TIDMDIS

RNS Number : 5591O

Distil PLC

13 June 2022

Distil plc

("Distil" or the "Group")

Final Results for year ended 31 March 2022

"Building for long term growth"

Distil plc (AIM: DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, Blavod Black Vodka, TRØVE

Botanical Spirit and Diva Vodka, announces its final results for

the year ended 31 March 2022.

Operational highlights

-- RedLeg Tropical Rum launched into UK and Australian market

-- New export markets opened in Eastern Europe

-- Additional listings secured for RedLeg Spiced Rum range

-- TRØVE Botanical Vodka listed in prestigious premium UK retailer

-- TRØVE Trademark successfully registered in USA

-- Successful launch of Blackwoods 2021 Vintage, including

branding refresh and new liquid development across the range as all

gin production moved to Scotland

-- Development of Blackwoods distillery at Ardgowan, near

Glasgow, continues in line with plans with gin production expected

to commence late Summer 2022.

Financial* and corporate highlights

-- Turnover decreased 19% to GBP2.94 million (2021: GBP3.62

million) (increased 20% vs 2020: GBP2.44 million)

-- Gross profit decreased 19% to GBP1.63 million (2021: GBP2.01

million) (increased 13% vs 2020: GBP1.45 million)

-- Volumes (litres) decreased 12% (increased13% over volumes in year ended 31 March 2020)

-- Margins remained broadly level at 55.4% (2021: 55.6%) (2020: 59.2%)

-- Advertising and promotion spend decreased 17% to GBP890k

(2021: GBP1.07 million) (2020: GBP665k)

-- Adjusted** administrative expenses increased 15% to GBP746k (2021: GBP651k) (2020: GBP597k)

-- Adjusted*** EBITDA of GBP9k (2021: GBP303k) (2020: GBP195k)

-- Operating loss of GBP132k (2021: GBP254k profit) (2020: GBP184k profit)

-- Net cash inflow of GBP500k (2020: GBP204k) resulting in

year-end cash reserves of GBP1.56 million (2021: GBP1.06

million)

-- Net assets of GBP7.34 million (2021: GBP3.81 million) at 31 March 2022

-- Successful equity fund raise of GBP3.2 million (before

expenses) to invest in Ardgowan Distillery Company Limited; Initial

advance of GBP2.85 million (GBP3 million less GBP150k retained

interest) made to Ardgowan

-- Appointment of Michael Keiller as Non-Executive Director

*Due to the unprecedented one-off surge in sales in the prior

financial year, especially during Q2 (June-September), caused by

the impact of lockdown and associated unusual trading patterns, the

above financial highlights are presented for both the prior year

and 2020 to enable a proper understanding of key trends.

** Administrative costs adjusted to remove the one-off

transaction costs associated with the Ardgowan investment

*** EBITDA adjusted for one-off transaction costs associated

with Ardgowan investment and annual share based payment expense

Don Goulding, Executive Chairman of Distil, said:

" Distil brands continued to perform well in a volatile market

recovering post-Covid. The reopening and return of consumer

confidence in the hospitality sector has contributed to growth

in-line with our forecasts pre-pandemic. Continued challenges to

costs have accelerated the consolidation of our production, which

has allowed us to benefit from greater efficiencies and economies

of scale. In addition, we are building our sales and marketing

departments internally to allow us to react quickly to market

challenges, increase our distribution footprint and drive marketing

reach "

Distil PLC

Don Goulding, Executive Chairman Tel: +44 20 3283 4006

Shaun Claydon, Finance Director

----------------------

SPARK Advisory Partners Limited

(NOMAD)

----------------------

Neil Baldwin Tel: +44 20 3368 3550

Mark Brady

----------------------

Turner Pope Investments (TPI)

Ltd (Broker)

----------------------

Andy Thacker/James Pope Tel: +44 20 3657 0050

----------------------

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

regulatory information service this information is considered to be

in the public domain

About Distil

Distil Plc is quoted on the AIM market of the London Stock

Exchange. It owns drinks brands in a number of sectors of the

alcoholic drinks market. These include premium spiced rum, vodka,

gin, and are called RedLeg Spiced Rum, Blackwoods Vintage Gin,

Blackwoods Vodka, Blavod Original Black Vodka, TRØVE Botanical

Spirit and Diva Vodka.

