TIDMDRV

RNS Number : 7743Q

Driver Group plc

23 February 2023

23 February 2023

DRIVER GROUP PLC

("Driver" or "the Group")

Preliminary Results and Dividend Declaration

Driver Group PLC (AIM: DRV), the global professional services

consultancy to construction and engineering industries, is pleased

to announce the dividend for the full year and its results for the

financial year ended 30 September 2022.

The final dividend for the full year of 0.75 pence per share

will be paid on 13 April 2023 to shareholders who are on the

register of members at the close of business on 3 March 2023, with

an ex-dividend date of 2 March 2023 subject to approval at the

forthcoming AGM.

Operational Highlights

-- De-risked Middle East business - Including reduced headcount -30

-- De-risked Asia Pacific business - Including reduced headcount -11

-- Successful focus on global office collaboration, impacting utilisation

-- Increased Diales headcount to 53 from 47

-- Improving pipeline of new enquires

-- Strengthened Board through the appointment of Charlotte

Parsons as CFO and appointment of Shaun Smith as non-executive

Chair (effective at the AGM)

Financial Summary

-- Revenue decreased by 4% to GBP46.9m (2021: GBP48.8m)

-- Underlying* loss before tax of GBP1.0m (2021: profit GBP2.0m)

-- Net cash** of GBP4.9m (2021: GBP6.5m)

-- Utilisation*** of 67.5% (2021: 72.4%)

Post period end: Financial Summary Q1

-- Q1 revenue increased by 5% to GBP11.8m

-- Operating profit of GBP0.25m

-- Net cash of GBP4.7m as at 31 January 2023

-- Utilisation increased to 70% (2022: 67.5%)

-- Interim Dividend approved

-- Overhead reduction implemented, with further savings in progress

-- The Board expects to return to profitability for FY23

* Underlying figures are stated before the share-based payment

costs and one off severance costs

** Net cash consists of cash and cash equivalents and bank

loans

*** Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

Mark Wheeler, Chief Executive Officer of Driver Group plc,

commented:

The FY22 trading year encompassed some unpredicted challenges

for the Group, in particular in the Middle East and APAC markets.

We reduced headcount and cost very significantly in these regions

in a very short space of time. Management took steps to minimise

the impact of the exit of these people while at the same time

taking the opportunity to de-risk these historic problem areas for

the strategic aims of the Group. Our UK and European businesses

continued to perform creditably. Trading in the first quarter has

begun profitably and we are sharply focussed on delivering cost

savings and delivering a return to profitability in the current

financial year.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

* Underlying figures are stated before the share-based payment

costs and one off severance costs

** Net cash consists of cash and cash equivalents and bank

loans

*** Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

Enquiries

Driver Group plc 020 7377 0005

Mark Wheeler (CEO)

Charlotte Parsons (CFO)

Singer Capital Markets (Nomad

& Broker) 020 7496 3000

Sandy Fraser

Jen Boorer

Alex Emslie

Acuitas Communications 020 3745 0293 / 07799 767676

Simon Nayyar simon.nayyar@acuitascomms.com

Arthur Dingemans arthur.dingemans@acuitascomms.com

CHAIRMAN'S STATEMENT

OVERVIEW

As I reported in our 2022 interim results, Driver Group's key

focus this year has been to take significant early action to

address underperforming areas in our global business, mitigate

commercial risk, improve operational resilience, and implement

systems to enhance profitability and margin performance.

The year was defined by the long-tail legacy effects of the

COVID-19 pandemic across the markets in which Driver operates.

These post-pandemic issues have been conflated by global energy and

supply chain uncertainties, rising interest rates, and the

inflationary pressures caused by the conflict in Ukraine. I believe

that we have managed these external challenges well for our

shareholders and clients, whilst executing our reorganisation

strategy in a decisive and effective way. In spite of this

difficult global trading environment the measures we have taken

have put the business on a strong and sustainable footing which

leaves the business well placed to capitalise on future

opportunities.

Europe and the Americas continue to be our best performing

regions and are a central focus of our growth plans in 2023. The

Driver Project Services team based in the UK and our Driver Trett

team both made a significant contribution to the results, and our

US team continues to develop organically into a valuable asset,

building out our bridgehead into the highly profitable markets of

Central and South America.

A major strategic aim this year has been a policy of

risk-reduction across the whole business. We have tackled major

legacy issues in the Middle East, streamlining our presence and

disposing of loss-making operations and assets. Although reducing

our operations in the region has crystallised a charge in the

2022-23 financial year, we are confident that as a result of this

reorganisation our presence in the UAE, KSA, Qatar and Oman will

now deliver more consistent profitability within the region.

I am pleased to report that we have also executed significant

internal administrative changes to improve our performance this

coming financial year and beyond. We expect the successful

implementation of our new accounting software at the start of the

second half of FY22 to have a positive impact on future periods

performance, improving visibility over utilisation levels,

supporting the collection of outstanding debts, and providing us

with cutting edge tools to maximise control over our cashflow.

Taken together these measures are expected to have a positive

impact on future business efficiency and productivity levels.

TRADING PERFORMANCE

While these changes leave us well-placed for growth, our mission

to de-risk and improve the efficiency of our business continues. It

is in the nature of a professional services business such as ours

that predicting revenue beyond a rolling six-week window has always

been difficult. We continue our focus on controlling overhead costs

and delivering client servicing more efficiently to enhance our

ability to be consistently profitable.

The cost of implementing these risk reduction strategies has

been significant but we have ended the year with a healthy cash

balance of GBP4.9m and no debt, reflecting our careful and prudent

stewardship.

DIVID

I am pleased to confirm that in spite of a challenging year the

Directors have recommended a final dividend of 0.75p (2021: 0.75p

per share) in addition to the interim dividend declared at the half

year, demonstrating the Directors confidence in the business.

BOARD CHANGES

The financial year has seen several changes at board level. Our

CEO Mark Wheeler continues to guide our strategy and has been

greatly assisted by our CFO Charlotte Parsons who has done a first

class job since joining us permanently in July 2022. She will

continue to provide insightful stewardship over the coming year.

Finally, I want to express my thanks to Tom Comerford who has

stepped up to the COO role in order to support Mark. These changes

have already significantly enhanced our ability to improve our

business in the face of global pressures.

