TIDMFRAN

RNS Number : 0746A

Franchise Brands PLC

18 January 2024

18 January 2024

FRANCHISE BRANDS PLC

("Franchise Brands", the "Group" or the "Company")

Year End Trading Update

Another year of strong growth; key divisions trading at record

levels and

Adjusted EBITDA in line with market expectations

Franchise Brands plc (AIM: FRAN), an international multi-brand

franchise business, provides the following trading update for the

financial year ended 31 December 2023.

Following the acquisition of Pirtek Europe in April 2023, the

Group now has over 625 franchisees across seven franchise brands in

ten countries covering the UK, Continental Europe and North

America, resulting in a diversified international footprint.

Divisional performance

The divisions serving business customers (Pirtek, Metro Rod,

Willow Pumps, Filta UK and Filta International) are trading at

record levels, demonstrating the resilient underlying demand for

their primarily essential reactive services in challenging

macro-economic conditions.

Pirtek traded at record levels, contributing as expected to the

Group results in the eight months of ownership, despite a softening

in sales in the construction and hire fleet sectors during Q4,

particularly in the UK and Germany. Integration of Pirtek into the

Group is progressing well, and the Group continues to identify

efficiencies, particularly in IT, where the Board foresees

significant synergies over the next few years. Work has also

started on expanding the range of services and cross-selling across

the Group's significantly enlarged customer base.

Metro Rod also delivered a record year with strong momentum,

resulting in system sales growth of almost 20%. This growth has

been driven by the continuing initiatives to widen and deepen the

services offered, particularly in pump service and maintenance.

Metro Plumb's system sales increased by over 20%, with this strong

growth reflecting the recruitment of new independent franchisees

and the broadening of its range of services.

Particularly good progress has also been made in Willow Pumps,

assisted by several planned management team changes. The special

project department is gathering momentum and with a more extensive

sales pipeline, the Board expects further progress in 2024.

At Filta UK, the transition from a direct labour operation to a

franchise model has accelerated and, whilst this reduces the gross

margin, it is helping the Group to build a more robust and

sustainable long-term business model. The previously reported

supply issues with the Cyclone grease recovery unit have been

resolved by the acquisition of all the intellectual property rights

associated with this unit. While this disruption has impacted sales

for the year, the Board is confident that full control of the

supply chain will enable accelerated growth in 2024.

Filta International's North American business had a record year,

with system sales increasing by over 15% and robust levels of

activity across all key customer sectors. Used oil volumes

increased by 25% but this was mostly offset by a c.20% reduction in

the average sale price achieved. The range of services offered to

Filta International's commercial kitchen customer base is being

expanded with the addition of new bulk virgin oil sales and a

kitchen cleaning service, which will drive the management service

fee income in future periods.

The B2C division delivered a creditable performance in a

challenging recruitment environment, and whilst its contribution to

the Group results will be below the prior year, it will exceed the

Group's more cautious expectations.

Balance Sheet

The Group's adjusted net debt on 31 December 2023 was reduced to

GBP74.8m (30 June 2023: GBP79.1m), comprised of gross debt of

GBP86.8m and cash of GBP12.0m. Adjusted net debt excludes debt on

right-of-use assets and is the debt measure used for testing bank

covenants. The Group is trading comfortably within all banking

covenants.

The strategic focus of the Group remains on integrating Pirtek,

promoting operational synergies, organic expansion of the range of

services and repaying acquisition debt. As a result, capital

allocation decisions will balance debt reduction, a progressive

dividend policy and organic investment. The Board has set a target

leverage range of 1.0-1.5 times Adjusted EBITDA before it will

consider any further acquisitions of scale.

Outlook

Despite challenging macro-economic conditions, the resilient

underlying demand for the Group's essential reactive services means

that the business continues to perform well and grow, with its key

divisions all achieving record results in 2023. As a result, and

subject to audit, the Board expects the Group's adjusted EBITDA for

the year ended 31 December 2023 to be within the range of current

market expectations of GBP29.2m to GBP30.1m.

Stephen Hemsley, Executive Chairman, commented:

"In 2023 we once again doubled the size of the Group with the

acquisition of Pirtek, having doubled in size in 2022 following the

merger with Filta. These acquisitions have transformed the Group

from a UK domestic business to a sizeable international business

with seven franchise brands in ten countries, and from adjusted

EBITDA of GBP8.5m in 2021 to c. GBP30m in 2023.

"The integration of these businesses into a single group focused

on providing essential business services primarily via a franchised

model is progressing well and at pace. We are beginning to share

resources internationally, particularly in the area of IT, which

will accelerate our operational gearing in the coming years for

both us and our franchisees.

"We also see significant potential for growth across our

principal franchise brands of Pirtek, Metro Rod and Filta, which

have small shares of large markets. As we continue to deliver on

our ambition by broadening the range of services offered,

increasing the geographical penetration and cross-selling to the

larger customer base, I am very confident in the future prospects

of the Group."

Capital Markets Day

The Group will be hosting a Capital Markets Day for

institutional investors on 20 February 2024, where it will set out

its medium-term strategic model and outline the growth potential of

the business. The event will be hosted by Stephen Hemsley,

Executive Chairman, and will include presentations from the Group's

leadership team. Further details of the Capital Markets Day will be

announced shortly.

Enquiries:

Franchise Brands plc + 44 (0) 1625 813231

Stephen Hemsley, Executive Chairman

Mark Fryer, Chief Financial Officer

Julia Choudhury, Corporate Development Director

Allenby Capital Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 3328 5656

Jeremy Porter / Liz Kirchner (Corporate

Finance)

Amrit Nahal / Joscelin Pinnington (Sales

& Corporate Broking)

Dowgate Capital Limited (Joint Broker) +44 (0) 20 3903 7715

James Serjeant / Russell Cook / Nicholas

Chambers

Stifel Nicolaus Europe Limited

(Joint Broker) +44 (0) 20 7710 7600

Matthew Blawat / Francis North

MHP Group (Financial PR) +44 (0) 20 3128 8100

Katie Hunt/Catherine Chapman +44 (0) 7884 494112

franchisebrands@mhpgroup.com

About Franchise Brands plc

Franchise Brands is an international, multi-brand franchisor

focused on building market-leading businesses primarily via a

franchise model. The Group has a combined network of over 625

franchisees across seven franchise brands in ten countries covering

the UK, North America and Europe.

Franchise Brands' focus is on B2B van-based reactive and planned

services. The Company owns several market-leading brands with long

trading histories, including Pirtek in Europe, Filta, Metro Rod and

Metro Plumb, all of which benefit from the Group's central support

services, particularly technology, marketing, and finance. At the

heart of Franchise Brands' business-building strategy is helping

its franchisees grow their businesses: "if they grow, we grow".

Franchise Brands employs over 700 people across the Group.

For further information, visit www.franchisebrands.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFLILEIDLIS

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

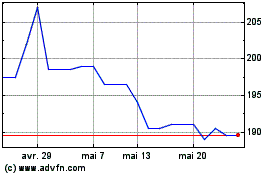

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Franchise Brands (LSE:FRAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025