9M 2024 financial information+4% organic growth driven by

ElectrificationSet for a robust year

_PRESS

RELEASE_

- Standard sales of €5,226

million in the first nine months of 2024, up +4.0% organically year

on year and up +6.9% excluding Other activities

- Electrification businesses

up +7.9% organically in the third quarter of 2024, reflecting

early-bird strategic investments in the Generation &

Transmission segment

- Strong adjusted backlog for

Generation & Transmission, mainly subsea-driven, at

€6.2 billion, up +19% compared to September 2023

- Expansion of manufacturing

capacities through investments in onshore high-voltage and the

production of low-carbon medium-voltage cables in

France

- Strategic investment

agreement in France to increase copper production and recycling

capacity across Europe

- Ambitious Net-Zero 2050

climate targets approved by the Science Based Targets

initiative

- Full-year 2024 guidance as

updated in July 2024 confirmed

- Adjusted EBITDA of between €750 and

800 million

- Normalized Free Cash Flow of

between €275 and 375 million

- Capital Markets Day to be

held on November 13, 2024 in London and virtually, and US investors

day on November 20, 2024 in New York City

~ ~ ~

Paris, October 30, 2024 –

Nexans, a global leader in the design and manufacturing of cable

systems to power the world, announces its financial information for

the first nine months of 2024. Commenting on the Group’s

highlights, Christopher Guérin, Nexans’ Chief Executive Officer,

said:

“The first nine months of 2024 have laid strong

foundations for a robust financial year. Our Electrification

businesses continue to drive growth, up +7.9% organically in the

third quarter of 2024, showcasing that early strategic investments

in Generation & Transmission are already yielding benefits.

In order to reinforce the positioning of our

electrification strategy and keep pace with increasing electricity

demand, we have decided to invest €90 million in onshore

high-voltage capacity at our French and Belgian plants and €15

million in the production of low-carbon medium-voltage cables in

France. In addition, Nexans continues to lead the way in the

circular economy with a strategic investment agreement at the Lens

plant, enabling the recycling of over 80,000 metric tons per

year.

As we look ahead, I am confident that our

continued focus on performance and strategic execution will drive

long-term value for all stakeholders. At our upcoming Capital

Markets Day in November, where we will further outline the

initiatives that will shape Nexans’ trajectory in the years to

come.”

CONSOLIDATED SALES BY SEGMENT

|

(in millions of euros) At standard metal prices

Copper reference at €5,000/t |

9M 2023 |

9M 2024 |

|

Organic growth 9M 2024 vs.

9M 2023 |

Organic growth Q3 2024 vs. Q3

2023 |

|

Electrification |

2,768 |

3,344 |

|

+12.1% |

+7.9% |

|

Generation & Transmission |

593 |

899 |

|

+54.3% |

+36.2% |

|

Distribution |

889 |

923 |

|

+1.6% |

-0.1% |

|

Usage |

1,286 |

1,522 |

|

+0.5% |

-0.7% |

|

Non-electrification (Industry &

Solutions) |

1,352 |

1,294 |

|

-3.8% |

-8.4% |

|

Total Group (excl. Other activities) |

4,120 |

4,639 |

|

+6.9% |

+2.5% |

|

Other activities |

800 |

588 |

|

-14.2% |

-19.4% |

|

Group Total |

4,921 |

5,226 |

|

+4.0% |

-0.5% |

9M AND Q3 2024 HIGHLIGHTS

In the first nine months of 2024, standard sales

amounted to €5,226 million, up +4.0% compared to the same period of

2023 and up +6.9% excluding Other activities, which are being

scaled down in line with the Group’s strategy. Third-quarter 2024

standard sales amounted to €1,680 million, down -0.5% organically

and up +2.5% excluding Other activities compared to the third

quarter of 2023.

The Electrification businesses (Generation &

Transmission, Distribution and Usage) witnessed a strong organic

sales increase of +12.1% in the first nine months thanks to (i) the

ramp-up of the Halden plant (Norway) in the Generation &

Transmission segment, (ii) ongoing positive demand driven by

long-term trends in the Distribution segment, and (iii) a

resilient Usage segment.