On a personal note, having served as your Chairman for over

eight years, I will be handing the stewardship of the Group to

Shaun Smith who will join the Board and become the Group's new

Non-Executive Chair following my retirement at the conclusion of

the forthcoming AGM on 23rd March 2023. It has been an enormous

privilege to lead Driver Group over this period and I am confident

that Shaun will continue to drive the business forward.

OUTLOOK

The 2022 financial year has been a period of dynamic change and

transition for us all and, for Driver Group, it has been no

different. As the world has adjusted to the post-Covid settlement,

one characterised by supply chain pressures and rapidly rising

inflation across many of our key markets, Driver Group has taken a

considered and commercial view about how to get the business on the

front foot and ready to take advantage of the opportunities ahead

of us.

It is no coincidence that over the last many years Driver Group

has sustained a global reputation for competitive performance and

professionalism. We have done so directly as a consequence of the

loyalty, ingenuity and teamwork of our brilliant staff around the

world. I would like to take this opportunity to send every one of

them my thanks and best wishes.

I want to express my gratitude to Mark and the executive team

and to my non-executive board colleagues for making my role such a

rewarding one to fulfil. I am confident that Driver Group will go

from strength to strength under my successor and trust he will find

his time at the helm as satisfying as I have.

The Board expects to deliver a return to profitability for FY23

and I shall continue to watch Driver Group's fortunes with great

affection and interest.

Steve Norris

Non-Executive Chairman

CHIEF EXECUTIVE OFFICER'S REVIEW

INTRODUCTION

FY22 has been a period of dynamic change and transition for us

all and, for Driver Group, it has been no different. As the world

has adjusted to the post-Covid settlement, one characterised by

supply chain pressures and rapidly rising inflation across many of

our key markets, Driver Group has taken a considered and commercial

view about how to get the business on the front foot and ready to

take advantage of the opportunities that we can already see ahead

of us.

Accordingly, we have implemented a raft of measures designed to

improve the resilience and competitiveness of our business going

forward: in particular, a focus on risk reduction in the Middle

East and Asia Pacific regions has brought Driver the early

advantages of significantly stronger long-term positioning.

As we emerged from the pandemic, workload began to increase in

line with expectations, and in the second quarter of the year we

took steps to restructure our presence in the Middle East.

Management has executed a strategy designed to reduce our exposure

in this region whilst ensuring seamless continuity of client

servicing, which has involved balancing the staff profile with

workload and the levels of income that could be generated.

Elsewhere, our businesses in Europe and the UK have delivered

strong performance and the growth of our organically generated

business in the United States has progressed significantly and

successfully, tapping into opportunities in fast growing Latin

American markets.

As with many businesses, the ongoing conflict in Ukraine has

caused disruption in relation to, a number of our markets for

arbitration and major project disputes, for clients working in

Russia. Although travel restrictions remain in place, and sanctions

are preventing multiple disputes and hearings progressing until the

conflict ends, we expect to reengage in these disputes once the

situation normalises.

During the current financial year, our management teams will

continue to realign our cost base with the revised requirements for

business support across our global operations. They will be

extracting efficiency gains wherever we deem this appropriate and

ensuring the business is exceptionally well positioned for the

future development that we anticipate in FY23.

Our key staff have returned to extensive travel post-pandemic to

reinforce global relationships and their delivery upon key

commissions provides encouragement as we look ahead. We have moved

away from regional silos and now operate fluidly around the globe,

which will improve our utilisation over the next 12 months.

I would like personally to thank our outgoing Chairman Steven

Norris for his service to Driver Group and for his insights and

experience which I and my colleagues around the business have

benefited from enormously over the last 8 years. I would also like

to thank our new CFO, Charlotte Parsons, who has proved to be a

great asset to the business; and our new COO, Tom Comerford, for

his support over recent months and indeed over 20 years service to

date. I also look forward to welcoming Shaun Smith to the Board at

our AGM and look forward to working together.

We remain one of the world's largest and most respected

practitioners in the specialist fields of Construction, Expert

Witness, and Dispute Resolution. Our staff continue to be our

greatest asset and enable us to retain and recruit business in a

way that promises enhanced levels of profitability in the year

ahead.

STRATEGY

Our strategy for developing the business has seen us focused on

our staff, our margin, and growth in the areas we have identified.

Our business culture and ethos will prioritise the maximal

utilisation and profitability of our staff, while our management

team remains committed to ensuring these areas receive the

attention they deserve and that the benefits flow through to the

bottom line in a timely and efficient way.

As a people-led business, we see staff retention as a key area

of focus and have made significant progress to ensure that, in a

marketplace where disruption from private equity-backed

organisations has proved a challenge, our staff benefit to the full

from Driver's exceptionally positive working environment and

collegiate and inclusive culture. We have taken steps to support

our staff around the world during the cost of living crisis,

introducing new and innovative staff benefit schemes to ensure our

people are best placed to weather the current economic storm.

Coupled with the updated staff retention programmes, we are

confident this will help the business both secure its existing

talent and be well placed to hire additional staff of the

appropriately high calibre to work in our business.

Our marketing team have performed extremely effectively in

recent years and are now fully integrated with business development

to bring in the larger international commissions which have a major

positive impact on our utilisation levels. The number of leads in

this pipeline of major commissions has significantly increased over

the last quarter and we hope to see these early signs of success

develop well into 2023 and beyond.

We have now completed the installation of our ERP IT system and

expect this to contribute significant new efficiencies over the

next 6 to 12 months. I would like to pay particular thanks to our

finance team who have worked tirelessly alongside our new CFO to

ensure this system runs effectively. The provision of real time

management data will be an enormous asset to the business moving

forward.

Running a global business in an environmentally responsible and

sustainable way, and one that is imbued with high standards of

governance and ethics is vital to all of us at Driver Group. The

importance that, like our clients, we attach to high standards of

ESG performance has been reflected by a migration within the

business towards e-communications with our investors and staff,

which promises greater time-efficiency, effectiveness and a reduced

environmental footprint. The Board remains deeply committed to

living our ESG values.

REGIONAL BREAKDOWN

EUROPE AND AMERICAS

The business had another good year in Europe with a significant

recovery in the Paris office following a reorganisation of our

operations there in the preceding year. We are also delighted to

see the addition of a new testifying expert in that office, further

developing this aspect of our business and reflecting our desire to

compete even more vigorously in this market in the future.

