TIDMCTY

RNS Number : 9837M

City of London Investment Trust PLC

20 September 2023

Legal Entity Identifier: 213800F3NOTF47H6AO55

THE CITY OF LONDON INVESTMENT TRUST PLC

Annual financial results for the year ended 30 June 2023

This announcement contains regulated information

CHAIRMAN'S COMMENT

"City of London's total return of 4.5%, whilst underperforming

the FTSE All-Share Index, should be considered in the light of its

longer-term outperformance and its consistent 57-year record of

annual dividend increases."

INVESTMENT OBJECTIVE

The Company's objective is to provide long-term growth in income

and capital, principally by investment in equities listed on the

London Stock Exchange. The Board fully recognises the importance of

dividend income to shareholders.

PERFORMANCE AT 30 JUNE

2023 2022

--------------------------------------------- ------- -------

Total Return Performance:

Net asset value ("NAV") per ordinary share

(1) 4.5% 7.5%

Share price(2) 4.1% 7.7%

FTSE All-Share Index (Benchmark) 7.9% 1.6%

AIC UK Equity Income sector(3) 8.1% -1.5%

IA UK Equity Income OEIC sector 4.0% -0.5%

2023 2022

--------------------------------------------- ------- -------

NAV per ordinary share 385.2p 390.9p

NAV per ordinary share (debt at fair value) 391.2p 393.5p

Share price 397.0p 400.5p

Premium 3.1% 2.5%

Premium (debt at fair value) 1.5% 1.8%

Gearing at year end 6.2% 7.1%

Revenue earnings per share 20.1p 20.7p

Dividends per share 20.1p 19.6p

Ongoing charge for the year(4) 0.37% 0.37%

Revenue reserve per share 8.9p 9.5p

1 Net asset value per ordinary share total return with debt at

fair value (including dividends reinvested)

2 Share price total return using mid-market closing price

3 AIC UK Equity Income sector size weighted average NAV total

return (shareholders' funds)

4 Calculated using the methodology prescribed by the Association

of Investment Companies ("AIC")

Sources: Morningstar Direct, Janus Henderson, Refinitiv

Datastream

CHAIRMAN'S STATEMENT

City of London produced a net asset value ("NAV") total return

of 4.5%, which compares with a total return of 7.9% for the FTSE

All-Share Index. Although this most recent underperformance is

disappointing, City of London's portfolio is managed for the long

term and its NAV total return has exceeded the FTSE All-Share Index

over 3, 5 and 10 years. The dividend was increased for the 57th

year and covered by earnings per share.

The Markets

Financial markets throughout the year have remained challenging

for investors, with the war in Ukraine and tensions in Asia causing

fluctuations in the cost of raw materials and energy. The fight

against inflation took centre stage in developed economies, with

the Federal Reserve, the European Central Bank and the Bank of

England all increasing interest rates (the latter by a factor of 4

times from 1.25% to 5.0% during the 12 months). UK inflation was

more persistent and elevated than inflation in the US and

Continental Europe, but the UK economy narrowly avoided a

recession.

The UK stock market produced a total return of 7.9%, as measured

by the FTSE All-Share Index. Large companies outperformed, with the

FTSE 100 Index (comprising the largest UK listed companies)

returning 9.2% helped by its heavy weighting in oil companies and

banks. Oil company shares outperformed despite the oil price moving

down over the 12 months. Banks benefited from the positive effect

of rising interest rates on their net interest margins while

impairments remained at a low level. The FTSE 250 Index of

medium-sized companies and the FTSE SmallCap Index underperformed,

with respective returns of 1.9% and 1.2%, weighed down by their

greater bias towards UK domestic cyclicals.

Performance

Earnings and Dividends

City of London's revenue earnings per share declined by 2.8% to

20.14p. This compares with an increase in revenue earnings per

share of 21.2% in the previous year, when we benefited from large

dividends from our investments in mining companies. Special

dividends, accounted as income, declined by GBP3.8 million to

GBP2.5 million, reflecting the non-recurrence of these special

dividends from Anglo American, BHP and Rio Tinto. Elsewhere in the

portfolio, there was significant dividend growth from oil companies

and banks, continuing the recovery from the dividend cuts and

suspensions during the pandemic.

Although our dividend increase was considerably lower than

inflation over the 12 months, City of London has increased its

dividend by 40.6% over the last 10 years compared with a cumulative

increase in UK CPI inflation of 33.5%. The Board fully understands

the importance of growing the dividend in real terms through the

economic cycle.

Expenses remained under tight control, with our ongoing charge

of 0.37% being very competitive when compared with other actively

managed funds. Our revenue reserve increased by GBP0.7 million to

GBP44.3 million, but revenue reserves per share declined by 0.6p to

8.9p due to the increase in the number of shares in issue. The

Board considers that maintaining a revenue reserve surplus is

important, particularly given the varied timing of dividend

receipts throughout the year from investee companies and the

experience during the pandemic when, in response to sudden dividend

cuts and suspensions, it was necessary to draw on revenue reserves

to cover dividends paid to shareholders. It should be noted that

the capital reserve arising from capital gains on investments sold,

which could help fund dividend payments, rose by GBP18.0 million to

GBP344.6 million.

NAV Total Return

City of London's NAV total return of 4.5% was 3.4 percentage

points behind the FTSE All-Share Index. Gearing contributed

positively by 1.1 percentage points due to the decline in fair

value of our secured debt. The GBP30 million 2.67% secured notes

maturing in 2046 and the GBP50 million 2.94% secured notes maturing

in 2049 provide low-cost debt financing over the next quarter of a

century for investment in equities.

Stock selection detracted by 4.3 percentage points. The biggest

stock detractor was Direct Line Insurance followed by Persimmon,

the housebuilder. At a sector level, our underweight position in

travel & leisure was the biggest detractor and not holding

Flutter Entertainment, the betting company, the third biggest stock

detractor. The stake in Verizon Communications, the US

telecommunications provider, was also a notable stock detractor. On

a more positive note, 3i, the investor in private companies, was

the biggest stock contributor, followed by Munich Re, the

reinsurer.

City of London's NAV total return was behind the FTSE All-Share

Index over 1 year but, as mentioned in the introduction, ahead over

3, 5 and 10 years. Against the AIC UK Equity Income sector average,

City of London was behind over 1 and 10 years but ahead over 3 and

5 years. Against the IA UK Equity Income OEIC sector average, City

of London was ahead over 1, 3, 5 and 10 years.

Share Issues

City of London's ordinary shares have again been in strong

demand during the year and continued to trade at a premium. 38

million shares were issued at a premium to NAV for proceeds of

GBP153.3 million. Issuing shares at a premium enhances NAV and

spreads costs across a larger asset base. Over the past ten years,

City of London has issued 240 million shares at a premium to NAV,

increasing our share capital by 93%.

Environmental, Social and Governance

The Fund Manager and Deputy Fund Manager give careful

consideration to environmental, social and governance ("ESG")

related risks and opportunities when selecting stocks for the

portfolio. An analysis by MSCI, a company widely used in ESG

analytics, shows that City of London's portfolio continues to rate

slightly better for ESG risks compared with the FTSE All-Share

Index. ESG matters are reported on at each Board meeting, including

how shareholdings have been voted on resolutions at investee

company meetings. Please see the Annual Report for more details of

the analysis by MSCI and a description of how ESG considerations

feature in the investment decision making process.

