TIDMDKE

RNS Number : 0257A

Dukemount Capital PLC

28 January 2022

Dukemount Capital Plc

("Dukemount" or "the Company")

Interim Results

Dukemount Capital Plc (LSE: DKE) is pleased to announce its

unaudited interim results for the six months ended 31 October 2021

("the Interim Report").

Highlights

-- Entered into JV agreement with HSKB Ltd (renamed DKE Flexible Energy Limited)

-- Completed gas peaker funding package

-- Completed purchase of two RTB 11kV energy generation sites

Operational Developments

Dukemount has successfully signed off a subordinated funding

package necessary to enable completion of the senior debt funding

for its gas peaking projects and through HSKB completed the

purchase of two special purpose companies. Each company contains an

11kV gas peaking facility, which are ready to build, with full

planning permission and grid access. HSKB has changed its name to

DKE Flexible Energy Limited ("DKE Energy"). DKE Energy will

initially build two gas peaking facilities. Dukemount will manage

the construction of the two sites and provide its knowledge of

long-dated income funding and finance to optimize the capital

structure.

Dukemount is currently working with its advisors and the FCA to

get a prospectus approved and the first tranche of the funding

available to be able to commence the construction process.

Paul Gazzard commented:

"It has been a very positive few months for DKE and we look

forward to continuing to grow the pipeline and getting into the

construction phase of the new sites with the support of our funders

and shareholders.

We look forward to updating the market with more developments

soon as they are delivered."

For further information, please visit

www.dukemountcapitalplc.com or contact:

Dukemount Capital Plc : Paul Gazzard

Media Enquiries: Miriad, Zak Mir Tel: +44 (0)7867 527 659

Shard Capital (Broker): Isabella Pierre / Damon Heath Tel: +44

(0) 20 7186 9927

Interim Management Report

I hereby present the Interim Report for the six months ended 31

October 2021. During the period the Group made a loss of GBP227,218

(six months to 31 October 2020: loss of GBP156,947). These losses

are consistent with the Group's run rate and arose in the course

of: pursuing transactions; maintaining the Company's listing on the

Official List of the UK Listing Authority by way of a standard

listing and include: consultancy fees, professional fees and

directors' fees.

During the period, the board has pushed on to securing long

dated income opportunities.

During the period the Company entered into a Joint Venture

Agreement in relation to flexibility power expert HSKB Ltd

("HSKB"). Pursuant to the Joint Venture Agreement, Dukemount

acquired 50% of the issued share capital of HSKB for nominal

value.

Dukemount successfully signed off a subordinated funding package

necessary to enable completion of the senior debt funding for the

gas peaking projects in September 2021 and announced in October

2021 that HSKB had successfully completed the purchase of two

special purpose companies. Each company contains an 11kV gas

peaking facility, which are ready to build, with full planning

permission and grid access. HSKB has also changed its name to DKE

Flexible Energy Limited ("DKE Energy"). DKE Energy will initially

build two gas peaking facilities. Dukemount will manage the

construction of the two sites and provide its knowledge of

long-dated income funding and finance to optimize the capital

structure. DKE Energy's management brings its technical,

operational and market expertise of the UK flexible power market,

as well as access to a pipeline of further deals.

Outlook

Dukemount believes the opportunities presented by the joint

venture to be an important milestone for Dukemount to meet its

projected growth targets. Dukemount is set to rollout further joint

venture projects with a focus on gas peaking and battery storage

facilities. Both asset types balance the fluctuating power

requirements of the grid during periods of high-level demand or

shortfalls of electricity supply: a problem which is set to become

more acute in the transition to a greater reliance on renewable

energy sources.

I would like to take the opportunity to thank our shareholders

for their support and the Dukemount team for their continuing

efforts in driving this business forward.

Paul Gazzard

On behalf of the Board

28 January 2022

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting,

as adopted by the EU;

-- gives a true and fair view of the assets, liabilities,

financial position and loss of the Group;

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Paul Gazzard

Director

28 January 2022

Consolidated Statement of Comprehensive Income

For the six months ended 31 October 2021

Group Group Group

Note Unaudited Unaudited Audited

6months 6months ended Year

ended 31 Oct 2020 ended

31 Oct 2021 30 April

2021

GBP GBP GBP

Continuing Operations

Revenue from contracts with

customers 4 - 1,348,227 3,296,730

Cost of sales - (1,283,553) (3,483,700)

------------- --------------- ------------

Gross Profit/(Loss) 64,674 (186,970)

Other income - - 14,750

Administrative expenses (227,218) (221,621) (741,636)

Operating loss (227,218) (156,947) (913,856)

Interest received - - 29

Loss before taxation (227,218) (156,947) (913,827)

Tax - - -

Loss for the financial period

attributable to equity owners (227,218) (156,947) (913,827)

Total comprehensive (loss) attributable

to the equity holders (227,218) (156,947) (913,827)

