TIDMESKN

RNS Number : 3630D

Esken Limited

21 June 2023

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018.

21 June 2023

Esken Limited

("Esken" or the "Group")

Results for the 12 months ended 28 February 202 3

Sale process advancing alongside continuing operational

optimisation

Esken Limited, the Aviation and Renewables Group, today

announces its results for the 12 months to 28 February 2023.

Summary

-- Esken completed a strategic review of its operating businesses and is actively progressing a managed sale process

of its core Renewables and Aviation businesses.

-- The sale of Esken Renewables is progressing well and is now at an advanced stage working with a preferred bidder

on an exclusive basis.

-- Esken has started the process for the sale of London Southend Airport (LSA), its key strategic airport asset

within the Aviation business.

-- In November 2022, Esken secured a new borrowing facility comprising GBP50m of committed funding.

-- Esken Renewables took steps to optimise its margins and secured additional sub supply agreements.

-- easyJet entered a multiyear agreement for the return of flying to LSA with three summer routes and has recently

announced additional all-year-round routes to Paris and Amsterdam. These new routes and airline partnership are

encouraging signs that LSA's recovery is now under way.

-- Since the year end, Esken has completed the sale of Star Handling Limited for up to GBP4.8m in May 2023.

-- As at 28 February 2023, the Group's headroom was GBP50.3m, in line with management expectations (see Alternative

performance measure note for the definition of headroom).

Strategic Review

At the time of our interim results we announced that a decision

had been taken by the Board to conduct a strategic review of the

Group's operational businesses. The Board concluded that the

interests of all stakeholders would be best served by seeking a new

owner for each of the core businesses through a managed sale

process. In each case the Renewables and Aviation businesses will

benefit from long term strategic owners with access to capital to

support growth ambitions, while offering stability and certainty to

the staff, customers and suppliers.

In view of the different rates of recovery of the businesses we

initiated a sale of the Renewables business first and that process

is now at an advanced stage working with a preferred bidder on an

exclusive basis. We have also started the process for the sale of

LSA, the core asset within the Aviation business.

As we progress with these disposals we are reducing the

underlying cost base of the Group to a level sufficient to support

the remaining operations, including an exit from the residual

non-core assets. In line with this approach we are exploring a move

to the Standard segment of the Main Market following completion of

the disposal of Renewables.

David Shearer , Executive Chairman of Esken said,

"Over the last financial year, we secured a successful debt fund

raising in difficult market conditions, completed a strategic

review of our operating businesses, and are now progressing with

our plans to sell our core operating businesses and residual

non-core assets through a managed disposal process with a view to

returning any remaining value to Esken shareholders.

Our Renewables business saw increased revenues albeit at a lower

margin, reflecting increased volumes of lower margin fuel supply,

an increased number of unplanned outages at customer waste wood

biomass plants and the impact of inflationary pressures where there

is a lag before the benefit of indexation on our contracts impact.

The Division is focused on steps to improve margins going forwards,

including optimising the fleet for efficiency and strong cost

control.

Our Aviation business continues to make progress as demand

recovers, with LSA signing a multi-year partnership with easyJet in

January 2023 - the airline will now serve five destinations from

the airport. We installed a new, experienced senior management team

and the case for the airport remains well founded as demonstrated

by the increase in routes served by easyJet."

Restated(1)

GBP'm 2023 2022 % change

---------------------------------------------- -------- ------------- ----------

Revenue by Division

Renewables 93.7 79.7 17.7%

Aviation 25.5 23.4 8.7%

---------------------------------------------- -------- ------------- ----------

15.6

Revenue for two core operating divisions 119.2 103.1 %

---------------------------------------------- -------- ------------- ----------

Investments and Non-Strategic infrastructure 0.6 0.7 (7.1%)

Group central and eliminations 0.2 0.8 (79.6%)

---------------------------------------------- -------- ------------- ----------

Total revenue 120.0 104.6 14.7%

---------------------------------------------- -------- ------------- ----------

Adjusted EBITDA(2) by division

Renewables 18.4 20.3 (9.5%)

(390

Aviation (3.8) (0.8) .9%)

Adjusted EBITDA(2) for two core operating (25.3

divisions 14.6 19.5 %)

---------------------------------------------- -------- ------------- ----------

Investments and Non-Strategic infrastructure (1.7) 3.3 (153.3%)

Group central and eliminations (7.3) (12.2) 41.0%

---------------------------------------------- -------- ------------- ----------

(46.9

Total adjusted EBITDA(2) 5.6 10.6 %)

---------------------------------------------- -------- ------------- ----------

(27.7 (35.7

Loss before tax ) ) 22.4%

---------------------------------------------- -------- ------------- ----------

Tax 2.5 9.9 (74.6%)

Discontinued operations, net of tax (0.0) (2.4) 97.5%

---------------------------------------------- -------- ------------- ----------

(25.2 (28.2 10.5

Loss for the year ) ) %

(17.3

Net debt (290.1) (247.3) %)

Cash and undrawn banking facilities 50.3 72.7 (30.9%)

---------------------------------------------- -------- ------------- ----------

1 The 2022 results have been restated where required due to prior period adjustments.

2 Adjusted EBITDA represents profit/(loss) before interest, tax,

depreciation and impairments. Refer to Segmental information note

for reconciliation to statutory loss before tax.

Financial summary

-- Esken's core Aviation and Renewables businesses generated a combined positive adjusted EBITDA of GBP14.6m (2022:

GBP19.5m).

-- Esken Renewables supplied 1.6m tonnes of biomass fuel, up 9.4% on last year (2022: 1.5m tonnes). The overall

increase i n the volume of f uel supplied reflected an improvement in lower margin forestry by-product and

third-party fuel supply and resulted in revenue increasing by 17.7% to GBP93.7m (2022 GBP79.7m). However, a

series of unplanned outages at plants where we supply higher margin waste wood fuel, coupled with the impacts of

inflation, resulted in a 9.5% reduction in adjusted EBITDA to GBP18.4m (2022 GBP 20.3 m).

-- Within Aviation, staffing challenges and industrial action taking place at airports across Europe reduced some

planned flights inbound to LSA at various points during the second half of the year. As a result, passenger

numbers reduced by 5.3% from 94k to 89k. The Aviation Division received GBP1.4m related to the recovery of

airline marketing support payments and delivered an adjusted EBITDA loss of GBP3.8m in FY23 . In the prior year,

the Division reported a loss of GBP0.8m having benefitted from GBP3.5m of one-off receipts associated with

Connect Airways and the conclusion of the partnership with Teesside International Airport.

-- Group central significantly reduced its costs during the year whilst there was no repeat of the GBP4.7m benefit

of the onerous lease exit in Non-Core Infrastructure in the prior year. Overall Group adjusted EBITDA reduced by

46.9% to GBP5.6m (2022 GBP10.6m). However, the Group benefitted from the reversal of impairment of loan notes and

a reduction in property impairments in the year and, as a result, total losses before tax improved by 22.4% to

GBP27.7m (2022 GBP35.7m).

-- At year end, the Group's portfolio of non-core assets had an aggregate book value of GBP43.1m (2022 GBP39.7m)

following the disposal of a portion of land in Widnes and the reversal of impairment of MBE loan notes during the

year. Since the period end, Esken completed the sale of Star Handling Limited for up to GBP4.8m in May 2023.

-- Esken continues to work to realise value from its remaining non-core assets; future proceeds of which will be

used to reduce debt and provide working capital as the realisation strategy is implemented. Once completed and

any remaining Group liabilities are settled, any surplus will be returned to shareholders.

