TIDMCGEO

RNS Number : 8098I

Georgia Capital PLC

09 August 2023

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF ARTICLE 7(1) OF THE MARKET ABUSE REGULATION (EU)

596/2014 (THE "MARKET ABUSE REGULATION")

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY JURISDICTION IN WHICH,

OR TO ANY PERSON TO OR FROM WHOM, IT IS UNLAWFUL UNDER APPLICABLE

LAWS TO DISTRIBUTE THIS ANNOUNCEMENT.

9 August 2023

JSC GEORGIA CAPITAL ANNOUNCES RESULTS OF TENDER OFFER TO

PURCHASE NOTES FOR CASH

JSC Georgia Capital (the "Issuer") announces today the results

of the tender offer that the Issuer commenced on 12 July 2023, for

its outstanding U.S.$300,000,000 [1] 6.125% notes due 2024 (the

"Notes"), for cash (the "Tender Offer"). The terms of the Tender

Offer are described in a tender offer memorandum dated 12 July 2023

(the "Tender Offer Memorandum").

Capitalised terms used in this announcement but not otherwise

defined have the meanings given to them in the Tender Offer

Memorandum.

Results of the Tender Offer

The Tender Offer expired at 11:59 p.m. (New York time) on 8

August 2023. The following table sets forth the results of the

Tender Offer, including the aggregate principal amount of Notes

accepted for purchase and the Purchase Price per U.S. $1,000 in

principal amount of Notes accepted for purchase in the Tender

Offer, as determined in accordance with the terms as set out in the

Tender Offer Memorandum.

Description ISIN/Common Minimum Benchmark Repurchase Purchase Aggregate

of the Notes Code/CUSIP Denomination Reference Yield Price Principal

Security Amount

Yield of Notes

accepted

for purchase

Regulation

S Notes

ISIN

XS1778929478/

Common Code:

177892947

Rule 144A Notes U.S.$1,001.07

ISIN U.S.$200,000 per U.S.$1,000

US373143AA49/ and integral in principal

Common Code multiples amount

U.S.$300,000,000 178546554/ of U.S.$1,000 of the

6.125% notes CUSIP 373143AA4 thereafter 5.424% 5.924% Notes U.S.$176,521,000

----------------- ---------------- ----------- ----------- ---------------- -----------------

New Financing Condition

The Issuer confirms that the New Financing Condition has been

satisfied.

Payment of the Purchase Price and the Accrued Interest

Amount

The Issuer will also pay an Accrued Interest Payment in respect

of any Notes accepted for purchase pursuant to the Tender Offer, as

further described in the Tender Offer Memorandum.

The Purchase Price and the Accrued Interest Amount for the Notes

accepted for purchase in the Tender Offer will each be paid on the

Payment Date, which is expected to be on or about 10 August

2023.

Future Actions in Respect of the Notes

The Issuer intends to cancel U.S.$176,521,000 in aggregate

principal amount of the Notes it accepts for purchase pursuant to

the Tender Offer and U.S.$106,878,000 in aggregate principal amount

owned by the Issuer. Following settlement of the Tender Offer and

the cancellation of U.S.$283,399,000 in aggregate principal amount

of the Notes, U.S.$16,601,000 in aggregate principal amount of the

Notes will remain outstanding.

Following such cancellation, the Issuer intends to exercise its

right to redeem any Notes not acquired in the Tender Offer pursuant

to the optional redemption and make whole provision contained in

"Terms and Conditions of the Notes-Condition 6(c) (Optional

Redemption at Make Whole)" in the listing particulars pursuant to

which the Notes were issued.

Further Information

A complete description of the terms and conditions of the Tender

Offer is set out in the Tender Offer Memorandum.

Requests for information in relation to the Tender Offer should

be directed to:

The Dealer Manager

J.P. Morgan Securities plc

25 Bank Street

Canary Wharf

London E14 5JP

United Kingdom

Email: em_europe_lm@jpmorgan.com

Attention: Liability Management

Tel: +44 20 7134 2468

The Tender and Information Agent

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

London SE1 9SG

United Kingdom

Attention: Jacek Kusion

Tel: +44 20 7704 0880

Email: gcap@is.kroll.com

Website: https://deals.is.kroll.com/gcap

DISCLAIMER

This announcement must be read in conjunction with the Tender

Offer Memorandum. No offer or invitation to acquire or exchange any

notes is being made pursuant to this announcement. This

announcement and the Tender Offer Memorandum contain important

information, which must be read carefully. If any Noteholder is in

any doubt as to the contents of this announcement or the Tender

Offer Memorandum or the action it should take, it is recommended to

seek its own legal, tax and financial advice, including as to any

tax consequences, immediately from its stockbroker, bank manager,

solicitor, accountant or other independent financial adviser. None

of the Issuer, the Dealer Manager, the Tender and Information

Agent, or any person who controls, or is a director, officer,

employee or agent of such persons, or any affiliate of such

persons, makes any representation or recommendation whatsoever

regarding this announcement, the Tender Offer Memorandum or the

Tender Offer.

This announcement is released by JSC Georgia Capital and

contains information that qualified or may have qualified as inside

information for the purposes of Article 7 of the Market Abuse

Regulation, encompassing information relating to the Tender Offer

described above. For the purposes of the Market Abuse Regulation,

this announcement is made by Giorgi Alpaidze, the Chief Financial

Officer of JSC Georgia Capital.

[1] In October 2022, the Issuer repurchased and cancelled

U.S.$65 million Notes, decreasing the outstanding principal amount

from U.S.$365 million to U.S.$300 million.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTEUKSKROKUWRRR

(END) Dow Jones Newswires

August 09, 2023 05:52 ET (09:52 GMT)

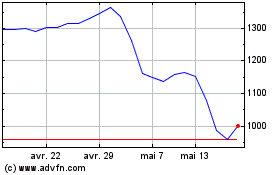

Georgia Capital (LSE:CGEO)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Georgia Capital (LSE:CGEO)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024