LIM reviews mine start-up at its AGM

23 Septembre 2011 - 9:30AM

UK Regulatory

TIDMAYM

Anglesey Mining plc LSE:LYM

22 September 2011

LIM reviews Successful Mine Start-Up at Annual Meeting of Shareholders

Schefferville Iron Ore Mine in Production

Anglesey Mining's 33% owned associate Labrador Iron Mines Holdings Limited

(TSX: LIM) reports that at the Annual Meeting of Shareholders, held at the TMX

Broadcast Centre Gallery in Toronto on September 22, 2011, shareholders were

presented with a review of the major developments over the past year at the

Schefferville Area Iron Ore project that have led to the commencement of

production and transport and sale of iron ore.

"This past year since the last Annual General Meeting has been the most

exciting in our history. LIM has moved from being an exploration and

development company and now joins the very limited number of companies mining

iron ore in Canada," remarked John Kearney, LIM's Chairman & Chief Executive.

"We have made great progress and passed important milestones and we look

forward to continuing growth in iron ore production over the coming years,"

added Mr. Kearney.

Developments since September 2010

* The James Mine has been developed and is now in full scale production.

* The Silver Yards processing plant has been constructed and commissioned and

is now running at design throughput and recovery levels.

* Rail agreements have been negotiated and LIM's iron ore is been railed from

Silver Yards to the Port of Sept-Iles.

* An agreement was signed with the Iron Ore Company of Canada for the sale and

shipping of all of LIM's 2011 iron ore production.

It is expected that, to the end of September 2011:

* a total of about 700,000 tonnes of ore will have been mined and some

1,700,000 tonnes of waste and overburden will have been removed.

* about 250,000 tonnes of high grade direct railing ore, included in the above

total, have been mined of which almost 200,000 tonnes will have been sent to

the Port of Sept-Iles.

* approximately 400,000 tonnes of ore will have been processed through the

Silver Yards plant, producing about 210,000 tonnes of lump and sinter fines

product.

Mining operations at the James Mine commenced in April 2011, full scale mining

operations got underway in June 2011 and have since been gradually ramped up.

The mining rate is now approximately 30,000 tonnes of ore and waste per day.

LIM is very encouraged by the grade of James ore which has been in excess of

expectations. Of the total production to the end of September, some 250,000

tonnes of direct railable ore will have been mined at an average grade of

around 65% iron which can be sent directly to Sept-Iles without further

processing.

The Silver Yards beneficiation plant has been completely constructed and

commissioned in under one year and is now running at design throughput and

recovery levels. The second stage expansion of the plant (installation of

Hydrosizer and filter) has been completed and the third stage expansion, which

should add about 1,000,000 tonnes to annual production capacity, is being

planned and designed and should be constructed in 2012.

Iron Ore Sale Agreement with IOC

In August 2011, LIM has entered into an agreement with the Iron Ore Company of

Canada ("IOC"), for the sale and shipping of all of LIM's calendar 2011 iron

ore production. Under the confidential sales contract with IOC, the iron ore

will be delivered to Asian markets and resold by IOC's marketing organization

on the spot market. The sale price for iron ore sold to IOC will be based on

the actual realized prices to Chinese customers, less an allocation for

handling, loading, shipping and sales costs.

The first ship carrying approximately 168,000 tonnes of iron ore mined and

produced by Labrador Iron Mines, (the Salt Lake City), is scheduled to depart

the Port of Sept-Iles on September 30, destined for China.

IOC, Canada's largest iron ore producer, owns 100% of the QNS&L railway and, at

the Port of Sept-Iles, owns established storage and ore handling facilities,

including its ship dock capable of taking ocean going vessels up to 240,000

(dwt) tonnes. LIM's agreement with IOC enables utilization of Cape Size Ocean

going ships, where current freight rates are lower than for the alternative but

smaller Panamax vessels, for the shipment of LIM's iron ore.

LIM believes that the benefits associated with this arrangement, together with

the benefits of the utilization of larger Cape Size Ocean going ships, will

ensure that the maximum possible tonnage of LIM's 2011 iron ore production will

be efficiently shipped and sold during the remainder of calendar 2011. LIM

expects that three or perhaps four shiploads of iron ore will be shipped to

China before the onset of winter.

Rail Operations

The first ore train loaded with direct shipping ore departed Silver Yards on

June 29, 2011 and almost 200,000 tonnes of direct railing ore will have been

shipped by rail to Sept-Iles by the end of September.

Earlier this year LIM purchased a fleet of 400 previously used rail cars of

which 260 have been delivered and commissioned into service. This process took

longer than anticipated due to the modifications needed to meet local operating

conditions. At the present time LIM is running two ore trains between Silver

Yards and the Port of Sept-Iles and is working to add a third but shorter train

within the next few weeks.

The buildup in rail operations has not happened as efficiently as expected and

this has led to shortfall in the tonnage of ore railed to date. LIM continues

to work with the railway companies in an attempt to improve cycle times of the

trains from mine to Port and back. The extent of such improvements, coupled

with the onset of the winter period, will determine the volumes to be railed

this year. It is now expected that the total tonnage to be delivered to the

Port will be between 500,000 and 700,000 tonnes.