--

ESG progress

-- Across its businesses Esken produced 23,633 tonnes of carbon

dioxide, representing a 11% decrease on the baseline year for Scope

1 and 2 emissions.

-- Esken has developed a Net Zero Roadmap to reduce its Scope 1 by 8% over the next 3-5 years and aims to reduce its

Scope 2 emissions to nil by 2030.

-- Esken continued to collect and voluntarily reported initial Scope 3 emissions data, with reduction plans under

review.

-- Esken Renewables again undertook third-party research with Logika Consultants to validate Scope 1-3 emissions

data. The research established that whilst Esken produced around 134,925 tonnes of greenhouse gas (GHG) emissions

in FY23, it saved the UK 620,000 tonnes of additional GHG emissions (equivalent to taking c.430k cars off the

road) by supplying biomass power customers directly or via third parties over 1.1m tonnes of waste wood that

would have otherwise gone to landfill, producing methane.

-- Esken continued to support its charity partnerships through fundraising and launched a volunteering programme,

contributing over 500 hours of volunteering to benefit the communities in which we operate.

-- The company established an ESG risk register and put in place ESG performance KPIs linked to Executive

remuneration.

Outlook

The challenges Esken Renewables experienced during the financial

year ending 28 February 2023 regarding biomass plant outages has

continued into the new financial year but there are now signs of an

improvement in gate fees and more consistency of plant performance,

with an expectation of improving performance as the year

progresses.

Following the sale of Star Handling's ground handling operations

at Manchester and Stansted airports the Aviation Division is now

entirely focused on the recovery at LSA. That airport has started

the year positively as demand for flights across the market has

shown a strong recovery towards pre pandemic levels. The return of

a route to Amsterdam and increased flight frequencies to Faro mean

that there is a 30% uplift in planned easyJet flights during the

summer. Flights will then continue through the winter months with

the announcement that easyJet will operate flights to Paris in

addition to Amsterdam starting from 29 October 2023.

These new routes and airline partnerships are encouraging signs

that LSA's recovery is now underway. While signs are encouraging,

the aviation industry as a whole has not yet fully recovered from

the effects of the pandemic. As a result and in view of the current

sale process, Esken has taken the decision not to reinstate

guidance for LSA at this time.

The Board is encouraged by the progress on the sale process for

Renewables and now has a sound base with which to progress the

process for the sale of LSA. The Board would expect to update the

market with further substantive progress in the months ahead.

Going concern

As at 28 February 2023, the Group had cash balances of GBP50.3m

(FY22: GBP52.7m), of which GBP5.3m is ring fenced in LSA and its

subsidiaries, as part of the Carlyle Global Infrastructure

Opportunity Fund (CGI) convertible debt facility. While the Group

continues to tightly manage its cash resources as it executes the

sale of the Renewables and Aviation Divisions, the current position

is that the Group has a material uncertainty primarily in relation

to the timing of the disposal of the Renewables business. Full

discussion around the Group's going concern position is set out in

the notes to the extracts from the audited financial statements in

this results announcement. This section must be read in order to

fully understand the significant judgements the Directors have made

and the material uncertainty that exists in respect of the going

concern assumption for the Group.

The Group will provide a live presentation relating to its

results via the Investor Meet Company platform at 9:30am BST

today.

The presentation is open to all existing and potential

shareholders. Investors can sign up to Investor Meet Company for

free and add to meet Esken via:

https://www.investormeetcompany.com/esken-limited/register-investor

. Investors who already follow Esken on the Investor Meet Company

platform will automatically be invited.

Esken Limited C/O Teneo

Charlie Geller, Communications Director

Teneo +44 207 353 4200

Olivia Peters esken@teneo.com

Chairman's Statement

I am pleased to present my chairman's statement for the year to

the end of February 2023. This has been a year when the Group, in

common with many other businesses, has faced a number of

challenges.

Review of the year

The year has seen continued progress as we streamlined the Group

to focus on the core businesses of Renewables and Aviation while

completing a medium-term debt refinancing in difficult market

conditions to support the Group through the implementation of its

strategy. The Board decided to undertake a strategic review and

concluded that it was in the interests of all stakeholders to

pursue a sale of the core businesses. I refer to the detail of this

review below but we have made good progress with the sale of the

Renewables business at an advanced stage working with a preferred

bidder on an exclusive basis. The process for the sale of LSA now

underway.

This was all achieved against the backdrop of the Russian

invasion of Ukraine which had an immediate impact on energy prices

and a significant knock-on effect on the global economy. This

occurred just as the aviation industry was finally emerging from

the pandemic and created further uncertainty with our airline

customers. In addition, the disruption to global supply chains as

they recovered from the pandemic led to strong inflationary

pressures across the developed world. The response from central

banks was to raise interest rates significantly and tighten money

supply, all of which impacted demand. These inflationary pressures

and interest rate increases affected the cost base of the

Group.

In a year characterised by these significant geo-political and

economic events, we continued our journey toward becoming a

focussed group with interests in Renewables and Aviation, while

managing the exit of non-core assets for value and reducing

residual liabilities. These liabilities had arisen through the

historic decisions in relation to the guarantee of aircraft lease

arrangements by the Group in 2017 which crystallised following the

failure of Stobart Air in June 2021. A number of these aircraft had

been returned by the year end and the remaining liabilities are due

to run off during Q3 of FY24. In total the Group is expecting to

have spent GBP134.2m addressing these matters from the

administration of Connect Airways to conclusion, meaning these

funds were not otherwise available to reduce debt or invest in the

core operations. We continued to streamline the cost base of the

Group consistent with the prevailing needs of the business.

In November 2022, we concluded a successful debt fund raising

with a medium-term facility of GBP50m to support the operational

needs of the business and settle the final residual liabilities of

Stobart Air and Propius. In view of the difficult market conditions

for raising debt at that time, the cost of this funding was

expensive but gave the Group certainty on its funding needs going

forward.

At LSA we changed the entire senior management team to ensure

the right leadership was in place to take that business forward

through the recovery. These changes were a combination of internal

promotions and external recruitment and provide a good blend of

knowledge of the operational assets and a fresh perspective on the

way forward. It was clear in the second half of the year that

aviation demand at London airports would recover to pre pandemic

levels and LSA is starting to see the impact of this with a

continuing momentum in new routes operating from the airport.

Results

Esken Renewables supplied 1.62m tonnes of fuel to biomass plant

customers in the year to 28 February 2023, up 9.4% on the prior

year (2022 1.47m tonnes). However, this increase reflected improved

demand from biomass plants to which Esken Renewables primarily

supplies third party and forestry by-product, which is at a lower

margin. Higher margin biomass plants that use waste wood

experienced an increased number of unplanned outages, particularly

during the winter months. This reduced the total volume of waste

wood supplied by Esken Renewables and the associated gate fee

income. This in turn resulted in adjusted EBITDA reducing by 9.5%

from GBP20.3m to GBP18.4m.

Esken Renewables has taken a number of steps to improve margins

going forward. The fleet has been optimised to achieve the most

efficient use of trucks and drivers, and strong cost control has

resulted in lower overheads. Inflationary pressures have been eased

by RPI-linked indexation elements within the Division's long-term

customer supply contracts, however these are retrospective in a

number of cases and as such the full benefit of indexation will not

be seen until FY24. Esken Renewables also took the decision to

close its Port Clarence site having entered into a new sub-supply

agreement to replace the supply provided from Port Clarence. This

is expected to deliver an additional GBP0.9m of annual recurring

adjusted EBITDA from 1 April 2023.

