TIDMALPH

RNS Number : 0676A

Alpha Group International PLC

18 January 2024

18 January 2024

Alpha Group International plc

("Alpha" or the "Group")

Trading Update

Alpha Group International plc, a high-tech, high-touch provider

of financial solutions to corporates and institutions, today

provides a trading update for FY 2023.

Unaudited Financial highlights[1]

- Revenue up 12% to GBP110m (FY 2022: GBP98.3m)

- Profit before tax up over 140% to c. GBP115m (FY 2022: GBP47.2m)

- Underlying profit before tax grew 10% to c. GBP42m (FY 2022:

GBP38.6m)

- Consistent underlying profit margins of 39% (FY 2022: 39%)

- Other operating income from interest on client balances

of over GBP73m (FY 2022: GBP9.3m)

- Very strong balance sheet, cash and liquidity position with

adjusted net cash increasing by over GBP60m to over GBP177m

- Alternative Banking Q4 2023 client balances increased by

31% against the same quarter last year, at GBP2.1bn (Q4

2022: GBP1.6bn)

Business highlights

- Benefits of diversification strategy clearly evidenced in

resilient revenue and strong profit growth

- Disciplined approach to credit and risk reflected in the

lowest level of client defaults in the past five years

- Investment programme yielding substantial efficiencies,

with operational gearing opportunity in 2024 and beyond,

and hiring now predominantly focused on Front Office

- Launch of new Fund Finance division in May 2023

- Launch of new Corporate FXRM offices in Madrid and Munich

- Completed the Group's first acquisition, of Cobase, in December

2023

[1] Numbers exclude Cobase, which was acquired on December 1

2023, and during the month generated revenue of GBP0.2m, EBITDA of

GBP0.0m, and a PBT loss of GBP0.2m.

Overview

The interest rate environment throughout 2023 drove exceptional

levels of client balance interest income, profit, and cash.

However, this same environment has also suppressed the activity

levels of both our corporate and institutional clients, resulting

in a more challenging trading environment. We describe this dynamic

internally as our 'natural interest rate hedge'. Overall, revenue

and underlying profit both continued to grow, demonstrating the

appeal and resilience of our offering, albeit the rate of

underlying growth was marginally lower than expected due to

prevailing economic headwinds throughout the year. Q3 was our most

challenging sales quarter in the year, coinciding with peak levels

of macro uncertainty around interest rates and inflation. In Q4

however, we were pleased to end the year with a record revenue

quarter for the Group, as we started to see activity levels

increase.

For FY23, Group revenue is expected to have grown by circa 12%,

underlying PBT by circa 10%, and statutory PBT (which includes

interest income from client balances) by over 140%.

Throughout the year, we made significant investments in

operational scalability, product, risk and governance. This should

significantly reduce our requirement for operational headcount

growth in 2024 compared to previous years. Furthermore, with the

operational scalability in place, a growing portfolio of

market-leading solutions, and average sales productivity[2]

increasing, we will continue to invest with confidence in growing

our Front Office teams across our global locations in 2024, in

order to capitalise on the vast market opportunity in front of

us.

Whilst the macro environment could remain challenging in 2024,

we remain confident in our strategy to take advantage of the vast

growth opportunity. Our full-year results statement will be

published w/c 18(th) March 2024. Ahead of this, we have also

provided an initial summary of our performance across our key

product lines below.

(2) Front Office productivity is measured by dividing our Group

FXRM revenue by the cumulative tenure of our FXRM sales team.

FX Risk Management

Throughout 2023, the challenging macro conditions described in

our Interim Report resulted in a noticeably more conservative

approach to forecasting and, thus, FX hedging amongst our client

base. At the same time, these macro conditions meant we chose to

tighten our own credit appetite, particularly in the first nine

months of the year when central banks were continually increasing

interest rates and we were still seeing high levels of inflation

globally. This created significant uncertainty around how high

rates could go, and therefore, when taking into consideration our

clients' ability to service their debts, we chose to take a more

conservative approach, resulting in a number of clients having

hedging facilities reduced or removed. This disciplined approach

ensured we had no significant defaults during the year but also

meant we walked away from revenue opportunities. Additionally,

despite the challenging sales environment, our team upheld Alpha's

high selling standards, guiding clients towards what they need,

rather than what they sometimes want, and in particular,

discouraging clients from using more complex derivative products.

