TIDMARCM

RNS Number : 0771O

Arc Minerals Limited

29 September 2023

29 September 2023

Arc Minerals Ltd

('Arc Minerals' or the 'Company')

Interim Results

Arc Minerals announces its unaudited financial results for the

six months ended 30 June 2023 (the "Interim Results") which is

available to view at the following link:

http://www.rns-pdf.londonstockexchange.com/rns/0771O_1-2023-9-28.pdf

and will be made available on the Company's website at

http://www.arcminerals.com/investors/document-library/default.aspx.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly undue reliance should not be put on

such statements due to the inherent uncertainty therein.

Shareholder consent to receive information electronically

At the Annual General Meeting of the Company held in September

2012, Shareholders approved electronic communication and

dissemination of information via the Company's official website,

including but not limited to Notices of General Meetings, Forms of

Proxy and Annual Reports and Accounts. Shareholders are reminded

that their right to request information in print remains unaffected

and that they can do so by contacting the Company giving no less

than 14 days' notice.

**S**

Contacts

Arc Minerals Ltd

Nicholas von Schirnding (Executive

Chairman) +44 (0) 20 7917 2942

SP Angel (Nominated Adviser & Joint

Broker)

Ewan Leggat / Adam Cowl +44 (0) 20 3470 0470

WH Ireland Limited (Joint Broker)

Harry Ansell / Katy Mitchell +44 (0) 20 7220 1666

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the period ended 30 June 2023

Six Months Six Months

to to

30 June 30 June

2023 2022

(Unaudited) (Unaudited)

Notes GBP 000's GBP 000's

Administrative expenses (2,201) (808)

Operating Income / (Loss) (2,201) (808)

Zamsort/Handa Restructuring 9 - (6,815)

Gains and losses on the disposal

of Casa 7 - (840)

Non-operating Income / (Loss) (2,201) (7,655)

Income / (Loss) before tax (2,201) (8,463)

Income tax expense - -

---------------------------------- ------ ------------ ------------

Income / (Loss) for the period 3 (2,201) (8,463)

----------------------------------- ------ ------------ ------------

Other comprehensive income

/ (loss)

Items that may be reclassified

subsequently to profit or

loss:

Unrealised gains (49) 32

Effect of currency translation 53 (487)

----------------------------------- ------ ------------ ------------

Other comprehensive income

/ (loss) for the period, net

of tax 4 (455)

----------------------------------- ------ ------------ ------------

Total comprehensive income

/ (loss) for the period (2,197) (8,918)

----------------------------------- ------ ------------ ------------

Income / (Loss) attributable

to:

Equity holders of the parent (2,196) (6,573)

Non-controlling interest (5) (1,890)

----------------------------------- ------ ------------ ------------

(2,201) (8,463)

Total comprehensive income

/ (loss) attributable to:

Equity holders of the parent (2,206) (6,830)

Non-controlling interest (9) (2,088)

----------------------------------- ------ ------------ ------------

(2,197) (8,918)

Loss per share attributable

to the owners of the parent

during the period

(expressed in pence per share)

- Basic 3 (0.18) (0.69)

The notes are an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2023

As at As at

30 June 31 December

2023 2022

(Unaudited) (Audited)

Notes GBP 000's GBP 000's

ASSETS

Non-current assets

Intangible assets 4 5,169 5,233

Fixed assets 5 7 12

Total non-current assets 5,176 5,245

Current assets

Trade and other receivables 6 1,109 1,096

Short term investments 8 231 1,738

Cash and cash equivalents 60 616

Total current assets 1,400 3,450

TOTAL ASSETS 6,576 8,695

-------------------------------- ------ ------------ -------------

LIABILITIES

Current liabilities

Trade and other payables 10 (2,933) (2,733)

Total current liabilities (2,933) (2,733)

Non-current liabilities

Long term payables 11 (106) (117)

Total non-current liabilities (106) (117)

TOTAL LIABILITIES (3,039) (2,850)

