SMCP - 2022 FY Results

2022

Full

Year

ResultsPress release - Paris,

March 2nd, 2023.

Financial

targets

achieved:Strong sales

performance driven by positive momentum in Europe and

Americaand doubling of Net

Income

- Record Sales

at €332m in Q4, up +4% on an organic1 basis vs. 2021, despite a

high comparison basis.

- 2022 Sales at

€1,206m, up +13% on an organic basis vs. 2021, driven by a

like-for-like growth of +14%.

- Sales momentum

driven by Europe and America as well as APAC region excluding

Mainland China, which has been significantly impacted by the

sanitary situation. Excluding Mainland China, the Group recorded an

organic growth of +23% vs 2021.

- Success of the

full-price strategy with an average discount rate down by 4 points

in one year and 9 points in two years.

- Store network

stable over the year, but positive momentum with 13 net openings in

Q4.

- Strong growth

of Adjusted EBIT to €111m (9.2% of sales) from €96m in 20212.

- Net profit

doubles and reaches €51m.

- Robust

financial structure and continued deleveraging to 1.9x adjusted

EBITDA3.

- 2023

objectives:

- Mid- to high-single digit sales growth vs.

2022 at constant exchange rates,- Adjusted EBIT margin up vs.

2022

Commenting on those results, Isabelle

Guichot, CEO of SMCP, stated: “The Group registers another

very good performance this year, with sales growth in all regions

except for Continental China due to Covid-related constraints. The

work we have been doing for several years on the desirability of

our brands has enabled us to adjust our sales prices in line with

inflation, while continuing to deploy our full-price strategy. We

have thus been able to maintain a solid level of profitability,

allowing us to double our net profit compared to the previous year.

We also made major progress in our CSR strategy, accelerating our

transparency and circular economy initiatives, improving our CDP

rating, and announcing the launch of our SMCP Retail Lab training

school. Finally, we opened new shops in key areas, notably in

China, in anticipation of the business recovery. I thank all the

teams for their dedication and together we look forward to 2023

with confidence, perfectly positioned to seize future growth

opportunities.”

| €m

except % |

Q4

2021 |

Q4

2022 |

Organic change |

Reported change |

|

FY 2021 |

FY 2022 |

Organic change |

Reported change |

|

Sales by region |

|

|

|

|

|

| France |

111 |

120 |

+9.1% |

+8.1% |

|

341 |

414 |

+23.3% |

+21.3% |

| EMEA4 |

90 |

105 |

+16.2% |

+16.8% |

|

285 |

377 |

+31.1% |

+32.2% |

| Americas |

46 |

52 |

+2.6% |

+14.3% |

|

143 |

184 |

+16.0% |

+29.3% |

|

APAC5 |

67 |

55 |

-19.6% |

-18.1% |

|

270 |

231 |

-20.0% |

-14.4% |

|

Sales by Brand |

|

|

|

|

|

| Sandro |

154 |

165 |

+4.9% |

+7.1% |

|

498 |

582 |

+13.3% |

+16.9% |

| Maje |

118 |

124 |

+3.1% |

+4.8% |

|

407 |

467 |

+11.4% |

+14.8% |

| Other

brands6 |

42 |

43 |

+5.0% |

+4.5% |

|

134 |

156 |

+17.9% |

+17.0% |

|

TOTAL |

314 |

332 |

+4.2% |

+5.9% |

|

1 039 |

1 206 |

+13.1% |

+16.1% |

SALES BREAKDOWN

BY REGION

In France, sales are up by +23%

organic compared to 2021 and exceed 2019 level. This growth was

driven exclusively by like-for-like, and mainly in physical stores

(in Paris, thanks to local customers and tourists, but also in the

rest of France). This performance is all the more impressive given

that it includes a -5.5 points drop in the discount rate over the

year. Digital sales are in line with 2021, with more qualitative

sales thanks to a reduction in the number of promotional

operations.The physical shop network optimization plan is coming to

an end and the number of stores openings in France picked up in the

fourth quarter with five net openings.