Chairman's Statement

Performance

Our brands performed well in a market recovering post-COVID-19,

which this year saw the encouraging return of the on-trade to 2019

levels despite experiencing months of closures, and Duty-Free

markets reopening amid increased confidence in travel. However,

this is being balanced by new pressures and volatility from supply

chain challenges, widespread cost inflation and, more recently, the

impact of tragic conflict in Ukraine.

Sales revenue declined 19% year on year as we lapped

extraordinary results in the year ended 31 March 2021. During that

year revenues increased 48% versus prior year, in part due to

additional retailer promotional activity throughout lockdown,

consumer panic buying and export market distributors building stock

cover.

Compared to the year ended 31 March 2020, revenue has increased

20% and in line with previous market growth expectations prior to

lockdown.

Reported losses of GBP95k over the past 12 months are mainly

attributed to the Ardgowan investment and financing costs totalling

GBP66k and prepaid marketing costs of GBP34k.

Marketing and new product development

Throughout recent market turbulence, we maintained focus on

creating stakeholder value through premium spirit brand building in

the UK and internationally.

To support this, marketing activity has focussed on price

premiumisation, and the development of our first TV commercial for

RedLeg Spiced Rum. Launched regionally at the start of the new

financial year commencing April 2022, this represents a major

investment in long-term growth of our most popular brand. Working

closely with strategic partners including ITV with the aim of

building consumer brand awareness, the advertisement received

critical acclaim in trade press. We will continue to ensure

strategic moves are made to build on this success in the coming

year.

New varieties of RedLeg Spiced Rum were launched including new

packaging formats. In January, 1L RedLeg Spiced Rum launched in the

UK to target new opportunities for growth with value-driven

consumers shopping online. In August, we developed a partnership

with a well-established national gifting company to launch a unique

miniature gift pack securing national listings in major grocery and

high-street retailers.

To capitalise on the growing popularity of flavoured spirits,

this year saw the introduction of RedLeg Tropical Rum, which has

been well received in the on-trade and has secured a major listing

in Australia.

TRØVE Botanical Vodka secured a listing of all three varieties

with a prestigious premium UK retailer, and the trademark was

successfully registered in the US.

New product development centred on the crafting of a new vintage

for Blackwoods gin, involving the creation of a new, premium liquid

from our Master Distiller, as well as a significant branding

refresh across the range to highlight Scottish provenance. As part

of the development of this new vintage, we transferred all

distillation and bottling of both Blackwoods gin and Blackwoods

vodka to Scotland. These moves align all aspects of production

ahead of the planned opening of our new Blackwoods distillery at

the impressive Ardgowan site near Inverkip, west of Glasgow.

Planning for the site has been approved and the team is pressing

ahead with the development of exciting plans for Blackwoods

Distillery. Scottish-made distillery equipment has been

commissioned and is expected to be delivered in the summer, with

gin production due to start shortly after. The Ardgowan Distillery

is investing in the latest technologies to reduce impact across the

production process and has pledged to be carbon negative by

2024.

Sustainability is a focus across all brands, we maintained

pressure to reduce our environmental footprint through improvement

measures large and small. This includes now using 100% recyclable

corks and stoppers with a no-glue system, moving our labels to 100%

recycled paper or, in the case of RedLeg, paper made from waste

sugarcane, and increasing the percentage of recycled glass used in

production of our bottles.

Improving our 'green' credentials is an area of good progress

although we still have much to do. We are, therefore, continually

looking for new ways to reduce fuel usage and waste throughout the

entire supply chain and to find creative packaging solutions.