The business in Germany continued to grow consistently and

organically in alignment with our strategic outlook, and our

longstanding business in the Netherlands also performed well during

this period. We are delighted to see the business in Madrid going

from strength to strength following a start-up during the pandemic,

enhancing our ability to service the important global

Spanish-speaking market.

Within the UK business, we supported some staff members through

challenging periods of ill health. Despite these challenges, the

business achieved similar levels of revenue and profit compared to

the preceding year, and is expected to return to its trend growth

rate in the current financial year - a level of performance which

has been achieved, year over year, for the previous 10 years.

I would like particularly to mention our Driver Project Services

business in the North East of England, which has enjoyed a year of

exceptional and highly commendable growth. DPS has grown the number

of its clients and the number of staff placed on projects

significantly during the year, whilst assisting with the challenges

of clients in the manufacturing, pharmaceutical and petrochemical

industries. It has helped our clients re-engage following the

pandemic and then manage the challenging impact of the energy and

cost of living crises.

Our business in Canada unfortunately also suffered from some

ill-health in its leadership and we have restructured to take that

team forward in 2022 and beyond. I would particularly like to thank

Kevin O'Neil our former Country Manager, for his unstinting support

over the last few years.

Having launched our presence in the US during the pandemic, I am

pleased to report that major project work has been secured; the

team has doubled every six months since its inception; and we now

have a well-established platform ensuring that we are positioned

for sustainable future growth. This is a tribute to the team on the

ground.

ASIA PACIFIC

In view of the need to resolve decisively an especially large

contract and management changes, the business in the Asia Pacific

region has seen the creation of a new leadership team in order to

capitalise on our business potential there. As part of this

restructuring, we no longer operate from within Hong Kong or

Malaysia but continue to service clients in those markets from our

operations in Singapore and Australia, delivered in a more

flexible, efficient and client-focused way.

Our leadership team in this region has been with us for a

considerable length of time and has a great track record of

success. I am very confident that we can see the return to profit

that has taken place in Asia Pacific not only stabilise, but grow,

in the next 2 to 3 years, to make a positive contribution to the

Group.

I would like particularly to praise our team in Australia who

have run a positive and profitable business throughout both the

closing phase of the pandemic and some of the global challenges of

2022.

MIDDLE EAST

Staff turnover in this region confirmed our strategy to de-risk

without placing undue pressure on debtor balances. The careful

implementation of this strategy has equipped us with a more

resilient business which is able to respond to client demand across

this region and allows us to continue to provide a world-class

service.

Thanks to the disposal of loss-making assets in the region, our

business in the UAE has returned to profit and has started to

contribute to other operations by securing work for Europe or Asia

Pacific to deliver. Our business in Qatar has also returned to

profit and we look forward to working with enquiries over the

legacy of World Cup 2022 projects, which we expect to take this

business forward profitably and sustainably over the next couple of

years.

The Company no longer operates from Kuwait, although we will

continue seamlessly to service clients there from our operations in

UAE or Qatar. As in Asia Pacific, this means an identical or even

better level of client servicing delivered from a more efficient

and effective service platform.

I would like particularly to thank our staff in our office in

Oman, who have been admirably resilient and have helped us to

secure a very significant reduction in the aging debt relating to

this office over the last 12 months: GBP650,000 was recovered at

the end of the financial year, and a further GBP1.2m was received

in October. They have worked tirelessly to return that business to

profit and I commend their contribution.

CURRENT TRADING AND OUTLOOK

The year has been one of reviewing, restructuring and resetting.

It has been informed by the Board's proactive and prudent approach

to servicing our clients in the most efficient and responsible

manner, and our desire to return value to shareholders whenever and

wherever possible.

The benefits of the steps we took last year are now starting to

feed through. We are trading profitably and are now well positioned

in FY23 to benefit from that earlier action and I am, therefore,

very positive about our ability to meet our strategic aims of

driving sustainable value creation for the benefit of our

shareholders in the short term, and of delivering an expanding

range of opportunities and incentives for our wider

stakeholders.

This positive outlook is further encouraged and endorsed by the

welcome progress I am pleased to report that we have made in Q1 of

FY23. Profitable performance in the first quarter serves only to

confirm that the tough decisions we took in the last financial year

in order to position ourselves better for the future are already

beginning to pay off. Where challenges have emerged, we have dealt

with them in a thoughtful, diligent and decisive way, recognising

the positive impact on our current cost base and competitiveness

and with a keen awareness of the strength such action brings to

Driver Group during the current financial year and in future

ones.

The collection of GBP1.85m of aged debts from Oman at the end of

the financial year serves as powerful testimony to our staff's

patience determination and resourcefulness in helping us deal with

legacy issues effectively and to reset our presence in the region

where we will in the future pursue a more flexible and dynamic

approach.

Going forward, we will be even more focused on ensuring we meet

client needs in the most efficient and seamless way, which may mean

delivering service from wherever in the world the business's most

relevant talents and expertise sit. We will do this in a

disciplined and resourceful way that delivers even better value to

our clients and, in the process, improves the utilisation of our

bench of professional talents and skills. Over the coming year, we

expect to see further benefits arising from this enhanced

operational focus.

The performance of our operations in Europe and the Americas

demonstrates clearly the value Driver Group creates for its

shareholders and clients. We ended the year with total revenue

exceeding GBP36.2m and our operations here are a model for us to

replicate elsewhere across our global business. Elsewhere, our

footprint has been more closely aligned with client need and,

again, this is a trend which we expect will continue over the

coming period in order to maximise benefits to the Group and its

shareholders.

Our healthy cash balance of GBP4.9m at the end of the year

stands us in good stead as we have evolved further our approach and

method of client servicing. The financial results for FY22 reflect

our strategy of risk and cost reduction and their benefits have, as

I have already indicated, been confirmed by our return to profit in

the first quarter of the new financial year. I am, therefore,

confident that the way in which we have dealt with past challenges

leaves us operationally and competitively well positioned for the

future.

SUMMARY AND CONCLUSIONS

Despite the success of our strategy to remain focused on higher

margins and to increase our profile within expert witness services,

2022 has certainly presented challenges. We have maintained a

steady pipeline of work and opportunities whilst effectively

securing our long-term prospects through the restructuring of our

business in the Middle East this year.