The EMEA region recorded the

strongest growth of the Group with an organic increase of 31%

compared to 2021, driven by the largest markets such as the UK,

Spain, Germany, Italy, and the Middle East. This performance was

driven by brick & mortar as well as digital sales, which grew

by +12% compared to 2021. The region is +9% ahead of 2019.The

reduction of the discount rate is -3pts in 2022 and -12pts over two

years. After some net POS closures in the first nine months of the

year, the network regained growth momentum with eight net openings

in the fourth quarter.

In APAC, the Group recorded a

-20% decline in organic sales vs 2021, mainly due to the sanitary

situation in Mainland China. After a first part of the year heavily

impacted by the COVID restrictions (stores and warehouse closures

for long periods, and a drop in traffic), the fourth quarter was

strongly penalized by a spike in positive cases, following the

lifting of the anti-COVID restrictions, and resulting in store

closures (30% of the network closed or on reduced hours in

December). Outside Mainland China, the region performed well,

particularly in Australia with a fully reopened network, in Korea

driven by strong local demand, and in Singapore and Malaysia which

benefited from a return of tourists. The region continued to expand

with four net openings over the year, to seize opportunities linked

to the market recovery.

In Americas, sales increased by

+16% organically compared to 2021, driven entirely by like-for-like

growth (+17%). Growth was homogeneous in all markets: United

States, Canada and Mexico. Digital sales continued their excellent

momentum (+21%). The pre-pandemic level was largely exceeded (+15%

compared to 2019 in organic terms). The average discount rate fell

by -5pts in 2022 and -17pts in two years. The region continued to

expand with three net openings in the year.

Unless stated

otherwise, all figures used to analyze the performance are

disclosed by taking into account the impact of the application of

IFRS 16.

|

KEY FIGURES (€m) |

2021

retreated |

2022 |

Change as reported |

|

Sales |

1 038.6 |

1 205.8 |

+16.1% |

| Adjusted

EBITDA |

245.7 |

266.6 |

+8.5% |

| Adjusted

EBIT |

95.7 |

110.5 |

+15.4% |

| Net Income

Group Share |

23.9 |

51.3 |

+114.4% |

| EPS7 (€) |

0.32 |

0.68 |

+113.1% |

| Diluted EPS8

(€) |

0.32 |

0.65 |

+102.0% |

| FCF |

69.8 |

34.3 |

-50.9% |

2022 CONSOLIDATED

RESULTS

Adjusted EBITDA increased by

€21m from €246m in 2021 to €267m in 2022 (adjusted EBITDA margin of

22% of sales), thanks to Sales growth, combined with a 0.8 point

increase in management gross margin (74.4%) and continued rigorous

cost management throughout the year.

Improvement in gross margin was driven by a

significant progress on our full price strategy, deliberately

reducing the proportion of promotional sales (with a reduction in

the discount rate of 4 points in 2022 and 9 points over two

years).

Total Opex (store costs9 and

general and administrative expenses SG&A) as a percentage of

sales increased by 0.8 point. The sanitary situation in China and

inflation weigh on store costs, partly offset by better SG&A

absorption. In addition, in the 2022 accounts, marketing traffic

costs (0.8 point) were reclassified from SG&A to store

costs.Depreciation, amortization,

and provisions at -€156m in 2022, compared with

-€150m in 2021. Excluding IFRS 16, depreciation and amortization

slightly decreased in absolute value, and represent 4.1% of sales

in 2022 (compared to 4.8% in 2021).

As a result, adjusted EBIT

increased by €15m, from €96m in 2021 to €111m in 2022. The adjusted

EBIT margin is 9.2% in 2022 (in line with 2021), a very

satisfactory performance in the second half of the year, reaching

10.2%.

Other non-current expenses went

down to -€12m in 2022 (compared to -€26m in 2021) and consisted

mainly of store impairments, with no cash impact.

Despite the context, the Group has

managed to reduce its financial expenses from -€27m in

2021 to -€24m in 2022 (including respectively -€12m and -11m€ of

interests on lease liabilities) thanks to the reduction in the

average debt outstanding.

Income tax at -€17m in 2022

compared to -€12m in 2021, reflecting the growth of pre-tax

income.

Net income - Group share

doubles in 2022 to reach €51m.