Annual General Meeting

The 2023 Annual General Meeting ("AGM") will be held at the

offices of Janus Henderson, 201 Bishopsgate, London EC2M 3AE on

Tuesday, 31 October 2023 at 2.30pm. The meeting will include a

presentation by our Fund Manager, Job Curtis, and Deputy Fund

Manager, David Smith. Any shareholder who is unable to travel is

encouraged to join virtually by Zoom, the conference software

provider. There will, as usual, be live voting for those physically

present at the AGM but we cannot offer live voting via Zoom because

of technical restrictions. We therefore request all shareholders,

and particularly those who cannot attend physically, to submit

their votes by proxy to ensure their vote counts at the AGM.

Outlook

Over two-thirds of revenues earned by the companies in City of

London's portfolio comes from overseas. Whilst this diversification

is helpful given the relative economic weakness of the UK,

prospects for the global economy remain very uncertain. The war in

Ukraine has no end in sight, there is continuing tension with

China, the outcome of the increasingly fractious US election

campaign remains in doubt and recent climatic events across the

world have demonstrated the severe risks of climate change.

A further uncertainty arises from the coordinated actions by

central banks to use the levers of monetary policy, and most

directly higher interest rates, to curb inflation. The implications

of this will take some time to show their effect, but it is already

clear that a return to the cheap lending rates that have prevailed

for the last 15 years will not recur. Households will experience a

significant increase in interest costs as their fixed rate

mortgages are rolled over, as will businesses when their existing

debt matures. Over time, although the rate of inflation should

continue to fall as increases in energy prices drop out of the

annual calculation, this will affect the behaviour of consumers,

with consequences for corporate profits and investment.

UK listed shares in general continue to trade at lower

valuations relative to comparable businesses overseas. The reasons

for this include continuing investor scepticism concerning the

benefits of Brexit, the preponderance of "value" stocks (such as

banks and energy companies) relative to "growth" stocks (such as

technology including AI), the lack of domestic support because many

UK investment institutions favour fixed interest in their asset

allocations and the prospect of a more interventionist Labour

government. These lower comparable valuations, however, offer

potential rewards for City of London as both private equity firms

and overseas businesses take advantage of opportunities to use the

UK's open markets to secure attractive acquisitions. It remains the

case that UK equities offer compelling dividend yields relative to

the main alternative equity markets and, on this basis, UK

investors can reasonably take the view that they are being "paid to

hold on" until valuations improve.

City of London has grown its dividend for 57 years during

periods of high and low inflation and, at times, political

instability in the UK and overseas. Our portfolio has, at its core,

good quality and cash generative companies that are well placed to

deliver reliable and competitive returns.

Sir Laurie Magnus CBE

Chairman

19 September 2023

FUND MANAGER'S REPORT

Investment Background

The UK equity market, as measured by the FTSE All-Share Index,

traded in a relatively narrow range during the 12-month period and

produced a total return of 7.9%. Economic growth was better than

some had feared and the economy avoided recession. UK CPI inflation

reached a 40-year high of 11.1% in October 2022. The monetary and

fiscal stimulus and supply chain disruptions during the pandemic

followed by shocks to oil and other commodity prices from the

Russian invasion of Ukraine were the initial causes of inflation.

The tight labour market and accelerating wage increases kept

inflation at elevated levels. The Bank of England increased its

base rate eight times, from 1.25% to 5.0%. In the US, the Federal

Reserve also increased interest rates in response to inflation as

did the European Central Bank.

From June 2022, the oil price declined. Despite the Ukraine war,

Russian supply proved more resilient than expected to countries

such as China and India, who took advantage of discounted Russian

oil. Concerns about shortages gave way to worries over demand

weakening as global economic growth slowed. Europe was able to

substitute Russian natural gas with imports of liquified natural

gas from the US and the Middle East.

Sterling fell to an exchange rate of 1.07 against the US dollar

during the short-lived Premiership of Liz Truss, when unfunded tax

cuts were proposed. By the end of June 2023, sterling had recovered

to 1.27, achieving a 5% gain against the US dollar over the 12

months. Against the euro, sterling made a small gain of 0.9%.

Against a backdrop of inflation and the Bank of England raising

the base rate to 5%, gilt yields also rose. By the end of June, the

10-year gilt yield was 4.4%, around the same as the peak reached

during the Truss Premiership, and above the FTSE All-Share dividend

yield of 3.7%. In recent years, during the period of exceptionally

low interest rates, the Company was able to fix cheap rates of

borrowing for long periods through issuing the following secured

notes: GBP35 million 4.53% 2029, GBP30 million 2.67% 2046 and GBP50

million 2.94% 2049. These borrowings remained fully invested in

equities throughout the year but the HSBC facility, which is priced

off the base rate, was only modestly drawn down. Gearing, which was

7.1% at the start of the 12 months, declined slightly to 6.2% at

the end of June 2023.

Performance Review

Estimated performance attribution (relative to FTSE All-Share

Index total return)

2023 2022

% %

================= ====== ======

Stock selection -4.32 +4.69

Gearing +1.13 +1.53

Expenses -0.37 -0.37

Share issues +0.18 +0.04

----------------- ------ ------

Total -3.38 +5.89

----------------- ------ ------

Source: Janus Henderson

The Company produced a net asset value total return of 4.51%,

which was 3.38 percentage points behind the FTSE All-Share total

return of 7.89%. Gearing contributed to performance by 1.13

percentage points as the fair value of our secured notes declined.

Stock selection detracted by 4.32 percentage points. The biggest

stock detractor was Direct Line Insurance, which suffered from

premium income not keeping pace with the rising cost of claims. In

contrast, Munich Re, the reinsurer, was the second biggest stock

contributor, benefiting from strong rate increases for

reinsurance.

Persimmon, the house builder, was the second biggest stock

detractor, as its share price reacted to the slowdown in the UK

housing market. In the building materials, merchants and equipment

rental sectors, not holding CRH and Ashtead were notable

detractors, partly compensated by our stakes in Holcim and

Ferguson, which were among the best contributors.

Other notable stock detractors were not holding, in the travel

& leisure sector, Flutter Entertainment, the betting company,

and Compass, the contract caterer. In contrast, 3i, the investor in

private companies, was the biggest stock contributor, driven by

outstanding growth from its investment in Action, the European

discount retailer.

The underperformance of 3.38 percentage points in 2023

contrasted with the outperformance of 5.89 percentage points in

2022.

It was a relatively good year for large companies, with the FTSE

100 Index of the largest companies returning 9.2% compared with

1.9% for the FTSE 250 Index of medium-sized companies and 1.2% for

the FTSE SmallCap Index. The FTSE 100 Index was helped by the

outperformance of the banks and oil sectors, where the Company was

underweight.