We no longer see COVID restrictions having a significant impact

upon the business except in relation to Chinese entities although,

at the time of writing, those restrictions appear to be lessening

significantly: this holds out the prospect of significant

opportunities and progress in the near term in this

jurisdiction.

The challenges created by the conflict in Ukraine are still

present, but that pipeline of work has not gone away but been

deferred pending the resolution of that conflict.

Whilst the increases in the cost of living and fuel prices have

undoubtedly posed a number of challenges for our clients and our

staff, we have met those challenges with targeted measures designed

to support our team through this period. We note that clients

experiencing challenges on projects where prices are rising

significantly represents a strong stream of work for the Group. In

the face of these global challenges, our experts in construction

cost and planning and technical matters are exceptionally well

placed to help clients deal with finding the right strategy for

their projects to cope with rising costs, and I anticipate that

further work will result from the current macro-economic and

trading environment.

The renewed scope for international travel, to an extent not

seen since early 2020, at long last, allows us to return to other

important business development activities. These will undoubtedly

secure some valuable additional revenue but, above all, the Group's

key asset is - as it has always been - its people.

Trading in the first quarter has begun profitably. We have an

incredibly talented and committed pool of staff around the globe

who I am confident will help the Board steer the business to a

return to a profitable trading performance this year and beyond.

Taken together with the strategic steps that we have taken to

right-size our operations around the world and to make our client

servicing more targeted, efficient and cost-effective, the

opportunities going forward are, I believe, very significant.

Mark Wheeler

Chief Executive Officer

CHIEF FINANCIAL OFFICER'S REVIEW

INCOME STATEMENT 2022 GBPm 2021 GBPm

--------------------------------- ---------- ----------

Revenue 46.90 48.77

Cost of sales (37.10) (36.35)

Impairment movement (0.19) (0.19)

--------------------------------- ---------- ----------

Gross Profit 9.61 12.23

Recurring operating expenses (9.90) (10.11)

Net finance costs (0.10) (0.11)

--------------------------------- ---------- ----------

Operational (loss)/profit before

tax (0.39) 2.01

One off non-recurring expenses (0.57) -

Underlying* (loss)/profit before

tax (0.96) 2.01

--------------------------------- ---------- ----------

Exceptional costs (1.00) -

Share-based payments charge (0.47) (0.15)

--------------------------------- ---------- ----------

(Loss)/profit before Tax (2.43) 1.86

Tax expense (0.46) (0.75)

--------------------------------- ---------- ----------

(Loss)/profit for the year (2.89) 1.11

--------------------------------- ---------- ----------

During the first quarter of the financial year to 30 September

2022, as we emerged from the pandemic, workload increased in line

with budget. The results in the second quarter were impacted by a

combination of a loss-making contract in the APAC region and a drop

in revenues in the Middle East region. The Middle East region was

also further impacted in Q3 due to the management team transferring

to a counterparty from 1 June 2022, along with 25 employees. The

EuAm region had another good year with revenues continuing to

increase, but, across all regions there was an operational loss

before tax of GBP0.39m for the financial year to 30 September 2022,

before one-off APAC and Middle East regions reorganisation costs of

GBP0.57m and an onerous lease provision of GBP1.0m. The key

financial metrics are as follows:

KEY METRICS 2022 2021

-------------------------------- ----------- ----------

Revenue GBP46.90m GBP48.77m

Gross Margin % 20.5% 25.1%

(Loss)/profit for the year GBP(2.89)m GBP1.11m

Utilisation Rates** 67.5% 72.4%

Basic (loss)/earnings per share (5.5)p 2.1p

-------------------------------- ----------- ----------

Total revenue decreased by 3.8% to GBP46.90m (2021: GBP48.77m)

and gross profit decreased by 21.4% to GBP9.61m (2021: GBP12.23m).

The reduction in gross profit was a result of the loss-making

contract in the APAC region and decreased revenue in the ME region,

the impact of which has been offset by a reduction in costs. This

resulted in an underlying* loss for the year of GBP0.96m, in-line

with our expectations, compared to an underlying profit before tax

of GBP2.01m in 2021. The net cash** at the year-end was GBP4.93m

(2021: GBP6.47m), after funding a dividend payment of GBP0.78m

(2021: GBP0.39m) and a share buyback programme of GBP0.50m

(2021:Nil).

The EuAm region increased revenue by 3.8% to GBP35.01m (2021:

GBP33.73m) with a decrease in segmental profit of 20.8% to GBP3.92m

(2021: GBP4.95m). This strong performance was driven by good

revenues in the UK of GBP24.88m (2021: GBP25.25m) an increase in

revenues in mainland Europe of 12.6% to GBP7.35m (2021: GBP6.53m)

and an increase in revenues in North America of 45.9% to GBP2.86m

(2021: GBP1.96m).

The ME region saw revenues decrease during the year by 26.2% to

GBP8.06m (2021: GBP10.92m) primarily as a result of the management

team responsible for the APAC and Middle East regions transferring

to a counterparty from 1 June 2022, along with 25 employees. The

segmental result for the region was a loss of GBP1.81m (2021:

segmental loss GBP0.74m).

The APAC region saw revenues reduce by 9.0% to GBP3.75m (2021:

GBP4.12m). The revenues in Australia increased by 12.4% to GBP1.63m

(2021: GBP1.45m), which helped to offset the reduction in the

remainder of the region. The segmental result for the year was a

loss of GBP0.54m (2021: segmental loss GBP0.41m) which reflects the

impact of the loss-making contract in the region. Increasing

utilisation will continue to be a key focus for the Group going

forward.

The utilisation*** rate of chargeable staff across the business

as a whole for the year fell to 67.5% (2021: 72.4%). Across the

regions this was 71.9% in EuAm, 68.1% in APAC and 52.6% in the

Middle East, reflecting the challenges highlighted above in APAC

and the Middle East.

After a net interest charge of GBP0.10m (2021: GBP0.11m) the

operational loss before tax was GBP0.39m (2021: GBP2.01m) and the

reported loss before tax was GBP2.43m post one-off Middle East

reorganisation costs of GBP0.57m and an onerous lease provision of

GBP1.00m (2021: GBP1.86m). The current year profit before tax

includes a charge for share-based payments of GBP0.47m

(2021:GBP0.15m).