Non-electrification sales were down -3.8% in the

first nine months of the year on account of a slowdown in the

Automation business and a high base effect in the Auto-harnesses

business. Other activities experienced a significant organic

decrease of -14.2% compared to the first nine months of 2023 in

line with the Group’s strategy.

SUSTAINABILITY

As a key player in electrification, Nexans is

committed to not only driving the future of power, but also to

integrating and promoting sustainability and safety across all its

operations and activities. Aligned with its fundamental principles

and commitments to achieving Net-Zero emissions by 2050, key

initiatives were implemented during third-quarter 2024:

- Nexans' ambitious

Net-Zero 2050 climate objectives were approved by the Science Based

Targets initiative, underscoring the company's leadership in

climate action.

- The Copper Mark, an

esteemed label for responsible copper production, was awarded to

Nexans' foundries in Montreal, Canada, and Lens, France,

highlighting the company's dedication to ethical and sustainable

practices.

- In a strategic move

to bolster energy efficiency, Nexans partnered with Niehoff to

launch an innovative rod breakdown line at the Lens facility in

France, which is projected to cut energy usage by 25%. This

translates into a substantial reduction of approximately 840 tons

of CO2 emissions annually.

- In line with its

target of 100% decarbonized electricity consumption by 2030, Nexans

inaugurated a 1.7 MW solar farm at its Cortaillod plant in

Switzerland, with over 90% of the energy generated being used

onsite.

9M 2024 STANDARD SALES PER

SEGMENT

| GENERATION &

TRANSMISSION (17% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

9M 2023 |

9M 2024 |

Q3 2023 |

Q3 2024 |

|

Sales at current metal prices |

611 |

919 |

215 |

284 |

| Sales

at standard metal prices |

593 |

899 |

209 |

277 |

|

Organic growth (%) |

-2.1% |

+54.3% |

+17.8% |

+36.2% |

Generation & Transmission standard

sales came in at €899 million in the first nine months of

2024, up +54.3% organically compared to the first nine months of

2023, propelled by the ramp up of new capacity at the Halden plant

(Norway). In the third quarter of 2024, sales were up +36.2%

organically compared to the third quarter of 2023, reflecting

notably robust installation campaigns, Great Sea Interconnector

execution and contributions from Inspection, Maintenance and Repair

(IMR) works.

Customer activity remained robust, and in line

with its risk-reward selectivity approach, the segment’s

adjusted backlog reached €6.2 billion at September

30, 2024, up +19% compared to September 30, 2023. In the third

quarter, Nexans secured the final contract for the pioneering

electrical transmission link from the Orkney Islands in Scotland.

Additionally, a definitive agreement was reached between Greece and

Cyprus for the ambitious Great Sea Interconnector at the end of

September. This key development represents a crucial step forward

for the project, and Nexans is now anticipating the final notice to

proceed with the contract.

During the third quarter, the Group unveiled a

strategic €90 million investment at its facilities in France and

Belgium. This investment will increase the production of advanced

525kV onshore cables meeting the requirements of the TenneT frame

agreement. Progress continues apace on Nexans Electra, the

company's third cable-laying vessel. This state-of-the-art vessel

is set to markedly increase the company's installation capacity,

effectively addressing the business's expanding backlog.

| DISTRIBUTION

(18% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

9M 2023 |

9M 2024 |

Q3 2023 |

Q3 2024 |

|

Sales at current metal prices |

1,026 |

1,077 |

331 |

344 |

| Sales

at standard metal prices |

889 |

923 |

290 |

288 |

|

Organic growth (%) |

+2.9% |

+1.6% |

+0.0% |

-0.1% |

Distribution sales amounted to

€923 million at standard metal prices in the first nine months of

2024, up +1.6% organically, compared to the first nine months of

2023.

Europe has seen an uptick, thanks to the

establishment of new frame agreements and a surge in renewable

energy projects. This progress has been achieved notwithstanding

the temporary dip in activity due to the consolidation of

manufacturing operations in Finland during the third quarter. In

France, the Group invested €15 million in late August to increase

its capabilities in producing low-carbon medium-voltage cables in

order to support growth in electrification requirements in France

and in Western Europe. Additionally, the Group pioneered a

cutting-edge solar power solution in France, designed to support

the photovoltaic sector with a sustainable, low-carbon

alternative.