-------------------------------- ------ ------------ -------------

NET ASSETS 3,537 5,845

================================ ====== ============ =============

EQUITY

Share capital 12 - -

Share premium 64,300 64,272

Share based payments reserve 283 283

Warrant reserve 84 84

Foreign exchange reserve 866 1,045

Retained earnings (61,362) (59,196)

-------------------------------- ------ ------------ -------------

Equity attributable to equity

holders of the parent 4,171 6,488

Non-controlling interest (634) (643)

TOTAL EQUITY 3,537 5,845

================================ ====== ============ =============

The notes are an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

for the period ended 30 June 2023

As at As at

30 June 30 June

2023 2022

(Unaudited) (Unaudited)

Notes GBP 000's GBP 000's

Cash flows from operating

activities

Loss before tax (2,201) (8,463)

Depreciation 5 3

Currency losses / (gains) 39 (285)

Fair value losses / (gains) 8 1,469 2,044

Zamsort/Handa restructuring 9 - 6,815

Operating loss before changes

in working capital (688) 114

(Increase)/ Decrease in trade

and other receivables (13) (1,018)

Decrease in trade and other

payables 194 (331)

Net cash used in operating

activities (507) (1,235)

---------------------------------- ------ ------------ ------------

Cash flows used in investing

activities

Additions to intangible assets (88) (139)

Net cash used in investing

activities (88) (139)

---------------------------------- ------ ------------ ------------

Cash flows from financing

activities

Proceeds from issue of ordinary

shares net of share issue

cost 28 2,191

Long term payables 11 (204)

Net cash used in financing

activities 39 1,987

---------------------------------- ------ ------------ ------------

Net increase/(decrease) in

cash and cash equivalents (556) 613

Cash and cash equivalents

at beginning of period 616 1,735

Cash and cash equivalents

at end of period 60 2,348

---------------------------------- ------ ------------ ------------

The notes are an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the period ended 30 June 2023

Share Share Foreign Share Warrant Retained Total Non-controlling Total

capital premium exchange based Reserve earnings interest equity

reserve payment

reserve

GBP GBP GBP GBP GBP GBP GBP GBP GBP

000's 000's 000's 000's 000's 000's 000's 000's 000's

As at 1 January 2022 - 62,019 (1,885) 273 84 (53,385) 7,106 1,076 8,182

========== ======== ========= ======== ======== ========= ======== ================ ========

Loss for the period - - - - - (6,573) (6,573) (1,890) (8,463)

Items that may be

reclassified

subsequently to

profit

or loss:

Currency translation

differences - - (257) - - - (257) (198) (455)

Total comprehensive

loss for the period - - (257) - - (6,573) (6,830) (2,088) (8,918)

Warrants exercised - 2,191 - - - - 2,191 - 2,191

Effect of foreign

exchange

on the opening

balance - - 4,768 - - - 4,768 - 4,768

Increase/(Decrease)

of

NCI - - - - - - - (1,210) (1,210)

Total transactions

with

owners, recognised

directly

in equity - 2,191 4,768 - - - 6,959 (1,210)) 5,749

---------- -------- --------- -------- -------- --------- -------- ---------------- --------

As at 30 June

2022(i) - 64,210 2,626 273 84 (59,958) 7,235 (2,222) 5,013

========== ======== ========= ======== ======== ========= ======== ================ ========

As at 1 January 2023 - 64,272 1,045 283 84 (59,196) 6,488 (643) 5,845

========== ======== ========= ======== ======== ========= ======== ================ ========

Loss for the period - - - - - (2,196) (2,196) (5) (2,201)

Items that may be

reclassified

subsequently to

profit

or loss:

Currency translation

differences - - (10) - - - (10) 14 4

Total comprehensive

loss for the period - - (10) - - (2,196) (2,206) 9 (2,197)

Share capital issued

net of share issue

costs - 28 - - - - 28 - 28

Effect of foreign

exchange

on the opening

balance - - (169) - - 30 (139) - (139)