NET WORKING CAPITAL

Net cash** remained healthy, closing the year at GBP4.93m (2021:

GBP6.47m) with a reduction in net working capital following an

increase in outstanding debtors and an increase in creditors.

TAXATION

The Group incurred a tax charge of GBP0.46m (2021: GBP0.75m).

The tax charge includes the effects of expenses not deductible for

tax purposes and is calculated at the prevailing rates for the

jurisdictions in which the Group operates and, consequently, the

effective tax rate for the year was 18.9% (2021: 40.3%). The

decrease in the effective rate is mainly due to the onerous lease

provision offset by losses or reduced profits made in jurisdictions

with either nil or lower tax rates which results in no relief for

tax losses.

EARNINGS PER SHARE

The basic loss per share was 5.5 pence (2021: profit 2.1 pence).

Underlying* continuing basic loss per share was 2.7p pence (2021:

profit 2.4 pence).

CASH FLOW

There was a net cash outflow from operating activities before

changes in working capital of GBP1.26m (2021: GBP3.36m), including

the current year benefit of GBP0.96m (2021: GBP0.97m) from the

amortisation of right of use assets under IFRS16. The movement also

reflects the reported loss for the year of GBP2.89m (2021: profit

GBP1.11m) after depreciation of GBP0.24m (2021: GBP0.26m). There

was an increase of GBP1.33m in trade and other receivables (2021:

increase of GBP0.88m) reflecting the more difficult market

conditions during the year, and an increase in trade and other

payables of GBP4.00m (2021: decrease GBP1.47m) resulting in a net

cash inflow from operating activities of GBP0.87m (2021: GBP0.25m).

Net tax paid in the year was GBP0.54m (2021: GBP0.76m).

There was a net cash outflow from investing activities of

GBP0.57m (2021: GBP0.52m) which is a result of increased capital

expenditure, including IT spend.

Net cash flow from financing activities was an outflow of

GBP2.20m (2021: GBP4.43m) with the current year reflecting the

dividends paid of GBP0.78m (2021: GBP0.39m), share buyback

programme GBP0.50m and lease repayments under IFRS 16 of GBP0.82m

(2021: GBP0.93m).

cash flow GBPm

---------------------------------------- -------

Net cash** at 30 September 2021 6.47

Operating cash flow before changes

in working capital (1.26)

Increase in Trade and other receivables (1.33)

Increase in Trade and other payables 4.00

Tax paid (0.54)

Net interest paid (0.10)

Net Capital spend (0.57)

Dividends paid (0.78)

Purchase of Treasury shares (0.50)

Repayment of leases (0.82)

Effects of Foreign Exchange 0.36

Net cash** at 30 September 2022 4.93

---------------------------------------- -------

LIQUIDITY AND GOING CONCERN

The Group is in a strong financial position. At the year end the

Group had net cash balances of GBP4.93m (2021: GBP6.47m). The net

cash position is appropriate for the Group's operating requirements

going forward but the current borrowing facilities are no longer

suitable and will be replaced by a more flexible working capital

arrangement.

The Directors have completed a review of the Group's financial

forecasts for a period of more than twelve months from the date of

approving these financial statements. This review has included

sensitivity analysis and stress tests which took account of

reasonable and foreseeable scenarios including any continuing

impact of the COVID-19 pandemic and related risks. Under all

scenarios modelled the Directors anticipate that any funding needs

required would be sufficiently covered by the existing cash

reserves. As such the Directors have a reasonable expectation that

the Group has sufficient resources and hence these financial

statements include information prepared on a going concern

basis.

DIVIDS

The Directors propose a final dividend for 2022 of 0.75p per

share (2021: 0.75p per share) in addition to the interim dividend

paid in October 2022 of 0.75p per share (2021: 0.75p) This will be

paid on 13 April 2023 to shareholders who are on the register of

members at the close of business on 3 March 2023, with an

ex-dividend date of 2 March 2023, subject to approval at the

Group's forthcoming Annual General Meeting.

CHARLOTTE PARSONS

CHIEF FINANCIAL OFFICER

* Underlying figures are stated before the share-based payment

costs and exceptional costs

**Net cash consists of cash and cash equivalents and bank

loans.

***Utilisation % is calculated by dividing the total hours

billed by the total working hours available for chargeable

staff

CONSOLIDATED INCOME STATEMENT

For the year ended 30 September 2022

2022 2021

GBP000 GBP000

----------------------------------------------- -------- --------

REVENUE 46,897 48,772

Cost of sales (37,095) (36,350)

Impairment movement (188) (187)

----------------------------------------------- -------- --------

GROSS PROFIT 9,614 12,235

Administrative expenses (12,107) (10,459)

Other operating income 167 194

----------------------------------------------- -------- --------

Underlying* operating (loss)/profit (861) 2,119

Exceptional costs (1,000) -

Share-based payment charges and associated

costs (465) (149)

----------------------------------------------- -------- --------

OPERATING (LOSS)/PROFIT (2,326) 1,970

Finance income - -

Finance costs (100) (110)

----------------------------------------------- -------- --------

(LOSS)/PROFIT BEFORE TAXATION (2,426) 1,860

Tax expense (460) (746)

(LOSS)/PROFIT FOR THE YEAR (2,886) 1,114

----------------------------------------------- -------- --------

Loss attributable to non-controlling (2) -

interest

(Loss)/Profit attributable to equity

shareholders of the Parent (2,884) 1,114

----------------------------------------------- -------- --------

(2,886) 1,114

----------------------------------------------- -------- --------

Basic (loss)/earnings per share attributable

to equity shareholders of the Parent

(pence) (5.5)p 2.1p

Diluted (loss)/earnings per share attributable

to equity shareholders of the Parent

(pence) (5.3)p 2.1p

----------------------------------------------- -------- --------

* Underlying figures are stated before the share-based payment

costs and exceptional costs

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2022

2022 2021

GBP000 GBP000

------------------------------------------------------- ------- -------

(LOSS)/PROFIT FOR THE YEAR (2,886) 1,114

------------------------------------------------------- ------- -------

Other comprehensive income:

Items that could subsequently be reclassified to

the Income Statement:

Exchange differences on translating foreign operations (970) 38

------------------------------------------------------- ------- -------

OTHER COMPREHENSIVE (LOSS)/PROFIT FOR THE YEAR

NET OF TAX (970) 38

TOTAL COMPREHENSIVE (LOSS)/INCOME FOR THE YEAR (3,856) 1,152

------------------------------------------------------- ------- -------

Total comprehensive income attributable to:

Owners of the Parent (3,854) 1,152

Non-controlling interest (2) -

------------------------------------------------------- ------- -------

(3,856) 1,152

------------------------------------------------------- ------- -------

Consolidated Statement of Financial Position

For the year ended 30(th) September 2022

2022 2021

-------------------------------

GBP000 GBP000 GBP000 GBP000

------------------------------- -------- -------- ------- --------

NON-CURRENT ASSETS

Goodwill 2,969 2,969

Property, plant and equipment 384 405

Intangible asset 798 516

Right of use asset 1,375 1,854

Deferred tax asset 192 272

------------------------------- -------- -------- ------- --------

5,718 6,016

------------------------------- -------- -------- ------- --------

CURRENT ASSETS

Trade and other receivables 20,281 18,865

Derivative financial asset - 57

Current tax receivable 470 -

Cash and cash equivalents 4,931 6,474

------------------------------- -------- -------- ------- --------

25,682 25,396

------------------------------- -------- -------- ------- --------

TOTAL ASSETS 31,400 31,412

------------------------------- -------- -------- ------- --------

CURRENT LIABILITIES

Lease creditor (754) (778)

Trade and other payables (11,296) (8,009)

Derivative financial liability (1,938) (169)

Current tax payable (251) (165)

------------------------------- -------- -------- ------- --------

(14,239) (9,121)

------------------------------- -------- -------- ------- --------

NON-CURRENT LIABILITIES

Lease creditor (634) (1,023)

Deferred tax liabilities (169) -

------------------------------- -------- -------- ------- --------

(803) (1,023)

TOTAL LIABILITIES (15,042) (10,144)

------------------------------- -------- -------- ------- --------

NET ASSETS 16,358 21,268

------------------------------- -------- -------- ------- --------

SHAREHOLDERS' EQUITY

Share capital 216 216

Share premium 11,496 11,496

Merger reserve 1,055 1,055

Currency reserve (1,381) (411)

Capital redemption reserve 18 18

Treasury shares (1,525) (1,025)

Retained earnings 6,478 9,916

Own shares (3) (3)

------------------------------- -------- -------- ------- --------

TOTAL SHAREHOLDERS' EQUITY 16,354 21,262

NON-CONTROLLING INTEREST 4 6

------------------------------- -------- -------- ------- --------

TOTAL EQUITY 16,358 21,268

------------------------------- -------- -------- ------- --------

CONSOLIDATED CASHFLOW STATEMENT

For the Year Ended 30 September 2022

2022 2021

GBP000 GBP000

------------------------------------------ ------- -------

CASH FLOWS FROM OPERATING ACTIVITIES

(Loss)/profit for the year (2,886) 1,114

------------------------------------------ ------- -------

Adjustments for:

Depreciation 239 261

Exchange adjustments (361) 38

Amortisation of right of use asset 917 969

Amortisation of intangible asset 40 -

Finance expense 100 110

Tax expense 460 746

Equity settled share-based payment charge 229 118

------------------------------------------ ------- -------

OPERATING CASH FLOW BEFORE CHANGES IN WORKING

CAPITAL AND PROVISIONS (1,262) 3,356

Increase in trade and other receivables (1,330) (881)

Increase/(decrease) in trade and other payables 4,000 (1,465)

CASH GENERATED IN OPERATIONS 1,408 1,010

Tax paid (539) (763)

----------------------------------------------------- ------- -------

NET CASH INFLOW FROM OPERATING ACTIVITIES 869 247

----------------------------------------------------- ------- -------

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received - -

Acquisition of property, plant and equipment (398) (187)

Proceeds from the disposal of property, plant

and equipment 150 -

Acquisition of intangible assets (321) (334)

----------------------------------------------------- ------- -------

NET CASH OUTFLOW FROM INVESTING ACTIVITIES (569) (521)

----------------------------------------------------- ------- -------

CASH FLOWS FROM FINANCING ACTIVITIES

Interest paid (100) (110)

Repayment of borrowings (1,000) (3,250)

Proceeds of borrowings 1,000 250

Repayment of lease liabilities (821) (928)

Purchase of Treasury shares (500) -

Dividends paid to equity shareholders of the

Parent (783) (391)

----------------------------------------------------- ------- -------

NET CASH OUTFLOW FROM FINANCING ACTIVITIES (2,204) (4,429)

----------------------------------------------------- ------- -------

Net (decrease)/increase in cash and cash equivalents (1,904) (4,703)

Effect of foreign exchange on cash and cash

equivalents 361 (38)

Cash and cash equivalents at start of period 6,474 11,215

----------------------------------------------------- ------- -------

CASH AND CASH EQUIVALENTS AT OF PERIOD 4,931 6,474

----------------------------------------------------- ------- -------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the Year ended 30 September 2022

Share Share Treasury Merger Other Retained Own Non- Total

capital premium shares reserve reserves(2) earnings shares(3) Total(1) controlling Equity

interest

==============

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

OPENING

BALANCE AT

1 OCTOBER

2020 216 11,496 (1,025) 1,055 (431) 9,075 (3) 20,383 6 20,389

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

Pro t for the

year - - - - - 1,114 - 1,114 - 1,114

Other

comprehensive

income for

the year - - - - 38 - - 38 - 38

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

Total

comprehensive

income for

the year - - - - 38 1,114 - 1,152 - 1,152

Dividends - - - - - (391) - (391) - (391)

Share-based

payment

(4) - - - - - 118 - 118 - 118

Purchase of - - - - - - - - - -

Treasury

shares

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

CLOSING

BALANCE AT

30 SEPTEMBER

2021 216 11,496 (1,025) 1,055 (393) 9,916 (3) 21,262 6 21,268

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

OPENING

BALANCE AT

1 OCTOBER

2021 216 11,496 (1,025) 1,055 (393) 9,916 (3) 21,262 6 21,268

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

Loss for the

year - - - - - (2,884) - (2,884) (2) (2,886)

Other

comprehensive

loss for the

year - - - - (970) - - (970) - (970)

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

Total

comprehensive

loss for the

year - - - - (970) (2,884) - (3,854) (2) (3,856)

Dividends - - - - - (783) - (783) - (783)

Share-based

payment

(4) - - - - - 229 - 229 - 229

Purchase of

Treasury

shares - - (500) - - - - (500) - (500)

============== ========== =========== ========= ========= =============== ========= ============= ========= =========== ==========

CLOSING

BALANCE AT

30 SEPTEMBER

2022 216 11,496 (1,525) 1,055 (1,363) 6,478 (3) 16,354 4 16,358

(1) Total equity attributable to the equity holders of the

Parent.

