Press Release

First quarter 2024 revenues

Sales down 20% as reported

Accelerating synergiesnow estimated (net of

costs) at 40 million euros for 2024 and over 200 million euros from

2026 onwards

GUIDANCE CONFIRMED

Paris (France), April 24, 2024 - Vantiva (Euronext

Paris: VANTI) today announced its unaudited sales for the

first quarter of 2024.

"Connected Home" sales fell by 21.7% over the quarter,

despite the integration of the Home Networks business in 2024 and

the contribution of the diversification activities. This is due to

a strong first quarter in Q1 2023, destocking in the sector and a

slowdown in capex from operators.“Supply Chain

Solutions" sales were down 13.2%.

- Group sales totaled 458 million euros for the quarter, down 20%

as reported (-19.1% at constant exchange rates).

- The contribution of Connected Home was 358 million euros, down

21.7% after the integration of the Home Networks business for 2024

(-20.8% at constant exchange rates). This amount includes 18

million euros of revenues from the diversification activities.

- The contribution from SCS was 100 million euros, down 13.2%

(-12.4% at constant exchange rates).

- Vantiva accelerates the implementation of synergies linked to

the integration of Home Networks and continues to optimize “Supply

Chain Solutions”.

- The group is now targeting 40 million euros in synergies (net

of costs) by 2024, linked to the integration of Home Networks.

- Synergy potential much greater than initially expected and

estimated at over 200 million euros from 2026 onwards compared to

over 100 million euros initially expected.

- The 2024 guidance is

confirmed.

Luis Martinez-Amago, group Managing

Director, comments:

"As expected, the first quarter was very weak, due to the

general slowdown in demand against a backdrop of persistently high

inventories, and we had prepared ourselves accordingly. The basis

for comparison is also unfavorable, since Q1 23 was a strong

quarter, stemming from a cycle of high demand due to the

precautions taken during the chip crisis, with an exceptional level

of activity at some of our strategic customers. The scale of the

slowdown is in line with our forecasts and justifies the strong

adjustment measures we are currently deploying. We expect business

to pick up gradually in the second quarter and second half of the

year. The integration of Home Networks is proceeding according to

plan and will generate the expected synergies more rapidly than

anticipated, enabling the group to defend its profitability in this

market context, and to be ready to benefit from the market

recovery".

I- Q1 2024

sales

|

In € million, continuing operations |

Q1 2024 |

Q1 2023 |

Current exchange rates |

Constant exchange rates |

|

Revenue |

458 |

573 |

-20.0% |

-19.1% |

First quarter highlights

The downturn in “Connected Home” sales is in line with our

forecasts at the start of the year. It can be explained by a first

quarter 2023 which saw an exceptional level of deliveries with some

of our biggest customers, both Vantiva and Home Networks. The

return to normal with these customers and a general downturn in

business, linked to the need to clear inventories, are therefore at

the root of this downturn. A sequential improvement is expected

from the second quarter of 2024 onwards.The integration of the Home

Networks business is proceeding according to plan, and the group is

accelerating the implementation of synergies, which should reach,

net of costs, around 40 million euros by 2024 and exceed 200

million euros from 2026 onwards.

The "SCS" business also saw a decline in sales, albeit more

contained. Diversification activities helped limit the impact of

the structural decline in demand for optical disks.

The 2024 guidance is confirmed.

OutlookThe group confirms its

guidance for fiscal 2024:

- EBITDA > €140 million

- FCF(1) > €0 million

(1) After interest and taxes

and before restructuring and Home Networks acquisition costs

II- Analysis by division

and highlightsConnected Home

Breakdown of sales by product

| |

|

|

|

|

|

|

In € million, continuing operations |

Q1 2024 |

Q1 2023 |

Current exchangerates |

Constant exchange rates |

|

Revenue |

358 |

458 |

-21.7% |

-20.8% |

| Of

which by product |

|

|

|

|

|

Broadband |

212 |

380 |

-44.2% |

-43.7% |

|

Video |

127 |

77 |

65.2 % |

67.5% |

|

Diversification |

18 |

0 |

ns |

|

“Connected Home” sales totaled 358 million

euros in the first quarter, down 21.7% despite the contribution of

Home Networks activities for 2024, and accounted for 78% of group

sales (80% in Q1 2023). At constant exchange rates, the decline

would have been 20.8% compared with Q1 2023 as reported.