The Asia Pacific region has witnessed a rebound

primarily fueled by substantial investments in renewable energy and

grid enhancement projects, especially in Australia and New

Zealand.

In the Americas, the underlying market

conditions have continued to exhibit strength. Despite this, the

growth trajectory has moderated slightly, influenced by destocking

and the timing of substantial orders.

| USAGE (29%

OF TOTAL STANDARD SALES)

|

(in millions of euros) |

9M 2023 |

9M 2024 |

Q3 2023 |

Q3 2024 |

|

Sales at current metal prices |

1,704 |

2,006 |

527 |

730 |

| Sales

at standard metal prices |

1,286 |

1,522 |

397 |

533 |

|

Organic growth (%) |

-6.1% |

+0.5% |

-12.6% |

-0.7% |

Usage sales amounted to €1,522

million at standard metal prices in the first nine months of 2024,

up +0.5% organically compared with the first nine months of

2023.

In North America (Canada), solid demand in

industrial markets during Q3 2024 supported the Group's growth.

While Europe faced headwinds with lower volumes and destocking in

certain markets, South America saw strong demand in Brazil and

Chile, while destocking in Columbia. In Africa, a robust recovery

in Morocco offset the subdued demand in Turkey.

In a strategic move to fortify its commitment to

30% recycled copper in its products by 2030, Nexans launched

CableLoop, an exclusive cable recycling and recovery service in

France and across Europe. CableLoop is a pioneering, end-to-end

solution that facilitates the collection of installation cable

off-cuts in distributors’ networks at the Group's recycling

centers. Here, these materials are transformed into high-quality

recycled raw materials, exemplifying the Group's dedication to

circular economy principles.

The sales figures reflect the strategic

acquisitions of La Triveneta Cavi as of June 1, 2024, and Reka

Cables since April 2023. These acquisitions are integral to Nexans'

Electrification strategy, expanding the Group’s capabilities in key

regions.

| NON-ELECTRIFICATION

(Industry & Solutions) (25% OF TOTAL STANDARD

SALES)

|

(in millions of euros) |

9M 2023 |

9M 2024 |

Q3 2023 |

Q3 2024 |

|

Sales at current metal prices |

1,459 |

1,406 |

479 |

443 |

| Sales

at standard metal prices |

1,352 |

1,294 |

443 |

404 |

|

Organic growth (%) |

+17.7% |

-3.8% |

+13.1% |

-8.4% |

In the Industry & Solutions segment,

standard sales for 9M 2024 amounted to €1,294

million, reflecting an organic year-on-year decline of -3.8%. This

was primarily attributed to a slowdown in Automation, which was

partially offset by robust growth in the Shipbuilding, Nuclear and

Rolling Stock markets. Auto-harnesses market remained resilient

despite a high base effect from last year.

| OTHER

ACTIVITIES (11% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

9M 2023 |

9M 2024 |

Q3 2023 |

Q3 2024 |

|

Sales at current metal prices |

1,104 |

889 |

344 |

273 |

| Sales

at standard metal prices |

800 |

588 |

260 |

177 |

|

Organic growth (%) |

-15.5% |

-14.2% |

-6.0% |

-19.4% |

The Other Activities segment –

corresponding for the most part to copper wire sales and corporate

costs that cannot be allocated to other segments – reported

standard sales of €588 million in 9M 2024.

Standard sales were down -14.2% organically year-on-year, mainly

linked to the Group’s strategy to reduce copper wire external sales

through tolling agreements in order to mitigate their dilutive

effect.

2024 OUTLOOK

As the world continues to embrace

electrification, Nexans is well-positioned to harness buoyant

market demand, supported by global megatrends and the Company's

commitment to delivering value-added solutions. Nexans' Generation

& Transmission segment boasts a strong risk-reward adjusted

backlog, ensuring solid visibility. The Group is poised to reap

benefits from the expanded capacity of the Halden plant in Norway,

positioning Nexans to meet the growing global demand for

high-voltage solutions. Looking ahead, the Generation &

Transmission business is on a trajectory of gradual improvement.

