TIDMELIX

RNS Number : 2566W

Elixirr International PLC

11 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 596/2014 AS IT FORMS PART OF UK DOMESTIC

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS

AMED.

8 December 2023

ELIXIRR INTERNATIONAL PLC

Acquisition of Insigniam LLC and Insigniam SAS.

Elixirr International plc (AIM: ELIX) ("Elixirr", the "Company"

and together with its subsidiaries, the "Group"), the established,

global award-winning challenger consultancy, is pleased to announce

the acquisition by its US subsidiary, Elixirr, Inc. of all of the

issued and outstanding membership interests of Insigniam LLC

("Insigniam LLC"), and by Elixirr International plc, of the entire

issued and outstanding shares of Insigniam SAS ("Insigniam

Performance", and together with Insigniam LLC, "Insigniam"), for a

maximum consideration payable of US$18.5 million (the

"Consideration") (the "Acquisition").

Acquisition highlights

-- Insigniam is a US-headquartered consultancy firm with 50+

personnel specialising in supporting clients and executives to

define and navigate large scale change and transformation.

-- This is the Group's fifth acquisition since its IPO in July

2020 and third in the US, enhancing the Group's presence in this

key market.

-- In the 12 months to November 2023 (unaudited), Insigniam

recorded revenue of US$13.7m, normalised EBITDA of US$2.3m and

normalised profit before tax of US$2.3m.

-- The initial consideration represents a multiple of 5.7x 2023

LTM EBITDA, based off November 2023 LTM financials (unaudited).

-- The transaction is immediately earnings-enhancing.

-- The Acquisition brings specialist services in transformation,

leadership alignment, cultural change, and executive coaching,

complementing the Group's existing service offerings.

-- In addition to an expansion of capabilities, Insigniam has

deep expertise in additive industries for Elixirr, and in

particular has built a reputation as market leaders within

industries such as healthcare, biopharmaceuticals, life sciences,

consumer and retail. Insigniam also has a significant presence and

client-base in continental Europe, complementing the Group's

presence in this region.

-- Insigniam's top clients include Fortune 500 companies and

household brands, many of which are maintained through the

leadership's long-standing relationships with the C-suite, coupled

with its unique service offering.

-- During due diligence and client interviews, Insigniam was

found to be rated 43% better than their competition and has an NPS

score of 66 - 85% of its clients report that Insigniam provides

more value than any other consulting firm. Together with Insigniam,

Elixirr will be able to enhance its existing service offering to

its global client base.

-- The US acquisition goodwill will be tax-deductible, resulting

in an estimated tax benefit of US$2.8m-$4.3m to be realised over 15

years.

Information on Insigniam and reasons for the Acquisition

Insigniam helps companies navigate large-scale, complex change

and transformation. Its offering includes leadership alignment,

organisational transformation, cultural change and executive

coaching, and its unique methodologies are used to break down

performance barriers for C-suite teams across industries. Insigniam

operates within a broadly unaddressed and in-demand white space in

the market, through a dual focus on catalysing breakthrough change

and achieving return on investment. This distinctive market

opportunity is a key reason for the acquisition, especially when

coupled with Insigniam's proven success at delivering for clients

over its 35+ year history. Elixirr leadership believes that both

firms' blue-chip clients stand to benefit from a joint proposition

between Insigniam and Elixirr.

Insigniam was co-founded by Shideh Sedgh Bina and Nathan Owen

Rosenberg, both of whom will continue to spearhead the growth of

the business alongside Elixirr moving forward. Shideh and Nathan

will join the Group as Elixirr partners, alongside Katerin Le

Folcalvez and Jennifer Zimmer.

In the 12 months to November 2023 (unaudited), Insigniam

recorded revenue of US$13.7m, normalised EBITDA of US$2.3m and

normalised profit before tax of US$2.3m.