Sales were impacted by continued weak activity due to order

reductions by our customers in a context of destocking, and also by

a particularly high basis for comparison due to an exceptional

level of deliveries with certain strategic customers in North

America and Europe.

The integration of Home Networks explains the sharp rise in

Video sales.

Diversification activities contributed 18 million euros, and the

group signed new contracts for its "Internet of Things" (IoT)

activities.

Supply Chain Solutions

|

In € million, continuing operations |

Q1 2024 |

Q1 2023 |

Current exchange rates |

Constant exchange rates |

|

Revenue |

100 |

115 |

-13.2% |

-12.4% |

First quarter SCS sales totaled 100 million

euros, representing 22% of group sales (20% in Q1 2023). This

represents a 13.2% decline compared with Q1 2023, and at constant

exchange rates would have been down 12.4%. This variation is the

result of contrasting trends: demand for optical discs continues to

fall, but is partially offset by price increases, while sales of

vinyl discs and logistics services have risen.

###

Warning: Forward Looking Statements

This press release contains certain statements that constitute

"forward-looking statements", including but not limited to

statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions or which

do not directly relate to historical or current facts. Such

forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted, or implied by such

forward-looking statements. For a more complete list and

description of such risks and uncertainties, refer to Vantiva’s

filings with the French Autorité des marchés financiers (AMF). The

Universal Registration Document (Document d’enregistrement

universel) for fiscal year 2022 was filed with the Autorité des

marchés financiers on April 26, 2023, under no. D.23-0337, and an

amendment was filed with the Autorité des marchés financiers on

December 8, 2023, under no. D.23-0337-A01.

###

About Vantiva

Pushing the Edge

Vantiva shares are admitted to trading on the regulated market

of Euronext Paris (VANTI).

Vantiva, formerly known as Technicolor, is headquartered in

Paris, France. It is an independent company which is a global

technology leader in designing, developing and supplying innovative

products and solutions that connect consumers around the world to

the content and services they love – whether at home, at work or in

other smart spaces. Vantiva has also earned a solid reputation for

optimizing supply chain performance by leveraging its decades-long

expertise in high-precision manufacturing, logistics, fulfillment

and distribution. With operations throughout the Americas, Asia

Pacific and EMEA, Vantiva is recognized as a strategic partner by

leading firms across various vertical industries, including network

service providers, software companies and video game creators for

over 25 years. The group’s relationships with the film and

entertainment industry goes back over 100 years by providing

end-to-end solutions for its clients.

Following the acquisition of CommScope’s Home Networks in

January 2024, Vantiva continues its 130-year legacy as a global

leader in the connected home market.

Vantiva is committed to the highest standards of corporate

social responsibility and sustainability across all aspects of

their operations.

For more information, please visit vantiva.com and follow

Vantiva on LinkedIn and Twitter.

Contacts

Vantiva Investor

Relations Image

7 for

Vantivainvestor.relations@vantiva.com vantiva.press@image7.fr

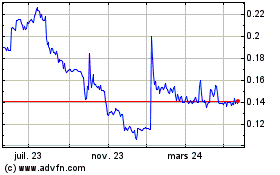

Vantiva (EU:VANTI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

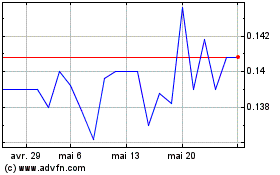

Vantiva (EU:VANTI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024