(2) 'Other reserves' combines the currency reserve and capital

redemption reserve. The movement in the current and prior year

relates to the translation of foreign currency equity balances and

foreign currency non-monetary items.

(3) The shortfall in the market value of the shares held by the

EBT and the outstanding loan is transferred from own shares to

retained earnings.

(4) The amount stated reflects only the share-based payment

charge and does not include the associated costs that are included

within the amount stated on the consolidated Income Statement.

BASIS OF PREPARATION

T he Financial Statements have been prepared under the

historical cost convention, as modified by the revaluation of

certain assets, and in accordance with Applicable Accounting

Standards.

The Financial Statements have been prepared on a going concern

basis. In reaching their assessment, the Directors have considered

a period extending at least twelve months from the date of approval

of this financial report.

The Directors have prepared cash flow forecasts covering a

period of more than 12 months from the date of releasing these

financial statements. This assessment has included consideration of

the forecast performance of the business for the foreseeable

future, the cash and financing facilities available to the Group.

At 30 September 2022 the Group had cash reserves of GBP4.9m with an

undrawn amount of GBP5.0m from a revolving credit facility of

GBP5.0m. However, post period end this GBP5.0m revolving credit

facility was cancelled. The strong cash position was after a year

of change and restructure within the Group, particularly for the

Middle East and Asia Pacific regions during the year which meant

the Group incurred one off losses.

The Directors have also prepared a stress case scenario that

demonstrates the Group's ability to continue as a going concern

even with a significant drop in revenues and limited mitigating

cost reduction to re-align with the revenue drop.

Based on the cash flow forecasts prepared including appropriate

stress testing, the Directors are confident that any funding needs

required by the business will be sufficiently covered by the

existing cash reserves. As such these Financial Statements have

been prepared on a going concern basis.

SEGMENTAL ANALYSIS

REPORTABLE SEGMENTS

For management purposes, the Group is organised into three

operating divisions: Europe & Americas (EuAm), Middle East (ME)

and Asia Pacific (APAC). This has remained unchanged from the

previous year. These divisions are the basis on which the Group is

structured and managed, based on its geographic structure. The

following key service provisions are provided across all three

operating divisions: quantity surveying, planning / programming,

quantum and planning experts, dispute avoidance / resolution,

litigation support, contract administration and commercial advice /

management. Segment information about these reportable segments is

presented below.

Europe Middle Asia

Year ended 30 September & Americas East Pacific Eliminations Unallocated Consolidated

2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Total external revenue 35,089 8,063 3,745 - - 46,897

Total inter-segment revenue 1,093 754 551 (2,398) - -

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Total revenue 36,182 8,817 4,296 (2,398) - 46,897

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Segmental profit/(loss) 3,923 (1,814) (544) - - 1,565

Unallocated corporate

expenses(1) - - - - (2,426) (2,426)

Share-based payments charge

and associated costs - - - - (465) (465)

Exceptional costs - - - - (1,000) (1,000)

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Operating profit/(loss) 3,923 (1,814) (544) - (3,891) (2,326)

Finance income - - - - - -

Finance expense - - - - (100) (100)

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) before taxation 3,923 (1,814) (544) - (3,991) (2,426)

Taxation - - - - (460) (460)

------------------------------ ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) for the

period 3,923 (1,814) (544) - (4,451) (2,886)

------------------------------ ----------- ------- -------- ------------ ----------- ------------

OTHER INFORMATION

Non current assets 3,241 245 48 - 2,184 5,718

Reportable segment assets 17.780 9,617 2,148 - 1,855 31,400

Capital additions(2) 138 249 6 - 326 719

Depreciation and amortisation 566 214 157 - 259 1,196

------------------------------ ----------- ------- -------- ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

(2) Capital additions comprise additions to property, plant and

equipment and intangible assets. No client had revenue exceeding

10% of the Group's revenue in the year to 30 September 2022.

Europe Middle Asia

Year ended 30 September & Americas East Pacific Eliminations Unallocated Consolidated

2021 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total external revenue 33,734 10,919 4,119 - - 48,772

Total inter-segment revenue 468 798 220 (1,486) - -

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total revenue 34,202 11,717 4,339 (1,486) - 48,772

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

Segmental profit/(loss) 4,947 (737) (408) - - 3,802

Unallocated corporate expenses(1) - - - - (1,683) (1,683)

Share-based payments charge

and associated costs - - - - (149) (149)

Exceptional costs - - - - - -

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

Operating profit/(loss) 4,947 (737) (408) - (1,832) 1,970

Finance income - - - - - -

Finance expense - - - - (110) (110)

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) before taxation 4,947 (737) (408) - (1,942) 1,860

Taxation - - - - (746) (746)

Profit/(loss) for the period 4,947 (737) (408) - (2,688) 1,114

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

OTHER INFORMATION

Non current assets 3,224 249 74 - 2,449 6,016

Reportable segment assets 14,865 10,051 2,401 - 4,095 31,412

Capital additions(2) 88 71 12 - 350 521

Depreciation and amortisation 602 240 157 - 231 1,230

---------------------------------- ----------- ------- -------- ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

(2) Capital additions comprise additions to property, plant and

equipment and intangible assets. No client had revenue exceeding

10% of the Group's revenue in the year to 30 September 2021.