Whilst LSA maintained adequate staffing levels during the year,

staffing challenges elsewhere across the aviation sector led to the

removal of planned flights at LSA at various points particularly

during the second half of the year. This resulted in passenger

numbers reducing by 5.3% from 94k to 89k.

The Aviation Division received GBP1.4m relating to the recovery

of previously paid airline marketing support payments and delivered

an adjusted EBITDA loss of GBP3.8m in FY23. In the prior year, the

Division reported a loss of GBP0.8m having benefitted from GBP3.5m

of one-off receipts associated with Connect Airways and the

conclusion of the partnership with Teesside International Airport

.

The airport continued to make progress despite the residual

impacts of the pandemic across the sector. It signed a multi-year

partnership with easyJet in January 2023 and easyJet started

operating a new route to Amsterdam at the end of May 2023 with

Paris staring October 2023. These two new routes will operate year

round. The addition of these routes takes the number of

destinations easyJet serves from the airport to five including

Malaga, Palma and Faro. The airline has also announced an increase

in the weekly frequency of flights to Faro.

Central costs were significantly reduced during the year as the

business was streamlined whilst there was no repeat of the GBP4.7m

benefit of the onerous lease exit in Non-Core Infrastructure in the

prior year. Overall Group adjusted EBITDA reduced by 46.9% to

GBP5.6m (2022 GBP10.6m). However, the Group benefitted from the

reversal of impairment of MBE loan notes and a reduction in

property impairments in the year and, as a result, total losses

before tax improved by 22.4% to GBP27.7m (2022 GBP35.7m).

At year end, the Group's portfolio of non-core assets had an

aggregate book value of GBP43.1m (2022 GBP39.7m) following the sale

of a portion of land in Widnes and the reversal of impairment of

MBE loan notes. Esken continues to work to realise the value of its

non-core assets and future proceeds will be used to reduce debt and

provide working capital as the Group executes its realisation

strategy. Since the year end Esken completed the sale of Star

Handling Limited for up to GBP4.8m in May.

Strategic Review of operating businesses

At the time of our interim results, we announced that a decision

had been taken by the Board to conduct a strategic review of the

Group's operational businesses. This was prompted by the fact that

the two core operating Divisions were recovering at differing rates

coming out of the pandemic, there was limited synergy between the

two businesses, each had different strategic and financial needs to

realise the full potential of its business, and the Group remained

financially constrained to support those future growth plans. In

common with many companies at the smaller end of the UK listed

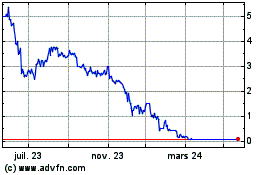

market, there also appeared to be a disconnect between the share

price and the potential value of the businesses on a sum of the

parts basis.

The Board worked with Canaccord Genuity in conducting this

review and the Board has concluded that the interests of all

stakeholders would be best served by seeking a new owner for each

of the core businesses through a managed sale process. In each case

the Renewables and Aviation businesses will benefit from long term

strategic owners with access to capital to support growth

ambitions, while offering stability and certainty to staff,

customers and suppliers. The market will determine the value of

each of these businesses and the proceeds, in conjunction with the

ongoing disposal process of the non-core assets, will be used to

repay debt, provide working capital and ultimately return value to

shareholders.

In view of the different rates of recovery of the businesses we

initiated a sale of the Renewables business first and are at an

advanced stage of process with a preferred bidder now undertaking

due diligence. We have also started the process for LSA which is

the key strategic asset within the Aviation business. The market

for aviation has improved significantly over the last six months

with most external analysis suggesting that capacity use at London

airports will have returned to pre pandemic levels this summer. We

would expect to see continuing positive moves by our airline

partners in the months ahead which will offer support to our market

approach. LSA was a proven airport in the pre pandemic period and

is a key strategic asset in the provision of passenger air services

to London at a time when peak time slots are starting to become

constrained once more. The Board is of the view that the airport

has strong potential within the right ownership structure along

with capital to support its medium to long term growth

ambitions.

In May 2023, we announced the sale of Star Handling, our ground

handling business with operations at Manchester and Stansted

Airports, while retaining the ground handling capability at LSA to

support the airport. While this business had been successful in

winning contracts and delivering for its airline clients it

remained sub scale in a market dominated by major international

competitors and we took the opportunity to exit for value at this

time.

As we progress with these disposals, we are reducing the

underlying cost base of the Group to a level sufficient to support

the remaining operations, including an exit from the residual non

-core assets. In line with this approach, we are exploring a move

to the Standard segment of the Main Market at the time of

completing the disposal of Renewables. The Board believe that

moving from the Premium segment will have a limited effect on

shareholders but will allow us to reduce the costs of being a

listed business while making it easier from an administrative point

of view to conclude the final delivery of the strategy. Once there

is clarity on the outcome of the sale processes, we will review the

appropriate means to return value to shareholders.

Environmental, social and governance

We have continued to build on the last two years of our ESG

journey by increasing the ownership and delivery within our

operating divisions. In light of the outcome of the strategic

review the divisions have further enhanced their own governance

structure to include a Steering Group, Working Groups and ownership

and oversight of their own individual implementation plans and KPI

tracking.

We understand the importance of developing our plans to reduce

our carbon footprint and this year have developed Net Zero Roadmaps

for our operating divisions that aim to bring our carbon footprint

to zero by 2040. These roadmaps are aligned with each division's

growth plans.

Our colleagues have continued to build relationships and

fundraise for our charitable partnerships. A partnership has been

developed with the Co-op Levy Share to contribute a percentage of

Esken's apprenticeship levy to community partners to take on

apprentices. An employee volunteering programme was also launched

during Volunteers' Week and our colleagues contributed over 500

hours of volunteering in the local community. Not only did this

benefit the chosen cause, but also provided invaluable team

building opportunities.

Board and people

I would like to express my personal thanks to my Board and all

of our colleagues at Esken for their hard work and support over the

last year. It has continued to be a challenging time for everyone

and I appreciate the efforts and dedication of our staff through

this difficult period. I do appreciate that the decisions taken

following the strategic review of our operating businesses creates

an element of uncertainty as to the future, in particular for those

people who work in the Group support areas at the centre. In making

the decision to sell the core operating businesses we will have

regard to ensuring that new owners will offer long term security to

the workforce and the opportunity for these businesses to grow.

Throughout the implementation period, the senior management team

and myself have engaged actively with staff affected and will offer

support for those who need to seek new roles outside the Group.

We have deferred any decisions around future Board composition

given the future direction of the Group. In particular, while

recognising that the Group does not meet the diversity targets in

respect of either gender or ethnicity, the skill sets which we have

around the Board table are best placed to support the Group through

its realisation strategy. The Board has decided against adding

additional Board members in view of the revised strategic

objectives.

Future

A successful conclusion to the sale process for Renewables will

allow the Group to reduce its core debt significantly while

providing working capital to facilitate the managed reduction of

Group support functions, facilitate the exit of the remaining

non-core assets and support the liquidity needs of LSA through to

its sale. There is no set timescale on the completion of the

airport sale as the Board wishes to ensure that the value is

optimised from a shareholder perspective as aviation continues to

recover. Following the completion of these steps, the remaining

value will be returned to shareholders.