Such products tend to tempt clients with immediate short-term

benefits of a more favourable exchange rate today, at the expense

of committing the client to a potentially more undesirable exchange

rate in the future, therefore serving no logical purpose in a

genuine risk management strategy. Guiding clients away from these

products resulted in a 68% reduction in complex options revenue in

the year, and whilst unfortunately we are currently seeing a trend

within our industry of more complex products being sold, we believe

upholding our principles will serve to support higher quality

revenue growth in the long-term, and protects the best interests of

our clients as well as our reputation in the market. As referenced

in our last annual report, we changed our team's commission

structure at the end of 2022, deliberately paying significantly

lower rates of commission on more complex products, whilst

celebrating and incentivising scenarios where they successfully

talk clients down from more complex ones, to using simpler

ones.

Our diversification strategy has also paid dividends, with

growth from our Institutional FXRM business and our overseas

offices offsetting the economic headwinds being felt in our UK

Corporate business. These factors have contributed towards overall

revenue growth of 10% to GBP76m for the year (FY 2022: GBP69.5m),

and client numbers growing by 2% to 1071. Average revenue per

client also continued to increase, reflecting our continued focus

on working with larger businesses as well as increasing wallet

share with existing clients, as our reputation continues to grow.

To understand the performances across our different offices, we

have provided a breakdown as follows.

Our UK Corporate office experienced a decline in revenue this

year and has remained the most impacted by the economic

environment. This is primarily because it has the largest and

longest-standing client base and has therefore also been affected

the most by the adjustments to our credit appetite. Additionally,

our UK office has historically served as the talent incubator for

cultivating leaders to spearhead the establishment of overseas

offices, and, therefore, during this more challenging period, the

team have missed some of this talent. With our current overseas

offices now established, there is no further need to export talent

from the UK for the time being, and we are confident this

marketplace remains an enormous growth opportunity within its own

right.

In Europe, our Corporate offices in Amsterdam and Milan

continued to deliver strong year-on-year growth, whilst our Madrid

office, setup in H1 2023 by a team of four with 15 years' combined

Alpha experience pitching from the UK, is already trading strongly.

I n Q4, we also launched a new office in Munich, Germany, creating

our fifth growth runway into Europe.

Beyond Europe, our Corporate Australia office has continued to

deliver good revenue growth and has been established by a core team

with over 30 years' combined experience working at Alpha. This has

created excellent foundations from which to grow in Australia,

whilst also providing the Group with the ability to service its

global client base 24/7.

Our Corporate Toronto office remains profitable but ended the

year with revenues slightly down. Those who have followed our

updates over the last 18 months will know we have been rebuilding

in Toronto, and at the end of 2023 we introduced new leadership.

The early performance and feedback from the team since making these

changes has been encouraging, and we are confident that we are

starting 2024 with stronger foundations in Toronto.

Our Institutional FXRM office (based in the UK) continued to

show particularly strong growth in the period, with revenue

increasing over 55%. Given the contraction in the alternative

investment market as a whole, this has been an outstanding

performance and, alongside the team's hard work, reflects the

growing reach of the division, as well as the increasing

cross-selling opportunities through our Alternative Banking

solution and, more recently, Fund Finance. Launching in 2018, the

Institutional FXRM team has quickly established a strong reputation

and loyal client base within the Institutional space, and given the

growth they've delivered in a suppressed market, we are excited

about their potential once market activity picks up again.

Outlook for FXRM

The macro backdrop to 2023 certainly provided challenges to the

growth of our FXRM revenues. The growth prospects for FXRM heading

into 2024 however remain exciting. Prior to the start of 2023, we

had a large runway and robust strategy to continue delivering

long-term growth with our existing FXRM teams, markets and

products. Throughout 2023, we have continued to make significant

investments to further enhance the FXRM division's potential,

including the opening of two new offices, an 18% increase in Front

Office headcount to 120 people (FY 2022: 102), investment in our

online platform, and the exciting acquisition of the

treasury-focused fintech, Cobase, in December 2023. At the same

time, average revenues per client continue to increase, alongside

Front Office Productivity, and we have built in significant amounts

of operational scalability through our investments in people and

technology.

At our IPO in 2017, we set a strategy to "land and expand". The

first part of this strategy (the "landing") has very much been

focused on establishing our overseas offices, and ensuring we have

the operational foundations in place to scale. With six overseas

FXRM offices across three continents launched, and the investment

required to scale reaching its "cruising altitude", we are now

looking forward to doubling down on the "expansion" phase of our

strategy and benefitting from more operational leverage as a result

of the investment made in the year. We will now place a particular

focus in 2024 on scaling our Front Office sales teams in our

current offices, whilst continuing to uphold our selling standards,

in order to deliver strong and sustainable revenue growth.