Consideration for the Acquisition

The Group acquired Insigniam for a maximum consideration payable

of US$18.5 million. The Consideration consists of:

- Initial consideration of US$11.6 million, from Elixirr's existing cash balances;

- Initial consideration of US$1.5 million to be settled through

the issue in December 2023 of 258,553 Elixirr International plc

Ordinary shares at a price per share of GBP4.60 by 15 December

2023; and

- Deferred consideration of up to US$5.4 million in either cash

or Ordinary Shares of Elixirr with, at a minimum, 33% of the

deferred consideration being satisfied in cash. This is contingent

on Insigniam achieving both revenue growth and EBITDA margin

targets in financial periods up to 31 December 2026.

Based off November 2023 LTM financials (unaudited), this

constitutes a Day 1 EV/EBITDA multiple of 5.7x, and a maximum

EV/EBITDA multiple of 8.1x if all deferred consideration is earned

over the three year period.

The Ordinary Shares will be subject to one-year lock-in

arrangements and limitations on the Ordinary Shares that each

seller can sell in each of the following three years under nominee

agreements.

Following the acquisition of Insigniam, Elixirr will have net

cash of approximately GBP13.5 million.

Partner Promotions

As part of its strategy to align incentives for senior

personnel, Elixirr is pleased to announce that three recently

promoted Partners will each be subscribing for 107,527 Ordinary

Shares in the Company at a GBP4.65 share price. The Ordinary Shares

issued to the new Partners will be subject to one-year lock-in

arrangements and limitations on the Ordinary Shares that each

Partner can sell in each of the following four years. In total,

Elixirr will issue an additional 322,581 Ordinary Shares to

promoted Partners.

Admission and Total Voting Rights

As referred to above, in total Elixirr will issue 581,134

Ordinary Shares ("New Shares"). The New Shares will rank pari passu

with the Company's existing issued Ordinary Shares. The New Shares

will be issued pursuant to the Company's existing outstanding

shareholder authorities. Application will be made to the London

Stock Exchange for the New Shares to be admitted to trading on AIM

("Admission") and it is expected that Admission will become

effective at 8.00 a.m. on 15(th) December 2023.

After Admission, the total number of Ordinary Shares in issue

will be 47,272,811 and the total number of voting rights will

therefore be 47,272,811. Following Admission, this figure may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

Founder & CEO of Elixirr, Stephen Newton said:

"I am always exceptionally proud to expand our team, and finding

the right people to bring into the group is no small task. Our

M&A team works tirelessly to find companies that not only

broaden what we're able to offer clients but improve the work we're

already doing with them. We also look for those who share in

Elixirr's ethos, entrepreneurial spirit and desire to create

meaningful change - and in Insigniam we have found exactly that. I

look forward to seeing the impact of their team's unique approach

to consulting - which looks deeply into the areas many

consultancies often overlook or don't have true capability to

impact. They are the undisputed market leaders in transformation

and organisational change, and this is something that will be

extremely valuable to both our current and future clients. By

combining our services and expertise, from strategy through to

execution, we are very well-positioned to provide full end-to-end

services to our collective clients in a more impactful, dynamic

way."

Co-Founder of Insigniam, Shideh Sedgh Bina said:

"We are thrilled that Elixirr not only expands our ability to

provide an enhanced range of services for our clients, but also

enables us to partner with C-suite executives to design and execute

on their fit-for-21st-century-agenda. The Elixirr disrupter

mindset, entrepreneurial culture and leadership team are perfectly

aligned with our commitment to serve our clients to deliver

remarkable results. Like Insigniam, Elixirr is not afraid to

challenge convention, talk straight and disrupt the status quo.

Elixirr and Insigniam both hold dear an ethos of deep client

service, and we believe that together, combining the best of 'being

human' with technology and data, we will deliver dramatic new

outcomes for our clients."

Co-Founder of Insigniam, Nathan Owen Rosenberg said:

"Insigniam's combination with Elixirr gives our clients a range

of services that, in my scan of the market, has not been available.