Geographical information

2022 2021

External revenue by location of customers GBP000 GBP000

------------------------------------------ ------- -------

United Kingdom 21,624 18,892

Netherlands 3,241 3,186

Germany 3,154 1,856

United Arab Emirates 2,074 3,474

Australia 2,041 1,462

South Korea 1,372 437

Qatar 1,357 2,581

Oman 1,327 3,065

Singapore 1,156 1,266

Saudi Arabia 1,150 3,137

France 1,107 1,030

Canada 1,059 1,146

Spain 975 955

United States 876 932

Italy 707 502

Hong Kong 626 74

Ireland 403 1,151

Kuwait 341 845

Peru 328 16

Belgium 279 224

Serbia 233 -

Norway 198 43

Russia 192 391

Malaysia 170 473

South Africa 149 209

Philippines 107 -

Chile 105 -

Indonesia 99 255

Other countries 447 1,170

------------------------------------------ ------- -------

46,897 48,772

------------------------------------------ ------- -------

Geographical information of Non current assets

2022 2021

GBP000 GBP000

------------ ------- -------

UK 5,094 5,347

Oman 140 123

UAE 63 125

Singapore 121 25

Qatar 42 41

Malaysia 34 58

Kuwait - 8

Hong Kong - 9

Netherlands 148 211

France 11 21

Australia 9 10

Canada 3 5

USA 8 8

Spain 6 25

Germany 39 -

------------ ------- -------

5,718 6,016

------------ ------- -------

Analysis of the tax charge

The tax charge on the profit for the year is as follows:

2022 2021

GBP000 GBP000

-------------------------------------------------- ------- -------

Current tax:

UK corporation tax on profit for the year 71 540

Non-UK corporation tax 140 173

Adjustments to the prior period estimates - (3)

-------------------------------------------------- ------- -------

211 710

Deferred tax:

Origination and reversal of temporary differences 249 36

-------------------------------------------------- ------- -------

Tax charge for the year 460 746

-------------------------------------------------- ------- -------

FACTORS AFFECTING THE TAX CHARGE

The tax assessed for the year varies from the standard rate of

corporation tax in the UK. The difference is explained below:

2022 2021

GBP000 GBP000

-------------------------------------------------- ------- -------

(Loss)/profit before tax (2,426) 1,860

-------------------------------------------------- ------- -------

Expected tax charge based on the standard average

rate of corporation tax in the UK of 19% (2021:

19%) (461) 353

Effects of:

Expenses not deductible 237 20

Deferred tax - other differences 249 36

Share options exercised (99) -

Foreign tax rate differences 554 375

Adjustment to prior period estimates - (3)

Utilisation of losses (32) (24)

Unprovided losses 12 (11)

-------------------------------------------------- ------- -------

Tax charge for the year 460 746

-------------------------------------------------- ------- -------

Factors that may affect future tax charges

Following Royal Assent of the Finance Bill 2021 an increase to

the main rate of UK corporation tax has been announced, increasing

this to 25% from 1 April 2023.

earnings per share

2022 2021

GBP000 GBP000

-------------------------------------------------- ----------- -----------

(Loss)/profit for the financial year attributable

to equity shareholders (2,884) 1,114

Exceptional costs 1,000 -

Share-based payment charges and associated

costs 465 149

-------------------------------------------------- ----------- -----------

Underlying (loss)/profit for the year before

share-based payments and exceptional costs (1,419) 1,263

Weighted average number of shares:

Ordinary shares in issue 53,962,868 53,962,868

Shares held by EBT (3,677) (3,677)

Treasury shares (1,405,839) (1,787,811)

-------------------------------------------------- ----------- -----------

Basic weighted average number of shares 52,553,352 52,171,380

-------------------------------------------------- ----------- -----------

Effect of Employee share options 2,309,028 2,125,958

-------------------------------------------------- ----------- -----------

Diluted weighted average number of shares 54,862,380 54,297,338

-------------------------------------------------- ----------- -----------

Basic (loss)/earnings per share (5.5)p 2.1p

Diluted (loss)/earnings per share (5.3)p 2.1p

Underlying basic earnings per share before

share-based payments and exceptional costs (2.7)p 2.4p

-------------------------------------------------- ----------- -----------

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Some asset and liability amounts reported in the Consolidated

Financial Statements contain a degree of management estimation and

assumptions. There is therefore a risk of significant changes to

the carrying amounts for these assets and liabilities within the

next financial year. The estimates and assumptions are made on the

basis of information and conditions that exist at the time of the

valuation.

The following are considered to be key accounting estimates:

Impairment reviews

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash generating units to which goodwill

has been allocated. The value in use calculation requires an entity

to estimate the future cash flows expected to arise from the cash

generating unit and a suitable discount rate in order to calculate

present value. An impairment review test has been performed at the

reporting date and no impairment is required.

Receivables impairment provisions

The amounts presented in the Consolidated Statement of Financial

Position are net of allowances for doubtful receivables, estimated

by the Group's management based on the expected credit loss within

IFRS 9. This is calculated using a simplified model of recognising

lifetime expected losses based on the geographical location of the

Group's entities and considers historical default rates, projecting

these forward taking into account any specific debtors and

forecasts relating to local economies. At the Statement of

Financial Position date a GBP3,159,000 (2021: GBP2,561,000)

provision was required. If management's estimates changed in

relation to the recoverability of specific trade receivables the

provision could increase or decrease. Any future increase to the

provision would lead to a corresponding increase in reported losses

and a reduction in reported total assets.

Revenue recognition on fixed fee projects

Where the Group enters into a formal fixed fee arrangement

revenue is recognised by reference to the stage of completion of

the project. The stage of completion will be estimated by the

Group's management based on the Project Manager's assessment of the

contract terms, the time incurred, and the performance obligations

achieved and remaining.

POST BALANCE SHEET EVENTS

There have been no significant events requiring disclosure since

30 September 2022.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR TTMBTMTATTRJ

(END) Dow Jones Newswires

February 23, 2023 02:01 ET (07:01 GMT)

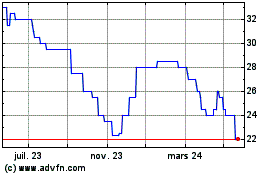

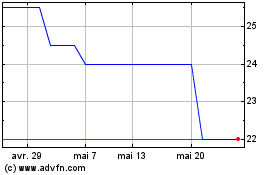

Driver (LSE:DRV)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Driver (LSE:DRV)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025