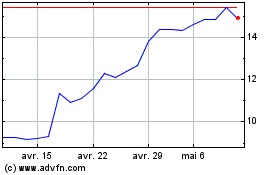

Medincell (EU:MEDCL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Medincell (EU:MEDCL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024