After the reopening of hospitality, we returned to events,

albeit on a reduced scale, and being face-to-face with the consumer

to build brand awareness and trial which we hope to be back in full

swing of by the end of this coming financial year.

Export growth

International market expansion progressed, with new markets

opened in central and eastern Europe. As confidence in

international travel began to resume, the Duty-Free market showed

encouraging signs of growth, especially for Blavod black vodka,

which was hardest hit during lockdown.

Ukraine and Russia were new growth markets for our brands prior

to the tragic conflict commencing in February. Both were still

relatively small and therefore these market closures have had

little or no material impact on our results or plans. In our spring

trading update we were able to confirm to all customers and

shareholders that we do not source, directly or indirectly, any

packaging, ingredients or production from either Ukraine or

Russia.

Cost pressures

Over the past year we have seen substantial cost price increases

being proposed by our suppliers due to inflation, paper shortages,

labour shortages and increased fuel costs. We continued to manage

these cost pressures and make savings where possible whilst

maintaining supply of products for all our markets. As part of this

cost management, we successfully consolidated the majority of

production to one site to gain economies of scale and improved

efficiencies.

Strategic investment into Ardgowan Distillery

In August, we announced a GBP3 million strategic investment in

the form of a convertible loan and with an option to increase to

GBP5 million in Ardgowan Distillery Company Limited which will see

the development of a new Malt Whisky distillery, planned for

opening in 2023. This move will provide the Company with a

long-term interest in a growing premium category as we develop our

own Malt Scotch, as well as providing a new home for Blackwoods Gin

with its own distillery, visitors' centre and retail

facilities.

Board Changes

In July, we welcomed Mike Keiller on to the board as an

Independent Non-executive Director.

Mike brings a wealth of experience to the business. Having begun

his career as a chartered accountant, Mike went on to hold senior

finance and business change roles at Guinness plc, United

Distillers Europe and Diageo plc in its early development stage.

Continuing this experience of business transformation, Mike joined

Suntory owned Morrison Bowmore Distillers Ltd as CEO in 2000,

developing a vision and strategy which converted the business from

bulk whisky supplier to a strongly profitable consumer brand

marketing-led business with globally acclaimed single malts. He

retired from full time management in 2014 after assisting Suntory

with the integration of their acquisition of Beam Inc. Following

this, from 2015 to 2018, Mike was Non-executive Director of The

Last Drop Distillers Ltd which was sold to The Sazerac Corporation

in 2017.

Outlook

The international premium spirits market remains attractive

despite local and global pressures, and our brands are well

positioned within their categories, and supported by our team which

is responding well with an adaptable and positive mindset to ever

changing environments and new growth opportunities to drive the

business forward.

In addition, we have plans to strengthen the organisation in

commercial and marketing departments to further accelerate growth

of our brands.

As we enter the new financial year, price inflation will play a

key role in determining cost of goods and consumer spending habits

as disposable income is squeezed.

On the supply side we will strongly resist increases and work to

find creative cost efficiencies and to leverage scale.

During a time of higher inflation and reductions in disposable

income, our brands will remain

reassuringly positioned as an affordable premium product.

Throughout this time, we will continue to focus on driving

efficiencies and closely managing our supply chain to ensure that

margins are protected wherever possible and will continue to invest

in marketing support of these brands, as well as new product

development, to build brand positions within the market.

Strategic Report

Results for the year

The loss before tax attributable to shareholders for the year

amounted to GBP95k which includes transaction costs relating to the

investment in the Ardgowan convertible loan in August 2021 (2021:

profit before tax GBP243k). Adjusted EBITDA* was GBP9k (2021:

GBP303k)

Year-on-year sales revenues and volumes declined 19% and 12%

respectively. However, this was against challenging prior year

figures, distorted by the initial Covid-19 lockdown and customer

stockpiling which resulted in an unprecedented surge in sales by

48%, particularly in the second quarter of that year. Compared to

pre-pandemic sales levels reported in the year ended 31 March 2020,

sales revenues and volumes grew 20% and 13% respectively, largely

driven by our lead brand, RedLeg Spiced Rum. This was in line with

previous growth forecasts and expectations.