Lower yielding shares also had a good year, as the chart in the

Annual Report shows. It compares the performance of the FTSE 350

Higher Yield Index (the higher dividend yielding half of the

largest 350 shares listed in the UK) with the FTSE 350 Lower Yield

Index (the lower dividend yielding half of the largest 350 shares

listed in the UK). Telecommunications service providers was a

notably underperforming higher yielding sector. Although the

portfolio avoided the underperformance of BT, Verizon

Communications of the US was a notable stock detractor.

Distribution of the portfolio as at 30 June 2023

% of the portfolio

-------------------------------------------- -------------------

Large UK-listed companies (constituents of

the FTSE 100 Index) 75%

Medium-sized and small UK-listed companies 10%

Overseas-listed companies 15%

Source: Refinitiv Datastream, 30 June 2023

Over the 12 months, the proportion of the portfolio invested in

companies with their prime listing overseas declined from 17% to

15%, with profits taken in Microsoft (of the US) and BHP (of

Australia), after exceptional long-term performance and with the

proceeds reinvested in shares that appeared to offer better value

in the UK equity market. The proportion invested in large,

UK-listed companies (included in the FTSE 100 Index) rose by four

percentage points to 75%. The proportion invested in medium-sized

and small companies fell by two percentage points to 10%, partly

reflecting the takeover of Brewin Dolphin and the promotion to the

FTSE 100 of Beazley and IMI.

Portfolio Changes

Six new holdings were bought over the 12 months. In the mining

sector, Glencore was purchased, financed by the sale of BHP.

Glencore is well placed in metals which are needed for the

transition to cleaner energy, such as copper, which accounts for

37% of profits. It is planning to run down its coal assets for cash

with the aim of the group to be net carbon zero by 2050. It also

has a world leading commodity trading business, accounting for 20%

of profits. On the other hand, 55% of BHP's profits comes from iron

ore. The iron ore price ended the 12-month period at a similar

level to where it had started.

The iron ore price is heavily dependent for demand from Chinese

steelmakers, where the outlook is uncertain. BHP had also rerated

against the UK-listed mining companies after its move from being

50% listed in London to 100% in Australia. In addition to Glencore,

Rio Tinto and Anglo American continue to be held in the

portfolio.

Three new holdings of UK-listed industrial companies were

purchased. Although having cyclical elements to their businesses,

the three companies appeared modestly rated relative to their

prospects and leadership positions. DS Smith is a provider of

corrugated packaging, which is supported by recycling and paper

making operations. Its packaging is largely made from recycled

materials and is used for fast moving consumer goods and industrial

products. It has a strong track record of innovation in packaging.

Its sales are predominantly in Europe (including the UK) where it

is the second largest corrugated packaging producer.

Morgan Advanced Materials, where a new stake was also bought, is

a global leader in making ceramic and other materials that need

precision in highly challenging operating environments, such as

extreme temperatures, for a range of industries. Its business is

backed by strong technology and is well spread geographically with

40% of sales in North America, 30% Asia Pacific and 28% Europe

(including UK). The third industrial stock bought was Vesuvius. Its

business is split into two divisions: firstly, products and systems

which regulate and protect the flow of molten steel during steel

manufacturing; and secondly, consumable products for the foundry

casting process. Vesuvius is the global leader in these businesses

with revenues split 31% Americas, 39% EMEA (Europe, the Middle East

and Africa) and 30% Asia Pacific.

Financial conditions were supportive for the banks over the 12

months with rising interest rates helpful for the net interest

margins they earn, the difference between the rate at which they

pay depositors and charge borrowers. A new holding was bought in

NatWest on a discount to its tangible book value despite its

guidance of 14-16% return on tangible equity for 2023. Overall,

banks delivered strong dividend growth over the year and additions

were made to our stakes in HSBC, where profits predominantly come

from Asia Pacific, and Lloyds Banking. The position in Barclays was

maintained.

A new holding was bought in Round Hill Music Royalties Fund

("RHM"), an investment company, which owns 51 catalogues with some

120,000 songs. 60% of RHM's income comes from publishing rights,

which refers to the actual musical composition i.e. the notes,

melodies and lyrics. 31% of income comes from music rights, which

refers to the sound recording of the written song or piece of

music. RHM is a beneficiary of the growth of streaming through

platforms, such as Spotify. RHM has an "evergreen" portfolio with

71% of its songs pre-2000. RHM was purchased at a deep discount to

its net asset value.

Disposals were made of the holdings in two companies that have

been very successful investments but where share price valuations

seemed expensive relative to prospects and other opportunities.

Microsoft, which entered the portfolio in 2011, has benefited in

recent years from its leading position in cloud computing. During

2023, investors became very excited about its prospects in

artificial intelligence leading to a further rerating of its

shares. At the time of the final sale of the portfolio's holding in

Microsoft, its market capitalisation was almost equal to all of the

stocks in the FTSE 100 Index combined.

Chemical company, Croda, had been held in the portfolio for over

two decades, during which time its share price rating had been

transformed from a high to low dividend yield as it delivered

consistent growth from products made from natural oils. However, it

is not immune from cyclical pressures and had to downgrade profit

expectations in the first half of 2023. The holding was sold given

the high share price valuation. Also in the chemical sector,

Synthomer was sold after a profits warning and the suspension of

its dividend.

Private client wealth manager, Brewin Dolphin, was sold after

its takeover by Royal Bank of Canada. Part of the proceeds were

invested in additions to the stake in Rathbones, another leading

private client wealth manager, who subsequently announced a merger

with Investec Wealth & Investment. The holding in the

non-voting shares of Schroders, the asset manager, was enfranchised

on attractive terms, converting into voting shares.

Portfolio Outlook

Two oil and gas companies are in the top ten investments: Shell,

the largest investment, and BP, ninth largest. In addition,

TotalEnergies and Woodside Energy are also held in the portfolio

for a total oil and gas sector exposure of 8.7% compared with 10.7%

for the FTSE All-Share Index. The companies owned have a relatively

low cost of production, providing some security for their

dividends. Oil and gas currently play a crucial role in the global

economy and although the transition to a clean energy future will

continue, our investee companies are preparing for it with

significant capital investment being spent on the development of

renewable and low carbon energy sources.

Consumer staples companies, which make and sell everyday

products, constitute 19.2% of the portfolio and include in the top

ten investments: Unilever (fourth largest), British American

Tobacco (fifth largest), Diageo (seventh largest) and Imperial

Brands (10th largest). These companies form a sound core to the

portfolio as their dividends are relatively dependable given

consistent profitability and the global spread of their operations.

Unilever has a significant presence in both developed and emerging

markets with its beauty, personal care, food and homecare products.

British American Tobacco ("BAT") and Imperial Brands are strong

cash generators and good dividend payers. Of the two companies, BAT

is more advanced in pivoting its operations towards less harmful

nicotine products than cigarettes. Diageo is the world's largest

spirits company (outside China) and the largest in the US, as well

as owning Guinness beer. Its leading spirits brands include Johnnie

Walker (Scotch whisky), Tanqueray (gin) and Don Julio

(tequila).