------------- --------------- ------------

Earnings per share

- Basic and diluted 5 (0.00046) (0.00035) (0.0020)

Consolidated Statement of Financial Position

At 31October 2021

Group Group Group

Note Unaudited Unaudited Audited

31 Oct 2021 31 Oct 2020 30 April

GBP GBP 2021

GBP

ASSETS

Current assets:

Trade and other receivables 6 938,836 714,728 576,316

Cash and cash equivalents 40,864 58,969 24,657

Total Current assets 979,700 773,697 600,973

------------- ------------- ------------

Total assets 979,700 773,697 600,973

------------- ------------- ------------

LIABILITIES

Current liabilities:

Trade and other payables 7 1,799,753 769,652 1,218,808

Total Current liabilities 1,799,753 769,652 1,218,808

------------- ------------- ------------

Total liabilities 1,799,753 769,652 1,218,808

------------- ------------- ------------

NET ASSETS (820,053) 4,045 (617,835)

------------- ------------- ------------

Capital and reserve attributable

to the equity holders of the

Parent

Share capital 513,535 454,283 481,283

Share premium 1,107,783 1,007,035 1,115,035

Share based payments reserve 2,960 30,499 2,960

Retained earnings (2,444,331) (1,487,772) (2,217,113)

------------- ------------- ------------

TOTAL EQUITY (820,053) 4,045 (617,835)

------------- ------------- ------------

Consolidated Statement of Changes in Equity

For the six months ended 31 October 2021

Share Share Share Retained Total shareholder

capital premium based losses equity

payment

reserve

GBP GBP GBP GBP GBP

Balance as at 1 May

2020 439,033 952,211 30,499 (1,330,825) 90,918

-------------------------- --------- ---------- --------- ------------ ------------------

Loss for the period - - - (156,947) (156,947)

--------- ---------- --------- ------------ ------------------

Total comprehensive

income for the period - - - (156,947) (156,947)

--------- ---------- --------- ------------ ------------------

Issue of ordinary shares 15,250 54,824 - - 70,074

Total transactions with

owners 15,250 54,824 - - 70,074

-------------------------- --------- ---------- --------- ------------ ------------------

Balance at 31 October

2020 454,283 1,007,035 30,499 (1,487,772) 4,045

-------------------------- --------- ---------- --------- ------------ ------------------

Loss for the period - - - (756,880) (756,880)

--------- ---------- --------- ------------ ------------------

Total comprehensive

income for the period - - - (756,880) (756,880)

--------- ---------- --------- ------------ ------------------

Issue of ordinary shares 27,000 108,000 - - 135,000

--------- ---------- --------- ------------ ------------------

Exercise of warrants - - (27,539) 27,539 -

Total transactions with

owners 27,000 108,000 (27,539) 27,539 135,000

Balance as at 30 April

2021 481,283 1,115,035 2,960 (2,217,113) (617,835)

-------------------------- --------- ---------- --------- ------------ ------------------

Loss for the period - - - (227,218) (227,218)

--------- ---------- --------- ------------ ------------------

Total comprehensive

income for the period - - - (227,218) (227,218)

--------- ---------- --------- ------------ ------------------

Issue of ordinary shares 32,252 (7,252) - - 25,000

Total transactions with

owners 32,252 (7,252) - - 25,000

-------------------------- --------- ---------- --------- ------------ ------------------

Balance at 31 October

2021 513,535 1,107,783 2,960 (2,444,331) (820,053)

-------------------------- --------- ---------- --------- ------------ ------------------

Consolidated Statement of Cashflows

For the six months ended 31 October 2021

Group Group Group

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 Oct 2021 31 Oct 2020 30 April

2021

GBP GBP GBP

Operating activities

Loss before taxation (227,218) (156,947) (913,827)

(Increase)/decrease in trade and other

receivables (33,214) (105,170) 33,242

(Decrease) / increase in trade and

other payables (419,055) (157,399) 265,070

------------- ------------- ------------

Net cash used in operating activities (679,487) (419,516) (615,515)

------------- ------------- ------------

Cash Flows from Investing Activities

Investment in JV (329,306) - -

------------- ------------- ------------

Net Cash generated from Investing (329,306) - -

Activities

------------- ------------- ------------

Cash Flows from Financing Activities

Loans received 1,000,000 - -

Net proceeds from issue of shares - 70,074 231,761

Shares issued in lieu of expenses 25,000 - -

Net Cash generated from Financing

Activities 1,025,000 70,074 231,761

------------- ------------- ------------

Increase/(Decrease) in cash and cash

equivalents in period/ year 16,207 (349,442) (383,754)

Cash and cash equivalents at beginning

of period / year 24,657 408,411 408,411

Cash and cash equivalents at end of

period / year 40,864 58,969 24,657

------------- ------------- ------------

Notes to the Interim Report

For the six months ended 31 October 2021

1. GENERAL INFORMATION

Dukemount Capital Plc (the "Company") is a company domiciled in

England. The interim report for the six months ended 31 October

2021 comprises the results of the Company and its subsidiaries

(together referred to as the "Group").