Despite an increase in production costs caused by supply chain

disruptions we maintained year-on-year gross margins at c.55%

during the period. In the short term we do not expect gross margins

to return to pre-Covid levels due to cost increases throughout the

supply chain. We continued to invest in brand development during

the period, maintaining overall marketing spend at 30% of sales

revenue. Additional marketing funds were invested in launching our

new Blackwoods 2021 Vintage and also in promotional activity across

Redleg Spiced Rum to support a retail sales price increase as we

'premiumise' the brand.

The Group continues to minimise overheads where possible, whilst

ensuring sufficient investment to support the growth in sales of

its existing brands and development of new brands. Other

administrative expenses (including lease amortisation costs and

one-off costs associated with the financing and investment in

Ardgowan Distillery Limited ("Ardgowan")) increased by 25% over

prior year. Adjusting for the one-off Ardgowan costs the increase

was a modest 15% largely due to investment in staff recruitment to

support business growth.

Cash flow

The operating loss together with net movements in working

capital resulted in a net cash outflow from operating activities of

GBP150k during the year (2021: GBP254k inflow). Following the

equity financing and investment in Ardgowan, exercise of warrants

by a shareholder during the period and modest capex, the Company's

cash and cash equivalents increased GBP500k to GBP1.56 million at

the financial year end.

Balance sheet

The Group had net assets of GBP7.55m at the financial year end

(2021: GBP3.81m). This included financial assets of GBP3.0m (2021:

GBPnil), cash reserves of GBP1.56m (2021: GBP1.06m) and intangible

assets of GBP1.61m (2021: GBP1.60m) comprising expenditure on

trademarks related to our brands. Financial assets solely comprise

our investment in Ardgowan, further details of which are set out

below and note 12 to the accounts. Inventories increased to GBP637k

(2021: GBP553k) primarily due to planned increases to mitigate

anticipated disruptions in supply.

Investment in Ardgowan Distillery Limited

In August 2021 we announced a GBP3 million strategic investment

(in the form of a convertible loan and with an option to increase

to GBP5 million before 31 December 2022) in Ardgowan Distillery

Limited which will see development of a new Malt Whisky distillery,

planned for opening in 2023. To enable the Ardgowan investment we

completed an equity fundraising in August that raised GBP3.2

million (before expenses) from existing and new shareholders.

The investment provides the Company with a long-term interest in

a growing premium category as we develop our own Malt Scotch, as

well as providing a new home for Blackwoods Gin with its own

distillery, Gin school and visitors' centre. Development of the gin

distillery at Ardgowan is progressing in line with plans with gin

production due to commence at the end of Summer 2022.

*EBITDA is adjusted for share based payment expenses of GBP59k

(2021: GBP34k) and one-off costs associated with the Ardgowan

financing and investment of GBP66k (2021: GBPnil).

Principal activities and business review

Distil Plc (the "Company") acts as a holding company for the

entities in the Distil Plc group (the "Group"). The principal

activity of the Group throughout the period under review was the

marketing and selling of RedLeg Spiced Rum, Blackwoods Vintage Gin,

Blackwoods Vodka, Blavod Original Black Vodka, TRØVE Botanical

Spirit and Diva Vodka.

The overall results for the 2022 financial year reflect the

continued priority of investing in the Group's key brands to drive

top line growth in both domestic and international markets whilst

ensuring overhead costs remain appropriate for the size of the

Group.

Key performance indicators

The Group monitors progress with particular reference to the

following key performance indicators:

-- Contribution - defined as gross margin less advertising and promotional costs

Contribution for the year decreased GBP200k to GBP739k (2021:

GBP939k) (2020: GBP781k). This decrease was primarily due to a 19%

fall in overall sales revenues whilst advertising and marketing

costs saw a lesser reduction of 17% during the year as we

maintained investment in our brands.