Total transactions

with

owners, recognised

directly

in equity - 28 (169) - - 30 (111) - (111)

---------- -------- --------- -------- -------- --------- -------- ---------------- --------

(61

As at 30 June 2023 - 64,300 866 283 84 362) 4,171 (634) 3,537

========== ======== ========= ======== ======== ========= ======== ================ ========

(i) The presentation of comparative amounts for the period 1

January to 30 June 2022 has been amended to correctly present the

allocation of losses (the loss for the period and other

comprehensive loss) between equity holders of the parent and

non-controlling interest.

The notes are an integral part of these consolidated financial

statements.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

For the period ended 30 June 2023

1. Basis of preparation

The condensed consolidated interim financial statements have

been prepared under the historical cost convention and on a going

concern basis and in accordance with International Financial

Reporting Standards and IFRIC interpretations adopted for use in

the European Union ("IFRS") and those parts of the BVI Business

Companies Act applicable to companies reporting under IFRS.

The condensed consolidated interim financial statements

contained in this document do not constitute statutory accounts. In

the opinion of the directors, the condensed consolidated interim

financial statements for this period fairly presents the financial

position, result of operations and cash flows for this period.

The Board of Directors approved this Interim Financial Report on

28 September 2023.

Statement of compliance

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Company has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing these interim

condensed consolidated interim financial statements. The condensed

interim financial statements should be read in conjunction with the

annual financial statements for the year ended 31 December 2022,

which have been prepared in accordance with IFRS as adopted by the

European Union.

Accounting policies

The condensed consolidated interim financial statements for the

period ended 30 June 2023 have not been audited or reviewed in

accordance with the International Standard on Review Engagements

2410 issued by the Auditing Practices Board. The figures were

prepared using applicable accounting policies and practices

consistent with those adopted in the statutory annual financial

statements for the year ended 31 December 2022.

Going concern

The Directors have reviewed a forecast prepared by the executive

and have a reasonable expectation that the Group has sufficient

funds to continue in operation and satisfy liabilities for the

foreseeable future.

The Directors are also required to assess the Group's ability to

continue as a going concern ("Going Concern Assessment") in the

event that the joint venture with a subsidiary of Anglo American as

announced on 20 April 2023 (the "Anglo JV") is delayed or fails to

close or if the Group cannot liquidate its receivables and/or

investments. It must be made clear that consideration of these

factors by the Directors for purposes of the Going Concern

Assessment, does not in any way reflect the Directors' views on the

commercial viability, nor probability of closing, the Anglo JV. The

Directors' Going Concern Assessment similarly does not reflect the

Directors' views in respect of liquidating the Group's receivables

and/or investments nor in terms of the potential realisable values.

When excluding the Anglo JV and non-cash receivables and

investments from their Going Concern Assessment, the Directors note

that that the Group's ability to remain a going concern for at

least 12 months from the approval of these interim financial

statements is dependent on the Group's ability to raise further

equity and/or debt finance. Whilst the Directors acknowledge that

this carries a high degree of uncertainty, in part due to current

market volatility, they have a reasonable expectation that the

Group will continue to be able to raise finance as required over

this period.

During the c.6 years ended 31 December 2022, Arc raised in

excess of GBP17.5 million from the sale of equity and exercise of

warrants of which c.GBP2 million was raised in 2022 from the

issuance of new ordinary shares in the Company. These ongoing

equity sales are indicative of consistent strong investor support.

The Directors therefore consider it appropriate, despite the loss

incurred during the period, for the Company to continue to adopt

the going concern basis in preparing these interim financial

statements.

Fair value measurement

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. The fair value

measurement is based on the presumption that the transaction to

sell the asset or transfer the liability takes place either in the

principal market for the asset or liability, or in the absence of a

principal market, in the most advantageous market for the asset or

liability.