David Shearer

Executive Chairman

Financial review

Strategic review

The Board has concluded that it is in the best interests of all

stakeholders to secure the long-term potential of the Group's

operating divisions, Esken Aviation and Esken Renewables, and

deliver value for the Esken shareholders through a managed disposal

of both of the businesses. A sale process for Esken Renewables is

at an advanced stage working with a preferred bidder on an

exclusive basis. A sale of the Aviation business will focus on

London Southend Airport (LSA) with the aim of securing a buyer with

the capital to drive growth at the airport over the long term.

Renewables

Adjusted EBITDA for the division was lower than anticipated at

the start of the financial year at GBP18.4m due to a number of

challenges. An increased number of unplanned shutdowns at customer

plants have resulted in a lower than expected supply of biomass

material by the division, along with increases in associated costs.

Gate fee income has been reduced as a result of a more competitive

market for waste wood impacting volumes and prices, in addition to

the reduced ability of several processing sites to take in waste

wood during times of unplanned customer plant closures. The

transport margin has been adversely affected by high fuel costs and

the rollover impact of wage inflation due to driver shortages last

year. The division has taken mitigating actions to counter these

challenges: the fleet size has been reduced to achieve the most

efficient use the trucks and drivers, and strong cost control has

resulted in lower than anticipated overheads. Inflationary

pressures have been eased by RPI-linked indexation elements within

the division's long-term customer supply contracts. However, these

are retrospective in a number of cases and as such the true

benefits of indexation will not be seen until FY24.

Aviation

The division serviced three routes for passenger flights during

the year, however airline take up of available slots at the airport

was lower than expected and passenger numbers are still well below

pre-COVID levels. Due to the slow take up management decided that

the best course of action was for LSA to be closed to commercial

flights for Winter 2022/2023. The division's cargo contract with

its global logistics partner ceased in September 2022 resulting in

an estimated GBP3.8m reduction in adjusted EBITDA for FY23 and

FY24. These downsides have been partly offset by cash benefits of

receipt of airline marketing costs and a number of commercial

initiatives including filming and other media opportunities.

LSA has secured a multi-year agreement with easyJet. The airline

will operate a new route to Amsterdam, in addition to the three

existing destinations of Malaga, Majorca and Faro. For the Summer

2023 season LSA will operate around 30% more flights in Summer 2023

than in Summer 2022 due to the new route and an increase in the

number of flights to Faro.

Liquidity

On 9 November 2022, the Group signed a three-year GBP50m term

loan agreement, see financial assets and liabilities note for

further details. The new loan will be used to settle maintenance

and lease liabilities in Propius, fees payable for cancellation of

the old Revolving Credit Facility (RCF) and entry into the facility

itself, and provide working capital for the Group. This loan was

fully drawn on 15 December 2022 and on the same day the Group

cancelled its GBP19.1m RCF with Lloyds and AIB. Going forward, the

Group will operate all corporate banking through Barclays. The

Group's headroom at the year end is GBP50.3m and includes GBP5.3m

of ringfenced cash in LSA. The Group also has non-core assets with

a net book value of GBP43.1m.

Non-core assets and sale of Star Handling

In August 2022, the Group disposed of another plot of land at

Widnes for GBP3.5m at net book value. Management is exploring a

number of options for the Group's remaining non-core assets. On 15

May 2023, the Group disposed of Star Handling Limited, our ground

handling business with operations at Manchester and Stansted

Airports, to Skytanking UK Ltd for a maximum cash consideration of

GBP4.8m.

Discontinued operations

Four of the eight ATR aircraft leased by Propius have been

successfully returned to the lessor by the year end, with the

remaining four to be returned in the period to September 2023. The

Group agreed the early hand back of two of the four aircraft

returned, resulting in maintenance savings of GBP2.0m. At 28

February 2023, the Group has c.GBP25.2m of obligations relating to

leases, maintenance and other aircraft-related costs, that will be

settled within one year, see alternative performance measure note

for breakdown of the costs. The remaining costs have been fully

provided for in these financial statements.

Revenue

2023 2022

GBP'm GBP'm Movement

--------------------------------- ------- ------- ---------

Renewables 93.7 79.7 17.7%

Aviation 25.5 23.4 8.7%

Revenue from two main operating

divisions 119.2 103.1 15.6%

Investments - - 0%

Non-Strategic Infrastructure 0.6 0.7 (7.1%)

Group Central and Eliminations 0.2 0.8 (79.6%)

--------------------------------- ------- ------- ---------

Total revenue 120.0 104.6 14.7%

--------------------------------- ------- ------- ---------

Revenue from continuing operations has increased by 14.7% to

GBP120.0m. Revenue from our two main operating divisions,

Renewables and Aviation, has increased by 15.6% to GBP119.2m.

RPI-linked contracts in the Renewables division have been the main

driver of the increase in the division's revenue year-on-year.

Revenue in the Aviation division increased due to improved

performance of the hotel, solar farm and Star Handling, partly

offset by a GBP1.5m one-off receipt in the prior year related to

Teesside settlement not repeating in the current year.

Profitability

Restated(1)

2023 2022

GBP'm GBP'm Movement

------------------------------------ -------- ------------- ------------

Adjusted EBITDA(2)

Renewables 18.4 20.3 (9.5%)

Aviation (3.8) (0.8) (390.9%)

Adjusted EBITDA(2) from

two main operating divisions 14.6 19.5 (25.3%)

Investments(3) - - -

Non-Strategic Infrastructure (1.7) 3.3 (151.8%)

Group Central and Eliminations (7.3) (12.2) 41.0%

------------------------------------ -------- ------------- ------------

Adjusted EBITDA(2) 5.6 10.6 (46.9%)

Depreciation (18.3) (20.7)

Impairments (1.0) (6.0)

------------------------------------ -------- -------------

Operating loss (13.7) (16.1)

Reversal of impairment of

loan notes 7.3 -

Finance costs (net) (20.7) (19.2)

Share of post-tax losses of

associates and joint ventures(3) (0.6) (0.4)

------------------------------------ -------- -------------

Loss before tax (27.7) (35.7)

------------------------------------ -------- -------------

Tax 2.5 9.9

------------------------------------ -------- -------------

Loss for the year from continuing

operations (25.2) (25.8)

------------------------------------ -------- -------------

Loss from discontinued operations,

net of tax (0.0) (2.4)

------------------------------------ -------- -------------

Loss for the year (25.2) (28.2)

------------------------------------ -------- -------------

1 The 2022 results have been restated where required due to

prior period adjustments, see prior year restatement note.

2 Adjusted EBITDA represents profit/(loss) before interest, tax,

depreciation and impairments. Refer to segment note for

reconciliation of divisional adjusted EBITDA to loss before

tax.

3 In the prior year the share of post-tax losses of associates

and joint ventures was presented as part of adjusted EBITDA. This

year it is presented on its own line as part of the loss before

tax.

Adjusted EBITDA and profit before tax are the Group's key

measures of profitability. Adjusted EBITDA has decreased by 46.9%

to GBP5.6m (2022: GBP10.6m) and the loss before tax has decreased

by GBP8.0m to GBP27.7m (2022: GBP35.7m).

In the Renewables division, performance has been hit by

unplanned shutdowns of customer plants and the impact of market

pressures on gate fee receipts, leading to a 9.5% decrease in

adjusted EBITDA to GBP18.4m (2022: GBP20.3m). The Aviation division

adjusted EBITDA loss has increased by 390.9% to GBP3.8m (2022:

GBP0.8m) primarily due to one-off receipts in the prior year of

GBP3.5m associated with Connect Airways and the conclusion of the

partnership with Teesside International Airport not being repeated

in the current year.

