TIDMDIS

RNS Number : 4581M

Distil PLC

12 January 2023

12 January 2023

Distil Plc

Trading Update

Distil plc (AIM: DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka, provides an update on trading for the third

quarter of its current financial year ending 31 March 2023.

-- Year-on-year third quarter (October to December 2022)

unaudited revenues decreased 48% to GBP411k (October to December

2021: GBP789k)

-- Decrease in revenue primarily due to:

o One-off reduction in UK market stock cover associated with

removal of UK distributor as previously forecast

o Significant one-off reduction in stock availability during key

Christmas trading period within a major retailer

-- RedLeg Spiced Rum delivered a strong performance across other

major retailers during the quarter

-- Blackwoods performance adversely impacted by delist in medium-sized retailer

-- Marussia (UK distributor) has taken control of on-trade and

is making positive progress increasing distribution

-- New export markets opened in Scandinavia, and Latin America

-- Option to invest additional GBP2m in Ardgowan not taken up at

this time in order to focus cash resources on core business

-- Ardgowan Distillery Project

o External renovation of gin building complete with internal

renovations ongoing

o Site construction underway following revised plans for a more

ambitious whisky distillery

-- Full-year revenue will be significantly below market

expectations, with the Company expected to make a full year EBITDA

loss of cGBP0.6m in line with previous market guidance

-- Cash reserves at period end of GBP277k, net of receivables and payables GBP840k

Don Goulding, Executive Chairman of Distil, said:

"The business faced several challenges in Q3 leading to

disappointing year-on-year performance versus the previous year.

These are one-off issues affecting this financial year and will not

continue into FY23.

As announced in our interim results in October, at the end of H1

we progressed our move away from our previous UK distributor and

commenced the implementation of a new business model, taking direct

control of major customers. This move was completed in October, and

in Q3 we were still seeing the associated impact of the significant

reduction in UK market stock cover, which in turn has reduced

revenue in this fiscal year as forecast when the move was

announced.

The third quarter, and December in particular, is the key

trading period for our business, however, the wider UK spirits

market was softer than anticipated during the quarter, with overall

UK spirits sales down in response to a challenging economic

environment.

It is important to be able to maximise sales throughout this key

trading period but, regretfully, a system issue within one of our

major customers resulted in reduced stock cover. RedLeg was

performing well with a strong rate of sale, however the system

issue meant that stock was not being replenished quickly enough,

resulting in erratic promotional activity and out of stock issues

at store level. Our team has been working hard with the customer

over the quarter to resolve the issue and have together found a

solution, with normality expected to return from Q4.

Our other major retail customers performed well across the

quarter, with sales at a consumer level showing on average +38% YOY

growth in December.

I am disappointed to report that despite positive brand growth,

a mid-sized retailer took the decision in Q3 to reduce its gin

range in response to the overall decline in the gin market, which

included delisting Blackwoods 40% Gin from its stores. This news

will have a significant impact on the brand; however, this gives us

the opportunity to re-examine the brand positioning in the current

market and focus efforts on rebuilding the brand in its home

territory of Scotland with on-trade and regional off-trade

listings.

The effect of these issues is that the Company's turnover for

the current year will be materially beneath market expectations;

the Board's expectation is that adjusted EBITDA loss for the

current year will be around GBP0.6m, in line with previous market

guidance.

To mitigate the effects of the issues faced on the full year

results, our focus for Q4 is firmly on driving growth, with

promotional activity and additional marketing support in place to

help recover volumes where possible.

In the UK on-trade, new partner Marussia has been making

encouraging progress in driving distribution and we will begin to

see the fruits of these efforts in Q4 and beyond into the next

financial year.

Expansion of our brand footprint in export markets has made

positive progress, with new markets opened in Scandinavia and Latin

America in Q3. Export growth remains a key objective for Q4,

including increased marketing support in key territories to support

accelerated brand growth.

We took the decision in Q3 not to exercise the option (which

expired at the end of December 2022) to invest a further GBP2m into

the Ardgowan Distillery project at this time to focus cash

resources on our core business. The Ardgowan plans remain intact,

however revised plans for a larger, more ambitious carbon negative

whisky distillery naturally led to a resubmission of plans which

have now been approved. External renovation of the gin building is

complete with internal works ongoing. Bespoke distillation

equipment is due to be installed and commissioned over the coming

months. The project still represents a significant long-term

investment for our business, and we continue to support the team's

vision.

We remain cautious as the market faces challenges around

inflation, and consumer confidence is impacted. Our brands are in

strong positions to withstand market turbulence, and we are

confident in our plans moving forward to the end of this financial

year and beyond. However, given the challenges experienced in Q3

and the prevailing headwinds in our chosen markets, we expect full

year revenue to be below, and operating losses in line with,

current market forecasts. We will provide longer-term market

guidance reflecting our new operational model at the time of

publishing our full year financial results.

For further information please contact:

Distil plc

Don Goulding Executive Tel: +44 203 283 4007

Chairman

Shaun Claydon, Finance

Director

----------------------

SPARK Advisory Partners

Limited (NOMAD)

----------------------

Neil Baldwin Tel +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments

(TPI) Limited (Broker)

----------------------

Andy Thacker / James Tel +44 20 3657 0050

Pope

----------------------

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

About Distil

Distil Plc is quoted on the AIM market of the London Stock

Exchange. It owns drinks brands in a number of sectors in the

alcoholic drinks market. These include premium spiced rum, vodka,

gin, lower ABV spirit drinks and are called RedLeg Spiced Rum,

Blackwoods Vintage Gin, Blackwoods Vodka, Blavod Original Black

Vodka, TRØVE and Diva Vodka.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFEALFILLIV

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

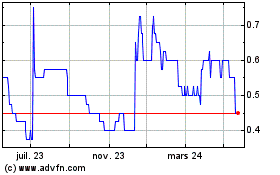

Distil (LSE:DIS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

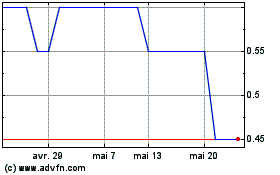

Distil (LSE:DIS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024