Already, the Elixirr partners and Insigniam partners are

collaborating to catalyse new value for our combined clients, as

well as working on a new set of offerings. Literally, we can now

offer the full range of expertise and services needed to transform

a CEO's agenda into reality. Clients will see new capabilities to

fulfill their intentions. We now provide extraordinary value to the

CEO and his or her team and to each executive in the C-suite,

beyond what either firm could offer before the combination."

The person responsible for arranging the release of this

announcement on behalf of the Company is Nicholas Willott, Finance

Director and Company Secretary of the Company.

For further information please contact:

Elixirr International plc

Stephen Newton, CEO

Graham Busby, CFO

Public and Investor Relations contacts:

investor-relations@elixirr.com

Cavendish Capital Markets Ltd (Nominated Adviser +44 (0) 20 7220

& Joint Broker) 0500

Stephen Keys, Charlie Beeson (Corporate Finance),

Sunila De Silva (ECM)

Investec Bank plc (Joint Broker) +44 (0) 20 7597

Carlton Nelson, Henry Reast (Corporate Broking) 4000

About Elixirr International plc

Elixirr is an established global award-winning management

consultancy, challenging the larger consultancies by delivering

innovative and bespoke solutions to a repeat, globally-recognised

client base.

Elixirr was founded in 2009, by Stephen Newton, Graham Busby,

Ian Ferguson, Andy Curtis and Mark Goodyear, experienced business

advisors who identified a market opportunity to provide bespoke,

personal services as a 'challenger' to the traditional consultancy

businesses in the market. Elixirr guides its clients to overcome

challenges such as: future-proofing against technological

disruption; development and roll-out of innovative new

propositions, products and services; incubating new businesses;

navigating a more complex and multinational regulatory environment;

and project management and implementation of major change

programmes.

General

This announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire ordinary

shares in the capital of the Company. In particular, this

announcement does not constitute or form part of any offer to issue

or sell, or the solicitation of an offer to acquire, purchase or

subscribe for, any securities in the United States.

This announcement has been issued by, and is the sole

responsibility of, the Company. No person has been authorised to

give any information or to make any representations other than

those contained in this announcement and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company.

No statement in this announcement is intended to be a profit

forecast or profit estimate and no statement in this announcement

should be interpreted to mean that earnings per share of the

Company for the current or future financial years would necessarily

match or exceed the historical published earnings per share of the

Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will",

"would" or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking

statements include matters that are not historical facts. They

appear in a number of places throughout this announcement and

include statements regarding the directors of the current Company's

intentions, beliefs or expectations concerning, among other things,

the Company's results of operations, financial condition,

liquidity, prospects, growth, strategies, and the Company's

markets. By their nature, forward-looking statements involve risk

and uncertainty because they relate to future events and

circumstances. Actual results and developments could differ

materially from those expressed or implied by the forward-looking

statements. Forward-looking statements may and often do differ

materially from actual results. Any forward-looking statements in

this announcement are based on certain factors and assumptions,

including the directors of the Company's current view with respect

to future events and are subject to risks relating to future events

and other risks, uncertainties and assumptions relating to the

Company's operations, results of operations, growth strategy and

liquidity. Whilst the directors of the Company consider these

assumptions to be reasonable based upon information currently

available, they may prove to be incorrect. Save as required by

applicable law, the AIM Rules or the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, the Company

undertakes no obligation to release publicly the results of any

revisions to any forward-looking statements in this announcement

that may occur due to any change in the directors of the Company's

expectations or to reflect events or circumstances after the date

of this announcement.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this announcement.

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

All references to time in this announcement are to London time,

unless otherwise stated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFFESSEDSEIE

(END) Dow Jones Newswires

December 11, 2023 02:00 ET (07:00 GMT)

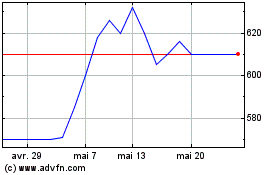

Elixirr (LSE:ELIX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Elixirr (LSE:ELIX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025