2022 FREE CASH FLOW AND

NET FINANCIAL DEBT

The Group generated €34m of free cash

flow in 2022, with a good performance in the second half

of the year (€29m).

Working capital

requirements increased from €134m in 2021 to €178m

in 2022, due to an increase in inventories to accompany the growth

of sales expected in 2023, combined to a restocking in China due to

health constraints and to the impact of inflation. Working capital

weight on total sales is 15% in 2022, compared with 13% in 2021 and

18% in 2020.

At the same time, the Group maintained a strict

control on its investments throughout the year, reaching €45m1 in

2022, nearly stable compared to 2021 (€43m) and better absorbed in

terms of weight on sales by half a point.

Net financial debt decreased by

€25m, from €318m at 31 December 2021 to €293m at 31 December 2022.

This decrease, combined with the improvement in adjusted EBITDA,

results in a decrease in the net financial debt/EBITDA10 ratio from

2.5x at 31 December 2021 to 1.9x at 31 December 2022.

FINANCIAL OUTLOOK

For the year 2023, SMCP expects a mid- to

high-single digit sales growth compared to 2022. In terms of

profitability, the Group aims to improve its adjusted EBIT margin

(as a % of sales).

The Group's mid-term financial ambitions

are:

- Mid- to high-single digit sales growth until

2026 and mid-single digit growth after 2026;

- Continue to selectively grow the physical

network, measured not only in terms of number of POS but also in

terms of total selling surface;

- Gross margin ratio at 75% by continuing the

full-price strategy and optimizing inventories;

- Better absorption of store costs and

SG&A.

This will allow SMCP group to target an adjusted

EBIT margin of 12% by 2026, then growing by around 0.5 point per

year for the following years.

OTHER

INFORMATION

Closing of the annual

accounts

The Board of Directors met on March 1st to

approve the consolidated accounts for the year 2022. The review

procedures have been carried out by the statutory auditors and the

related report is being issued.

Evolution of the

shareholders’

situation

The Board of Directors of SMCP has taken note of

GLAS’ communication dated March 1st, 2023, according to which GLAS,

acting as Trustee in respect of the bonds exchangeable for SMCP

shares issued by European TopSoho S.à r.l. in 2018, has indicated

that it is initiating a process to sell the 37% of the Company’s

capital pledged in the context of the above-mentioned bond issue.

The Company welcomes this first step, which could allow SMCP to

regain a stable shareholding structure on which it could rely to

pursue its development strategy. GLAS further indicated that the

process should last several months and that it is not yet possible

to assess whether it will trigger a mandatory takeover bid.

The Board of Directors has entrusted the ad hoc

Committee established in January 2022, composed of Ms. Orla Noonan,

Mr. Xavier Véret and Mr. Christophe Cuvillier, all of whom are

independent directors within the meaning of the Afep-MEDEF Code,

with the task of monitoring developments in this process, while

ensuring that the interests of the Company, its employees and all

of its shareholders are strictly respected.

The Company has appointed Rothschild & Co as

financial advisor to assist in this process.

Board composition

Jean Loez was elected by the social and economic

committee as a board member representing the employees to replace

Marina Dithurbide.

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 9:00 a.m. (Paris time).

Related slides will also be available on the website

(www.smcp.com), in the Finance section.

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

The Group uses certain key financial and

non-financial measures to analyze the performance of its business.

The principal performance indicators used include the number of its

points of sale, like-for-like sales growth, Adjusted EBITDA and

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin.

Number of points of sale

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly-operated stores, including

free-standing stores, concessions in department stores,

affiliate-operated stores, factory outlets and online stores, and

(ii) partnered retail points of sale.

Organic sales growth

Organic sales growth refers to the performance

of the Group at constant currency and scope, i.e. excluding the

acquisition of Fursac.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year, expressed as a percentage change between the two

periods. Like-for-like points of sale for a given period include

all of the Group’s points of sale that were open at the beginning

of the previous period and exclude points of sale closed during the

period, including points of sale closed for renovation for more

than one month, as well as points of sale that changed their

activity (for example, Sandro points of sale changing from Sandro

Femme to Sandro Homme or to a mixed Sandro Femme and Sandro Homme

store). Like-for-like sales growth percentage is presented at

constant exchange rates (sales for year N and year N-1 in foreign

currencies are converted at the average N-1 rate, as presented in

the annexes to the Group's consolidated financial statements as of

December 31 for the year N in question).

