Trading Statement - Labrador Iron financing increased to C$35 million (GBP22.6 million)

08 Mars 2010 - 8:30AM

UK Regulatory

TIDMAYM

Anglesey Mining plc LSE:AYM

8 March 2010

Labrador Iron financing increased to C$35 million (GBP22.6 million)

Anglesey grants options over LIM shares for up to GBP2.9 million

Anglesey Mining plc is pleased to announce that its 50% owned associate

Labrador Iron Mines (LIM) arranged a $C35 million bought deal financing on

Friday 5 March 2010. This was in two stages the first of which was announced

by Anglesey on Friday, followed after the close of UK business by a $C10

million extension bringing the total to be raised to $C35 million. The

complete financing involves the issue of 5,406,000 LIM common shares at a

price of $C5.55 each together with 764,000 tax flow-through shares at

C$6.65 each.

In parallel with this increased LIM financing, Anglesey has granted an over-

allotment option to the underwriters to purchase up to 810,900 shares from

Anglesey's current LIM holding at $C5.55 each and if exercised in full this

will provide Anglesey with gross proceeds of C$4.5 million (GBP2.9

million).

The bought deal is with a syndicate of Canadian underwriters led by Canaccord

Financial Ltd. The increase in the offer is of 1,766,000 common shares at C$5.55

per share from LIM's treasury, subject to receipt by LIM of all necessary

regulatory approvals. Under the amended terms of the offering the underwriters

have agreed to purchase an aggregate of 6,166,000 LIM shares for anticipated

total gross proceeds of C$35,057,300 (GBP22.6 million). LIM plans to use the net

proceeds from the offering for exploration and development of its mineral

projects, and for general corporate and working capital purposes.

In addition, Anglesey has increased the option granted to the underwriters to

purchase LIM common shares from those already owned by Anglesey, up to an

aggregate of 810,900 shares for the purpose of covering the underwriters' over-

allocation position in respect of the LIM bought deal. These shares represent

15% of the number of new shares being issued by LIM (excluding flow-through

shares) and 4.4% of Anglesey's current holding in LIM of 18,600,000 shares.

Following the LIM financing this potential share sale by Anglesey would reduce

its holding in LIM by 1.9 percentage points.

The price for the LIM shares under option is C$5.55 per share, for gross

proceeds of up to C$4,500,495 (GBP2.9 million), The same terms and conditions as

in respect of the LIM issue apply and the option is exercisable at any time in

whole or in part up to 30 days after the date of the closing of the underwritten

offering.

The net proceeds from the sale of Anglesey's LIM shares will be used by Anglesey

for general corporate costs and working capital purposes.

Bill Hooley, Chief Executive of Anglesey said "We are very pleased that we are

able to join with our associate company in this financing that provides LIM with

additional capital to enable it to become a new force in the Canadian Iron ore

business and that at the same time, if the option is exercised, will enable

Anglesey to raise some necessary funding through the sale of a small portion of

its holding in LIM. We would expect that this new cash injection will be

sufficient for at least one year's requirements and that further sales of LIM

shares are not contemplated at this time."

Other terms and conditions including the filing of a short form prospectus in

Toronto are unchanged. The underwritten offer is expected to close on or about

25 March 2010. LIM has 37,203,951 common shares outstanding prior to the offer.

The Offering is being made pursuant to a short form prospectus to be filed in

the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New

Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador. The

Offered Securities will not be registered under the U.S. Securities Act of 1933,

as amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration requirements.

Labrador Iron Mines Holdings Limited (LIM)

LIM's Schefferville area project involves the exploration and development of

direct shipping iron ore deposits in western Labrador and north eastern Quebec

near Schefferville. LIM's properties are part of the historic Schefferville area

iron ore district where mining of adjacent deposits was previously carried out

by the Iron Ore Company of Canada from 1954 to 1982. LIM plans to mine its

deposits in varying stages, the first stage comprising the James and Redmond

deposits, which are located in Labrador in close proximity to existing

infrastructure. Subject to timely receipt of all permits and licences, iron ore

production is planned to commence in the summer of 2010.

About Anglesey Mining

Anglesey Mining plc is a UK based company listed on the London Stock Exchange

which currently holds 18,600,000 shares in Labrador Iron Mines Holdings Limited.

The company also holds the Parys Mountain base metals project with a

historical resource of 7.7 million tonnes at 9.3% combined copper, lead and zinc

in Anglesey, UK.

For further information contact

Bill Hooley, Chief Executive 01492-541981

Ian Cuthbertson, Finance Director 01248 361333

Emily Fenton/Charlie Geller, Conduit PR 020 7429 6666

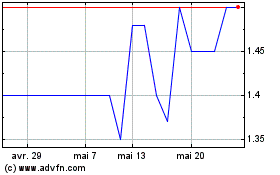

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024