This progress is contingent upon the successful execution of

projects and the completion of legacy contracts. The Distribution

market is entering a significant hyper cycle of investment,

presenting Nexans with opportunities for growth and enhanced

profitability. Despite weak demand in certain geographies within

the construction sector, Nexans’ Usage segment remains resilient,

with strategic initiatives in place to mitigate the impact of these

macroeconomic conditions.

The Group expects to achieve the following

targets which were upgraded in July, excluding the impact of any

non-closed acquisitions and divestments:

- Adjusted EBITDA of between €750 and

€800 million (€670 - €730 million previously);

- Normalized Free

Cash Flow of between €275 and €375 million (€200 - €300 million

previously).

Nexans reaffirms its commitment to the 2021

Capital Markets Day targets and will continue to execute its

strategic roadmap and priorities.

SIGNIFICANT EVENTS SINCE THE END OF

SEPTEMBER

October 22, 2024 – Nexans

signed a strategic investment agreement in France to increase its

copper production and recycling capacity across Europe. With an

investment of over €90 million, wire rod production capacity will

increase by over 50% at the Lens plant, boosting its copper scrap

recycling capacity to manage up to 80,000 metric tons per year.

The third-quarter 2024 press release and

presentation slides are available in the Investor Relations Results

section at Nexans - Financial results.

A conference call is scheduled today at 9:45

a.m. CET. Please find below the access details:

Webcast

https://channel.royalcast.com/landingpage/nexans/20241030_1/

Audio dial-in

- International

switchboard: +44 (0) 33 0551 0200

- France: +33 (0)

1 70 37 71 66

- United Kingdom:

+44 (0) 33 0551 0200

- United States:

+1 786 697 3501

Confirmation code: Nexans

~ ~ ~

Financial calendar

November 13, 2024:

Capital Markets

Day, London and virtuallyNovember 20, 2024:

US investors day,

New York CityFebruary 19, 2025:

Full-year 2024

earnings

About Nexans

For over a century, Nexans has played a crucial

role in the electrification of the planet and is committed to

electrifying the future. With approximately 28,500 people in 41

countries, the Group is paving the way to a new world of safe,

sustainable and decarbonized electricity that is accessible to

everyone. In 2023, Nexans generated €6.5 billion in standard sales.

The Group is a leader in the design and manufacturing of cable

systems and services across four main business areas: Generation

& Transmission, Distribution, Usage and Industry &

Solutions. Nexans was the first company in its industry to create a

Foundation supporting sustainable initiatives, bringing access to

energy to disadvantaged communities worldwide. The Group is

recognized on the CDP Climate Change A List as a global leader on

climate action and has committed to Net-Zero emissions by 2050

aligned with the Science Based Targets initiative (SBTi).

Nexans. Electrify the Future.

Nexans is listed on Euronext Paris, compartment

A.For more information, please visit

www.nexans.com

Contacts

|

Investor relations |

Communication |

|

Elodie Robbe-MouillotTel.: +33 (0)1 78 15 03

87elodie.robbe-mouillot@nexans.com |

Mael Evin (Havas Paris)Tel.: +33 (0)6 44 12 14

91mael.evin@havas.com |

NB: Any discrepancies are due to rounding

This press release contains forward-looking

statements which are subject to various expected or unexpected

risks and uncertainties that could have a material impact on the

Company’s future performance.

Readers are invited to visit the Group’s website

where they can view and download the Universal Registration

Document, which include a description of the Group’s risk

factors.

- Nexans_Third quarter 2024 Press release_Final

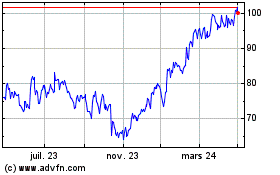

Nexans (EU:NEX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

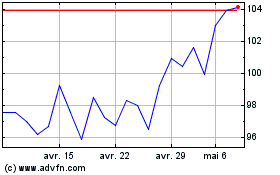

Nexans (EU:NEX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025