Alternative Banking

Within the alternative investment market, the decline in deal

activity experienced in the first half of 2023 continued throughout

the rest of the year, with deal volumes and flows significantly

down on 2022 across all of the key asset classes served by our

Alternative Banking division. Despite the macro-economic headwinds,

revenues increased by 18% to GBP34m, and in addition to this

revenue, our Alternative Banking solution has enabled us to

generate over GBP73m in Other Operating Income from interest on

client balances (2022 GBP9.3m), which grew from an average of

GBP1.6bn in Q4 2022 to GBP2.1bn in Q4 2023.

Reduced deal activity in the alternative investment market

impacted demand for new accounts, payments and FX spot

transactions. Consequently, growth in account numbers was lower

than expected, with the team ending the year with just under 6,500

accounts against our updated forecast of 7,000 - a growth rate of

c. 50% against the 4,200 accounts we had in FY 2022.

Despite the temporary downturn in investment activity within our

core markets, it is encouraging that we have been able to continue

to grow, and we are excited about the prospects for Alternative

Banking as this slowdown unwinds and normal business activity

resumes, which we feel will likely follow interest rate cuts. Our

growing market presence and scale means we are well-positioned to

capitalise on any unwind, and can do so with increasing levels of

operational efficiency. Our product remains highly attractive, and

our strategic investments in technology and automation made

throughout the year will not only lead to a better service for our

clients but also reduce our time and cost to serve them - enabling

us to do more with less. This step-change in scalability and

efficiency will also likely reduce the level of operational

headcount growth we need in Alternative Banking from this point,

whilst giving us the confidence to significantly grow our Front

Office teams in 2024 within this division.

Alternative Banking also plays an important role in providing a

whole product solution to the alternative investment market, acting

as a gateway product that facilitates cross-selling with our FXRM

and (more recently) Fund Finance divisions.

Net Interest Income from Client Balances

As previously outlined, our average client balances grew by 31%

between 2022 and 2023, as we continued to open more accounts and

grow wallet share with clients. The interest rates we received on

these balances meanwhile averaged 3.6% for the year. Together this

resulted in over GBP73m of other operating income for the year - an

increase of over eight times against FY 2022. A quarter-on-quarter

breakdown of our average client balances and the interest rates we

received is shared below.

Quarter in 2023 Average Balance Average Interest

Rate

Q1 GBP1.6bn 2.8%

----------------- -----------------

Q2 GBP1.9bn 3.8%

----------------- -----------------

Q3 GBP1.9bn 3.8%

----------------- -----------------

Q4 GBP2.1bn 3.8%

----------------- -----------------

Fund Finance

Launched in May 2023, our fund finance offering had an excellent

start, ending the year with the launch of the industry's first

online platform for connecting borrowers with lenders.

Our fund finance offering embodies Alpha's hallmark 'high-tech,

high-touch' approach to business, combining specialist expertise

with smart technology to disrupt industries that are both outdated

and have high barriers to entry. This is evidenced in the early

success of the division. We are excited to report that our solution

is already proving popular. Despite this, we have further

medium-term ambitions for the technology, providing an exciting

roadmap for the future.

With its focus on the alternative investment market, our fund

finance offering has, and will continue to, benefit from

cross-selling opportunities with clients that come from Alpha's

Institutional FXRM and Alternative Banking teams. At the same time,

the Fund Finance team is already reciprocating by creating new

business opportunities of their own, which can then be sold Alpha's

other services.

Our expansion into fund finance is another important part of our

vision to become a global leader of financial solutions for the

alternative investment market - a bank alternative, dedicated to

Alternatives.

Cobase

The process to acquire Cobase began in September 2023 and was

completed in December 2023 (see announcement here ). Despite the

fact that the acquisition process can be fairly disruptive, Cobase

grew revenues by c. 67% to EUR2m(3) in FY 2023, with all revenues

derived through SaaS subscription fees. In addition, the client

base has increased by c. 67% during the year, to end 2023 with over

130 clients.

Cobase's solution has proven highly attractive amongst medium to

large corporates. Its SaaS model lends itself to scaling a valuable

and integrated client base with excellent levels of retention. Our

initial strategy focuses on helping Cobase to accelerate client

acquisition; we then plan to explore how we can complement these

SaaS revenues through cross-selling of products from our other

divisions via our sales teams and digital integration.