HSBC is the third largest investment in the portfolio and the

largest bank shareholding. The next largest bank holding is Lloyds

Banking, which is twentieth. 8.1% of the portfolio is held in the

banks sector, which compares with the FTSE All-Share weighting of

9.4%. Overall, the profitability of banks should continue to

benefit from the higher level of interest rates and its effect on

their net interest margins. Share price valuations for the banks

are attractive compared with consensus expectations of their

profitability. But banks always remain vulnerable to economic

shocks although their capital ratios are much stronger than they

were before the global financial crisis of 2007 to 2009.

AstraZeneca is the eighth largest investment in the portfolio

and the largest pharmaceutical sector holding, but the position is

underweight relative to its FTSE All-Share weighting. AstraZeneca's

share price has been a strong performer in recent years, reflecting

its success in discovering new medicines, especially in the

immunotherapy area of cancer. Unusually for a UK listed company, it

is relatively highly rated compared with overseas listed peers.

8.6% of the portfolio is invested in healthcare, which is a

defensive area of the economy, with spending well protected given

its importance to individuals and usually backed by government

spending or private insurance. The overseas listed pharmaceutical

stocks held in the portfolio (Johnson & Johnson, Merck,

Novartis and Sanofi) have produced better dividend growth than the

UK listed holdings (AstraZeneca and GlaxoSmithKline).

The outlook for the portfolio's second largest holding, BAE

Systems, remains positive. Defence spending has moved on from the

post-Cold War "peace dividend" period to an era when many countries

want to spend more on defence to give protection against external

threats. In addition to its core markets in the US and UK, BAE has

significant opportunities in many other countries and areas, such

as Australia, Japan, Eastern Europe and the Middle East. RELX, the

sixth largest holding in the portfolio, continues to produce

consistent growth from providing essential information and

analytics for businesses, professionals and scientists. In

addition, it is benefiting from the recovery of its business

exhibitions division.

There are significant investments in life assurers Phoenix (14th

largest investment) and Legal & General (18th largest) and fund

manager and life assurer M&G (15th largest). These companies

offer, in our view, highly attractive dividend yields and should

have opportunities for new business growth in bulk annuities given

the levels of interest rates and bond yields. National Grid and

SSE, which are respectively the 16th and 17th largest investments

in the portfolio, will grow their asset bases significantly given

the global economy's need to decarbonise and generate more

electricity from renewable sources going forward. Both companies

own electricity transmission and distribution networks and SSE is

the UK's leading generator of renewable energy, through wind and

hydro.

Revenue exposure

% of the portfolio

---------------------------------- -------------------

United Kingdom 31

North America 24

Europe ex UK 16

Emerging Markets (Other) 12

Emerging Markets (Asia) 11

Developed Markets (Asia/Pacific) 3

Japan 3

Source: Refinitiv Datastream, 30 June 2023

The portfolio remains well diversified with a bias towards

large, international companies and shares with above average

dividend yield. 69% of investee companies' revenues comes from

overseas, which is slightly up from a year ago when it was 67%. The

aim is to be invested in those companies that can support their

dividends through profits and cash generation and invest enough for

growth. The quality of the companies in the portfolio, some leading

global businesses and others with strong market positions in the

UK, gives confidence for the future.

Job Curtis

Fund Manager

David Smith

Deputy Fund Manager

19 September 2023

FORTY LARGEST INVESTMENTS AS AT 30 JUNE 2023

The 40 largest investments, representing 78.22% of the portfolio, are

listed below.

Market

value Portfolio

Position Company Sector GBP'000 %

--------- ------------------ ------------------------------- -------- ----------

1 Shell Oil, Gas and Coal 78,731 3.87

2 BAE Systems Aerospace and Defence 71,843 3.53

3 HSBC Banks 69,941 3.44

Personal Care, Drug

4 Unilever and Grocery Stores 68,019 3.34

British American

5 Tobacco Tobacco 67,795 3.33

6 RELX Media 66,830 3.28

7 Diageo Beverages 66,219 3.26

Pharmaceuticals and

8 AstraZeneca Biotechnology 60,327 2.97

9 BP Oil, Gas and Coal 57,752 2.84

10 Imperial Brands Tobacco 49,967 2.46

--------- ------------------ ------------------------------- -------- ----------

Top 10 657,424 32.32

------------------------------- ------------------------------------------- ----------

Investment Banking and

11 3i Brokerage Services 49,623 2.44

Personal Care, Drug

12 Tesco and Grocery Stores 49,183 2.42

Industrial Metals and

13 Rio Tinto Mining 46,360 2.28

14 Phoenix Life Insurance 46,001 2.26

Investment Banking and

15 M&G Brokerage Services 45,936 2.25

16 National Grid Gas, Water and Multi-utilities 45,552 2.24

17 SSE Electricity 44,552 2.19

18 Legal & General Life Insurance 38,624 1.90

St. James's Investment Banking and

19 Place Brokerage Services 38,062 1.87

20 Lloyds Banking Banks 36,616 1.80

--------- ------------------ ------------------------------- -------- ----------

Top 20 1,097,933 53.97

------------------------------- ------------------------------------------- ----------

Industrial Metals and

21 Glencore Mining 35,560 1.75

Investment Banking and

22 Schroders Brokerage Services 32,353 1.59

Pharmaceuticals and

23 GlaxoSmithKline Biotechnology 31,831 1.56

Personal Care, Drug

24 Reckitt Benckiser and Grocery Stores 29,560 1.45

25 Nestlé Food Producers 28,375 1.39

Investment Banking and

26 IG Brokerage Services 28,007 1.38

27 TotalEnergies Oil, Gas and Coal 27,058 1.33

28 Severn Trent Gas, Water and Multi-utilities 26,943 1.32

Real Estate Investment

29 Land Securities Trusts 26,547 1.30

30 NatWest Banks 25,755 1.27

--------- ------------------ ------------------------------- -------- ----------

Top 30 1,389,922 68.31

------------------------------- ------------------------------------------- ----------

Pharmaceuticals and

31 Merck Biotechnology 24,493 1.20

32 Barclays Banks 24,157 1.19

Industrial Metals and

33 Anglo American Mining 23,112 1.14

34 Munich Re Non-life Insurance 21,230 1.04

Pharmaceuticals and

35 Novartis Biotechnology 20,808 1.02

36 Holcim Construction and Materials 19,312 0.95

37 Swire Pacific General Industrials 18,067 0.89

38 Ferguson Industrial Support Services 17,994 0.88

Investment Banking and

39 Rathbones Brokerage Services 16,740 0.82

Software and Computer

40 Sage Services 15,814 0.78

--------- ------------------ ------------------------------- -------- ----------

Top 40 1,591,649 78.22

------------------------------- ------------------------------------------- ----------

Convertibles and all classes of equity in any one company are treated

as one investment.

PRINCIPAL RISKS

The Board, with the assistance of the Manager, has carried out a

robust assessment of the principal risks and uncertainties facing

the Company, including those that would threaten its business

model, future performance, solvency or liquidity and

reputation.