-- Sales turnover versus previous year

Total sales decreased 19% year-on-year to GBP2.94m

(2021:GBP3.62m) (2020:GBP2.44m). Sales of RedLeg Spiced Rum which

accounts for the majority of sales revenue decreased 19% whilst

Blackwoods Gin posted a 20% decrease in revenue during the period.

Blackwoods Vodka and Blavod Original Black Vodka experienced a

recovery in sales with increases of 56% and 129% respectively,

albeit off relatively small bases.

-- Gross margin versus previous year

Gross margin as a percentage of sales experienced only a small

reduction to 55.4% (2021: 55.6%) (2020: 59.2%) despite an increase

in production costs arising from disruptions to the supply chain

(caused by widespread staff shortages across production and

distribution) and materials cost inflation.

We also closely monitor both the level of, and value derived

from our advertising and promotional costs and other administrative

costs. As a percentage of sales, advertising and promotional spend

amounted to 30% (2021: 30%) (2020: 27%) during the year, reflecting

our continued commitment to investing in existing and new brand

development.

Other administrative costs increased 25% to GBP812k (2021:

GBP651k) (2020: GBP597k). Adjusting for GBP66k one-off costs

associated with the financing and investment in Ardgowan during the

period, other administrative costs amounted to GBP746k, a 15%

increase on 2021 levels.

Principal risks and uncertainties

As a relatively small but growing business our senior management

is naturally involved day to day in all key decisions and the

management of risk. Where possible, structured processes and

strategies are in place to monitor and mitigate as appropriate.

This involves a formal review at Board level.

The directors are of the opinion that a thorough risk management

process has been adopted which involves a formal review of the

principal risks identified below. Where possible, processes are in

place to monitor and mitigate such risks.

-- Economic downturn

The success of the business is reliant on consumer spending. An

economic downturn, resulting in reduction of consumer spending

power, will have a direct impact on the income achieved by the

Group. In response to this risk, senior management aim to keep

abreast of economic conditions. In cases of severe economic

downturn, marketing and pricing strategies will be modified to

reflect the new market conditions.

-- High proportion of fixed overheads and variable revenues

A large proportion of the Group's overheads are fixed. There is

the risk that any significant changes in revenue may lead to the

inability to cover such costs. Senior management closely monitor

fixed overheads against budget on a monthly basis and cost saving

exercises are implemented wherever possible when there is an

anticipated decline in revenues.

-- Competition

The market in which the Group operates is highly competitive. As

a result, there is constant downward pressure on margins and the

additional risk of being unable to meet customer expectations.

Policies of constant price monitoring and ongoing market research

are in place to mitigate such risks.

-- Failure to ensure brands evolve in relation to changes in consumer taste

The Group's products are subject to shifts in fashions and

trends and the Group is therefore exposed to the risk that it will

be unable to evolve its brands to meet such changes in taste. The

Group carries out regular consumer research on an ongoing basis in

an attempt to carefully monitor developments in consumer taste.

-- Portfolio management

A key driver of the Group's success lies in the mix and

performance of the brands which form the Group's portfolio. The

Group constantly and carefully monitors the performance of each

brand within the portfolio to ensure that its individual

performance is optimised together with the overall balance of

performance of all brands marketed and sold by the Group.

Future developments

We remain focused on four key growth drivers to maintain

profitable brand growth and create value. These are listed

below:

Brand activation and marketing at the point of sale:

-- Precise timing and frequency of promotional activity including occasions & gifting.

-- Bringing promotions to life and aligned with changing consumer needs.

-- Marketing and promotional activity tailored to local market needs.

Innovation in liquid & packaging development:

-- Pack sizes & formats, new brands, liquids and flavours.

Route to consumer:

-- Build long term relationships with capable local distributors in each key market.

-- Open new territories for each key brand, targeting premium growth markets.

-- Develop new trade channels through format and product.

Access to new production and design:

Across all aspects of distilling, bottling, packaging.