The fair value of an asset or a liability is measured using the

assumptions that market participants would use when pricing the

asset or liability, assuming that market participants act in their

economic best interest. A fair value measurement of a non-financial

asset takes into account a market participant's ability to generate

economic benefits by using the asset in its highest and best use or

by selling it to another market participant that would use the

asset in its highest and best use.

The Group uses valuation techniques that are appropriate in the

circumstances and for which sufficient data are available to

measure fair value, maximising the use of relevant observable

inputs and minimising the use of unobservable inputs. All assets

and liabilities for which fair value is measured or disclosed in

the financial statements are categorised within the fair value

hierarchy, described as follows, based on the lowest level input

that is significant to the fair value measurement as a whole:

-- Level 1 - Quoted (unadjusted) market prices in active markets

for identical assets or liabilities.

-- Level 2 - Valuation techniques for which the lowest level

input that is significant to the fair value measurement is directly

or indirectly observable.

-- Level 3 - Valuation techniques for which the lowest level

input that is significant to the fair value measurement is

unobservable.

2. Financial Risk Management

Risks and uncertainties

The Board continually assesses and monitors the key risks of the

business. The key risks that could affect the Group's medium-term

performance and the factors that mitigate those risks have not

substantially changed from those set out in the Group's December

2022 Annual Report and Financial Statements, a copy of which is

available from the Group's website: www.arcminerals.com. The key

financial risks are market risk, currency risk, and liquidity.

3. Loss per share

Six Months Six Months

to to

30 June 30 June

2023 2022

(Unaudited) (Unaudited)

Notes GBP 000's GBP 000's

Loss for the period (2,201) (8,463)

Weighted average number of ordinary

shares used in calculating basic

loss per share (000's) 1,225,745 1,223,545

Basic loss per share (expressed

in pence) (0.18) (0.69)

------------------------------------------------ ------------ ------------

As the inclusion of the share options would result in a decrease

in the earnings per share, they are considered to be anti-dilutive

and, as such, a diluted loss per share is not included.

4. Intangible Assets

Zaco Alvis-Crest Handa Total

Deferred Prospecting Deferred Other

Exploration & Exploration Exploration Intangible

Costs rights Costs Assets

GBP GBP GBP GBP GBP

000's 000's 000's 000's 000's

As at 1 January

2023 1,103 1,312 2,162 656 5,233

Additions 33 - 9 46 88

Foreign exchange (32) - (86) (34) (152)

As at 30 June

2023 1,104 1,312 2,085 668 5,169

====================== ============= =============== ============= ============ =======

As at 31 December

2022 1,103 1,312 2,162 656 5,233

5. Fixed Assets

Processing Mining Motor Furniture

Plant Equipment Vehicles & Fittings Total

GBP 000's GBP 000's GBP 000's GBP 000's GBP 000's

-------------------------- ------------ ------------ ---------- ------------ ----------

Cost

At 1 January 2023 - - 37 2 39

Additions - - - - -

Effects of foreign - - -

exchange movements - -

-------------------------- ------------ ------------ ---------- ------------ ----------

At 30 June 2023 - - 37 2 39

-------------------------- ------------ ------------ ---------- ------------ ----------

Accumulated Depreciation

At 1 January 2023 - - (26) (1) (27)

Depreciation - - (5) - (5)

-------------------------- ------------ ------------ ---------- ------------ ----------

At 30 June 2023 - - (31) (1) (32)

-------------------------- ------------ ------------ ---------- ------------ ----------

Cost

At 1 January 2022 - - 86 33 119

Disposal of Zamsort

subsidiary - - (40) (31) (71)

Effects of foreign

exchange movements - - (11) - (11)

-------------------------- ------------ ------------ ---------- ------------ ----------

At 31 December 2022 - - 37 2 39

-------------------------- ------------ ------------ ---------- ------------ ----------

Accumulated Depreciation

At 1 January 2022 - - (66) (31) (97)

Disposal of Zamsort

subsidiary - - 40 30 70

Depreciation - - (9) - (9)