Adjusted EBITDA and adjusted EBITDA

margin

Adjusted EBITDA is defined by the Group as

operating income before depreciation, amortization, provisions and

charges related to share-based long-term incentive plans (LTIP).

Consequently, Adjusted EBITDA corresponds to EBITDA before charges

related to LTIP.Adjusted EBITDA is not a standardized accounting

measure that meets a single generally accepted definition. It must

not be considered as a substitute for operating income, net income,

cash flow from operating activities, or as a measure of liquidity.

Adjusted EBITDA margin corresponds to adjusted EBITDA divided by

net sales.

Adjusted EBIT and adjusted EBIT

margin

Adjusted EBIT is defined by the Group as earning

before interests and taxes and charges related to share-based

long-term incentive plans (LTIP). Consequently, Adjusted EBIT

corresponds to EBIT before charges related to LTIP. Adjusted EBIT

margin corresponds to Adjusted EBIT divided by net sales.

Management Gross margin

Management gross margin corresponds to the sales

after deducting rebates and cost of sales only. The accounting

gross margin (as appearing in the accounts) corresponds to the

sales after deducting the rebates, the cost of sales and the

commissions paid to the department stores and affiliates.

Retail Margin

Retail margin corresponds to the management

gross margin after taking into account the points of sale’s direct

expenses such as rent, personnel costs, commissions paid to the

department stores and other operating costs.

The table below summarizes the reconciliation of

the management gross margin and the retail margin with the

accounting gross margin as included in the Group’s financial

statements for the following periods:

|

(€m) – excluding IFRS 16 |

2021 |

2022 |

|

Gross margin (as appearing in the account) |

658.4 |

769.2 |

| Readjustment

of the commissions and other adjustments |

106.3 |

128.3 |

|

Management Gross margin |

764.7 |

897.5 |

| Direct costs

of point of sales |

-419.7 |

-514.5 |

| Retail

margin |

345.1 |

383.0 |

Net financial debt

Net financial debt represents the net financial

debt portion bearing interest. It corresponds to current and

non-current financial debt, net of cash and cash equivalents and

net of current bank overdrafts.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros and rounded to the first digit after

the decimal point. In general, figures presented in this press

release are rounded to the nearest full unit. As a result, the sum

of rounded amounts may show non-material differences with the total

as reported. Note that ratios and differences are calculated based

on underlying amounts and not based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties, including the impact of