In the Non-Strategic Infrastructure division a GBP4.7m one-off

receipt in the prior year relating to the agreement to exit a

long-term onerous property lease has not been repeated in the

current year. This is the main driver of the decrease in adjusted

EBITDA to a GBP1.7m loss (2022: GBP3.3m gain). The Group Central

and Eliminations division's adjusted EBITDA loss decreased by 41.0%

to GBP7.3m (2022: GBP12.2m) mainly due to one-off legal fees and an

increase in the provision for part 1 claims relating to LSA in the

prior year which have not been repeated.

Business segments

The business segments reported in the financial statements are

Renewables, Aviation, Investments and Non-Strategic Infrastructure,

which represent the operational and reporting structure of the

Group. The Operational review contains further details about the

performance of the operating divisions.

The fair value of the investment in Logistics Development Group

plc (LDG), increased by GBP1.0m (2022: GBP1.2m decrease) due to an

increase in the LDG share price. The gain on revaluation of the

investment to current market share price is presented in the

consolidated statement of comprehensive income.

The Non-Strategic Infrastructure division continues to realise

value from its property assets when the time and price is right. At

28 February 2023, the book value of Infrastructure assets held was

GBP43.1m (2022: GBP39.7m). During the year, there was a disposal of

a portion of Widnes land generating net proceeds of GBP3.5m (2022:

GBPnil). Following commercial discussions regarding a potential

disposal of the Group's investment in, and shareholder loan notes

issued to, Mersey Bioenergy Holdings Limited (MBHL), the Group

recognised a reversal of impairment of the loan notes from GBPnil

to GBP7.3m.

Depreciation

Depreciation has reduced from GBP20.7m to GBP18.3m due to an

overall reduction in the asset base across the Group.

Impairments and reversal of impairment of loan notes

There was an impairment of GBP1.0m of assets relating to the

Port Clarence site in the Renewables division ahead of the disposal

of the site post year end. The GBP7.3m reversal of impairment of

MBHL loan notes is presented on a separate line, impairment of loan

notes, on the consolidated income statement.

Net finance costs

Finance costs increased by GBP3.3m to GBP24.8m, mainly due to

full year's interest charged on the CGI convertible debt instrument

in the current year, but only part year in the prior. Finance

income increased by GBP1.8m to GBP4.0m primarily due to gains on

the revaluation of Esken Limited's intercompany US Dollar

denominated loan with Propius.

Tax

The tax credit on continuing operations of GBP2.5m (2022:

GBP9.9m) reflects an effective tax rate of 9.1% (2022: 27.7%). The

effective rate is lower than the standard rate of 19%, mainly due

to the net release of provisions relating to uncertain tax

positions. Deferred tax has been calculated at a blended rate. The

amounts expected to unwind pre 1 April 2023 are calculated at 19%

and the amounts expected to unwind post 1 April 2023 are calculated

at 25%.

Discontinued operations

The results of Propius, our aircraft leasing business are

presented as discontinued as it is abandoned in line with the IFRS

5 definition of a discontinued operation. The decrease in the loss

from discontinued operations of GBP2.4m to GBP0.1m is primarily due

to the provision of maintenance and other aircraft related costs

being made in the prior year.

Loss per share

Loss per share from continuing operations was 2.47p (2022:

3.12p). Total basic loss per share was 2.47p (2022: 3.41p).

Balance sheet

Restated

2023 2022

GBP'm GBP'm

------------------------- -------- ---------

Non-current assets 352.7 359.3

Current assets 86.2 89.2

Non-current liabilities (272.7) (244.9)

Current liabilities (126.3) (133.0)

------------------------- -------- ---------

Net assets 39.9 70.6

------------------------- -------- ---------

The overall value of property, plant and equipment (PPE) of

GBP263.4m (2022: GBP269.9m) has decreased in the year mainly due to

the depreciation charge across the Group and the impairment of Port

Clarence assets, partly offset by the reclass of Widnes land from

property inventories, and fixed asset additions related to terminal

improvements at LSA and plant and machinery in Renewables.

There has been a GBP7.3m reversal of impairment of MBHL loan

notes and a GBP3.1m increase in trade receivables, offset by a

GBP10.8m decrease in property inventory and a GBP2.5m decrease in

cash, see following section on the major cash flows in the

year.

Non-current liabilities have increased from GBP244.9m to

GBP272.7m. In the year a GBP44.8m liability was recognised on the

balance sheet relating to the term loan and an interest accrual of

GBP12.2m on the CGI convertible debt. These increases are partially

offset by a GBP19.3m reduction in lease liabilities, due to capital

repayments, and a GBP13.3m reduction in non-current provisions,

mainly due to maintenance payments.

Current liabilities have reduced mainly due to a reduction in

corporation tax provisions.

Debt and gearing(1)

Restated

2023 2022

-------------------------- ----------- ------------

Loans and borrowings GBP340.4m GBP300.0m

Cash (GBP50.3m) (GBP52.7m)

-------------------------- ----------- ------------

Net debt GBP290.1m GBP247.3m

-------------------------- ----------- ------------

Adjusted EBITDA/interest 0.2 0.6

Net debt/total assets 66.1% 55.1%

Gearing 726.8% 350.5%

-------------------------- ----------- ------------

1 See Alternative performance measures note for an explanation

and reconciliation of gearing.

During the year the Group signed a three year GBP50m term loan,

following the loan the GBP19.1m RCF with current bank lenders was

cancelled.

Cash flow

2023 2022

GBP'm GBP'm

------------------------- ------- -------

Operating cash flow (10.5) 3.2

Investing activities 9.6 (5.2)

Financing activities 22.4 82.2

------------------------- ------- -------

Increase in the year 21.5 80.2

Discontinued operations (24.9) (39.9)

Restricted cash 1.0 -

At beginning of year 52.7 12.4

------------------------- ------- -------

Cash at end of year 50.3 52.7

------------------------- ------- -------

Discontinued cash flows in the year relates to Propius lease,

maintenance and other aircraft related costs.

Restricted cash relates to money held in escrow within the

Renewables division as security for one of its contracts.

Investing activities include inflows of GBP3.5m received from

the sale of a portion of Widnes land, GBP2.2m from the sale of PPE

and GBP1.7m for the receipt of the capital element of net

investment in leases.

Financing activities includes net proceeds from the term loan of

GBP44.8m. Offsetting this there were outflows of GBP16.4m for the

repayment of the capital element of lease obligations and GBP6.8m

for interest payments.

Lewis Girdwood

Chief Financial Officer

Operating reviews

Renewables

Esken Renewables supplied 1.6m tonnes of fuel to biomass plant

customers in the year to 28 February 2023, up 9.4% on the prior

year (2022 1.5m tonnes).

However, this increase reflected improved demand from biomass

plants to which Esken Renewables primarily supplies third party and

forestry by-product, at a lower margin. Higher margin biomass

plants that use waste wood experienced an increased number of

unplanned outages, particularly during the winter months. This

reduced the total volume of waste wood supplied by Esken Renewables

and the associated gate fee income. Ongoing fluctuations in UK

construction supply chains also led to a market wide reduction in

waste wood, further impacting gate fee income and margins.

The overall increase in volume supplied resulted in revenue

increasing 17.7% to GBP93.7m (2022 GBP79.7m) but the reduction in

higher margin waste wood income resulted in adjusted EBITDA

reducing by 9.5% from GBP20.3m to GBP18.4m.