The Board regularly considers the principal risks facing the

Company and has drawn up a register of these risks. The Board has

also put in place a schedule of investment limits and restrictions,

appropriate to the Company's investment objective and policy. The

principal risks which have been identified and the steps taken by

the Board to mitigate these are set out in the table below. The

principal financial risks are detailed in note 16 to the financial

statements in the Annual Report. Details of how the Board monitors

the services provided by Janus Henderson and its other suppliers,

and the key elements designed to provide effective internal

control, are explained further in the internal controls section of

the Corporate Governance Report in the Annual Report.

Principal risks Trend Mitigating measure

Geopolitical The Fund Managers keep the global

Heightened political tensions political and economic picture under

in and among a number of countries review as part of the investment

around the world have potential process.

impacts, including increasing

market volatility, risks to

cyber security and on the supply

of commodities, including oil

and gas, and manufacturing components.

------ --------------------------------------------

Global pandemics The Fund Managers maintain close

The impact that a global pandemic oversight of the Company's portfolio,

or some future major health and in particular the dividend strategies

crisis could have on the Company's of investee companies. Regular stress

investments and its direct and testing of the revenue account under

indirect effects, including different scenarios for dividends

the effect on the global economy. is carried out.

The Board also maintains close oversight

of the third-party service providers

which assist in the administration

of the Company.

------ --------------------------------------------

Portfolio and market price The Board reviews the portfolio at

Although the Company invests the seven Board meetings held each

almost entirely in securities year and receives regular reports

that are listed on recognised from the Company's brokers. A detailed

markets, share prices may move liquidity report is considered on

rapidly. The companies in which a regular basis.

investments are made may operate

unsuccessfully, or fail entirely. The Fund Managers closely monitor

A fall in the market value of the portfolio between meetings and

the Company's portfolio would mitigate this risk through diversification

have an adverse effect on equity of investments. The Fund Managers

shareholders' funds. periodically present the Company's

investment strategy in respect of

The wider consequences of Brexit current market conditions. Performance

on employment and regulation relative to the FTSE All-Share Index,

together with resultant, adverse other UK equity income trusts and

trade negotiations may impact IA UK Equity Income OEICs is also

the Company's investments. monitored.

The majority of the Company's investments

are multi-national companies with

operations in local markets.

------ --------------------------------------------

Dividend income The Board reviews income forecasts

A reduction in dividend income at each meeting. The Company has

could adversely affect the Company's revenue reserves of GBP44.3 million

dividend record. (before payment of the fourth interim

dividend) and distributable capital

reserves of GBP344.6 million.

------ --------------------------------------------

Investment activity, gearing At each meeting, the Board reviews

and performance investment performance, the level

An inappropriate investment of gearing, the level of premium/discount,

strategy (for example, in terms income forecasts and a schedule of

of asset allocation or the level expenses. It also has an annual meeting

of gearing) may result in underperformance focused on strategy at which these

against the Company's benchmark. matters are considered in more depth.

------ --------------------------------------------

Tax and regulatory The Manager provides its services,

Changes in the tax and regulatory inter alia, through suitably qualified

environment could adversely professionals and the Board receives

affect the Company's financial internal control reports produced

performance, including the return by the Manager on a quarterly basis,

on equity. which confirm legal and regulatory

compliance. The Fund Managers also

A breach of Section 1158/9 of consider tax and regulatory change

the Corporation Tax Act 2010 in their monitoring of the Company's

as amended could lead to a loss underlying investments.

of investment trust status,

resulting in capital gains realised

within the portfolio being subject

to corporation tax. A breach

of the Listing Rules could result

in suspension of the Company's

shares, while a breach of the

Companies Act 2006 could lead

to criminal proceedings, or

financial or reputational damage.

The Company must also ensure

compliance with the Listing

Rules of the New Zealand Stock

Exchange.

------ --------------------------------------------

Operational The Board monitors the services provided

Disruption to, or failure of, by the Manager and its other suppliers

the Manager's or its Administrator's and receives reports on the key elements

(BNP Paribas) accounting, dealing in place to provide effective internal

or payment systems or the Depositary's control.

records could prevent the accurate

reporting and monitoring of Cyber security is closely monitored

the Company's financial position. and the Audit Committee receives

Cyber crime could lead to loss regular presentations from Janus

of confidential data. The Company Henderson's Chief Information Security

is also exposed to the operational Officer.

risk that one or more of its

suppliers may not provide the The Board considers the loss of the

required level of service. Fund Manager as a risk but this is

mitigated by the experience of the

team at Janus Henderson as detailed

in the Annual Report.

------ --------------------------------------------

Emerging risks

In addition to the principal risks facing the Company, the Board

also regularly considers emerging risks, which are defined as

potential trends, sudden events or changing risks which are

characterised by a high degree of uncertainty in terms of the

probability of them happening and the possible effects on the

Company. Should an emerging risk become sufficiently clear, it may

be moved to a significant risk.

BORROWINGS

The Company has a borrowing facility of GBP120.0 million (2022:

GBP120.0 million) with HSBC Bank plc, of which GBP9.0 million was

drawn at the year end (2022: GBP16.3 million).

The Company has GBP114.2 million (2022: GBP114.2 million) (par

value) of secured notes in issue (fair value of the loan notes:

GBP83.3 million (2022: GBP101.1 million)).

The level of gearing at 30 June 2023 was 6.2% of net asset value

with debt at par (2022: 7.1%) and 4.5% with debt at fair value

(2022: 6.4%).

VIABILITY STATEMENT

The AIC Code of Corporate Governance includes a requirement for

the Board to assess the future prospects for the Company, and to

report on the assessment within the Annual Report.

The Board considers that certain characteristics of the

Company's business model and strategy are relevant to this

assessment:

-- The Board seeks to deliver long-term performance by the Company.

-- The Company's investment objective, strategy and policy, which are

subject to regular Board monitoring, mean that the Company is invested

mainly in readily realisable, UK-listed securities and that the level

of borrowings is restricted.

-- The Company is a closed end investment company and therefore does

not suffer from the liquidity issues arising from unexpected redemptions.

-- The Company has an ongoing charge of 0.37%, which is lower than other

comparable investment trusts.

Also relevant were a number of aspects of the Company's

operational agreements:

-- The Company retains title to all assets held by the Custodian under

the terms of formal agreements with the Custodian and Depositary.

-- Long-term borrowing is in place, being 4.53% secured notes 2029,

2.94% secured notes 2049 and 2.67% secured notes 2046 which are subject

to formal agreements, including financial covenants with which the

Company complied in full during the year. The value of long-term

borrowing is relatively small in comparison to the value of net assets,

being 6.0%.

-- Revenue and expenditure forecasts are reviewed by the Directors at

each Board meeting. This includes stress testing of the forecast

under different scenarios.

-- Cash is held with approved banks.

Three model scenarios are considered which evaluate the impact

on revenue reserves. These range from a worst case scenario which

includes low consensus estimates, significant dividend cuts of up

to 50% in specific sectors and specific investee companies, to a

best case scenario with high consensus estimates, no dividend cuts

in any specific sector and limited dividend cuts in specific

investee companies. Increasing dividend payments to shareholders

could continue under all three scenarios whether through revenue,

or supported by distributable capital reserves. None of the results

from the three scenarios would therefore threaten the viability of

the Company.