Consolidated statement of comprehensive income

For the year ended 31 March 2022

2022 2021

GBP'000 GBP'000

--------------------------------------------- --------- ---------

Revenue 2,942 3,616

Cost of sales (1,313) (1,606)

---------------------------------------------- --------- ---------

Gross profit 1,629 2,010

Administrative expenses:

Advertising and promotional costs (890) (1,071)

Other administrative expenses (812) (651)

Share based payment expense (59) (34)

Total administrative expenses (1,761) (1,756)

---------------------------------------------- --------- ---------

(Loss)/profit from operations (132) 254

Finance income 37 -

Finance expense - (11)

(Loss)/profit before tax (95) 243

Taxation 269 100

---------------------------------------------- --------- ---------

Profit for the year and total comprehensive

income 174 343

---------------------------------------------- --------- ---------

Earnings per share

Basic (pence per share) 0.03 0.07

Diluted (pence per share) 0.02 0.07

---------------------------------------------- --------- ---------

Consolidated statement of financial position

As at 31 March 2022

2022 2021

GBP'000 GBP'000

----------------------------------------- -------- --------

Assets

Non-current assets

Property, plant and equipment 167 167

Intangible assets 1,606 1,598

Financial assets at amortised cost 3,000 -

Deferred tax asset 445 176

------------------------------------------ -------- --------

Total non-current assets 5,218 1,941

------------------------------------------ -------- --------

Current assets

Inventories 637 553

Trade and other receivables 687 609

Cash and cash equivalents 1,562 1,062

------------------------------------------ -------- --------

Total current assets 2,886 2,224

------------------------------------------ -------- --------

Total assets 8,104 4,165

------------------------------------------ -------- --------

Liabilities

Current liabilities

Trade and other payables 407 358

Financial liabilities at amortised cost 150 -

------------------------------------------ -------- --------

Total current liabilities 557 358

------------------------------------------ -------- --------

Total liabilities 557 358

------------------------------------------ -------- --------

Net assets 7,547 3,807

------------------------------------------ -------- --------

Equity

Share capital 1,474 1,292

Share premium 6,211 2,908

Share-based payment reserve 198 117

Accumulated losses (336) (510)

------------------------------------------ -------- --------

Total equity 7,547 3,807

------------------------------------------ -------- --------

Consolidated statement of changes in equity

For the year ended 31 March 2022

Share-based

Share Share payment Accumulated Total

capital premium reserve losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- ----------- ----------- -------

Balance at 1 April 2020 1,292 2,908 83 (853) 3,430

Profit for the year

and total comprehensive

income - - - 343 343

Share based payment

expense - - 34 - 34

------------------------- -------- -------- ----------- ----------- -------

Balance at 31 March

2021 and

1 April 2021 1,292 2,908 117 (510) 3,807

------------------------- -------- -------- ----------- ----------- -------

Profit for the year

and total comprehensive

income - - - 174 174

Shares issued 182 3,466 - - 3,648

Share issue costs - (141) - - (141)

Share based payment

expense - (22) 81 - 59

------------------------- -------- -------- ----------- ----------- -------

Balance at 31 March

2022 1,474 6,211 198 (336) 7,547

------------------------- -------- -------- ----------- ----------- -------

Consolidated statement of cash flows

For the year ended 31 March 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------- --------- --------

Cash flows from operating activities

(Loss)/profit before taxation (95) 243

Adjustments for non-cash/non-operating items:

Finance income (37) -

Finance expense - 11

Depreciation 16 15

Expenses settled by shares 15 -

Share-based payment expense 59 34

(42) 303

Movements in working capital

Increase in inventories (84) (204)

Increase in trade and other receivables (78) (66)

Increase in trade and other payables 54 221

Net cash generated (used in)/from operating

activities (150) 254

-------------------------------------------------- --------- --------

Cash flows from investing activities

Purchase of property, plant and equipment (16) (29)

Expenditure relating to licences and trademarks (8) (21)

Payment on issue of convertible loan notes (2,850) -

-------------------------------------------------- --------- --------

Net cash used in investing activities (2,874) (50)