With Cobase's bank-connectivity technology added to Alpha's

stable of products, the Group is now able to offer our corporate

client base a comprehensive and flexible portfolio of

treasury-focused products covering FX, payments, accounts, and bank

management. This is expanding the Group's addressable market,

providing us with the opportunity to become more integrated with

our clients, and also enabling us to engage with new clients, who

may not have engaged us without the Cobase solution, but can still

utilise Alpha's other offerings further down the line. In addition,

Cobase has historically worked with a small number of institutional

clients, and having conducted some further research across our own

institutional clients, we believe there are opportunities for

Cobase within our institutional marketplace too.

Having only recently completed the acquisition, it remains

relatively early days; the focus of 2024 is to determine how we can

maximise the synergies between the two businesses in the long

term.

(3) Only revenue delivered by Cobase after it was acquired in

December 2023 is attributable to the Group, which was c. EUR200k;

however, in order to show a like-for-like comparison with 2022 this

has not been included in the numbers reported in this update.

Morgan Tillbrook, CEO, commented:

"Despite a challenging trading environment in 2023, our team

have continued to work hard to deliver profitable revenue growth,

whilst also making excellent progress on our long-term growth

strategy. At the same time, our previous diversification into

Alternative Banking has enabled us to benefit from exceptional

levels of interest income. Whilst we have opted to exclude these

numbers from our underlying profit for transparency, the fact

remains that this is very much a by-product of our diversified

business model and is providing us with transformative levels of

capital from which we can significantly enhance our long-term

growth prospects. We have already started to show this in 2023 with

the acquisition of Cobase, the launch of our new Fund Finance

division, and new offices in Spain and Germany.

The higher interest rate environment has created economic

headwinds which have impacted our underlying revenue momentum.

However, the additional operating income of over GBP73m that we

have generated as a result of this same environment has more than

compensated for this, and highlights the resilience of our

diversified business model. In simple terms, 2023 showed that in a

higher interest rate environment, underlying growth becomes more

challenging, but the cash and statutory profit from interest income

becomes exceptional - a trade-off that, in reality, creates

significant opportunities for Alpha's long-term growth

prospects.

Nonetheless, as a business that strives for high levels of

performance, we very much remain focused on delivering strong

underlying growth, and so whilst this additional income is a boost,

as a team, it is not one by which we will be measuring our own

success.

I would like to thank our team for all of their hard work and

commitment throughout the year, and look forward to updating

shareholders in more detail on all of the progress we've made in

our full-year report in March."

This announcement is released by Alpha Group International plc

and contains inside information for the purposes of the Market

Abuse Regulation (EU) 596/2014 ("MAR") and is disclosed in

accordance with the Company's obligations under Article 17 of MAR.

The person who arranged for the release of this announcement on

behalf of Alpha Group International plc was Tim Powell, Chief

Financial Officer.

Enquiries:

Alpha Group International plc Via Alma Strategic Communications

Morgan Tillbrook, Founder and CEO

Tim Powell, CFO

Liberum (Nominated Adviser and Joint

Broker)

Max Jones

Ben Cryer

Kane Collings +44 (0) 20 3100 2000

Peel Hunt (Joint Broker)

Neil Patel

Paul Gillam

Richard Chambers +44 (0) 20 7418 8900

Alma Strategic Communications

(Financial Public Relations)

Josh Royston

Andy Bryant

Kieran Breheny +44 (0) 20 3405 0205

Notes to editors

Alpha is a high-tech, high-touch provider of enhanced financial

solutions dedicated to corporates and institutions globally.

Working with clients across 50+ countries, we blend intelligent

human capabilities with new technologies to provide clients with an

enhanced alternative to their bank, with solutions covering: FX

risk management, global accounts mass payments, fund finance and

bank management.

Key to our success is our team - over 400 people based across

seven global offices, brought together by a high-performance

culture and a partnership structure that empowers them to act as

owners of our business.

Whilst we are an established business listed on the London Stock

Exchange, we remain relentlessly focused on maintaining the same

level of operational agility and client focus we had when we first

started in 2009. This dynamic, combined with the passion of our

people, have enabled us to make a substantial and enduring

difference to our clients, and deliver a growth story to match.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFITLFIDLIS

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

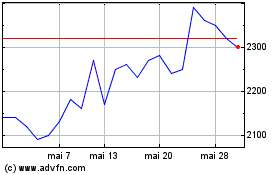

Alpha (LSE:ALPH)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Alpha (LSE:ALPH)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024