Trading update 31 March 2024

23 Avril 2024 - 8:00AM

Trading update 31 March 2024

WERELDHAVE BELGIUM MAINTAINS PERFORMANCE LEVELS

IN LINE WITH EXPECTATIONS

• Increase in net rental income by 2.1% to € 16.0M (€

15.7M at 31 March 2023);• Decrease of the net

result from core activities per share of 7.1% to € 1.17 at 31 March

2024 (€ 1.26 at 31 March 2023);• Increase of the

fair value of the investment property portfolio (+4.1% compared to

31 December 2023);• Net asset value per share of €

83.57 (+7% vs. 2023: € 78.07);• Slight decrease in

EPRA occupancy rate of 0.8% to 95.3% for the entire portfolio

(96.1% at 31 December 2023) due to pop-up contracts significantly

higher by year-end;• Healthy debt ratio of 27.2%

at 31 March 2024 (29.6% at 31 December 2023);•

Outlook of net result from core activities maintained between €

4.80 - € 4.90 per share.

- Trading update 31 March 2024

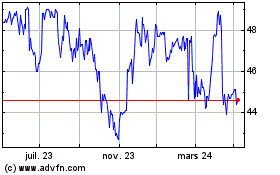

Wereldhave Belgium (EU:WEHB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

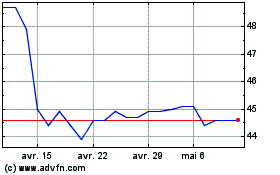

Wereldhave Belgium (EU:WEHB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024