Margins are expected to improve as biomass plant customers

continue to better understand their infrastructure and optimise

performance. Margins will also be supported by continued annual

contracted indexation revisions that reflect the cost inflation

experienced during the year. RPI linked contracts for two of the

six largest plants were revised to reflect higher costs in April

2022 with a further two revised by the end of the first half of the

financial year. The remaining two contracts were revised in January

2023.

Further steps were taken to optimise ongoing margins through the

closure of Esken Renewables' Port Clarence processing and storage

site, which had originally been built to service the Port Clarence

Biomass Plant, which was never commissioned. The processing site

had never been profitable as a result. Esken Renewables took the

decision to close the site having entered into a new sub-supply

agreement to support the Chilton Biomass plant, replacing the

supply provided from Port Clarence. The sub-supply agreement and

closure of Port Clarence is expected to deliver an additional

GBP0.9m of annual recurring EBITDA from 1 April 2023.

A new sub-supply arrangement in Yorkshire and the Cramlington

supply contract moving to an exclusive basis from September 2022

will also support improved recurring revenues going forward, and

Esken Renewables continues to seek further supply agreements and

strategic partnerships.

Aviation

The Aviation Division received GBP1.4m related to the recovery

of airline marketing support payments and delivered an adjusted

EBITDA loss of GBP3.8m in FY23. In the prior year, the Division

reported a loss of GBP0.8m having benefitted from GBP3.5m of

one-off receipts associated with Connect Airways and the conclusion

of the partnership with Teesside International Airport . The

adjusted EBITDA loss of GBP3.8m included positive contributions

from the airport hotel, London Southend Jet Centre, and Star

Handling.

The aftereffects of the pandemic continued to impact the

aviation sector during the year. Whilst LSA continued to maintain

adequate staffing levels, several aviation businesses saw their

staffing numbers reduce during the last two years and the industry

experienced challenges in recruiting people back into aviation.

During the summer months, many airline staff also went on strike,

causing airlines to both continue to retrench to traditional hub

bases and remove flights if there weren't staff available to

operate them. The challenges elsewhere in turn led to the removal

of planned flights at LSA at various points over the summer,

reducing passenger numbers by 5.3% from 94k to 89k.

LSA has continued to position itself for recovery despite the

legacy challenges that followed the pandemic. This recovery will be

built on having in place a strong management team that is taking a

proactive approach to airline engagement while continuing to

develop the airport proposition.

John Upton joined the airport team as CEO in September 2022 and

has sought to engender an entrepreneurial spirit in the business.

John leads a new management team with the Finance Director and

Business Development Director appointed toward the beginning of the

year under review. They are joined by recently promoted operations

and commercial directors in a newly formed operational Board.

That team are regularly engaging with airlines on both based and

non-based flying, using the data from 40 previously proven routes

to indicate the profit opportunities arising from operating at

LSA.

Those airlines are increasingly aware that London's traditional

airport hubs are now very close to pre-pandemic operating levels

and that peak slot capacity is reaching a cliff edge. LSA is

therefore making the case for profitable and sustainable growth

capacity now, serving the fast-growing east London and east of

England catchment area. Direct rail access to London Liverpool

Street and Stratford, the UK's busiest train station, with further

connections to the Elizabeth Line 30 minutes away in Shenfield also

add to the attractiveness of the airport's location.

The airport's affluent and growing catchment area, direct, quick

rail access to London and modern airport infrastructure were

important factors that led to LSA signing a multi-year partnership

with easyJet in January 2023. easyJet started operating a new route

to Amsterdam at the end of May 2023 with Paris starting October

2023. These two new routes will operate year round. The addition of

these routes takes the number of destinations easyJet serves from

the airport to five including Malaga, Palma and Faro. The airline

has also announced an increase in the weekly frequency of flights

to Faro.

LSA will also aim to build on its positive engagement last

summer with airlines following a small number of flights that were

added by Blue Air to Bucharest, Sky Express to Athens and Wideroe

to Bergen in late July. The airport team will also continue to

explore further logistics opportunities following a successful

operation supporting a new logistics partner on a temporary basis

from January through to March 2023.

The Board of Esken believe LSA has the potential to grow well

beyond the 2.1m passengers that it welcomed in FY20. The Board

concluded that the best way to help the airport achieve this

potential, and deliver value for Esken shareholders, is through a

managed disposal process. A key objective will be to find the right

buyer with the capital to support the growth prospects of the

airport over the long term and benefit airline partners, customers

and local stakeholders.

Consolidated income statement

For the year ended 28 February 2023

Restated(1)

Year ended Year ended

28 February 28 February

2023 2022

GBP'000 GBP'000

---------------------------------------- -------------- -------------

Continuing operations

Revenue 120,004 104,633

Other income 2,220 8,364

Operating expenses (116,587) (102,386)

Adjusted EBITDA 5,637 10,611

---------------------------------------- -------------- -------------

Depreciation (18,284) (20,749)

Impairments (1,016) (5,970)

Operating loss (13,663) (16,108)

---------------------------------------- -------------- -------------

Reversal of impairment of loan

notes 7,302 -

Finance costs (24,786) (21,446)

Finance income 4,027 2,240

Share of post-tax losses of associates

and joint ventures (566) (356)

----------------------------------------

Loss before tax (27,686) (35,670)

Tax 2,508 9,865

---------------------------------------- -------------- -------------

Loss for the year from continuing

operations (25,178) (25,805)

---------------------------------------- -------------- -------------

Discontinued operations

Loss from discontinued operations,

net of tax (59) (2,386)

---------------------------------------- -------------- -------------

Loss for the year (25,237) (28,191)

---------------------------------------- -------------- -------------

Loss per share expressed in pence

per share - continuing operations

Basic (2.47)p (3.12)p

Diluted (2.47)p (3.12)p

---------------------------------------- -------------- -------------

Loss per share expressed in pence

per share - total

Basic (2.47)p (3.41)p

Diluted (2.47)p (3.41)p

---------------------------------------- -------------- -------------

(1) The 2022 results have been restated where required due to

prior period adjustments, see note below.

Consolidated statement of comprehensive income

For the year ended 28 February 2023

Restated(1)

Year ended Year ended

28 February 28 February

2023 2022

GBP'000 GBP'000

Loss for the year (25,237) (28,191)

Exchange differences from discontinued

operations, net of tax (7,017) (1,824)

----------------------------------------

Other comprehensive expense -

items that are or may be reclassified

subsequently to profit or loss,

net of tax (7,017) (1,824)

Remeasurement of defined benefit

plan 324 1,876

Change in fair value of financial

assets classified as fair value

through other comprehensive income 963 (1,187)

Tax on items relating to components

of other comprehensive income (341) (417)

----------------------------------------

Other comprehensive income - items

that will not be reclassified to

profit or loss, net of tax 946 272

----------------------------------------

Other comprehensive expense for

the year, net of tax (6,071) (1,552)

---------------------------------------- -------------- -------------

Total comprehensive expense for

the year (31,308) (29,743)

---------------------------------------- -------------- -------------

(1) The 2022 results have been restated where required due to

prior period adjustments, see note below.

Of the total comprehensive expense for the year, a loss of

GBP24,232,000 (2022: GBP25,533,000) is in respect of continuing

operations and a loss of GBP7,076,000 (2022: GBP4,210,000) is in

respect of discontinued operations.

