Wereldhave Belgium - Results 2022

08 Février 2023 - 8:00AM

Wereldhave Belgium - Results 2022

SOLID FULL-YEAR RESULTS SLIGHTLY ABOVE

EXPECTATIONS

- Increase in net result from core activities per share

by 6.8% to € 4.87 (€ 4.56 end 2021);

- Solid balance sheet with a debt ratio of 28.6% (28.2%

end 2021);

- Net asset value per share of € 78.99 (+ 2.3% vs. 2021:

€ 77.19);

- Increase in EPRA occupancy rate of 1.3% to 95.2% for

the entire portfolio (93.9% end 2021);

- Dividend proposal: € 4.20 gross (net € 2.94) per share

(+2.4% vs. 2021);

- Belle-Île weight

decreased to 18.9% of consolidated assets;

- Successful refinancing of €

80M in anticipation of

maturities in 2023;

- Dynamic leasing activity: 89 contracts signed at 13%

above market rent on average.

The Company's net result from core activities

increased by 10.1% in 2022 compared to 2021. It's net result from

core activities per shareshows a nice increase from € 4.56 in 2021

to € 4.87 in 2022 due to an increase in net rental income. The

Company recorded a very nice leasing activity in 2022 with 89

transactions.

The EPRA occupancy rate of the retail portfolio

was 97.7% at 31 December 2022 compared to 97.2% at 31 December

2021. Especially in the office portfolio, the Company was able to

conclude nice transactions thereby increasing the occupancy rate

from 76% to 81.5% by the end of 2022. For the whole investment

properties portfolio, the EPRA occupancy rate was 95.2% at 31

December 2022, compared with 93.9% a year earlier.

The net asset value per share before dividend

distribution was € 78.99 as at 31 December 2022 (2021: €

77.19).

The debt ratio was 28.6% at 31 December 2022,

compared to 28.2% at 31 December 2021.

- Press release results 2022

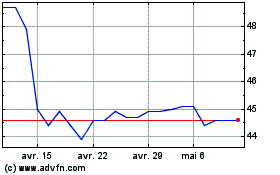

Wereldhave Belgium (EU:WEHB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

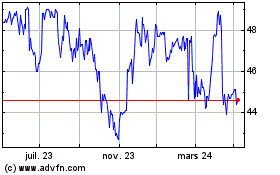

Wereldhave Belgium (EU:WEHB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024