Apollo Funds Agree to Sell 28.4% Stake in Vallourec to ArcelorMittal

12 Mars 2024 - 11:21PM

Apollo (NYSE: APO) today announced that Apollo-managed Funds

(“Apollo Funds” or the “Funds”) have agreed to sell 65.2 million

common equity shares in Vallourec SA (Euronext: VK; “Vallourec”,

the “Company”), a value-added manufacturer of premium tubular steel

products, for €14.64 per share to ArcelorMittal. The shares sold

represent a 28.4% equity interest1 in Vallourec and a total

transaction value of approximately €955 million, and upon close

will mark the Apollo Funds’ exit of the investment.

“We’re proud of the extremely strong results achieved during our

Funds’ ownership as the Company transformed its operations under a

top leadership team led by Philippe Guillemot and established

itself as a focused world leader in the manufacturing of high

performance tubular products. Along with this business

transformation have come record levels of profitability, a more

sustainable competitive position and an opportunity to capture

future growth in the energy transition markets,” said Apollo

Partner Gareth Turner. “There is still considerable potential to

expand upon what we have achieved but it is now appropriate for

Apollo to transition our Funds’ shareholding to an industrial

partner that can take the Company forward. We remain confident that

Vallourec is well-positioned for long-term growth and we wish

Philippe and the entire team continued success.”

Philippe Guillemot, Vallourec Chairman and CEO, said, “Apollo’s

operational and capital markets expertise was instrumental to

Vallourec’s turnaround, and we thank the Apollo team for their

unfailing support and world-class partnership. With Apollo’s Funds’

assistance, we have fundamentally changed the operational and

financial structure of Vallourec and we believe we are on the right

trajectory to deliver enhanced shareholder value over the coming

years.”

After leading the financial restructuring of Vallourec, Apollo

Funds became the largest equity investor in Vallourec in 2021. As a

strategic capital partner, Apollo played a pivotal role in the

design, launch, and implementation of the “New Vallourec” plan in

May 2022, which helped to transform the Company’s operational

design, footprint and capabilities, and drove EBITDA from €258mm in

2020 prior to Apollo Funds’ investment to €1,196mm in 2023,

reflecting the best results in nearly 15 years.

The transaction is expected to close in the second half of the

year, subject to satisfaction of customary closing conditions.

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade to private equity with a focus on three investing

strategies: yield, hybrid, and equity. For more than three decades,

our investing expertise across our fully integrated platform has

served the financial return needs of our clients and provided

businesses with innovative capital solutions for growth. Through

Athene, our retirement services business, we specialize in helping

clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of December 31, 2023, Apollo had

approximately $651 billion of assets under management. To learn

more, please visit www.apollo.com.

Contacts

Noah GunnGlobal Head of Investor RelationsApollo Global

Management, Inc.(212) 822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

1 Not taking into account preferred shares already issued but

not vested as of today.

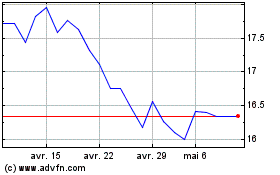

Vallourec (EU:VK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Vallourec (EU:VK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024