Consolidated statement of financial position

As at 28 February 2023

Restated(1)

28 February 28 February

2023 2022

GBP'000 GBP'000

------------------------------------ ------------- --------------

Non-current assets

Property, plant and equipment 263,412 269,944

Investment in associates and joint

ventures 450 1,016

Other financial assets 15,324 14,105

Intangible assets 54,669 54,669

Net investment in leases 16,888 17,763

Defined benefit pension surplus 1,937 348

Other receivables - 1,495

------------------------------------ ------------- --------------

352,680 359,340

------------------------------------ ------------- --------------

Current assets

Inventories 1,729 12,552

Trade and other receivables 34,195 23,883

Cash and cash equivalents 49,264 52,738

Restricted cash 1,000 -

------------------------------------

86,188 89,173

------------------------------------ ------------- --------------

Total assets 438,868 448,513

------------------------------------ ------------- --------------

Non-current liabilities

Loans and borrowings (259,841) (222,981)

Other liabilities (8,894) (8,643)

Provisions (3,942) (13,279)

------------------------------------

(272,677) (244,903)

------------------------------------ ------------- --------------

Current liabilities

Trade and other payables (27,611) (30,160)

Loans and borrowings (80,521) (77,099)

Corporation tax (583) (5,110)

Provisions (17,560) (20,674)

------------------------------------

(126,275) (133,043)

------------------------------------ ------------- --------------

Total liabilities (398,952) (377,946)

------------------------------------ ------------- --------------

Net assets 39,916 70,567

------------------------------------ ------------- --------------

Capital and reserves

Issued share capital 102,534 102,534

Share premium 403,225 403,225

Foreign currency exchange reserve (6,799) 218

Reserve for own shares held by

employee benefit trust (7,596) (7,596)

Retained deficit (451,448) (427,814)

------------------------------------

Group shareholders' equity 39,916 70,567

------------------------------------ ------------- --------------

(1) The 2022 results have been restated where required due to

prior period adjustments, see note below.

Consolidated statement of changes in equity

For the year ended 28 February 2023

Reserve

Foreign for own

Issued currency shares

share Share exchange held by Retained Total

capital premium reserve EBT deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2022 (restated) 102,534 403,225 218 (7,596) (427,814) 70,567

Loss for the year - - - - (25,237) (25,237)

Other comprehensive

expense for the

year - - (7,017) - 946 (6,071)

------------------------ --------- --------- ---------- --------- ---------- ---------

Total comprehensive

expense for the

year - - (7,017) - (24,291) (31,308)

Employee benefit

trust - - - - (3) (3)

Share-based payment

charge - - - - 630 630

Tax on share-based

payment charge - - - - 30 30

Balance at 28 February

2023 102,534 403,225 (6,799) (7,596) (451,448) 39,916

------------------------ --------- --------- ---------- --------- ---------- ---------

For the year ended 28 February 2022 (restated(1) )

Reserve

Foreign for own

Issued currency shares

share Share exchange held by Retained Total

capital premium reserve EBT deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2021 62,492 390,336 3,826 (7,480) (400,861) 48,313

Prior period adjustments - - - - 1,204 1,204

------------------------------ --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2021 - restated 62,492 390,336 3,826 (7,480) (399,657) 49,517

------------------------------ --------- --------- ---------- --------- ---------- ---------

Loss for the year - - - - (28,191) (28,191)

Other comprehensive

(expense)/income

for the year - - (1,824) - 272 (1,552)

------------------------------ --------- --------- ---------- --------- ---------- ---------

Total comprehensive

expense for the

year - - (1,824) - (27,919) (29,743)

Issue of ordinary

shares 40,042 12,889 - - (600) 52,331

Employee benefit

trust - - - (116) (4) (120)

Reclassification

of exchange differences

on disposal of subsidiaries - - (1,784) - - (1,784)

Share-based payment

charge - - - - 285 285

Tax on share-based

payment charge - - - - 81 81

Balance at 28 February

2022 102,534 403,225 218 (7,596) (427,814) 70,567

------------------------------ --------- --------- ---------- --------- ---------- ---------

(1) The 2022 results have been restated where required due to

prior period adjustments, see note below.

Consolidated statement of cash flows

For the year ended 28 February 2023

Year ended Year ended

28 February 28 February

2023 2022

GBP'000 GBP'000

----------------------------------------- ------------- -------------

Cash (used in)/generated from

continuing operations (8,481) 3,291

Cash outflow from discontinued

operations (10,610) (17,775)

Income taxes paid (2,060) -

----------------------------------------- ------------- -------------

Net cash outflow from operating

activities (21,151) (14,484)

Purchase of property, plant and

equipment net of financing 1,705 (3,015)

Proceeds from the sale of property

inventory 3,539 -

Proceeds from the sale of property,

plant and equipment 2,197 1,115

Receipt of capital element of net

investment in lease 1,725 1,547

Cash disposed on liquidation/disposal

of subsidiary undertakings - (362)

Acquisition of other investments - (4,900)

Interest received 451 415

Cash inflow/(outflow) from discontinued

operations 2,171 (7,808)

----------------------------------------- ------------- -------------

Net cash inflow/(outflow)/inflow

from investing activities 11,788 (13,008)

----------------------------------------- ------------- -------------

Proceeds from the issue of ordinary

shares (net of issue costs) - 52,330

Proceeds from issue of convertible

debt (net of costs) - 111,459

Proceeds from new borrowings (net

of costs) 44,784 -

Proceeds from grants 1,705 2,600

Principal element of lease payments (16,603) (17,026)

Net repayment of revolving credit

facility (net of costs) (850) (58,165)

Interest paid (6,658) (8,992)

Cash outflow from discontinued

operations (16,489) (14,384)

-----------------------------------------

Net cash inflow from financing

activities 5,889 67,822

----------------------------------------- ------------- -------------

(Decrease)/increase in cash and

cash equivalents (3,474) 40,330

----------------------------------------- ------------- -------------

Cash and cash equivalents at beginning

of year 52,738 12,408

----------------------------------------- ------------- -------------

Cash and cash equivalents at end

of year 49,264 52,738

----------------------------------------- ------------- -------------

Cash transferred from unrestricted

cash 1,000 -

----------------------------------------- ------------- -------------

Cash , cash equivalents and restricted

cash 50,264 52,738

----------------------------------------- ------------- -------------

Notes to the consolidated financial statements

Accounting policies of Esken Limited

Basis of preparation and statement of compliance

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 28 February 2023

and 28 February 2022. The information presented is an extract from

the audited consolidated Group statutory accounts. The Auditors

have reported on those accounts; their report was (i) unqualified,

and (ii) contains a material uncertainty in respect of going

concern to which the auditor drew attention by way of emphasis

without modifying their report. The Auditors' report can be found

in the Group's full 2023 Annual Report and Accounts which will be

published on the Group's website.

These Group financial statements have been prepared in

accordance with UK-adopted international accounting standards.

The financial statements of the Group are also prepared in

accordance with the Companies (Guernsey) Law 2008.

Esken Limited (the Company) is a Guernsey-registered company.

The Company's ordinary shares are traded on the London Stock

Exchange.

Measurement convention

The financial statements are prepared on the historical cost

basis except financial assets held at fair value through other

comprehensive income (FVOCI) and derivative financial instruments

which are stated at their fair value.

Going concern

The Group's business activities, together with factors likely to

affect its future performance and position, are set out in the

Executive Chairman's statement and the financial position of the

Group, its cash flows and funding are set out in the Financial

Review.

The financial assets and liabilities note of the financial

statements includes details of the Group's loans and borrowings at

the year end, together with the Group's objectives, policies and

processes for managing its capital, its financial risk management

objectives, details of its financial instruments and its exposure

to credit risk and liquidity risk. After making enquiries, the

Directors have a reasonable expectation that the Group will have

adequate resources to continue in operational existence for the

foreseeable future until at least 30 June 2024. Accordingly, the

financial statements have been prepared on a going concern basis.