Effects of foreign

exchange movements - - 9 - 9

At 31 December 2022 - - (26) (1) (27)

-------------------------- ------------ ------------ ---------- ------------ ----------

NET BOOK VALUE - 30

June 2023 - - 6 1 7

========================== ============ ============ ========== ============ ==========

NET BOOK VALUE - 31

December 2022 - - 11 1 12

========================== ============ ============ ========== ============ ==========

6. Trade and Other Receivables

Included in trade and other receivables at 30 June 2023 is

c.GBP986k (USD 1,250,000) in relation to the disposal of the

Company's interest in Casa Mining Ltd and the Misisi Project (see

note 7).

7. Disposal of Casa Mining Ltd

Consideration

As announced on 29 April 2022, Regency Mining Ltd ("Regency")

acquired a 73.5% interest in the Misisi gold project ("Misisi

Project") from Golden Square Equity Partners Limited ("Golden

Square"), replacing Rackla Metals Inc. as the acquiror of Misisi.

The terms of the transaction were that Arc would be paid USD

250,000 in cash and the equivalent of USD 1,250,000 in shares in a

publicly listed company in Canada ("Consideration Shares"). The

agreement also provided Arc with a royalty agreement on the same

terms as the previous royalty agreement announced on 5 May

2021.

On 30 June 2022, the Company received the first cash payment of

USD 125,000 towards the USD 1,500,000 receivable from the disposal

of its Casa interests. On 12 September 2022, the Company received

the second cash payment of USD 125,000, bringing the aggregate cash

payments received by the Company to date to USD 250,000. The

balance of USD 1,250,000 is to be settled by the issuance of listed

stock which has been delayed due to corresponding delays in the

listing process of the underlying entity. Management continues to

follow up on progress and the directors consider the balance

recoverable.

USD 5m Loan Note

From 19 March 2020, Arc held a USD 5,000,000 loan note issued by

Golden Square (Pty) Ltd ("Golden Square Loan Note") secured by 3

million shares in OTC:TMNA ("Security Shares"). As announced on 29

April 2022 the Company accepted the Security Shares in full and

final settlement of the Golden Square Loan Note resulting in a gain

of c.GBP2m. At 30 June 2023, the closing share price of the

Security Shares was US$0.055 per share (2022 - USD$0.79). The

unrealised fair value loss recognised during the year is GBP1.47m

(2022 - GBP2.28m).

8. Short-term Investments Held at Fair Value Through Profit and

Loss

The Group's investments held at fair value through profit and

loss consist of investments publicly traded on the London Stock

Exchange and the Over-The-Counter (OTC) market. These investments

are valued at the mid-price as at period end.

Level Level Level

1* 2* 3* Total

GBP 000's GBP 000's GBP 000's GBP 000's

--------------------------- ---------- ---------- ---------- ----------

At 1 January 2023 1,738 - - 1,738

Additions - - - -

Fair value changes (1,469) - - (1,469)

Gain/(Loss) on disposals - - - -

Disposals - - - -

Foreign exchange (38) - - (38)

---------------------------- ---------- ---------- ---------- ----------

At 30 June 2023 231 - - 231

---------------------------- ---------- ---------- ---------- ----------

Level Level Level

1(i) 2(i) 3(i) Total

GBP 000's GBP 000's GBP 000's GBP 000's

--------------------------- ---------- ---------- ---------- ----------

Gains on short-term investments held at fair value through

profit and loss

Fair value loss on

investments (1,469) - - (1,469)

Realised gain on disposal - -

of investments - -

--------------------------- ---------- ---------- ---------- ----------

At 30 June 2023 (1,469) - - (1,469)

---------------------------- ---------- ---------- ---------- ----------

(i) See note 1 (accounting policy).