the current COVID-19 outbreak. These risks and uncertainties

include those discussed or identified under Chapter 3 “Risk factors

and internal control” of the Company’s Universal Registration

Document filed with the French Financial Markets Authority

(Autorité des Marchés Financiers - AMF) on 19 April 2022 and

available on SMCP's website (www.smcp.com).This document has not

been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

FINANCIAL

CALENDAR

- April 27, 2023

– 2023 Q1 Sales publication

APPENDICES

Breakdown of DOS

|

Number of DOS |

2021 |

Q1-22 |

Q2-22 |

Q3-22 |

2022 |

|

Q4-22

variation |

Full year variation |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

472 |

459 |

462 |

455 |

460 |

|

+5 |

-12 |

| EMEA |

402 |

395 |

394 |

392 |

395 |

|

+3 |

-7 |

| Americas |

166 |

165 |

167 |

167 |

166 |

|

-1 |

- |

| APAC |

252 |

251 |

251 |

258 |

259 |

|

+1 |

+7 |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

552 |

541 |

546 |

547 |

551 |

|

+4 |

-1 |

| Maje |

455 |

451 |

453 |

453 |

457 |

|

+4 |

+2 |

| Claudie

Pierlot |

211 |

209 |

206 |

203 |

201 |

|

-2 |

-10 |

| Suite 341 |

10 |

3 |

2 |

2 |

2 |

|

- |

-8 |

| Fursac |

64 |

66 |

67 |

67 |

69 |

|

+2 |

+5 |

|

Total DOS |

1,292 |

1,270 |

1,274 |

1,272 |

1,280 |

|

+8 |

-12 |

Breakdown of POS

|

Number of POS |

2021 |

Q1-22 |

Q2-22 |

Q3-22 |

2022 |

|

Q4-22

variation |

Full year variation |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

473 |

460 |

463 |

456 |

461 |

|

+5 |

-12 |

| EMEA |

548 |

545 |

542 |

544 |

552 |

|

+8 |

-1 |

| Americas |

195 |

195 |

195 |

198 |

198 |

|

- |

+3 |

| APAC |

468 |

467 |

470 |

472 |

472 |

|

- |

+4 |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

745 |

736 |

742 |

745 |

752 |

|

+7 |

+7 |

| Maje |

620 |

618 |

620 |

620 |

627 |

|

+7 |

+7 |

| Claudie

Pierlot |

245 |

244 |

239 |

236 |

233 |

|

-3 |

-12 |

| Suite 341 |

10 |

3 |

2 |

2 |

2 |

|

- |

-8 |

| Fursac |

64 |

66 |

67 |

67 |

69 |

|

+2 |

+5 |

|

Total POS |

1,684 |

1,667 |

1,670 |

1,670 |

1,683 |

|

+13 |

-1 |

|

o/w Partners POS |

392 |

397 |

396 |

398 |

403 |

|

+5 |

+11 |

CONSOLIDATED FINANCIAL STATEMENTS

|

INCOME STATEMENT (€m) |

2021

retreated |

2022 |

|

Sales |

1 038.6 |

1 205.8 |

| Adjusted

EBITDA |

245.7 |

266.6 |

| D&A |

-149.9 |

-156.1 |

|

Adjusted EBIT |

95.7 |

110.5 |

| Allocation of

LTIP |

-6.7 |

-5.6 |

|

EBIT |

89.0 |

104.9 |

| Other

non-recurring income and expenses |

-26.2 |

-12.4 |

|

Operating profit |

62.8 |

92.5 |

| Financial

result |

-26.7 |

-23.8 |

| Profit

before tax |

36.1 |

68.7 |

| Income tax |

-12.2 |

-17.4 |

| Net

income Group share |

23.9 |

51.3 |

|

CASH FLOW STATEMENT (€m) |

2021

retreated |

2022 |

| Adjusted

EBIT |

95.7 |

110.5 |

| D&A |

149.9 |

156.1 |

| Changes in

working capital |

5.5 |

-45.4 |

| Income tax

expense |

-5.0 |

-12.2 |

|

Net cash flow from operating activities |

246.1 |

208.9 |

| Capital

expenditure |

-43.2 |

-44.5 |

| Others |

-0.1 |

-0.0 |

|

Net cash flow from investing activities |

-43.3 |

-44.5 |

| Treasury shares

purchase program |

-5.5 |

-7.4 |

| Change in

long-term borrowings and debt |

55.4 |

0.0 |

| Change in

short-term borrowings and debt |

-114.9 |

-85.0 |

| Net interests

paid |

-14.6 |

-9.9 |

| Other financial

income and expenses |

0.4 |

0.5 |

| Reimbursement

of rent lease |

-120.4 |

-120.9 |

|

Net cash flow from financing activities |

-199.6 |

-222.7 |

| Net foreign

exchange difference |

1.5 |

0.2 |

|

Change in net cash |

4.7 |

-58.1 |

|

FCF (€m) |

2021

retreated |

2022 |

| Adjusted

EBIT |

95.7 |

110.5 |

| D&A |

149.9 |

156.1 |

| Change in

working capital |

5.5 |

-45.4 |

| Income

tax |

-5.0 |