However, there is a material uncertainty in respect of this going

concern assumption and the Directors have exercised a significant

degree of judgement in concluding that the Group remains a going

concern. In particular, the assumption that the disposal of the

Renewables business will complete prior to 31 August 2023, with the

timing of completion and forecast consideration are both

significant judgements.

In performing the going concern assessment, the Directors have

reviewed the cash flow forecasts together with the funding options

that may be available to the Group and the likelihood of them being

accessible, for the period to 30 June 2024. Within this timescale,

it is forecast that funds will be generated from the disposal of

the Renewables business and that those proceeds, together with

certain non-core asset disposals, will enable the repayment of the

GBP50m term loan, and associated costs, settlement of the

exchangeable bonds (bonds) in May 2024, and provide further

liquidity to London Southend Airport (LSA), in addition to the

short-term facility currently being negotiated with an existing

lender, during the ongoing sale process.

The project to dispose of the Renewables business is

significantly progressed, with the process being at an advanced

stage with a preferred bidder now undertaking due diligence. The

current timetable and management judgement assumes completion in

August 2023.

As at 28 February 2023, the Group had cash balances of GBP50.3m.

Included in this GBP50.3m of cash is GBP5.3m of cash ringfenced in

London Southend Airport (LSA) and its subsidiaries, as part of the

Carlyle Global infrastructure Opportunity Fund (CGI) convertible

debt facility. Whilst the Group continues to tightly manage its

cash resources, the current position is that the Group needs to

complete the disposal of the Renewables business prior to the end

of December 2023, or complete significant asset disposals,

otherwise the Group may be unable to continue trading. The

Directors have a reasonable expectation, following discussions with

the appointed advisor, that the required disposal of the Renewables

business will be completed at the quantum and within the timescales

required.

Should the business disposal not successfully complete before

the end of December 2023, this is expected to lead to severe

liquidity issues and the Group will likely breach its forward

looking covenant. The Directors would have a limited amount of time

to raise additional funds if the timing of the business disposal

was to be delayed, to allow the Group to continue trading. The

Directors have prepared base case forecasts, together with

sensitivity analysis on those forecasts, including a severe but

plausible downside set of assumptions detailed below. Under both

the base and plausible downside scenario, Group liquidity following

the maturity of the bonds in May 2024 becomes negative, excluding

the key mitigating action of disposal of the Renewables business.

The reasonableness of the assumption made by the Directors that

funds from the disposal of the Renewables business will be received

is a significant judgement and this gives rise to a material

uncertainty in respect of securing the necessary funds. Both

forecasts include the critical assumption that the business

disposal is successful, the base case forecast indicates Group

headroom of c.GBP26m at 30 June 2024 and the severe but plausible

downside indicates that the Group will have headroom of c.GBP4m at

this date.

For the purposes of this going concern analysis, the base case

forecast assumes:

-- The Group completes the disposal of its Renewables business before 31 August 2023. The proceeds of which will be

used to repay the term loan drawn in December 2022;

-- The Group settles its bonds, paying cash in excess of the collateral shares held;

-- Full year passenger volumes from LSA of c.0.1m for the year ending 28 February 2024 and c.0.5m passengers in the

year ending 28 February 2025;

-- GBP34.0m cash received in respect of non-core asset disposals in the year ending February 2024;

-- The Group is able to finalise terms with an existing lender for a suitable additional short-term facility that

would enable additional required liquidity of up to GBP5m to be injected into LSA, prior to 31 July 2023; and

-- Proceeds from the Renewables disposal would be available to be used in the LSA Group to meet ongoing forecast

liquidity needs.

e severe but plausible downside excludes all but GBP9m of

non-core asset disposals. That forecast also includes a reduction

in 2025 Aviation operational and trading performance due to the

slower recovery following the COVID-19 pandemic, resulting in a

cash reduction to forecast. The passenger forecast for 2024, of

c.0.1m, is primarily based on the known current routes available,

and therefore management do not believe that a downside sensitivity

is required to these assumptions. The severe but plausible forecast

also assumes that the completion of the Renewables business

disposal will be delayed until November 2023. Based on those

assumptions, the severe but plausible downside scenario does not

have a material impact on the ability of the Group to continue in

operational existence for the foreseeable future. However, it is

important to note that if the Renewables business disposal is

delapyed beyond the severe but plausible downside forecast, the

forward looking covenant will be breached without additional

mitigating actions, including the accelerated disposal of non-core

assets and alternative funding arrangements.

Overall, the Directors are satisfied that the Group will have

sufficient funds to continue to meet its liabilities as they fall

due until at least 30 June 2024 and therefore have prepared the

financial statements on a going concern basis. However, as

previously noted this is highly dependent on the successful

completion of the Group's disposal plans, which indicate the

existence of a material uncertainty related to events or conditions

that may cast significant doubt on the ability of the Group to

continue as a going concern and, therefore, to continue realising

its assets and discharging its liabilities in the normal course of

business. The financial statements do not include any adjustments

that would result from the basis of preparation being

inappropriate.

Significant accounting policies

Changes in accounting policies and disclosures

The accounting policies adopted are consistent with those of the

previous financial year except as follows:

(a) New standards, amendments to existing standards and

interpretations to existing standards adopted by the Group

The Group has considered the following amendments and

definitions that are effective in this financial year and concluded

that they do not have a material impact on the financial position

or performance of the Group:

-- Definition of Accounting Estimates (Amendments to IAS 8)

-- Deferred Tax Related to Assets and Liabilities Arising from a

Single Transaction (Amendments to IAS 12)

-- Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)

(b) New standards and interpretations not applied

The following UK-endorsed standards and amendments have an

effective date after the date of these financial statements:

Effective

for accounting Proposed

periods commencing adoption in

on or after the year ending

---------------------------------------------- -------------------- ------------------

Classification of Liabilities as Current 1 January 2024 28 February

or Non-current and non-current Liabilities 2024

with Covenants (Amendments to IAS 1)

Disclosure of Accounting Policies (Amendments 1 January 2024 28 February

to IAS 1 and IFRS Practice Statement 2024

2)

---------------------------------------------- -------------------- ------------------

The adoption of these standards and amendments is not expected

to have a material effect on the net assets, results and

disclosures of the Group. There are no other new UK-endorsed

standards and amendments that are issued but not yet effective that

would be expected to have a material impact on the Group in future

reporting periods and on foreseeable future transactions.

Segmental information

The reportable segment structure is determined by the nature of

operations and services. The operating segments are Renewables,

Aviation, Investments and Non-Strategic Infrastructure. The results

for Propius are presented as discontinued operations on the face of

the consolidated income statement.

The Renewables segment specialises in the supply of sustainable

biomass material for the generation of renewable energy. The

Aviation segment specialises in the operation of commercial

airports and the provision of ground handling services. The

Investments segment holds a non-controlling interest in a logistics

services investing business and a baggage-handling business. The

Non-Strategic Infrastructure segment specialises in the management,

development and realisation of a portfolio of property assets,

including Carlisle Lake District Airport.

The Executive Directors are regarded as the Chief Operating

Decision Maker. The Directors monitor the results of each business

unit separately for the purposes of making decisions about resource

allocation and performance assessment. The main segmental profit

measure is adjusted EBITDA, which is calculated as loss before

interest, tax, depreciation and impairments. Income taxes and