TIDMEPIC

RNS Number : 1991O

Ediston Property Inv Comp PLC

29 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMENDED. ON THE PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For immediate release.

Ediston Property Investment Company plc

Completion of the Disposal of the Property Portfolio

Further to the Results of General Meeting announcement of 26

September 2023, the Board of Ediston Property Investment Company

plc (the "Company") announces the completion, on 29 September 2023,

of the sale (the "Disposal") of the entirety of the EPIC Group's

property portfolio to RI UK 1 Limited, a wholly owned subsidiary of

Realty Income, for a total gross aggregate cash consideration of

GBP196.8 million (comprising the headline consideration of GBP200.8

million less agreed deductions of GBP4.0 million) (the

"Consideration").

As previously indicated, it is the intention of the Board to

seek Shareholder approval for the voluntary liquidation of the

Company with the aim of distributing the Company's net assets

(which comprises of cash) to Shareholders by the end of this

calendar year, unless an appropriate corporate opportunity is

identified in the meantime which, in the view of the Board (having

consulted with key Shareholders), merits further consideration. The

Board would only recommend an alternative corporate opportunity if

it reasonably believed that such opportunity would offer

Shareholders greater benefit than a simple return of capital. In

the absence of such an opportunity, the Board intends to seek

Shareholder approval for voluntary liquidation following

finalisation of the completion balance sheet in relation to the

Disposal.

In the meantime, the Company will add the cash proceeds from the

Disposal to its existing cash. Apart from a small amount held in a

current account for operating expenses, the remainder will be held

in interest bearing current accounts. GBP113 million will be held

in a blocked account as security for the debt facilities that have

been successfully novated to the Company from the Company's

subsidiaries for a term of 6 months and otherwise on the same terms

that were in place prior to Completion. The interest earned from

funds in the blocked account will exceed the cost of servicing the

debt by approximately 2.3 per cent. p.a. assuming interest rates

remain at current levels.

The Board intends to maintain the current level of dividend,

with monthly dividend payments of 0.4167 pence per Ordinary Share

(the first of which is due to be paid on 29 September 2023) made to

Shareholders until the proposed liquidation date.

Should Shareholders approve the intended voluntary liquidation

of the Company on or around 31 December 2023, the estimated amount

per Ordinary Share available for distribution to Shareholders in

the liquidation (taking into account the estimated costs of

liquidation, service provider termination costs and estimated net

income in the period to liquidation) is expected to be

approximately 72.0 pence, except and to the extent that any

dividends are paid in the period between today's date and the date

of liquidation (inclusive of those dates).

Capitalised terms used and not defined in this announcement have

the meanings given to them in the circular sent to Shareholders

dated 8 September 2023, which is available on the Company's website

at https://www.epic-reit.com.

Enquiries

Investec Bank plc (Lead Financial

Adviser and Corporate Broker) 020 7597 4000

David Yovichic

Denis Flanagan

Dickson Minto Advisers

(Joint Financial Adviser and

Sponsor) 020 7649 6823

Douglas Armstrong

KL Communications (PR Advisers) 07729 911301

Stephanie Ross

Ben Robinson

IMPORTANT NOTICES

Information regarding forward-looking statements

This announcement and any information incorporated by reference

into this announcement contains statements which are, or may be

deemed to be, "forward-looking statements" which are prospective in

nature. All statements in this announcement other than statements

of historical fact are forward-looking statements. They are based

on intentions, beliefs and/or current expectations and projections

about future events, and are therefore subject to risks and

uncertainties which could cause actual results to differ materially

from the future results expressed or implied by the forward-looking

statements. Often, but not always, forward-looking statements can

be identified by the use of a date in the future or forward-looking

words such as "plans", "expects", "is expected", "is subject to",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", "believes", "targets", "aims", "projects" or words

or terms of similar substance or the negative of those terms, as

well as variations of such words and phrases or statements that

certain actions, events or results "may", "could", "should",

"would", "might" or "will" be taken, occur or be achieved. Such

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations or events that

are beyond the Company's control.

Forward-looking statements include statements regarding the

intentions, beliefs or current expectations of the Company

concerning, without limitation: (a) future capital expenditures,

expenses, revenues, earnings, synergies, economic performance,

indebtedness, financial condition, dividend policy, losses and

future prospects; (b) business and management strategies and the

expansion and growth of the Company's operations and assets; and

(c) the effects of global economic conditions on the Company's

business.

Such forward-looking statements involve known and unknown risks

and uncertainties that could significantly affect expected results

and are based on certain key assumptions. Many factors may cause

the actual results, performance or achievements of the EPIC Group

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Important factors that could cause the actual results,

performance or achievements of the EPIC Group to differ materially

from the expectations of the EPIC Group include, amongst other

things, general business and economic conditions globally, industry

and market trends, competition, changes in government and changes

in law, regulation and policy, including in relation to taxation,

interest rates and currency fluctuations, the outcome of any

litigation, the impact of any acquisitions or similar transactions,

and IT system and technology failures. Such forward-looking

statements should therefore be construed in the light of such

factors.

Neither the Company nor any of its Directors, officers or

advisers provides any representation, assurance or guarantee that

the occurrence of the events expressed or implied in any

forward-looking statements in this announcement will actually

occur. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

hereof.

Forward-looking statements contained in this announcement apply

only as at the date of this announcement. Other than in accordance

with its legal or regulatory obligations (including under the

Prospectus Regulation Rules, the Listing Rules, the Disclosure

Guidance and Transparency Rules and UK MAR) the Company is not

under any obligation and the Company expressly disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

No profit forecast or estimate

No statement in this announcement is intended as a profit

forecast or profit estimate for any period and no statement in this

announcement should be interpreted to mean that earnings, earnings

per Ordinary Share or income, cash flow from operations or free

cash flow for the EPIC Group or the Company, as appropriate, for

the current or future financial years would necessarily match or

exceed the historical published earnings, earnings per Ordinary

Share or income, cash flow from operations or free cash flow for

the EPIC Group or the Company, as appropriate.

Presentation of financial information

References to "GBP", "GBP", "pounds", "pounds sterling",

"sterling", "p" and "pence" are to the lawful currency of the

United Kingdom.

Certain financial data has been rounded, and, as a result of

this rounding, the totals of data presented in this announcement

may vary slightly from the actual arithmetic totals of such

data.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISLLMBTMTJTBRJ

(END) Dow Jones Newswires

September 29, 2023 07:39 ET (11:39 GMT)

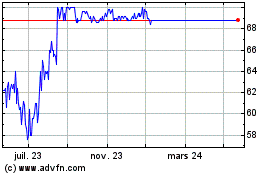

Ediston Property Investm... (LSE:EPIC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ediston Property Investm... (LSE:EPIC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025