Level Level Level

1(i) 2(i) 3(i) Total

GBP 000's GBP 000's GBP 000's GBP 000's

--------------------------- ---------- ---------- ---------- ----------

At 1 January 2022 - - - -

Additions 4,433 - - 4,433

Fair value changes (2,281) - - (2,281)

Loss on disposals (25) - - (25)

Disposals (176) - - (176)

Foreign exchange 120 - - 120

---------------------------- ---------- ---------- ---------- ----------

At 30 June 2022 2,071 - - 2.071

---------------------------- ---------- ---------- ---------- ----------

Level Level Level

1(i) 2(i) 3(i) Total

GBP 000's GBP 000's GBP 000's GBP 000's

--------------------------- ---------- ---------- ---------- ----------

Gains on short-term investments held at fair value through

profit and loss

Fair value loss on

investments (2,281) - - (2,281)

Realised loss on disposal

of investments (25) - - (25)

---------------------------- ---------- ---------- ---------- ----------

At 30 June 2022 (2,306) - - (2,306)

---------------------------- ---------- ---------- ---------- ----------

(i) See note 1 (accounting policy).

9. Zamsort/Handa Restructuring

Zamsort Settlement (background)

The Company announced in February 2022 that the parties to the

legal cases in Zambia and in the UK have come to an agreement to

settle various disputed matters and for all legal proceedings to be

permanently dropped (the "Settlement Agreement"). The Settlement

Agreement was submitted to Zambian courts to effect a Consent

Judgement which has the force of law.

In return for the claimant parties, being Terra Metals Limited,

Zambia Mineral Exchange Corporation Limited and their related

parties (including Mumena Mushinge and Brian Chisala),

relinquishing all claims against Zamsort or any other company in

the Arc Minerals Ltd Group, present or contingent, and in full and

final settlement of all claims in formal conclusion of all matters,

the Group agreed to transfer to the claimant parties, for nil

consideration, 100% of the issued share capital of Zamsort Ltd (the

"Zamsort Transfer"), which owns the pilot plant. The Group also

agreed to consent to the claimant parties applying for the 8 square

kilometre small mining and small exploration license areas that

were previously in existence at Zamsort prior to Arc's involvement

(the "Original Zamsort License Area").

As announced on 31 March 2022, the Company issued 3,000,000

options in relation to the Zamsort Settlement with an exercise

price of 5 pence each and an expiry date of 31 March 2024.

Following the grant of these options there were 20,133,334 share

options outstanding.

All of the Group's representative directors who served on the

board of directors of Zamsort resigned effective 1 April 2022

("Resignation Date").

Transfer of assets and liabilities from Zamsort to Handa

The pilot plant, related equipment and intangible assets that

relate to the Original Zamsort License Area which remained in

Zamsort ("Zamsort Retained Assets") was treated as available for

sale assets at 31 December 2021. All assets and liabilities, other

than the Zamsort Retained Assets, immediately preceding the date of

the Zamsort Transfer (the "Transferred Assets & Liabilities")

were transferred to Handa Resources Ltd ("Zamsort/Handa

Restructuring"). The Zamsort/Handa Restructuring has been recorded

on 31 March 2022, being the date immediately preceding the

Resignation Date and resulted in a c.GBP6.8m expense in the year to

31 December 2022.

10. Trade and Other Payables

Group Group

30

June 31 December

2023 2022

GBP GBP

Trade and Other Payables 000's 000's

----------------------------------- ------- ------------

Surrendered share options payable 1,263 1,181

Minority shareholder loans 1,247 1,271

Trade and other payables 423 281

2,933 2,733

======= ============

Surrendered Share Options Payable

The surrendered share options payable is in relation to the

surrendered share options as announced on 16 March 2021.

Minority shareholder loans

The minority shareholder loans represent the aggregate of (i) a

loan from the 34% minority shareholder to Handa Resources Limited

and (ii) a loan from the 27.5% minority shareholder to Zaco

Investments Limited. The Company has also provided loans to these

companies on similar terms which had a balance on the reporting

date of cGBP3.6 million.