2011 Outlook

It is expected that a total of about 2,000,000 tonnes of ore will be mined from

the James Mine during the current year. Forecast production and sales for the

remainder of 2011 will to a large extent be dependent upon the weather and the

time when winter conditions close in and curtail certain aspects of the

operation.

The total tonnage treated in the Plant for the year is expected to lie within

the range of 500,000 to 800,000 tonnes. This will yield saleable products of

between 300,000 and 500,000 tonnes of lump ore and sinter fines to be added to

the 200,000 tonnes of direct railable product already railed to the Port.

It is now expected that the total tonnage to be delivered to the Port will be

between 500,000 and 700,000 tonnes.

If other conditions remain as forecast a stockpile of approximately 1,000,000

tonnes of ore will be built up in Silver Yards by year end and will be

available for a rapid start to treatment, railing and sales in the spring of

2012.

The 2011 season is considered to be a short start-up and testing year and unit

operating costs are expected to be higher than the anticipated life-of-mine

average. LIM is in a strong financial position that will enable it to fund its

working capital requirements for 2011 and to fund its ongoing exploration and

expansion plans.

Summer Exploration Program

The summer 2011 drilling program in both Labrador and Quebec has advanced

steadily with three reverse circulation drill rigs being utilized. The

principal drilling areas are the deposits that will comprise Stage 1 subsequent

to James and Redmond, including Knob Lake, Ruth Lake and Gill and the Stage 2

deposits at Houston and Malcolm.

By the end of September approximately 7,500 metres of the planned 14,000 metres

program will have been completed. It is expected that new resource estimates on

a number of these deposits will be completed before the end of 2011.

Stage 2 Houston Deposit and Redmond Plant

LIM continues to evaluate the development of a new separate Stage 2 operation

for the Houston deposit including a dedicated processing plant to be located at

Redmond which, subject to environmental assessment, permitting and detailed

engineering, could be brought into production commencing in 2013 at an eventual

rate of 2.5 to 3 million tonnes per year. This would be in addition to the

existing processing plant at Silver Yards which, with planned enhancements and

additions, will have a similar design capacity.

First Nations Support

LIM's relations with its aboriginal neighbours and partners continue very

satisfactorily, with aboriginal employees representing a substantial percentage

of the workforce.

LIM had previously entered into an Impact Benefits Agreement with the Innu

Nation of Labrador, which has been working satisfactorily since mid-2008.

In September 2010 LIM signed an Impact Benefit Agreement with the Naskapi

Nation of Kawawachikamach (near Schefferville), following a long period of

co-operation since the initial MOU was signed with Naskapi in April 2008.

In December 2010, LIM signed an Agreement in Principle with the Innu Takuaikan

Uashat Mak Mani-Utenam (Sept-Iles), which stipulates the principal terms to be

included in an IBA. Negotiations with the Innu Takuaikan Uashat Mak Mani-Utenam

Quebec towards the completion of an IBA have been concluded, and it is expected

that the agreement will be submitted to the community of Takuaikan Uashat Mak

Mani-Utenam for ratification later in the year.

In June 2011 LIM signed an Impact Benefits Agreement with the Nation Innu

Matimekush-Lac John of Schefferville, Quebec. The life-of-mine Agreement was a

significant step for LIM and for the Innu Community of Matimekush-Lac John, and

paved the way for the development of LIM's iron ore project that is providing

opportunities for the local community at Schefferville, while at the same time

protecting Innu traditional and cultural activities.

These Impact Benefits Agreements with the four local communities demonstrate

LIM's commitment to work in a positive relationship with the aboriginal

communities and to ensure that the members benefit through employment,

training, business opportunities and financial participation in LIM's iron ore

projects.

Grant of Stock Options

The Board of Directors of LIM has approved the grant of an additional 100,000

options to new members of senior management at an exercise price of $6.80 per

share, all with an expiry date of September 20, 2016, all vesting as to

one-eighth thereof quarterly over a period of two years.

About Labrador Iron Mines Holdings Limited (LIM)

LIM's Schefferville Projects involve the development of twenty direct shipping

iron ore deposits in western Labrador and north-eastern Quebec near

Schefferville, Quebec. The properties are part of the historic Schefferville

area iron ore district where mining of adjacent deposits was previously carried

out by the Iron Ore Company of Canada from 1954 to 1982. For further

information, please view www.labradorironmines.ca.

About Anglesey Mining plc

Anglesey Mining with its LSE main board listing is primarily focused on its 33%

interest in Labrador Iron Mines (TSX:LIM). In addition to any new projects that

may be brought forward the company owns 100% of Parys Mountain in North Wales

with an historical resource in excess of 7 million tonnes at over 9% combined

copper, lead and zinc.

For further information, please contact:

Bill Hooley, Chief Executive +44 (0) 1492 541981

Ian Cuthbertson, Finance Director +44 (0) 1248 361333

Samantha Harrison / Shaun Whyte, Ambrian Partners Limited +44 (0) 2076 344700;

Emily Fenton / Jos Simson, Tavistock Communications

+44 (0) 20 7920 3155 / +44 (0) 7788 554035.

END

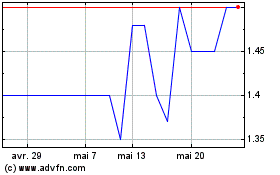

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Anglesey Mining (LSE:AYM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024