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements have

been prepared under the historical cost convention and on a going

concern basis and in accordance with International Financial

Reporting Standards, International Accounting Standards and IFRIC

interpretations endorsed for use in the United Kingdom ("IFRS").

The condensed consolidated interim financial statements contained

in this document do not constitute statutory accounts. In the

opinion of the directors, the condensed consolidated interim

financial statements for this period fairly presents the financial

position, result of operations and cash flows for this period. The

Board of Directors approved this Interim Financial Report on 27

January 2022.

Statement of compliance

The Interim Report includes the consolidated interim financial

statements which have been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting'.

The condensed interim financial statements should be read in

conjunction with the annual financial statements for the period

ended 30 April 2021, which have been prepared in accordance with

IFRS endorsed for use in the United Kingdom.

Accounting policies

The condensed consolidated interim financial statements for the

period ended 31 October 2021 have not been audited or reviewed in

accordance with the International Standard on Review Engagements

2410 issued by the Auditing Practices Board. The figures were

prepared using applicable accounting policies and practices

consistent with those adopted in the statutory annual financial

statements for the year ended 30 April 2021. There have been no new

accounting policies adopted since 30 April 2021.

Going concern

The Group has assessed its ability to continue as a going

concern. The Directors, having made due and careful enquiry, are of

the opinion that the Group will have access to adequate working

capital to meet its obligations for the period of at least twelve

months from the date when the condensed interim financial

statements are authorised for issue. The Directors therefore have

made an informed judgement, at the time of approving these

condensed interim financial statements, that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. As a result, the

Directors have adopted the going concern basis of accounting in the

preparation of the condensed interim financial statements for the

period ended 31 October 2021.

3. RISKS AND UNCERTAINTIES

The Board continually assesses and monitors the key risks of the

business. The key risks that could affect the Group's short and

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Company's

2021 audited financial statements, a copy of which is available on

the Company's website: http://www.dukemountcapitalplc.com .

4. REVENUE

Revenue relates to amounts contractually due under a property

development agreement at the balance sheet date relating to the

stage of completion of a contract as measured by surveys of work

performed to date. Revenue is recognised for services when the

Group has satisfied its contractual performance obligation in

respect of the services. The amount recognised for the services

performed is the consideration that the Group is entitled to for

performing the services provided. Revenue from contracts with

customers is recognised over time.

Group Unaudited Group Unaudited Group

31 Oct 2021 31 Oct 2020 Audited

30 April

2021

GBP GBP GBP

Revenue from contracts with customers - 1,348,227 3,296,730

5. EARNINGS PER SHARE

The basic loss per share is derived by dividing the loss for the

period attributable to ordinary shareholders by the weighted

average number of shares in issue.

Group Unaudited Group Unaudited Group

31 Oct 2021 31 Oct 2020 Audited

30 April

2021

GBP GBP GBP

Loss for the period (227,218) (156,947) (913,827)

Weighted average number of shares

- expressed in thousands 496,352 450,950 456,930

Basic earnings per share - expressed

in pence (0.00046) (0.00035) (0.0020)

6. TRADE AND OTHER RECEIVABLES

Group Unaudited Group Unaudited Group

31 Oct 2021 31 Oct 2020 Audited

30 April 2021

GBP GBP GBP

Trade and other receivables 377,620 30,623 15,100

Amounts recoverable on contracts 561,216 684,105 561,216

---------------- ---------------- ---------------

938,836 714,728 576,316

================ ================ ===============

Amounts recoverable on contracts represents sales invoices

issued after the period end in respect of work undertaken during

the period with appropriate provision being made in accruals and

deferred income for costs incurred in undertaking such work but

which had not been invoiced at the period end.

7. TRADE AND OTHER PAYABLES

Group Unaudited Group Unaudited Group

31 Oct 2021 31 Oct 2020 Audited

30April 2021

GBP GBP GBP

Trade and other payables 1,681,253 264,016 1,052,660

Accruals 118,500 93,500 166,148

Accrued property costs - 412,136 -

1,799,753 769,652 1,218,808

================ ================ ==============

8. APPROVAL OF INTERIM FINANCIAL STATEMENTS

The Condensed interim financial statements were approved by the

Board of Directors on 28 January 2022. A copy can be obtained on

the Company's website at www.dukemountcapitalplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKFBNNBKDODB

(END) Dow Jones Newswires

January 28, 2022 08:43 ET (13:43 GMT)

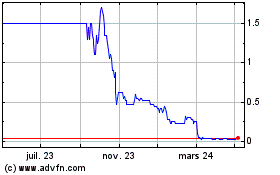

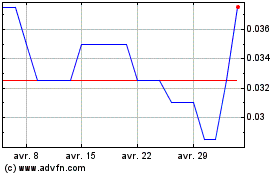

Dukemount Capital (LSE:DKE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dukemount Capital (LSE:DKE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025