Covenant limits are tested to ascertain the level that net

assets would need to fall by to breach any covenant conditions. Net

assets would need to fall by amounts in excess of GBP1.5 billion to

breach covenants, with all other factors remaining constant. The

Board considers this to be highly unlikely and therefore does not

threaten the viability of the Company.

In addition, the Directors carried out a robust assessment of

the principal risks and uncertainties which could threaten the

Company's business model, including future performance, liquidity

and solvency and considered emerging risks that could have a future

impact on the Company.

The principal risks identified as relevant to the viability

assessment were those relating to investment portfolio performance

and its effect on the net asset value, share price and dividends,

and threats to security over the Company's assets. The Board took

into account the liquidity of the Company's portfolio, the

existence of the long-term fixed rate borrowings, the effects of

any significant future falls in investment values and income

receipts on the ability to repay and renegotiate borrowings, grow

dividend payments and retain investors and the potential need for

share buybacks to maintain a narrow share price discount.

The Directors assess viability over five-year rolling periods,

taking account of foreseeable severe but plausible scenarios. In

coming to this conclusion, the Directors have considered the

aftermath of the Covid-19 pandemic and heightened macroeconomic

uncertainty following Russia's invasion of Ukraine, in particular

the impact on income and the Company's ability to meet its

investment objective. The Directors do not believe that they will

have a long-term impact on the viability of the Company and its

ability to continue in operation, notwithstanding the short-term

uncertainty these events have caused in the markets and specific

short-term issues such as energy, supply chain disruption,

inflation and labour shortages.

The Directors believe that a rolling five-year period best

balances the Company's long-term objective, its financial

flexibility and scope with the difficulty in forecasting economic

conditions affecting the Company and its shareholders.

Based on their assessment, and in the context of the Company's

business model, strategy and operational arrangements set out

above, the Directors have a reasonable expectation that the Company

will be able to continue in operation and meet its liabilities as

they fall due over the five-year period to June 2028.

RELATED PARTY TRANSACTIONS

The Company's transactions with related parties in the year were

with the Directors and the Manager. There were no material

transactions between the Company and its Directors during the year

and the only amounts paid to them were in respect of expenses and

remuneration for which there were no outstanding amounts payable at

the year end. Directors' shareholdings are disclosed in the Annual

Report.

In relation to the provision of services by the Manager, other

than fees payable by the Company in the ordinary course of business

and the provision of marketing services, there were no material

transactions with the Manager affecting the financial position of

the Company during the year under review. More details on

transactions with the Manager, including amounts outstanding at the

year end, are given in the Annual Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

Each of the Directors, who are listed below, confirms that, to

the best of his or her knowledge:

-- the Company's financial statements, which have been prepared in accordance

with UK Accounting Standards on a going concern basis, give a true

and fair view of the assets, liabilities, financial position and

return of the Company; and

-- the Strategic Report and financial statements include a fair review

of the development and performance of the business and the position

of the Company, together with a description of the principal risks

and uncertainties that it faces.

On behalf of the Board

Sir Laurie Magnus CBE

Chairman

19 September 2023

INCOME STATEMENT

Year ended 30 June 2023 Year ended 30 June 2022

Revenue Capital Total Revenue Capital Total

return return return return return return

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----- ------------------------- -------- -------- --------------- -------- ---------------- ---------------

(Losses)/gains on

investments held

at fair value through

profit or loss - (27,111) (27,111) - 13,394 13,394

Income from investments

held at fair value

through profit or

2 loss 101,747 - 101,747 98,028 - 98,028

Other interest receivable

3 and similar income 224 - 224 190 - 190

-------- -------- --------------- -------- ---------------- ---------------

Gross revenue and

capital (losses)/gains 101,971 (27,111) 74,860 98,218 13,394 111,612

Management fee (1,844) (4,304) (6,148) (1,746) (4,073) (5,819)

Other administrative

expenses (860) - (860) (774) - (774)

-------- -------- --------------- -------- ---------------- ---------------

Net return/(loss)

before finance costs

and taxation 99,267 (31,415) 67,852 95,698 9,321 105,019

Finance costs (1,621) (3,416) (5,037) (1,474) (3,075) (4,549)

-------- -------- --------------- -------- ---------------- ---------------

Net return/(loss)

before taxation 97,646 (34,831) 62,815 94,224 6,246 100,470

Taxation (1,406) - (1,406) (1,236) - (1,236)

-------- -------- --------------- -------- ---------------- ---------------

Net return/(loss)

after taxation 96,240 (34,831) 61,409 92,988 6,246 99,234

-------- -------- --------------- -------- ---------------- ---------------

Return/(loss) per

ordinary share basic

5 and diluted 20.14p (7.29p) 12.85p 20.72p 1.39p 22.11p

-------- -------- --------------- -------- ---------------- ---------------

The total columns of this statement represent the Company's

Income Statement. The revenue return and capital return columns are

supplementary to this and are prepared under guidance published by

the Association of Investment Companies. All revenue and capital

items in the above statement derive from continuing operations. The

Company has no recognised gains or losses other than those

recognised in the Income Statement.

STATEMENT OF CHANGES IN EQUITY

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

Notes 30 June 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2022 114,910 909,143 2,707 726,294 43,603 1,796,657

Net (loss)/return

after taxation - - - (34,831) 96,240 61,409

Issue of 37,715,000

new ordinary

8 shares 9,429 143,918 - - - 153,347

7 Dividends paid - - - - (95,521) (95,521)

---------- ---------- ------------ ---------- --------- ----------

At 30 June

2023 124,339 1,053,061 2,707 691,463 44,322 1,915,892

---------- ---------- ------------ ---------- --------- ----------

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

Notes 30 June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2021 111,406 855,597 2,707 720,048 37,567 1,727,325

Net return

after taxation - - - 6,246 92,988 99,234

Issue of 14,015,000

new ordinary

8 shares 3,504 53,546 - - - 57,050

7 Dividends paid - - - - (86,952) (86,952)

---------- ---------- ------------ ---------- --------- ----------

At 30 June

2022 114,910 909,143 2,707 726,294 43,603 1,796,657

---------- ---------- ------------ ---------- --------- ----------

STATEMENT OF FINANCIAL POSITION

30 June

2023 30 June 2022

Notes GBP'000 GBP'000

-------- -------------------------------------------------------- ---------- ---------------

Fixed assets

Investments held at fair value through profit or loss

Listed at market value in the United Kingdom 1,734,695 1,642,199

Listed at market value overseas 299,605 281,071

Investment in subsidiary undertakings 347 347

---------- ---------------

2,034,647 1,923,617

---------- ---------------

Current assets

Debtors 10,823 11,451

10,823 11,451

Creditors: amounts falling due within one year (13,956) (22,835)

---------- ---------------

Net current liabilities (3,133) (11,384)

---------- ---------------

Total assets less current liabilities 2,031,514 1,912,233

Creditors: amounts falling due after more than one year (115,622) (115,576)

---------- ---------------

Net assets 1,915,892 1,796,657

---------- ---------------

Capital and reserves

8 Called up share capital 124,339 114,910

Share premium account 1,053,061 909,143

Capital redemption reserve 2,707 2,707

Other capital reserves 691,463 726,294

Revenue reserve 44,322 43,603

---------- ---------------

6 Total shareholders' funds 1,915,892 1,796,657

---------- ---------------

6 Net asset value per ordinary share - basic and diluted 385.22p 390.88p

---------- ---------------

NOTES TO THE FINANCIAL STATEMENTS

Accounting policies

1.