11. Long Term Payables

Group Group

30

June 31 December

2023 2022

GBP

Long term payables 000's GBP 000's

---------------------------- ------- ------------

Minority shareholder loans 106 117

106 117

======= ============

The minority shareholder loans consists of a loan from the 25%

minority shareholder of Alvis-Crest (Pty) Ltd. The Company has also

provided a loan to Alvis Crest on similar terms which had a balance

on the reporting date of GBP648,000.

12. Share Capital

The authorised share capital of the Company and the called up

and fully paid amounts at 30 June 2023 were as follows:

A) Authorised GBP 000's

Unlimited ordinary shares

of no par value -

B) Called up, allotted, Number Nominal

issued and fully paid of shares value

-------------------------- -------------- ----------

As at 1 January 2023 1,225,744,782 -

Additions: -

As at 30 June 2023 1,225,744,782 -

-------------------------- -------------- ----------

13. Events after the reporting date

On 12 May 2022 the Company announced that it, together with its

partners, had entered into an agreement with Anglo American with

the intention to form a joint venture in respect of its Zambian

copper interests ("Joint Venture"). The key commercial terms of the

Joint Venture were that, upon signing of a binding Joint Venture

agreement ("JV Agreement"), Anglo American would have an initial

ownership interest of 70% with Arc and its partners holding the

balance via Unico Minerals Ltd ("Unico") in which Arc will have a

69% interest with the balance held by its partners. On 20 April

2023, the binding JV Agreement was signed with the JV Agreement

being subject to completing certain conditions precedent including

a restructuring of the Group's assets, obtaining approvals from

relevant government and regulatory authorities and other customary

conditions.

At the date of this report the Company continues to work towards

finalising the conditions precedent in the JV Agreement.

The key commercial terms of the Joint Venture are as

follows:

-- Upon signing of the Joint Venture Documents ("Effective

Date"), a Joint Venture vehicle will be formed with initial

ownership interests by Anglo American and Unico of 70% and 30%,

respectively ("Initial Ownership Interests");

-- Anglo American has the right to retain an Ownership Interest of 51%, by:

o funding exploration expenditures equal to USD 24,000,000 on or

before the date that is 180 days after the third anniversary of the

Effective Date ("Phase I End Date"); and

o making cash payments to Unico totalling up to USD 14,500,000,

as follows:

-- USD 3,500,000 upon signing of the Joint Venture Agreement and

satisfying the conditions precedent;

-- USD 1,000,000 on the first anniversary of the Effective

Date;

-- USD 1,000,000 on the second anniversary of the Effective

Date;

-- USD 1,000,000 on the third anniversary of the Effective Date;

and

-- USD 8,000,000 by the Phase I End Date.

-- Following the completion of Phase I, Anglo American will have

the right to retain an additional ownership interest equal to 9%

(for a total ownership interest of 60%) by funding USD 20,000,000

of additional exploration expenditures within 2 years of the Phase

I End Date ("Phase II End Date")

-- Following the completion of Phase II, Anglo American will

have the right to retain an additional ownership interest equal to

10% (for a total ownership interest of 70%) by funding USD

30,000,000 within 2 years of the Phase II End Date.

-- Anglo American, for as long as it holds the largest interest

in the Joint Venture, shall have the right to nominate three

directors and Unico shall have the right to nominate two directors.

Joint Venture board decisions shall be adopted by simple majority

vote.

14. Other Matters

The condensed consolidated interim financial statements set out

above do not constitute the Group's statutory accounts for the

period ended 30 June 2023 or for earlier periods but are derived

from those accounts where applicable.

A copy of this interim statement is available on the Company's

website: www.arcminerals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VVLFLXKLBBBK

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

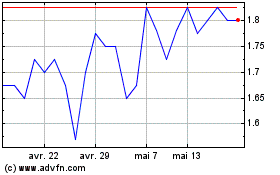

Arc Minerals (LSE:ARCM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Arc Minerals (LSE:ARCM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025