-------------------------------------------------- --------- --------

Cash flows from financing activities

Proceeds from issue of shares, net of issue 3,492 -

costs

Interest received on convertible loans 32 -

Net cash generated from financing activities 3,524 -

-------------------------------------------------- --------- --------

Net increase in cash and cash equivalents 500 204

Cash and cash equivalents at beginning of

year 1,062 858

Cash and cash equivalents at end of year 1,562 1,062

-------------------------------------------------- --------- --------

1. Basis of preparation and summary of significant accounting policies

The consolidated and company financial statements are for the

year ended 31 March 2022. They have been prepared in accordance

with UK-adopted International Accounting Standards ("IFRS").

The financial statements have been prepared under the historical

cost convention. The measurement bases and principal accounting

policies of the Group are set out below.

Distil Plc is the Group's ultimate parent company. The Company

is a public limited company incorporated and domiciled in England

and Wales. The address of Distil Plc's registered office is 201

Temple Chambers, 3-7 Temple Avenue, EC4Y 0DT and its principal

place of business is 73 Watling Street, EC4M 9BJ.

These results are audited; however, the financial information

does not constitute statutory accounts as defined under section 434

of the Companies Act 2006. The consolidated balance sheet at 31

March 2022 and the consolidated statement of comprehensive income,

consolidated statement of changes in equity and consolidated

statement of cash flows for the year then ended have been extracted

from the Group's 2022 statutory consolidated financial statements

upon which the auditor's opinion is unqualified. The statutory

consolidated financial statements for the year ended 31 March 2022

were approved by the Board on 10 June 2022 and will be delivered to

the Registrar of Companies in due course.

The financial information for the year ended 31 March 2022 has

been derived from the Group's statutory consolidated financial

statements for that year, as filed with the Registrar of Companies.

Those consolidated financial statements contained an unqualified

audit report.

A copy of the Annual Report & Accounts will shortly be

available on the Company's website www.distil.uk.com and from the

Company's registered office.

2. Earnings per share

The calculation of the basic earnings per share is based on the

results attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The diluted earnings per share is calculated based upon dilutive

share options and warrants.

The earnings and weighted average number of shares used in the

calculations are set out below.

2022 2021

---------------------------------------------- ------------ ------------

Profit attributable to ordinary shareholders

(GBP'000) 174 343

Weighted average of number of shares 676,801,406 501,982,913

---------------------------------------------- ------------ ------------

Basic per share (pence) 0.03 0.07

Diluted per share (pence) 0.02 0.07

---------------------------------------------- ------------ ------------

3. Segment reporting

2022 2021

GBP'000 GBP'000

--------- -------- --------

Revenue

UK 2,612 3,221

Export 330 395

--------- -------- --------

2,942 3,616

--------- -------- --------

Gross profit

UK -1,424 1,810

Export 205 200

-------------- ------- ------

1,629 2,010

-------------- ------- ------

The directors have decided that providing a geographical split

by two locations, UK and Export, offers an enhanced indicator of

business activity. Only revenue and gross profit can be easily

identifiable when splitting between UK and export markets. All

trade is undertaken and assets are held in one geographic location,

being the UK.

During the year ended 31 March 2022, 86% of the Group's revenue

was derived from one wholesale distributor (2021: 78%). All of this

related to UK revenue. There were no other customers who accounted

for more than 10% of revenue.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SFMFIEEESESM

(END) Dow Jones Newswires

June 13, 2022 02:00 ET (06:00 GMT)

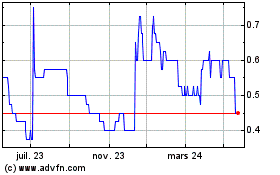

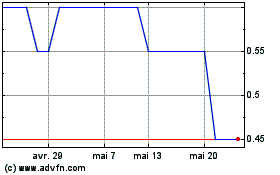

Distil (LSE:DIS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Distil (LSE:DIS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024