Basis of accounting

The Company is a registered investment company as defined in Section

833 of the Companies Act 2006 and is incorporated in the UK. It operates

in the UK and is registered at the address below.

The financial statements have been prepared in accordance with the

Companies Act 2006, FRS 102, the Financial Reporting Standard applicable

in the UK and Republic of Ireland, and with the Statement of Recommended

Practice: Financial Statements of Investment Trust Companies and Venture

Capital Trusts ("the SORP") issued in July 2022 by the Association

of Investment Companies.

The principal accounting policies applied in the presentation of these

financial statements are set out in the Annual Report. These policies

have been consistently applied to all the years presented.

As an investment fund the Company has the option, which it has taken,

not to present a cash flow statement. A cash flow statement is not

required when an investment fund meets all the following conditions:

substantially all of the entity's investments are highly liquid, substantially

all of the entity's investments are carried at market value, and the

entity provides a Statement of Changes in Equity. The Directors have

assessed that the Company meets all of these conditions.

The financial statements have been prepared under the historical cost

basis except for the measurement at fair value of investments. In

applying FRS 102, financial instruments have been accounted for in

accordance with Sections 11 and 12 of the standard. All of the Company's

operations are of a continuing nature.

The financial statements of the Company's three subsidiaries have

not been consolidated on the basis of immateriality and dormancy.

Consequently, the financial statements present information about the

Company as an individual entity. The Directors consider that the values

of the subsidiary undertakings are not less than the amounts at which

they are included in the financial statements.

The preparation of the Company's financial statements on occasion

requires the Directors to make judgements, estimates and assumptions

that affect the reported amounts in the primary financial statements

and the accompanying disclosures. These assumptions and estimates

could result in outcomes that require a material adjustment to the

carrying amount of assets or liabilities affected in the current and

future periods, depending on circumstance.

The decision to allocate special dividends as income or capital is

a judgement but not deemed to be material. The allocation of expenses

to income or capital is a judgement as well, but also is not deemed

to be material. The Directors do not believe that any accounting judgements

or estimates have been applied to this set of financial statements

that have a significant risk of causing a material adjustment to the

carrying amount of assets and liabilities within the next financial

year.

Going concern

The assets of the Company consist of securities that are readily realisable

and, accordingly, the Directors believe that the Company has adequate

resources to continue in operational existence for at least twelve

months from the date of approval of the financial statements. The

Directors have also considered the aftermath of the Covid-19 pandemic

and the risks arising from the wider ramifications of the conflict

between Russia and Ukraine, including cash flow forecasting, a review

of covenant compliance including the headroom above the most restrictive

covenants and an assessment of the liquidity of the portfolio. They

have concluded that the Company is able to meet its financial obligations,

including the repayment of the bank overdraft, as they fall due for

a period of at least twelve months from the date of approval of the

financial statements. Having assessed these factors, the principal

risks and other matters discussed in connection with the viability

statement, the Board has determined that it is appropriate for the

financial statements to be prepared on a going concern basis.

Income from investments held at fair value through profit or loss

2.

2023 2022

GBP'000 GBP'000

--------------------- ------------

UK dividends:

Listed - ordinary dividends 82,884 79,682

Listed - special dividends 1,949 5,702

--------------------- ------------

84,833 85,384

--------------------- ------------

Other dividends:

Dividend income - overseas investments 13,727 10,041

Dividend income - overseas special dividends 568 586

Dividend income - UK REIT 2,619 2,017

16,914 12,644

--------------------- ------------

Total 101,747 98,028

--------------------- ------------

3. Other interest receivable and similar income

2023 2022

GBP'000 GBP'000

--------------------- ------------

Stock lending revenue 224 190

--------------------- ------------

224 190

--------------------- ------------

At 30 June 2023, the total value of securities on loan by the Company

for stock lending purposes was GBP121,213,000 (2022: GBP177,048,000).

The maximum aggregate value of securities on loan at any one time

during the year ended 30 June 2023 was GBP285,320,000 (2022: GBP288,549,000).

The Company's agent holds collateral at 30 June 2023, with a value

of GBP133,180,000 (2022: GBP192,321,000) in respect of securities

on loan, the value of which is reviewed on a daily basis and comprises

CREST Delivery By Value ("DBVs") and Government Bonds with a market

value of 110% (2022: 109%) of the market value of any securities on

loan.

Management fee

4.

2023 2022

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ --------- ----------- -------- -------- -----------

Management fee 1,844 4,304 6,148 1,746 4,073 5,819

------------ --------- ----------- -------- -------- -----------

A summary of the terms of the Management Agreement is given in the

Annual Report. Details of apportionment between revenue and capital

can be found in the Annual Report.

Return/(loss) per ordinary share - basic and diluted

5.

The return per ordinary share is based on the net return attributable

to the ordinary shares of GBP61,409,000 (2022: gain of GBP99,234,000)

and on 477,932,402 ordinary shares (2022: 448,747,183), being the

weighted average number of ordinary shares in issue during the year.

The return per ordinary share is analysed between revenue and capital

as below:

2023 2022

GBP'000 GBP'000

-------------------------- -------------------------------

Net revenue return 96,240 92,988

Net capital (loss)/return (34,831) 6,246

-------------------------- -------------------------------

Net total return 61,409 99,234

-------------------------- -------------------------------

Weighted average number of

ordinary shares in issue during

the year 477,932,402 448,747,183

-------------------------- -------------------------------

2023 2022

Pence Pence

-------------------------- -------------------------------

Revenue return per ordinary

share 20.14 20.72

Capital (loss)/return per

ordinary share (7.29) 1.39

-------------------------- -------------------------------

Total return per ordinary

share 12.85 22.11

-------------------------- -------------------------------

The Company does not have any dilutive securities, therefore the basic

and diluted returns per share are the same.

6. Net asset value per ordinary share - basic and diluted

The net asset value per ordinary share is based on the net assets

attributable to the ordinary shares of GBP1,915,892,000 (2022: GBP1,796,657,000)

and on 497,354,868 (2022: 459,639,868) shares in issue on 30 June

2023.

An alternative net asset value per ordinary share can be calculated

by deducting from the total assets less current liabilities of the

Company the preference and preferred ordinary stocks and secured notes

at their market (or fair) values rather than at their par (or book)

values. The net asset value per ordinary share at 30 June 2023 calculated

on this basis was 391.24p (2022: 393.45p). See the Annual Report for

further details of the Alternative Performance Measure and how it

is calculated.

The movements during the year of the assets attributable to the ordinary

shares were as follows:

GBP'000

------------

Total net assets attributable to the ordinary shares at

30 June 2022 1,796,657

Total net return after taxation 61,409

Dividends paid on ordinary shares in the year (95,521)

Issue of shares 153,347

------------

Total net assets attributable to the ordinary shares

at 30 June 2023 1,915,892

------------

The Company does not have any dilutive securities.

