TIDMFRAN

RNS Number : 1663R

Franchise Brands PLC

25 October 2023

25 October 2023

FRANCHISE BRANDS PLC

("Franchise Brands", the "Group" or the "Company")

Q3 Trading Update

All B2B business trading at record levels, with Pirtek meeting

expectations and integrating well

Confident in delivering adjusted EBITDA for the full year in

line with market expectation with debt levels reducing

Franchise Brands plc (AIM: FRAN), an international multi-brand

franchise business, provides the following trading update for the

three months to 30 September 2023 ("Q3").

Following the acquisition of Pirtek Europe in April 2023, the

Group now operates seven franchise brands in ten countries in the

UK, Continental Europe and North America, resulting in a more

diversified international footprint and a broad range of resilient

business services.

Divisional performance

The B2B businesses, which are engaged primarily in providing

essential reactive services and includes Metro Rod and Metro Plumb

in the UK and Pirtek in eight European countries, are all trading

at record levels despite some softening in demand over the summer

period. Whilst the type of reactive services provided have

resilient underlying demand whatever the macroeconomic conditions,

demand naturally reduces when customers' equipment or facilities

are not being used as intensively. Consequently, Q3 was a little

softer than in H1, but we saw a modest increase in activity at the

start of Q4.

Pirtek is integrating well and has met our expectations at the

time of its acquisition. We continue to work on expanding the range

of services and growing the customer base by identifying

cross-selling opportunities within the Group. As a result of the

significant opportunities to build a much larger business, the

Group has decided to accelerate the integration process. We have

optimised the management structure for cost and operating

efficiencies, and the new leadership team has settled in well and

is developing strong relationships across the Group. We have also

launched several initiatives to integrate technology, finance and

marketing into our central functions, with the initial focus being

on technology.

Metro Rod has experienced continued strong momentum in the

year-to-date in the growth of system sales due to the continuing

initiatives to widen and deepen the services offered, particularly

in the area of pump service and maintenance. Metro Plumb continues

to grow strongly as new independent franchisees are recruited and

the range of services offered improves. Good progress has been made

in Willow Pumps, where the special project department is gathering

momentum. The transition from a direct labour operation to a

franchise model at Filta Environmental has accelerated with

additional franchisees recruited, resulting in over 70% of the

grease recovery unit maintenance work being delivered by the

franchisees. Whilst this has reduced the Filta UK gross margin, it

is helping us build a stronger, more sustainable franchise model in

the longer term.

Filta's North American business has benefited from robust

activity across all key customer sectors, with used oil volumes and

revenues up strongly. The range of services being offered to its

commercial kitchen customer base is also being expanded with the

addition of new bulk oil sales and a steam cleaning service, which

will drive the management service fee income in future periods.

However, some of this underlying growth has been offset by a

reduction in the price achieved from the sale of used cooking

oil.

The B2C division continues to operate in a challenging

environment, although profitability is being maintained in line

with expectations.

Balance Sheet

Group net debt (excluding leases) on 30 September 2023 reduced

to GBP76.0m (30 June 2023: GBP79.1m), comprised of gross debt of

GBP92.4m and net cash of GBP16.4m. The Group is trading comfortably

within key banking covenants. The Group's interest charge is

averaging c.8% on the gross debt, which is higher than projected at

the time of the Pirtek acquisition due to increases in the Sterling

Overnight Interest Average (SONIA).

Management Team

During Q3 the Group has continued strengthening the senior

management team with Mark Fryer joining as Chief Financial Officer

and Rob Bellhouse appointed as Company Secretary. We have also

developed our corporate governance structure, in line with the

expansion of the Group and our ambition for the future, by

reorganising the board structure. We now have a smaller plc board

comprising two executive directors and three non-executive

directors, including Peter Kear, who has been appointed as Senior

Independent Non-executive Director. The plc board is supported by a

Management Board comprising the divisional CEOs and heads of the

support functions.

Outlook

Despite challenging macro-economic conditions, the resilient

nature of our services means that the Group continues to perform

well and expand. As a result, the Board expects the Group's

adjusted EBITDA for the year ending 31 December 2023 to be in line

with current consensus market expectations*.

Stephen Hemsley, Executive Chairman, commented:

"The integration of Pirtek is progressing well, and the new

senior leadership appointments are allowing us to accelerate the

process of integrating this business into the Group and achieve

more cross-functional and cross-geographic co-operation,

particularly where we can leverage our shared resources.

"We see significant potential for growth across our principal

franchise brands, which have a small share of large markets, by

broadening the range of services offered, increasing the

geographical penetration and cross-selling to the larger customer

base. This scale, and our continued investment in IT

infrastructure, will accelerate our operational gearing in future

years and be a further driver of adjusted EBITDA.

"Whilst the trading environment has become more challenging as

the year has progressed, the resilient nature of the business

services we provide gives us confidence in delivering adjusted

EBITDA for the full year in line with consensus market

expectations."

* Consensus market expectations for the financial year ending 31

December 2023 is adjusted EBITDA of GBP29.3m.

Enquiries:

Franchise Brands plc + 44 (0) 1625 813231

Stephen Hemsley, Executive Chairman

Mark Fryer, Chief Financial Officer

Julia Choudhury, Corporate Development Director

Allenby Capital Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 3328 5656

Jeremy Porter / Liz Kirchner / George Payne

(Corporate Finance)

Amrit Nahal / Joscelin Pinnington (Sales

& Corporate Broking)

Dowgate Capital Limited (Joint Broker) +44 (0) 20 3903 7715

James Serjeant / Russell Cook / Nicholas

Chambers

Stifel Nicolaus Europe Limited (Joint Broker) +44 (0) 20 7710 7600

Matthew Blawat / Francis North

MHP Group (Financial PR) +44 (0) 20 3128 8100

Katie Hunt/Catherine Chapman +44 (0) 7884 494112

franchisebrands@mhpgroup.com

About Franchise Brands plc

Franchise Brands is an international, multi-brand franchisor

focused on building market-leading businesses primarily via a

franchise model. The Group has a combined network of over 625

franchisees across seven franchise brands in ten countries covering

the UK, North America and Europe.

Franchise Brands' focus is on B2B van-based reactive and planned

services. The Company owns several market-leading brands with long

trading histories, including Pirtek in Europe, Filta, Metro Rod and

Metro Plumb, all of which benefit from the Group's central support

services, particularly technology, marketing, and finance. At the

heart of Franchise Brands' business-building strategy is helping

its franchisees grow their businesses: "if they grow, we grow".

Franchise Brands employs over 700 people across the Group.

For further information, visit www.franchisebrands.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZMZGVDVGFZM

(END) Dow Jones Newswires

October 25, 2023 02:00 ET (06:00 GMT)

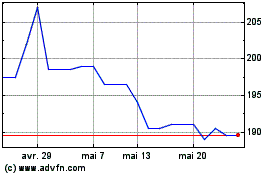

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025