-12.2 |

|

Net cash flow from operating activities |

246.1 |

208.9 |

| Capital

expenditure |

-43.2 |

-44.5 |

| Reimbursement

of rent lease |

-120.4 |

-120.9 |

| Interest &

Other financial |

-14.3 |

-9.4 |

| Other &

FX |

1.5 |

0.0 |

|

Free cash-flow |

69.8 |

34.3 |

|

BALANCE SHEET - ASSETS (€m) |

2021

retreated |

2022 |

| Goodwill |

626.3 |

626.3 |

| Trademarks,

other intangible & right-of-use assets |

1 139.2 |

1 128.5 |

| Property,

plant and equipment |

87.6 |

82.5 |

| Non-current

financial assets |

19.6 |

18.7 |

| Deferred tax

assets |

49.7 |

35,7 |

|

Non-current assets |

1 922.4 |

1 891.8 |

| Inventories

and work in progress |

233.5 |

291.6 |

| Accounts

receivables |

56.7 |

62.9 |

| Other

receivables |

63.7 |

61.4 |

| Cash and cash

equivalents |

131.3 |

73.3 |

|

Current assets |

485.2 |

489.2 |

|

|

|

|

|

Total assets |

2 407.6 |

2 381.0 |

|

|

|

|

|

|

BALANCE SHEET - EQUITY & LIABILITIES (€m) |

2021

retreated |

2022 |

|

Total Equity |

1 117.2 |

1 172.1 |

| Non-current

lease liabilities |

313.2 |

302.9 |

| Non-current

financial debt |

338.7 |

261.9 |

| Other

financial liabilities |

0.1 |

0.1 |

| Provisions and

other non-current liabilities |

3.4 |

0.7 |

| Net employee

defined benefit liabilities |

5.2 |

4.2 |

| Deferred tax

liabilities |

181.4 |

169.2 |

|

Non-current liabilities |

842.1 |

739.1 |

| Trade and

other payables |

154.7 |

171.8 |

| Current lease

liabilities |

99.1 |

100.0 |

| Bank

overdrafts and short-term financial borrowings and debt |

110.2 |

104.2 |

| Short-term

provisions |

1.4 |

1.6 |

| Other current

liabilities |

82.9 |

92.2 |

|

Current liabilities |

448.4 |

469.8 |

|

|

|

|

|

Total Liabilities |

2 407.6 |

2 381.0 |

|

NET FINANCIAL DEBT (€m) |

2021 |

2022 |

| Non-current

financial debt & other financial liabilities |

-338.9 |

-262.0 |

| Bank overdrafts

and short-term financial liability |

-110.2 |

-104.2 |

| Cash and cash

equivalents |

131.3 |

73.3 |

|

Net financial debt |

-317.7 |

-292.9 |

| adjusted EBITDA

(excl. IFRS) |

129.3 |

151.3 |

|

Net financial debt / adjusted EBITDA |

2,5x |

1,9x |

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 47 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

1 Organic growth | All references in this document to the

“organic sales performance” refer to the performance of the Group

at constant currency and scope2 All 2021 figures have been

retreated with impacts of IFRS IC decision on the configuration and

customization costs software used as a SaaS contract3 Net debt /

adjusted EBITDA excluding IFRS

4 EMEA covers the Group's activities in European

countries excluding France (mainly the United Kingdom, Spain,

Germany, Switzerland, Italy) as well as the Middle East (including

the United Arab Emirates).5 APAC includes the Group's Asia-Pacific

operations (mainly Mainland China, Hong Kong SAR, South Korea,

Singapore, Thailand, Malaysia, and Australia).6 Claudie Pierlot and

Fursac brands7 Net Income Group Share divided by the average number

of ordinary shares as of December 31st, 2022, minus existing

treasury shares held by the Group.8 Net Income Group Share divided

by the average number of common shares as of December 31st, 2022,

minus the treasury shares held by the company, plus the common

shares that may be issued in the future. This includes the

conversion of the Class G preferred shares and the performance

bonus shares – LTIP which are prorated according to the performance

criteria reached as of December 31st, 2022.9 Excluding IFRS 1610

adjusted EBITDA excluding IFRS

- Press Release - SMCP - 2022 FY Results

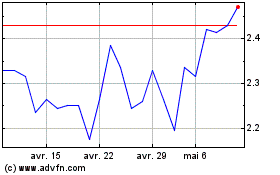

SMCP (EU:SMCP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

SMCP (EU:SMCP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024