7. Dividends paid on ordinary shares

2023 2022

Record date Payment date GBP'000 GBP'000

------------------- --------------- ----------- -----------

Fourth interim dividend (4.80p) for the year 31 August

ended 30 June 2021 6 August 2021 2021 - 21,434

First interim dividend (4.80p) for the year 30 November

ended 30 June 2022 29 October 2021 2021 - 21,434

Second interim dividend (4.80p) for the year 28 February

ended 30 June 2022 28 January 2022 2022 - 21,434

Third interim dividend (5.00p) for the year

ended 30 June 2022 28 April 2022 31 May 2022 - 22,684

Fourth interim dividend (5.00p) for the year 31 August

ended 30 June 2022 4 August 2022 2022 23,139 -

First interim dividend (5.00p) for the year 30 November

ended 30 June 2023 27 October 2022 2022 23,518 -

Second interim dividend (5.00p) for the year 28 February

ended 30 June 2023 26 January 2023 2023 23,910 -

Third interim dividend (5.05p) for the year

ended 30 June 2023 27 April 2023 31 May 2023 24,954 -

Unclaimed dividends over 12 years old - (34)

----------- -----------

95,521 86,952

----------- -----------

In accordance with FRS 102, interim dividends payable to equity shareholders are recognised

in the Statement of Changes in Equity when they have been paid to shareholders.

All dividends have been or will be paid out of revenue reserves or current year revenue profits

and at no point during the year did the revenue reserve move to a negative position.

The total dividends payable in respect of the financial year which form the basis of the test

under Section 1158 of the Corporation Tax Act 2010 are set out below.

2023 2022

GBP'000 GBP'000

--------------- ----------------

Revenue available for distribution by way of dividend for the year 96,240 92,988

First interim dividend of 5.00p (2022: 4.80p) (23,518) (21,434)

Second interim dividend of 5.00p (2022: 4.80p) (23,910) (21,434)

Third interim dividend of 5.05p (2022: 5.00p) (24,954) (22,684)

Fourth interim dividend of 5.05p (2022: 5.00p) paid on 31 August 2023(1) (25,374) (23,139)

--------------- ----------------

Transfer (from)/to revenue reserve (2) (1,516) 4,297

--------------- ----------------

1 Based on 502,464,868 ordinary shares in issue at 27 July 2023 (the ex-dividend date) (2022:

462,789,868)

2 The deficit of GBP1,516,000 (2022: surplus of GBP4,297,000) has been taken from the revenue

reserve

Since the year end, the Board has announced a first interim dividend of 5.05 p per ordinary

share, in respect of the year ending 30 June 2024. This will be paid on 30 November 2023 to

holders registered at the close of business on 27 October 2023. The Company's shares will

go ex-dividend on 26 October 2023.

8. Called up share capital

Nominal value

of total shares

in issue

Shares in issue GBP'000

----------------------- ------------------------

Allotted and issued ordinary shares of 25p each

At 1 July 2022 459,639,868 114,910

Issue of new ordinary shares 37,715,000 9,429

----------------------- ------------------------

At 30 June 2023 497,354,868 124,339

----------------------- ------------------------

Nominal value

of total shares

in issue

Shares in issue GBP'000

----------------------- ------------------------

Allotted and issued ordinary shares of 25p each

At 1 July 2021 445,624,868 111,406

Issue of new ordinary shares 14,015,000 3,504

----------------------- ------------------------

At 30 June 2022 459,639,868 114,910

----------------------- ------------------------

The Company issued 37,715,000 (2022: 14,015,000) ordinary shares with

total proceeds of GBP153,347,000 (2022: GBP57,050,000) after deduction

of issue costs of GBP393,000 (2022: GBP291,000). The average price of

the ordinary shares that were issued was 407.7p (2022: 408.6p). During

the year there were no shares re-purchased by the Company (2022: there

were no shares repurchased).

9. 2023 financial information

The figures and financial information for the year ended 30 June 2023

are extracted from the Company's annual financial statements for that

period and do not constitute statutory accounts. The Company's annual

financial statements for the year to 30 June 2023 have been audited but

have not yet been delivered to the Registrar of Companies. The Independent

Auditors' Report on the 2023 annual financial statements was unqualified,

did not include a reference to any matter to which the auditors drew

attention without qualifying the report, and did not contain any statements

under Sections 498(2) or 498(3) of the Companies Act 2006.

10. 2022 financial information

The figures and financial information for the year ended 30 June 2022

are compiled from an extract of the published financial statements for

that year and do not constitute statutory accounts. Those financial statements

have been delivered to the Registrar of Companies and included the report

of the auditors which was unqualified, did not include a reference to

any matter to which the auditors drew attention without qualifying the

report, and did not contain any statements under Sections 498(2) or 498(3)

of the Companies Act 2006.

11. Annual Report

The Annual Report will be posted to shareholders in late September 2023

and will be available on the Company's website www.cityinvestmenttrust.com

. Copies will be available thereafter in hard copy format from the Company's

registered office, 201 Bishopsgate, London, EC2M 3AE.

12. Annual General Meeting

The Annual General Meeting will be held on Tuesday, 31 October 2023 at

2.30pm at the Company's registered office. The Notice of Meeting will

be sent to shareholders with the Annual Report.

13. General Information

Company Status

The City of London Investment Trust plc is a UK domiciled investment

trust company.

ISIN number / SEDOL: ordinary shares: GB0001990497 / 0199049

London Stock Exchange (TIDM) Code: CTY

New Zealand Stock Exchange Code: TCL

Global Intermediary Identification Number (GIIN): S55HF7.99999.SL.826

Legal Entity Identifier (LEI): 213800F3NOTF47H6AO55

Company Registration Number

UK : 00034871

New Zealand : 1215729

Registered Office

201 Bishopsgate, London EC2M 3AE

Directors and Secretary

The Directors of the Company are Sir Laurie Magnus (Chairman), Samantha

Wren (Audit Committee Chair), Clare Wardle (Senior Independent Director),

Ominder Dhillon and Robert (Ted) Holmes.

The Corporate Secretary is Janus Henderson Secretarial Services UK Limited,

represented by Sally Porter, ACG.

Website

Details of the Company's share price and net asset value, together with

general information about the Company, monthly factsheets and data, copies

of announcements, reports and details of general meetings can be found

at www.cityinvestmenttrust.com.

For further information please contact:

Job Curtis

Fund Manager

The City of London Investment Trust plc

Telephone: 020 7818 4367

Dan Howe

Head of Investment Trusts

Janus Henderson Investors

Telephone: 020 7818 4458

Harriet Hall

Investment Trust PR Manager

Janus Henderson Investors

Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) are incorporated into, or form part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKRKROAUKAAR

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

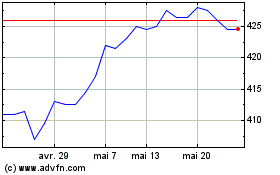

City Of London Investment (LSE:CTY)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

City Of London Investment (LSE:CTY)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024