TIDM54XE

RNS Number : 4516I

A2Dominion Housing Group Ltd

12 August 2021

Publication of Annual Financial Statements 2021

A2Dominion Housing Group Ltd has today published its Annual

Report & Accounts 2020/21, recording a turnover of GBP303.3m

and a net surplus of GBP6.4m.

The full audited financial statements can be found in the

following location:

https://www.a2dominiongroup.co.uk/about/reports-and-accounts

This has been a challenging year for the Group due to the

Covid-19 pandemic. While we continued to provide essential services

throughout and helped to ensure the safety of our customers and

employees, our financial performance has been heavily impacted by

the pandemic with a loss of circa GBP20 million of anticipated

surplus.

While we were able to reopen our construction sites quickly and

safely, social distancing slowed down work and longer build times

delayed the completion of homes for both rent and sale. This

inevitably reduced our revenue and increased our costs. Lower

occupancy rates in our student and key worker accommodation, due to

access restrictions and our decision not to charge rents where

students were unable to occupy their homes, also impacted our

rental income.

Despite the circumstances, we maintained a strong level of

service during the year across the organisation, including at our

extra care services where the residents rely upon our frontline

care workers. We also maintained an uninterrupted repairs service

throughout the year.

Our operating surplus fell by 12.3% from last year to GBP78.4

million, reflecting the higher operating costs from increased

expenditure on our properties, particularly in relation to fire

safety follow-up works. Our operating margin of 25.8% remained

fairly steady, boosted by the operating profits from our

development joint ventures which increased from last year. Our net

surplus outcome of GBP6.4 million has been affected by higher

interest costs and a fall in the values of our investment

properties from last year. The fall in our investment properties is

attributed to values being reduced by future fire safety costs

needed on three of the schemes in our portfolio.

The organisation continues to be financially strong, with our

core business achieving a strong result. Our social housing

lettings delivered a 29.0% margin which, although down on the

previous year, still compares well with our benchmark group. The

Group forecast shows we are well placed in the next few years to

show improved financial performance as well as being able to cope

with any future unforeseen challenges. All banking covenants remain

comfortably met.

Summary Financial Performance

GROUP STATEMENT OF COMPREHENSIVE 2021 2020

INCOME AND EXPENDITURE restated

GBPm GBPm

Turnover 303.3 320.4

Cost of sales (44.1) (57.0)

Operating costs (207.2) (192.1)

Surplus on sale of fixed assets 7.3 9.4

Share of jointly controlled

entity operating profit 19.1 8.7

Operating surplus 78.4 89.4

Operating margin 25.8% 27.9%

Net interest charges (64.8) (62.6)

Change in fair value of investments 0.8 0.5

Movement in fair value of financial

instruments 2.3 (0.1)

Movement in fair value of investment

properties (9.4) (3.9)

Taxation 0.7 2.0

Non-controlling interest (1.6) (1.1)

Net surplus for the year 6.4 24.2

We built 754 homes, 72% of our target of 1,041 but 82% more than

in 2019 (415). This included 153 shared ownership and affordable

rent, 311 private sale (125 in joint ventures) and 290 private rent

homes. We achieved 589 starts on site, which is 89 above our target

of 500 homes. Just under 100 of these are joint venture schemes,

while we are directly developing the rest. We secured detailed

planning permission for 1,168 homes across seven locations and have

sites secured for over 5,000 homes in our development pipeline over

the next five years and beyond.

This year, we achieved customer satisfaction levels of 83% which

is above our target. This score combines our customers'

satisfaction with complaints, repairs and our customer contact

centre services. This achievement can, in large part, be attributed

to the additional focus and resource we placed on customer service

during the pandemic, including calling customers with the greatest

needs and providing reassurance and guidance about our services. As

already mentioned, we also maintained a full repair service

throughout, keeping customers' homes safe and running smoothly.

Darrell Mercer, A2Dominion Group's Chief Executive, said: "T he

pandemic has had a significant financial impact on the organisation

and although we delivered a smaller surplus than expected, we

continue to be financially strong.

"Operationally, we've also continued to deliver hundreds of new

homes and have maintained high customer satisfaction ratings.

"Overall, we are in a very good position and well placed to

deliver improved performance over the next few years."

Other achievements in 2020/21 included:

-- Social value of GBP9m against a target of GBP7m

-- Established a GBP400-million estate services framework to

facilitate safety, remedial and improvement works for A2Dominion

and our partners, including public sector organisations

-- Fourth consecutive Investors in People Gold accreditation (since 2011).

GROUP STATEMENT OF FINANCIAL 2021 2020

POSITION GBPm GBPm

Tangible fixed assets and investments 3,587.5 3,575.6

Current assets 434.9 452.8

Creditors including loans and

borrowings (1,980.6) (1,984.2)

Deferred capital grant (1,081.3) (1,081.6)

Non-controlling interest (1.6) (1.2)

Total reserves 958.9 961.4

A copy of the Annual Financial Statements has also been

submitted to the National Storage Mechanism and will shortly be

available for inspection:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information, please contact:

Ellie Lodge

A2Dominion Housing Group

The Point

37 North Wharf Road

London W2 1BD

Tel: 07860 411202

Email: ellie.lodge@a2dominion.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSVLLBFFVLZBBZ

(END) Dow Jones Newswires

August 12, 2021 06:00 ET (10:00 GMT)

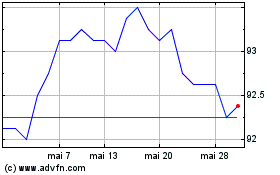

A2dominion 28 (LSE:54XE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

A2dominion 28 (LSE:54XE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025